Templates

Documents and spreadsheets available for customization to meet the specific needs of your tax advisory practice.

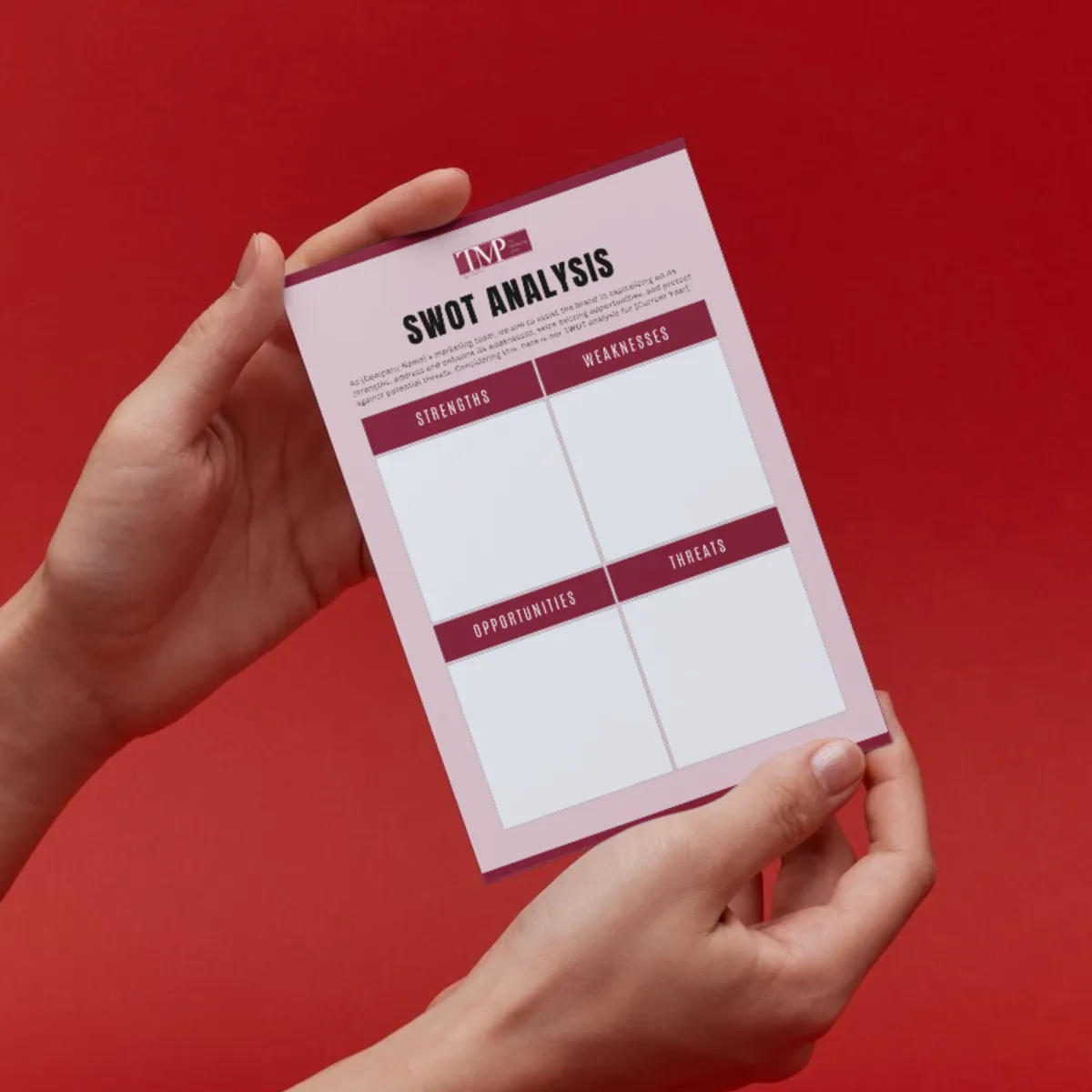

SWOT Analysis

A SWOT analysis is a strategic planning tool used to identify and evaluate an organization's Strengths, Weaknesses, Opportunities, and Threats.

