Become a Funding Partner. Earn 20% Per Client.

You refer them. We fund them. You get paid

How The Partner Program Works

Simple. Transparent. Profitable.

Most business owners get denied by banks even when they have strong businesses

You can connect them to alternative funding that actually works — and earn every time they get approved.

Invite Business Owners

Share your unique partner link or connect clients directly to our pre-qualification form.

We Do the Work

Our team reviews, matches, and gets your clients funded through

our marketplace — with no hard credit pull.

You Get Paid

Earn 20% of our funding fee for every approved client. We pay you monthly, straight to your account.

Why Partnering With CEO Capital Connection Beats Going Directly to the Bank

When your clients apply at a single bank, they only see one option — and a hard inquiry hurts their credit even if they’re denied

With us, one soft pull connects them to hundreds of lenders across the country.They get multiple offers at once, more approvals, and often more total funding — all without impacting their credit.

Earn up to 10–20% on Every Funded Client

You help your clients access capital — we help you earn more doing it.

Perfect for:

Business coaches and consultants

Real estate professionals

Marketing agencies

Credit repair specialists

Financial advisors

Tax Professionals

Example

If 5 clients each get funded for $100,000

that’s

$500,000 total funding

$45,000

average fee

You Earn $9,000

Example

If 5 clients each get funded for $100,000

that’s

$500,000 total funding

$45,000

average fee

You Earn $9,000

We Give You Everything You Need to Succeed

You don’t need to be a funding expert — we do the heavy lifting. Partners get instant access to:

Custom Partner Dashboard to track clients and payouts

Swipe copy for emails, posts, and DMs

Branded marketing templates (Canva + social)

