How does credit repair work?

Credit Repair Is The Process Of Hiring A Company To

Fix Your Bad Credit Through The Removal Of Inaccurate, Negative Information On Your Credit Reports.

In the illustrious and often bewildering world of personal finance, credit repair stands out as a beacon of hope for those navigating the murky waters of a less-than-stellar credit score. As a credit expert with 15 years tucked under my belt, I've seen it all – from the highs of credit enlightenment to the lows of credit despair. And let me tell you, when it comes to credit repair, there's a light at the end of the tunnel, even if it might seem like the oncoming train of financial doom at first glance.

How Does Credit Repair Work? A Journey from Credit Despair to Credit Repair

Credit repair, in its essence, is the process of addressing and correcting inaccuracies on your credit reports that may be dragging your scores down. Imagine your credit report as a high school report card, but instead of grades in subjects like Math or History, you're evaluated on your ability to manage debt and pay bills on time. Now, imagine if that report card mistakenly said you failed P.E. because you were marked absent on days you were actually breaking school records. That's what incorrect information on your credit report can look like.

Step 1: Pulling Your Credit Reports

Our journey begins with obtaining a copy of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. It's like gathering maps before a treasure hunt. Thanks to federal law, you're entitled to one free copy of your credit report from each bureau every 12 months. Consider this the first step in your credit repair odyssey.

Step 2: Identifying Inaccuracies

Once you have your reports in hand, it's time for some detective work. You're looking for any inaccuracies, from small errors like misspelled names to major ones like accounts that aren't yours or incorrect payment histories. It's akin to finding that someone has been telling tales about your P.E. attendance all over school.

Step 3: Disputing Errors

Found something wrong? It's time to dispute it. You'll need to write to the credit bureau and the creditor that reported the incorrect information, laying out what you believe is wrong and providing evidence to support your claim. It's a bit like arguing with the P.E. teacher about your attendance record, except with more paperwork and fewer running laps.

Step 4: Waiting for Investigation Results

After you've submitted your disputes, the credit bureau will investigate your claims, typically within 30 days. This waiting period can feel a bit like watching paint dry or grass grow, but patience is key. The bureaus will check with the creditor, and if your dispute is valid, the error will be corrected.

Step 5: Improving Credit Habits

While disputes are underway, it's a great time to focus on improving your credit habits. Pay down balances, make payments on time, and avoid opening new credit accounts unless necessary. Think of it as hitting the gym to improve your physical fitness but for your credit score.

A Dash of Humor: A Credit Repair Story

Let me lighten the mood with a quick story. A client once told me they were so bad with money, that even their Monopoly game was in debt. Their credit report was more tangled than a bowl of spaghetti after a toddler's dinner. We embarked on a credit repair journey together, and by the end, their credit score had improved so much, that even their Monopoly bank was offering them a loan!

Wrapping Up

Credit repair might not be an overnight miracle, but with diligence, patience, and a bit of elbow grease, it's possible to clean up your credit report and improve your financial standing. Remember, it's not just about disputing errors; it's about building and maintaining good credit habits for the long haul.

Embarking on a credit repair journey can often feel daunting, yet choosing a "pay after deletion" approach offers a compelling incentive to take the plunge. This method aligns the cost of services with tangible results, ensuring you only compensate for the actual improvements made to your credit report. It's a performance-based model that motivates credit repair agencies to work diligently on your behalf, removing inaccuracies and disputing errors with added zeal. While initial fees may cover setup and administrative tasks, the core of your investment directly correlates with the successful deletion of disputable items. Opting for pay after deletion not only provides a sense of financial control but also instills confidence that every penny spent is a step towards a brighter financial future.

