Learn How To Build and Repair Your Own Credit

Secret Ways To Remove Late Payments

Have you ever been late on a credit card and in the next month your score went down a lot of points? Many people undergo this situation without understanding why it happens and what they can do to bring back their credit score.

In this article, you will learn why that happens and what you can do to bring those scores back up. You can also watch a detailed video here to learn more about late payments.

Late payments are very important in terms of scores because it makes 35% of your score. When it comes to the full pie chart of what makes your credit, payment history is the highest ratio out of other factors that makes up your complete score.

When you miss a late payment you can potentially bring the scores down to a 100 or probably 50 points. The higher the credit score the more points you are going to lose when you make a late payment.

Late payment is an account that you have been laid on for 30 days. I.e. if you had a payment that was due on the 16th and you pay it on the 20th, that’s not considered a late payment: it’s considered within the financial institution that you are working with but not with the credit bureaus.

The credit bureaus only report payments that have not been due for longer than 30days. In case you have been late longer than that and have a late payment appear on your credit report, and have been trying to get it removed, here are tips on how you can remove those late payments in the best way.

Fix the late payment

The first tip to get your name removed is to fix the late payment. You need to be fully up to date on all your payments with the financial institution that you have a late payment with. You need to catch up with all of your balances with that financial institution before you start the next guideline.

Contact the institution reporting late payments

The second sequence in fixing your credit scores is building a friendly relation with the institution that’s responsible for reporting the late payments. This is the intermediary between the creditor and the credit bureau. You can contact the institution through their chatbox.

Open a chat with the representative and report your situation by using for example Covid-19 as a method of hardship to explain to them why you would like to be removed from the late payment list. Remember to be as nice and friendly as possible.

You should not contact credit bureaus directly because even though they have the power to remove the late payment, you are still regularly working with the creditor. Focus on going directly to the creditor first.

Covi-19 has made chatbox a successful method to many people since it creates hardship situation which everybody is sympathetic about.

Suggested offer

Your chance of approval is excellent

Call the creditor

Another method to fix your credit scores is calling the creditor and talking to a representative. Directly explaining to them the situation gives you a higher ratio of getting removed.

However, when you choose to talk to the creditor, you should note that the newer the late payment the harder it becomes to get removed. For example, if your late payment is only 2months old, it might give you a little trouble getting it removed, unlike an older late payment.

Again, getting or never getting late payment removed depends on the minimum amount due for that loan or credit automatically deducted. An automatic deduction is what credit professionals do to avoid late payment and maintain that score.

Getting auto deducted means that you never have to worry about more credit since you have a hard track record to keep for that particular debt.

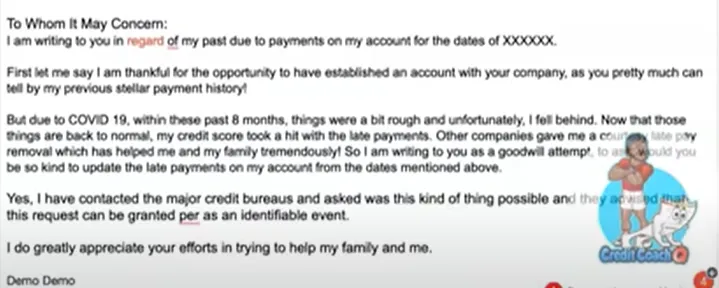

Send a hardship letter

Sending hard copy hardship letters to the creditor can also be a method to convince them to remove your late payment. To use the letter, you have to learn to customize the letter as much as possible and not using some direct templates from the web.

You must use the correct font size, good background and a real voice to convince the reader that it’s you speaking. Here is a template of a hardship letter:

Using direct templates in your credit repair journey can damage the process as some credit mills use escrow to scan and show the originality of the letter.