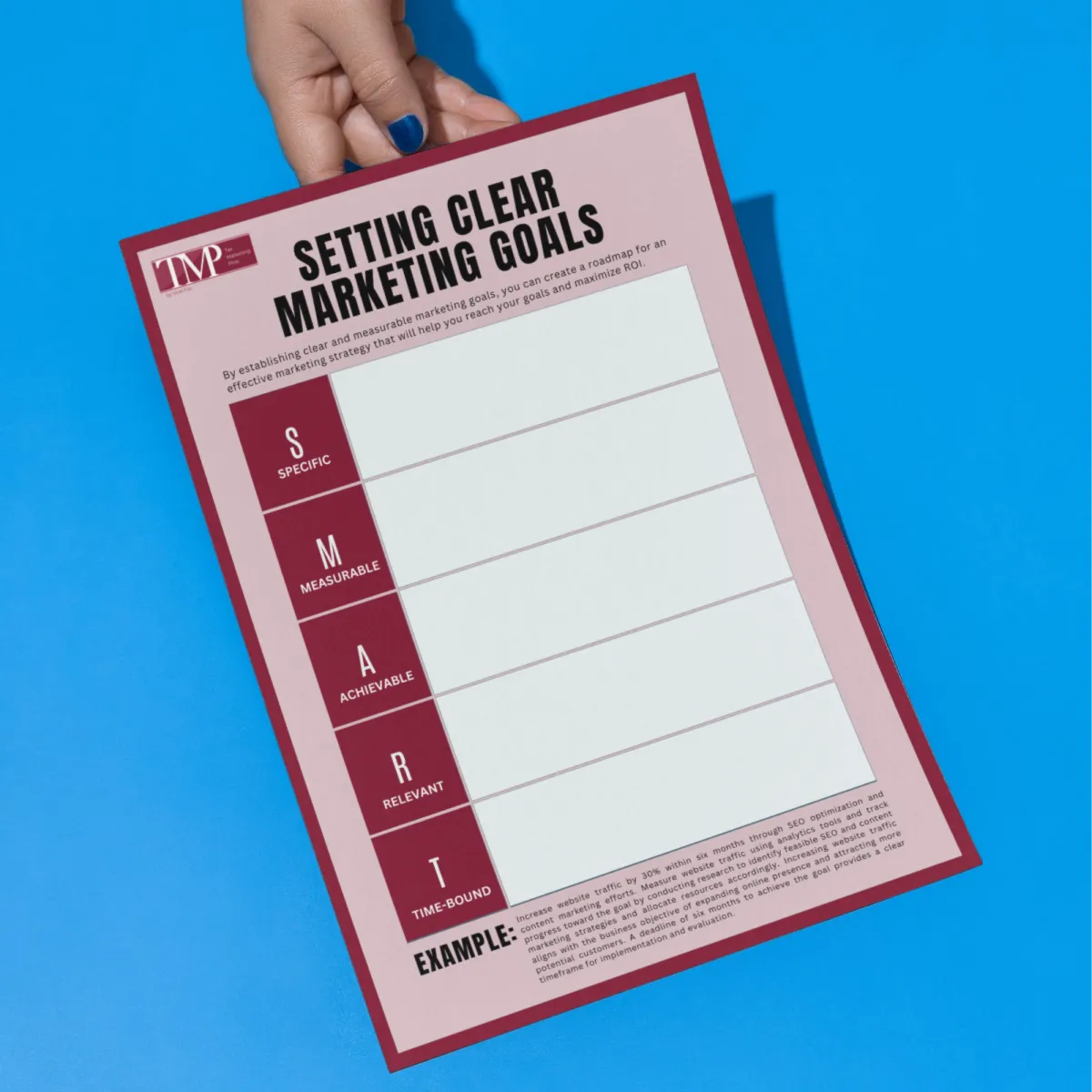

SMART Action Plan

A SMART action plan is a structured framework for setting and achieving specific, measurable, achievable, relevant, and time-bound goals.

