Insider Moves

STAY UP TO DATE ON REAL ESTATE NEWS AND MORE

Decoding Current Mortgage Rates for Home buying Success!

If you're thinking about buying a home, there are a few important things to consider. Two of these are home prices and current mortgage rates, which can affect your decision. Let's take a closer look at these factors to help you make an informed choice.

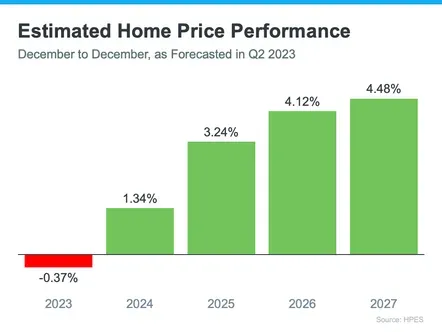

Where Do I Think Home Prices Are Heading? To get an idea of where home prices might be going, experts conduct a survey called the Home Price Expectation Survey. They ask over a hundred economists, real estate experts, and other professionals for their opinions. According to the latest survey, experts think that home prices might go down a bit this year.

But here's what's important to know: The worst price drops have already happened, and many markets are seeing prices go up again. The small predicted drop for this year is far from the big crash that some people thought might happen. Looking ahead, the experts believe that home prices will start to rise again in 2024 and beyond.

So, why is this important? It means that if you buy a home now, it's likely to increase in value over time. This can be good for you because it means you'll have more equity in your home. If you wait to buy, the price might go up, and you'll end up paying more.

Where Do I Think Mortgage Rates Are Heading? Mortgage rates are the interest rates you pay when you borrow money to buy a home. Over the past year, mortgage rates have gone up because of things like uncertainty in the economy and inflation. However, recent reports show that inflation is starting to slow down, which is good news for mortgage rates.When inflation goes down, mortgage rates usually go down too.

Some experts predict that mortgage rates will drop slightly over the next few months. They might settle somewhere around 5.5% to 6% on average. However, nobody can say for sure what will happen with mortgage rates in the future.

Let's look at a few scenarios to understand how mortgage rates can affect your decision:

a) If you buy a home now and mortgage rates stay the same: This is a good move because home prices are expected to go up. By buying now, you can avoid paying more in the future.

b) If you buy a home now and mortgage rates go down (as experts predict): It's still a good decision because you'll get the house before prices go up. If rates do go down, you might have the option to refinance your home later and get a lower rate.

c) If you buy a home now and mortgage rates go up: This is an even better decision because you bought the house before both prices and rates increased.

In conclusion, when you're thinking about buying a home, it's important to pay attention to home prices and current mortgage rates. Although nobody can predict exactly what will happen, experts can give us some idea. It's a good idea to talk to a professional who knows about your local market to get their opinion.

Buying a home is a big decision, and it's important to consider all the factors. By keeping an eye on current mortgage rates, you can make informed choices and take advantage of opportunities. Remember, the goal is to find a home that fits your needs and financial goals.

By gathering reliable information and taking your time to make a decision, you'll be on the right track to finding the perfect home for you.