Monthly training calls & success tips

Dedicated partner support team

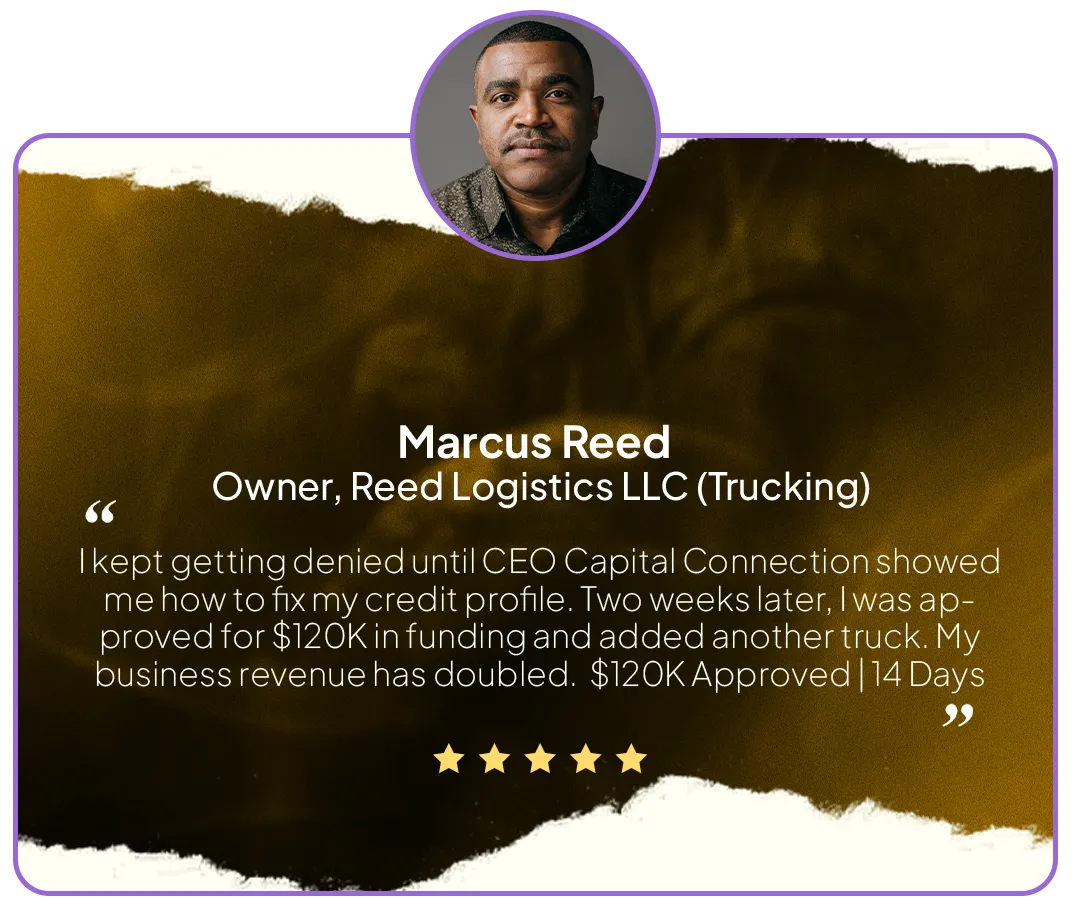

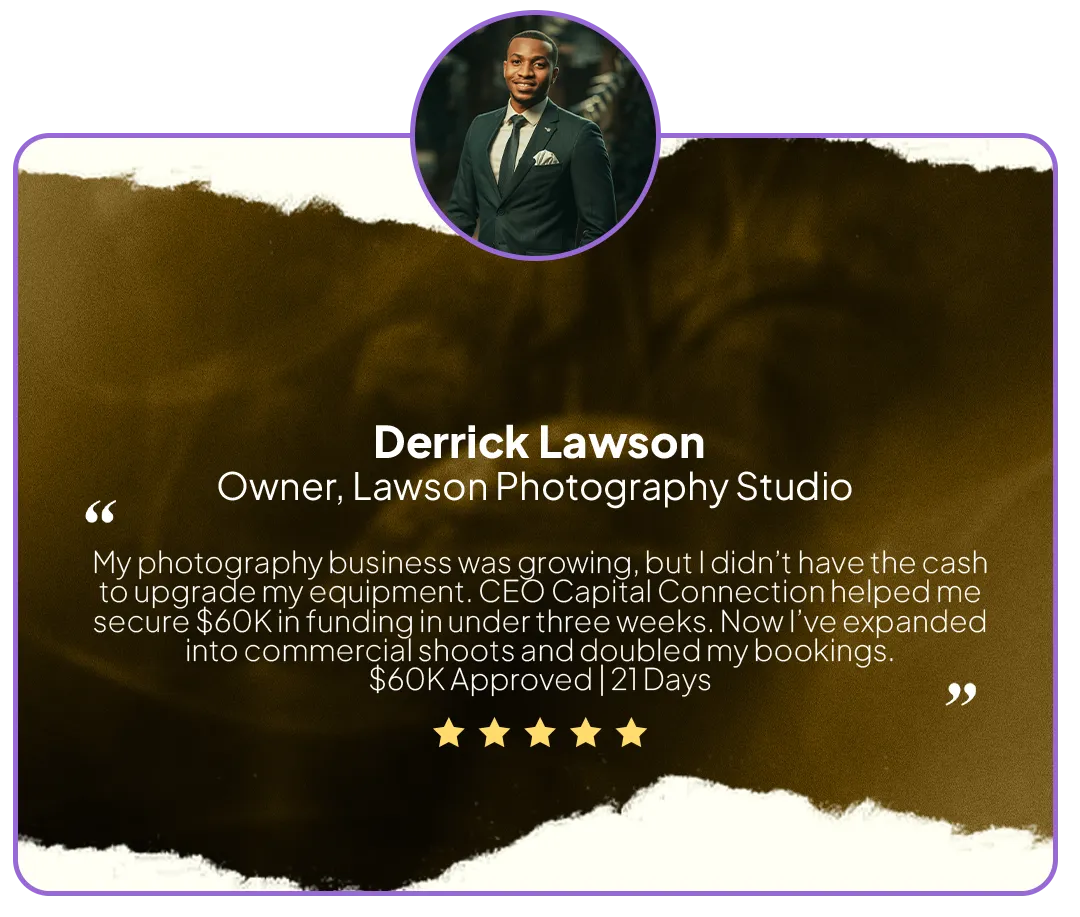

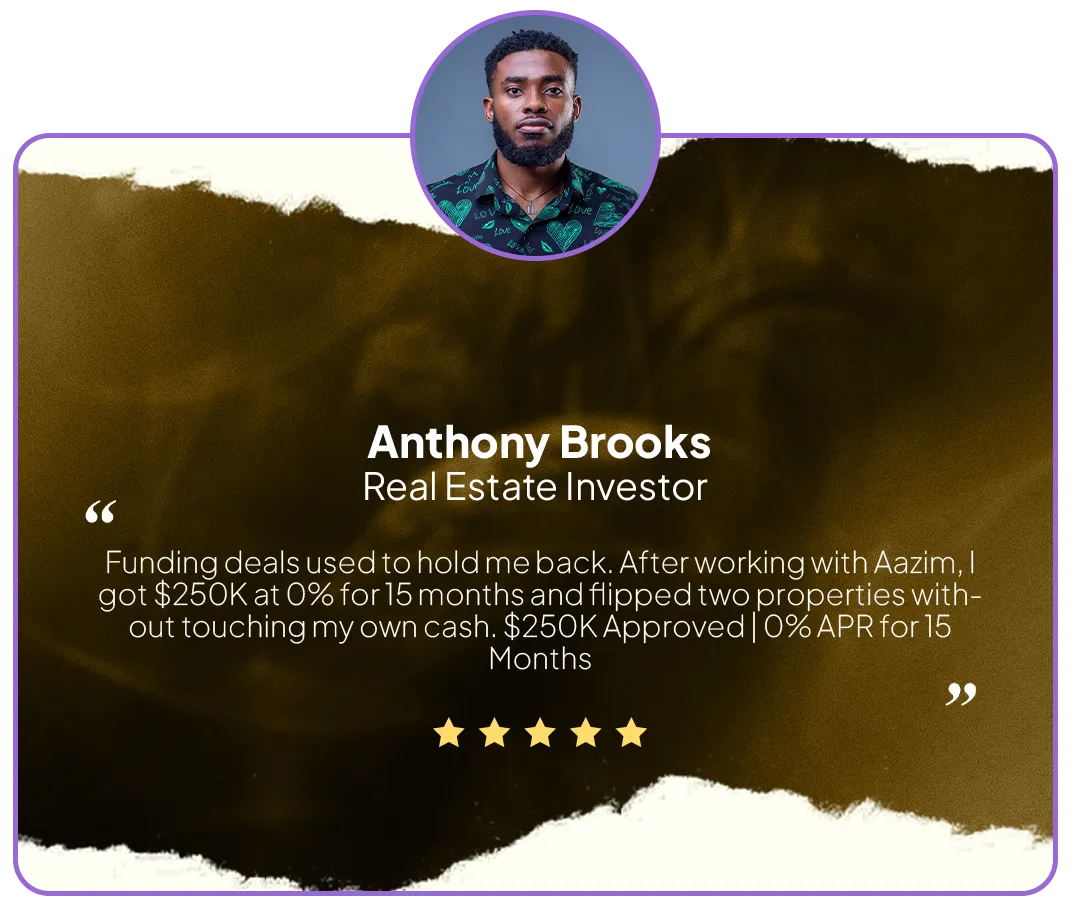

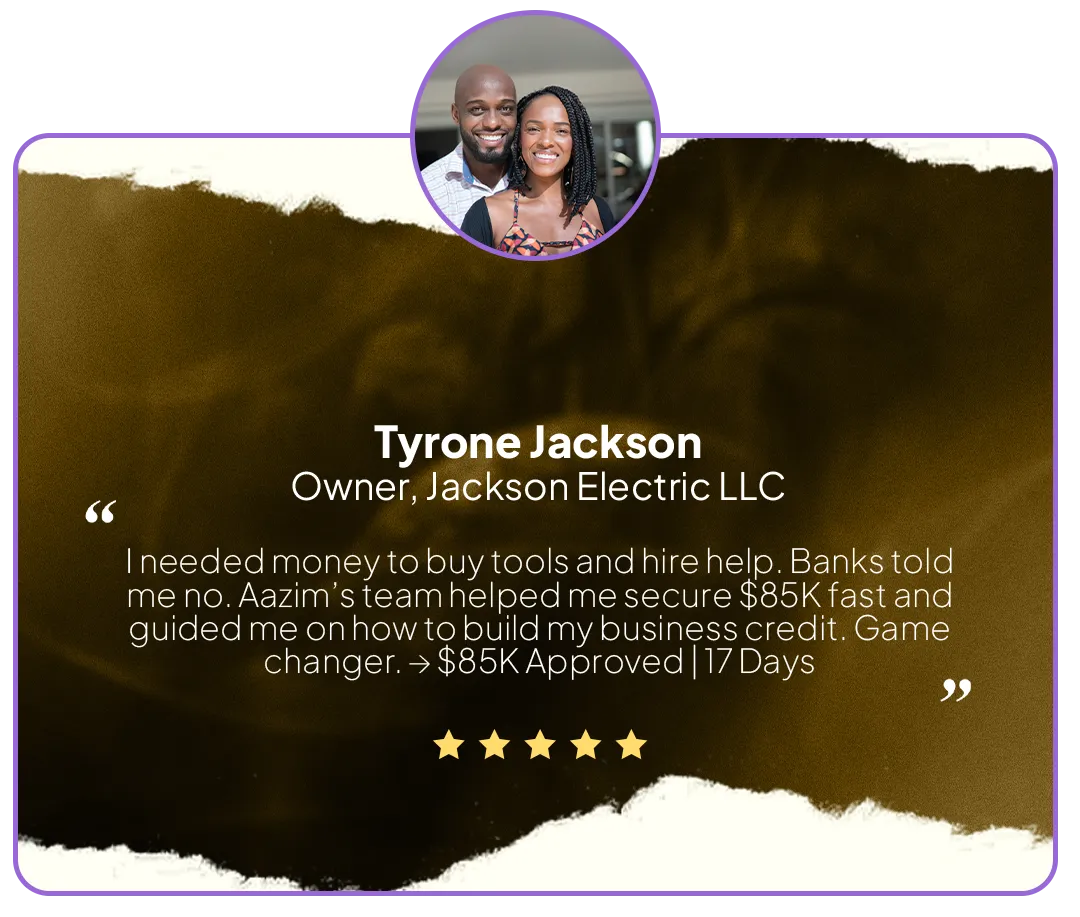

Real Business Owners. Real Funding. Real Results.

My client secured $120K and I earned $1,200 — easiest partnership ever.

“I trust CEO Capital Connection with every client. They communicate and deliver.”

“I made more in one month of referrals than three months of coaching.”

The studio was a brand new venture — less than a month old — and he had just opened the business bank account. He needed funding for

He needed funding for

Leasing and building out the new studio space

Purchasing gym flooring and training equipment

Marketing to attract new clients

Hiring two part-time trainers

He was seeking $75,000 in total funding, but since the business was new and had no financial history, most lenders declined his applications.

Why He Was Denied

Brand new business (less than one month old)

No tax returns or business financials

