Text-to-Pay Apps Simplify Transactions in the Digital Age

Introduction

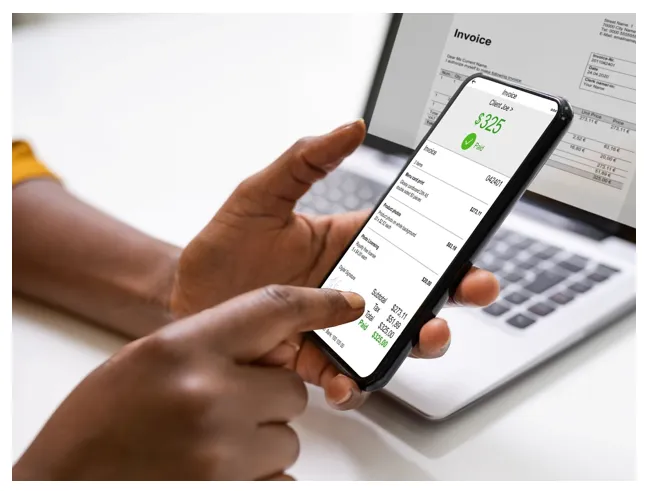

In the fast-paced and interconnected digital world, the evolution of financial technology has paved the way for more streamlined and efficient transactions. Text-to-Pay apps have emerged as a revolutionary solution, simplifying the complexities of financial interactions and providing users with a seamless and secure transaction method. With their user-friendly interfaces and robust security features, these apps have transformed the way businesses and consumers manage their financial activities. This comprehensive guide explores how Text to Pay apps are reshaping the landscape of digital transactions, offering unparalleled convenience and security for users worldwide.

Revolutionizing Financial Transactions

Text-to-Pay apps have ushered in a new era of convenience and efficiency in the realm of financial transactions. These apps have eliminated the need for cumbersome paperwork and complicated payment processes by enabling users to initiate payments through simple text commands. Users can effortlessly settle bills, make purchases, and transfer funds with just a few taps on their smartphones, simplifying their financial activities and saving valuable time.

Ensuring Secure and Encrypted Transactions

Security is a paramount concern in the digital age, especially regarding financial transactions. These apps prioritize protecting sensitive information through advanced encryption technologies and multi-layered security protocols. By safeguarding user data and financial details from potential cyber threats, these apps instill a sense of trust and confidence among users, ensuring that their transactions remain confidential and secure.

User-Friendly Interface for Enhanced Convenience

One of the key advantages of Text-to-Pay apps lies in their intuitive and user-friendly interfaces. Designed to cater to users of all technological proficiencies, these apps offer a seamless and hassle-free transaction experience. With clear and straightforward navigation menus, users can easily navigate through the app, initiate transactions, and manage their financial activities without extensive technical knowledge, making the process convenient and accessible for all.

Streamlining Business Operations and Financial Management

Businesses are increasingly integrating Text-to-Pay apps into their operations, recognizing the myriad benefits these apps offer regarding financial management. By providing customers with a convenient and efficient payment option, businesses can enhance their cash flow and reduce the complexities associated with traditional payment methods. Furthermore, integrating these apps with existing accounting software streamlines record-keeping and financial analysis, empowering businesses to make more informed and data-driven decisions.

The Future of Financial Transactions

The rapid advancement of technology continues to drive the evolution of financial transactions, and Text-to-Pay apps are at the forefront of this digital transformation. With their emphasis on convenience, security, and user experience, these apps are set to play a central role in shaping the future of financial interactions. As the world embraces a more interconnected and digital future, these apps will continue redefining how individuals and businesses manage their financial activities, offering unparalleled efficiency and security.

Frequently Asked Questions (FAQs):

How secure are Text to Pay apps?

Text to Pay apps employ robust encryption and security measures to ensure the safety of transactions and user data.

Can businesses integrate Text to Pay apps into their existing systems?

Yes, Text to Pay apps can seamlessly integrate into existing business operations, streamlining financial management and improving customer payment experiences.

Are Text to Pay apps easy to use for individuals with limited technological knowledge?

Yes, these apps are designed with user-friendliness, making them accessible and easy to navigate for users of all technological backgrounds.

What benefits do Text to Pay apps offer for small businesses?

Text to Pay apps can significantly improve cash flow management and simplify financial processes, giving small businesses a competitive edge.

Are Text to Pay apps compatible with different banking systems?

Yes, Text to Pay apps are compatible with various banking systems, facilitating seamless transactions across different financial platforms.

How do Text to Pay apps contribute to the overall digital transformation of financial services?

Text to Pay apps represent a fundamental shift in financial transactions, marking a significant step toward a more interconnected and efficient digital ecosystem.

Conclusion

In conclusion, Text-to-Pay apps have emerged as a game-changer in the realm of digital transactions, offering unparalleled convenience, security, and efficiency for users and businesses alike. With their seamless functionality, user-friendly interfaces, and robust security measures, these apps have simplified the complexities associated with financial activities, transforming the way individuals and businesses manage their transactions. As we embrace the digital future, integrating these apps into our financial routines is essential for staying ahead in the dynamic and interconnected landscape of the digital age.

Copyright Time sparQ 2023 -- All Rights Reserved

We’re on a mission to build a better future where technology creates good jobs for everyone.