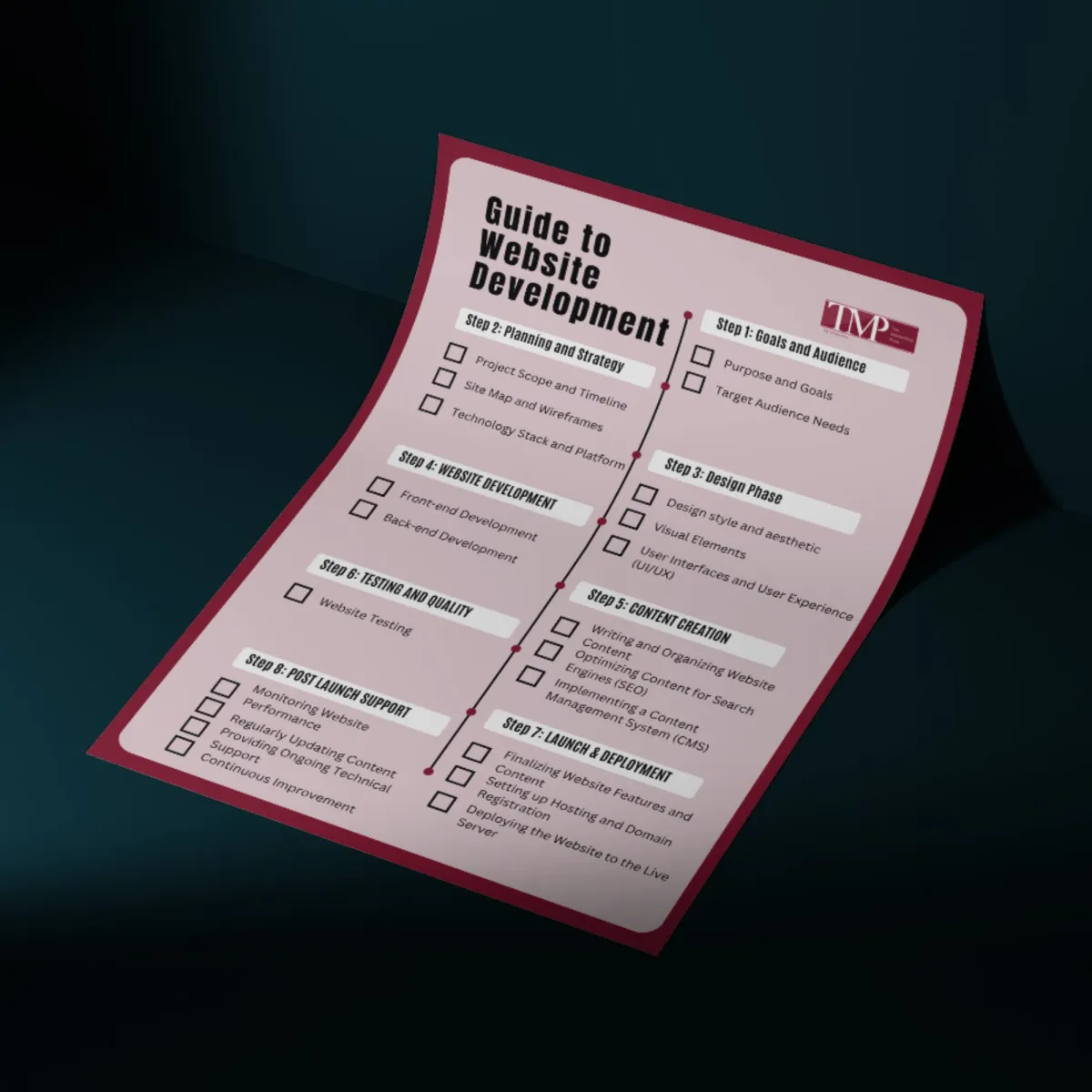

Website Development Checklist

A website development checklist is a comprehensive list of tasks and considerations to ensure the successful planning, design, development, testing, and launch of a website.