No revenue history to verify income

Denied by traditional banks due to business age

Marcus owns a small trucking company and wanted to expand his operations further, but needed funding to make it happen.

But he hit three major roadblocks:

High personal credit utilization (over 75%)

Credit score stuck at 668, too low for most business lenders

Limited cash flow to pay down his balances

The high credit utilization made Marcus appear overextended and too risky, preventing him from qualifying for the funding he needed.

Why He Was Denied

75%+ credit utilization showed overextension.

668 credit score didn’t meet lender requirements.

Limited cash flow concerned lenders.

Overall profile appeared too risky for approval.

Stop Delaying Growth — Start Expanding Now

Business funding should be a growth tool — not a burden.

Your clients can use their funding to:

Buy inventory or equipment

Invest in marketing and ads

Hire staff or contractors

Launch new products

Expand into new locations

Ready to Partner

With CEO Capital Connection?

Join hundreds of affiliates and business partners earning commissions while

helping entrepreneurs secure $50K–$500K in funding.

01

Click “Join the Program” below

02

Complete the short application form

03

Receive your

Partner Dashboard link

04

Start referring and track your progress

Got Questions? We’ve Got Answers.

How much can I earn?

You earn 10% of the total funding fee per approved client, with potential to increase based on volume.

When do I get paid?

Commissions are paid monthly after client funding completion.

Do I need to sell?

No — just refer. We handle the funding process end-to-end.

How will I know if my client gets funded?

You’ll receive automatic notifications through your Partner Portal.

What kind of clients qualify?

Any business owner seeking $50K–$500K in capital — new or existing.

Let’s Help More Business Owners Win Together

Join the CEO Capital Connection Partner

Program today and start earning while helping entrepreneurs secure the capital they need to grow.

Helping Small Business Owners Secure $50K–$500K in Funding — Fast.

Legal

Privacy Policy

Terms & Conditions