Text Payments and Financial Inclusion: Expanding Access to Digital Transactions

Introduction

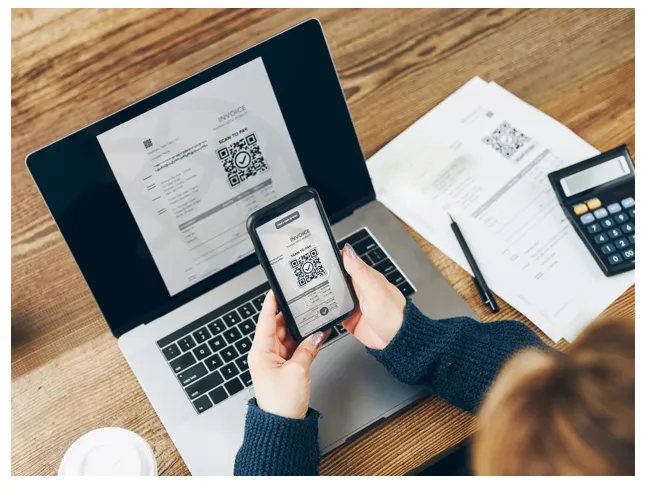

In the dynamic landscape of the digital age, where technological advancements shape the way we conduct financial transactions, the evolution of text payment solutions has emerged as a transformative force. This innovation not only enhances accessibility but also redefines the convenience of digital transactions for all. Text-to-pay solutions have become integral in providing seamless financial experiences, bridging gaps and fostering financial inclusion in unprecedented ways.

Understanding Text Payments

Text payments refer to the process of conducting financial transactions through text messages, providing a simplified and efficient method of digital exchange.

Role in Financial Inclusion

Text payments play a crucial role in promoting financial inclusion, bridging the gap between underserved populations and the formal banking system, thereby empowering individuals to participate in the digital economy.

Benefits for Unbanked Population

For the unbanked population, text payments serve as a lifeline, offering a secure and accessible platform for conducting financial transactions without the need for traditional banking infrastructure.

Security Measures and Concerns

While text payments offer convenience, there are inherent security concerns that need to be addressed, highlighting the importance of robust encryption and authentication protocols to safeguard user data and financial information.

Integration in Digital Economy

The seamless integration of text to pay solutions into the digital economy has catalyzed a profound shift in consumer behavior. This evolution encourages more individuals to adopt digital transactions, revolutionizing the way they engage in various financial activities. The ease and simplicity offered by text payment solutions serve as a gateway, making financial interactions more intuitive and accessible to a wider audience.

Enhancing Accessibility for All

Text-to-pay solutions have become instrumental in significantly enhancing accessibility, especially for individuals with limited access to traditional banking services. This transformative technology fosters financial empowerment by breaking down barriers and enabling the participation of diverse demographics in the broader digital financial ecosystem. The simplicity of text payments extends a helping hand to those who were previously underserved, ensuring that everyone has the opportunity to partake in the benefits of digital finance.

Collaborations and Partnerships

The widespread adoption of text to pay solutions owes much to strategic collaborations and partnerships within the financial industry. These alliances play a pivotal role in fostering innovation, expanding the scope of financial services, and ensuring that text payment solutions reach a broader demographic. By joining forces, industry players create an environment where interoperability and shared resources propel the evolution of text payments, making them an integral part of the modern financial landscape.

Regulatory Considerations

Amid the rapid expansion of text to pay solutions, regulatory frameworks play a crucial role in shaping the trajectory of this financial innovation. Robust regulations are essential to ensure consumer protection, uphold data privacy standards, and maintain the overall integrity of the financial system. By addressing regulatory considerations, authorities can create an environment that fosters trust and confidence in the use of text payments, safeguarding the interests of both consumers and financial institutions.

Text Payment Technology Advancements

Advancements in text payment technology continue to redefine the digital transaction landscape. The ongoing development introduces innovative features and functionalities that not only enhance the user experience but also strengthen the security measures associated with text payments. These technological strides underscore the adaptability and resilience of text to pay solutions, positioning them as a cornerstone in the digital economy.

Impact on Small Businesses

For small businesses, adopting text payments has presented new opportunities for growth and expansion, allowing for more efficient and secure payment processing, improved cash flow management, and enhanced customer engagement.

Future of Text Payments

Looking ahead, the future of text payments appears promising, with continued advancements in technology, increased collaborations, and supportive regulatory frameworks paving the way for a more inclusive and accessible digital financial ecosystem.

Conclusion

In conclusion, the evolution of text payments has transformed the landscape of digital transactions, playing a pivotal role in fostering financial inclusion and expanding access to formal financial services. With its ability to bridge gaps, enhance accessibility, and foster innovation, text payments are poised to shape the future of digital finance, empowering individuals and businesses to participate more actively in the digital economy.

FAQs

How secure are text payment transactions?

Text payment transactions are highly secure, employing robust encryption and authentication measures to protect sensitive financial information. These security protocols ensure that user data remains confidential and shielded from cyber threats.

What are the key benefits of text payments for underserved populations?

Text payments offer underserved populations a gateway to financial inclusion, providing them with a convenient and accessible platform to conduct transactions without relying on traditional banking infrastructure. This empowers individuals to participate in the digital economy, fostering financial independence and empowerment.

How do regulatory considerations impact the adoption of text payments?

Regulatory considerations are crucial in establishing a framework for the secure and ethical adoption of text payments. These regulations ensure consumer protection, data privacy, and overall financial system integrity, fostering trust and confidence among users and encouraging wider adoption of text payment solutions.

What technological advancements are shaping the future of text payments?

Technological advancements in text payments are constantly shaping the future of digital transactions. Innovations such as biometric authentication, advanced encryption algorithms, and seamless integration with other digital services enhance the security, convenience, and overall user experience of text payment solutions.

How do text payments contribute to the growth of small businesses?

Text payments provide small businesses with a streamlined and efficient method of processing transactions, improving cash flow management and enhancing customer engagement. By offering a secure and user-friendly payment option, text payments contribute to the growth of small businesses by facilitating a seamless and convenient financial ecosystem, fostering business expansion and customer satisfaction.

Copyright Time sparQ 2023 -- All Rights Reserved

We’re on a mission to build a better future where technology creates good jobs for everyone.