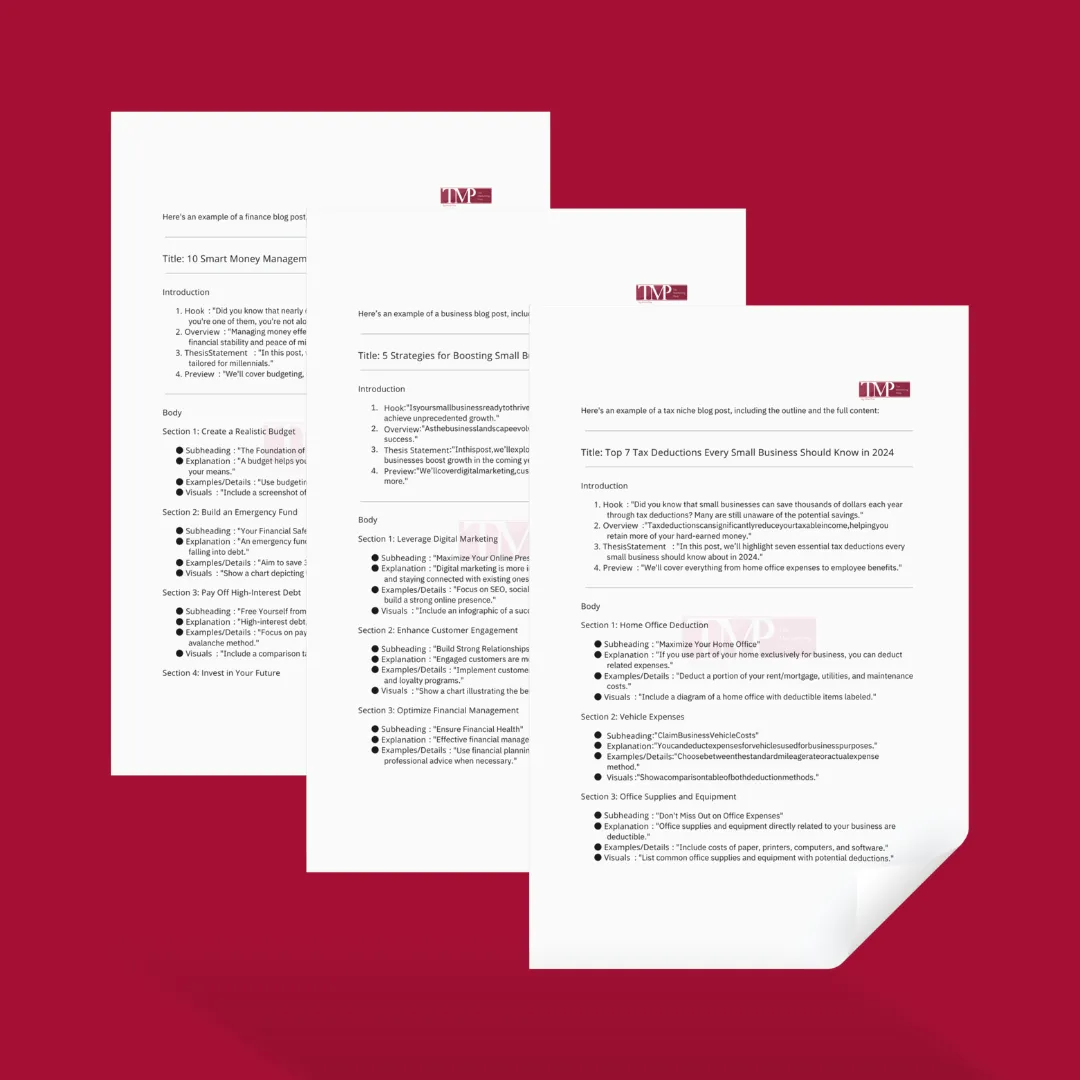

Blog Post Templates

A blog post template serves as a structured outline that guides the creation of content, ensuring consistency and coherence across posts.

Setting Digital Marketing Strategy

7 marketing strategies designed to take your tax advisory practice to the next level. These strategies will be your roadmap to online success.

Branding Templates

Simplified standards for using the various elements of a brand to ensure that it is presented consistently across all marketing materials and channels.