GET A FREE QUOTE TODAY

Contact Us

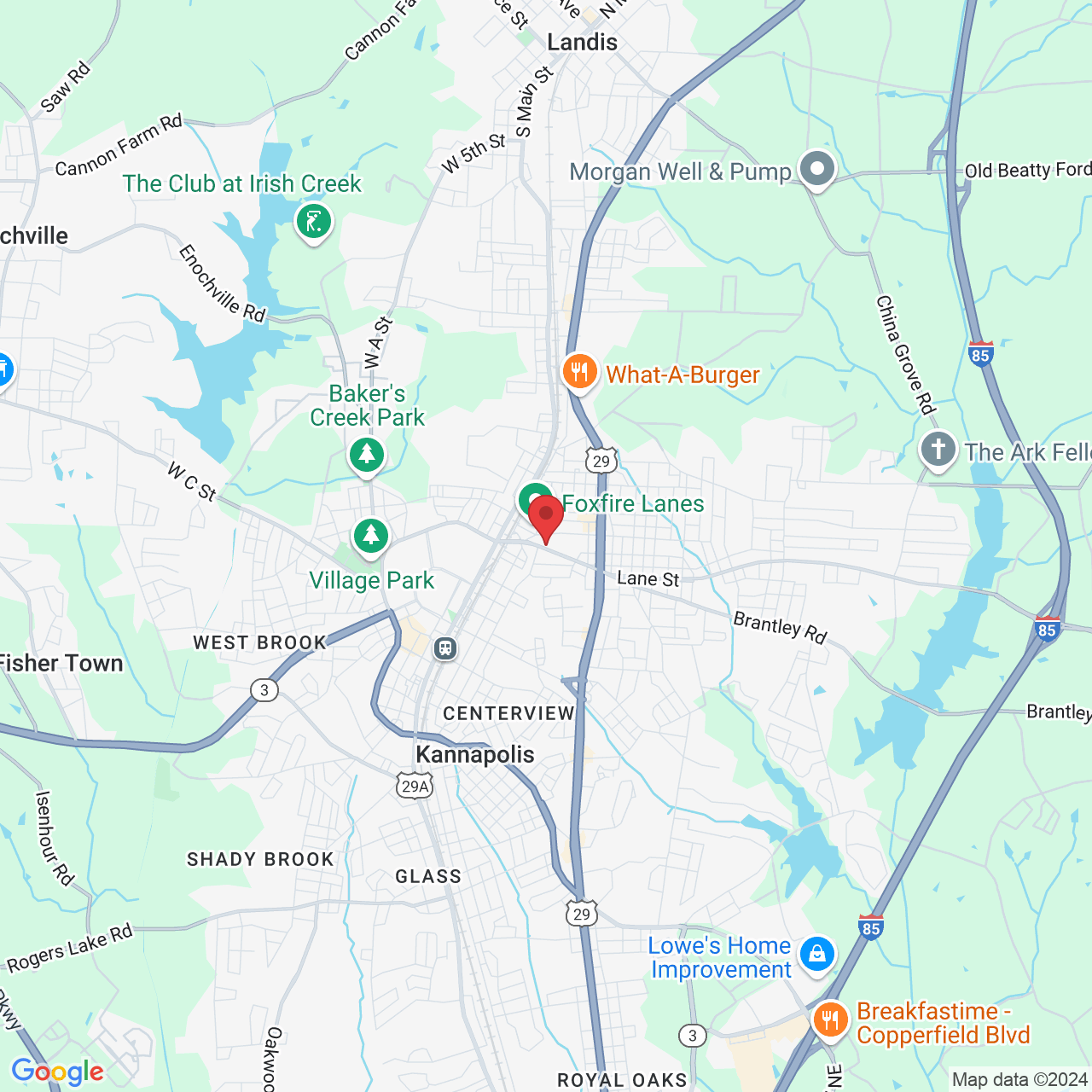

Address:

407 Jackson Park Rd

Kannapolis, NC 28083

(By Appointment Only)

Phone

Tel: 813-345-4097

Text: 813-345-4097

Business Hours-

Monday - 8am - 7pm

Tuesday- 8am - 7pm

Wednesday - 8am - 5pm

Thursday - 8am - 7pm

Friday - 8am - 7pm

Saturday - 8am - 7pm

Sunday - closed