Digital Marketing Plan Template

A pre-designed framework that helps marketers plan, execute, and monitor digital marketing strategies efficiently.

Buyer Persona Template

Structured outline with characteristics, behaviors, and motivations of a target customer to guide marketing strategies.

Social Media Feed Ads Template

A visually appealing, customizable ad layout designed to engage and convert audiences on social media platforms.

Finding Your Niche Checklist

Finding Your Niche Checklist Template is a comprehensive guide designed to help tax professionals identify and refine their unique niche.

Website Audit Checklist

Evaluate if your website is ready to leverage Google Ads by reviewing checklist. Bridge the gap and bring immediate results.

Other Articles You Might Also Like

How to Market Your Tax Preparation Service

Are you tired of watching your tax season profits dwindle like a melting ice cream cone?

Imagine a world where your tax preparation service is the go-to destination for everyone from small business owners to retirees, where your expertise is celebrated and your clients are raving supporters. Sounds like a dream, right?

Well, it's time to turn that dream into a reality.

In today's digital age, getting the word out about your tax preparation service is more important than ever. But with so many strategies out there, it can be overwhelming to know where to start. That's where we step in.

In this guide, we'll share 8 proven tips to help you market your tax preparation service effectively.

By following these tips, you'll be well on your way to growing your tax preparation business and becoming the go-to expert in your community.

Are you ready to take your tax preparation business to the next level? Let's dive in and explore these strategies in more detail!

1. Identify Your Target Audience

When it comes to marketing your tax preparation service, it's all about knowing your audience like you know the back of your hand. Get personal and tailor your services to fit the unique needs of different groups. From young professionals to retirees, everyone's got their own tax tale to tell.

Give local small businesses the VIP tax treatment they deserve with tax filings and compliance, ensuring they understand the value of your expertise.

Freelancers and contractors have tax puzzles to solve, so be their tax detective and unravel those tricky deductions and credits. And let's not forget our non-profit fellows—guide them through the tax maze with your specialized services.

By zeroing in on these groups, you can create more effective marketing strategies that resonate with your potential clients.

For instance, according to a study by Bain & Company, acquiring a new client costs 6 to 7 times more than retaining an existing one. This highlights the importance of understanding and catering to your current clients' needs to foster loyalty and encourage referrals.

2. Develop a Strong Online Presence

A study by BrightLocal found that 97% of consumers use the internet to find local businesses, and 12% do so every day. This underscores the importance of having a robust online presence.

Looking to boost your tax preparation service? A strong online presence is key! First up, create a slick website that showcases your expertise and happy client reviews – this builds trust and shows your value. Optimize it with keywords like "tax preparation" and "tax help" to rank higher on search engines.

A case study from TaxSlayer Pro highlighted that businesses that actively manage their Google My Business profiles see a 70% increase in visits to their website and a 50% increase in the likelihood of attracting potential clients.

Don't forget to use social media – share tax tips, updates, and promote your services on platforms like Facebook, LinkedIn, and Twitter. And be sure to set up and optimize your Google My Business profile to appear in local searches. This way, potential clients can find you with ease.

3. Content Marketing

Don't forget this clever tax prep marketing tip: Use content marketing to show off your expertise and improve your online presence. Start with insightful blog posts about tax tips, law changes, and common filing mistakes. It's like giving a masterclass in tax prep! And don't stop there—grab attention with snappy videos demystifying tax topics.

Email marketing is another powerful tool. Blast out targeted newsletters filled with valuable tax tips, friendly reminders about deadlines, and irresistible special offers.

Statistics show that segmented email campaigns could potentially result in a mind-blowing 760% increase in revenue! As if that wasn't enough, showcase success stories and case studies of happy clients who have reaped the benefits of your services.

Consistency is the name of the game! By delivering valuable and relevant content, you'll keep your audience hooked and coming back for more.

4. Leverage Referrals and Word of Mouth

Did you know that word of mouth is an incredibly powerful tool for promoting your business and attracting new clients? It's true!

Nielsen reports that a whopping 92% of people trust recommendations from friends and family more than traditional advertising. Even more impressive, 74% of people base their purchasing decisions on word of mouth. That's the kind of impact that can really drive your business forward!

Don't forget the importance of networking! Attending local business events, joining chambers of commerce, and connecting with other professionals can help you expand your referral network and establish your presence in the community. So, beat out that elevator pitch and sprinkle it with some benefits.

5. Offer Free Resources

One powerful strategy in marketing your tax preparation service is to offer free resources. Offering free resources can work wonders. How about kicking off with a complimentary initial consultation? This not only draws in potential clients but also allows you to showcase your expertise and build trust.

According to studies, acquiring a new client can cost 6 to 7 times more than retaining an existing one. So, providing a free consultation isn't just a savvy move - it's a cost-effective way to expand your client base.

Additionally, hosting tax planning workshops or webinars can really help you stand out and build trust with your audience. By sharing valuable insights, you'll establish yourself as a trustworthy tax expert and seize a great opportunity to meet a crucial market demand

Don't forget to check out the awesome free marketing tools available for download! For example, Tax Marketing Pros has a wide range of ready-to-use marketing templates that can help you save loads of time every week.

Be a trusted and essential resource in your tax preparation community.

6. Seasonal Promotions

Looking to expand your client base for your tax preparation service? Offering Early Bird Discounts during tax season is a powerful strategy to attract clients. Not only does it motivate early sign-ups, but it also helps streamline your workload.

According to a study by the National Society of Accountants, early bird promotions can increase client acquisition by up to 20%. Additionally, promoting Last-Minute Help for those who need assistance with last-minute tax filing can attract clients who procrastinate or face unexpected tax issues.

7. Online Reviews

You've just expertly guided a client through a tricky tax situation, leaving them ecstatic with your service. Now's the golden moment to nudge them towards leaving a dazzling review on Google and Yelp. Reviews don't just elevate your online reputation; they also help cultivate trust with future clients.

A study shows that 93% of consumers read online reviews before making a purchase decision. Engaging with these reviews, whether positive or negative, shows that you value client feedback and are committed to improving your services.

Instead of waiting for reviews to trickle in, why not shake things up and actively seek them out and engage with your clients to create a compelling online presence? This approach not only humanizes your brand but also fosters a community of loyal clients who feel heard and appreciated.

8. Compliance and Expertise

Marketing your tax preparation service effectively hinges on showcasing your compliance and expertise. Start by highlighting your certifications, such as CPA or EA, to build trust and demonstrate your qualifications.

For instance, a CPA certification can significantly enhance your credibility, as it is a rigorous credential recognized globally. Staying updated on tax laws is crucial; clients appreciate a proactive approach where you inform them about changes that could impact their finances.

In Summary

It's prime time to draw in new clients and establish yourself as the go-to tax expert. But with so much competition, how do you make your tax preparation service stand out?

This blog post unveils 8 powerful marketing strategies to help you win the tax season game:

Know Your Audience: Tailor your services to resonate with specific groups, from young professionals to retirees.

Dominate Online: Create a user-friendly website, optimize it for search engines, and leverage social media to connect with potential clients.

Content is King: Share valuable tax tips, updates, and case studies through blog posts, videos, and email marketing.

Harness Referrals: Encourage satisfied clients to spread the word through positive reviews and referrals. Network with other professionals to expand your reach.

Offer Free Resources: Provide free consultations, workshops, or downloadable resources to showcase your expertise and attract new clients.

Seasonal Promotions: Offer Early Bird Discounts and Last-Minute Help to incentivize clients and manage your workload efficiently.

Reviews are Reputation Gold: Encourage clients to leave positive online reviews to build trust and attract new business.

Compliance is Key: Highlight your certifications (CPA, EA) and stay updated on tax laws to position yourself as a reliable and knowledgeable tax expert.

Ready to transform your tax preparation business?

Take Action Today!

Contact Tax Marketing Pros at [email protected] or visit our website https://taxmarketingpros.com to access free marketing tools and resources designed to help you thrive this tax season. Let's work together to turn your dream of a thriving tax preparation business into a reality!