7.5 Million Affordable Apartments Just Vanished

7.5 Million Affordable Apartments Just Vanished - And Nobody Noticed

America lost over 7.5 million rentals under $1,000/month in a decade. Here's where they went—and who's profiting.

The Affordable Rental Apocalypse

While everyone was watching home prices skyrocket, something even more devastating was happening to renters.

Between 2013 and 2023, America lost 7,536,859 affordable rental units.

These weren't luxury apartments being converted to condos. These were the bottom of the market—the units that kept people off the streets.

Rentals under $600/month:

2013: 9,021,447 units

2023: 6,525,581 units

LOSS: 2,495,866 units (27.7% gone)

Rentals $600-$999/month:

2013: 15,739,551 units

2023: 10,698,558 units

LOSS: 5,040,993 units (32.0% gone)

Read that again.One-third of all affordable rentals disappeared in 10 years.

Where Did They Go?

They didn't disappear. They got renovated, repositioned, and re-priced.

That $650 apartment your friend rented in 2013? It's now $1,400 with "upgraded" finishes and a new name: "luxury living."

The economics are simple: Why charge $700 when you can slap on some stainless steel appliances, add "luxury" to the listing, and charge $1,600?

Landlords aren't evil. They're responding to incentives. But the result is the same:the affordable housing stock is being systematically eliminated.

The States Losing the Most

Top 10 States by Total Affordable Rental Loss:

Texas– 896,947 units lost

Florida– 759,763 units lost

California– 652,657 units lost

Georgia– 411,393 units lost

Arizona– 352,992 units lost

North Carolina– 349,986 units lost

Ohio– 263,418 units lost

Michigan– 255,490 units lost

Washington– 236,646 units lost

Illinois– 231,951 units lost

These aren't small numbers. Texas alone lost nearly900,000 affordable units.That's like erasing the entire rental market of a major city.

The Percentage Wipeout States

Some states didn't just lose affordable housing—they lost nearlyhalfof it:

Top 10 States by Percentage Loss (Rentals under $600):

Nevada– 47.7% loss (46,952 → 24,566)

Idaho– 47.7% loss (48,186 → 25,215)

Montana– 46.4% loss (46,947 → 25,162)

Arizona– 44.7% loss (152,589 → 84,320)

Texas– 42.5% loss (681,994 → 392,132)

Oregon– 41.5% loss (89,158 → 52,138)

Tennessee– 38.6% loss (301,572 → 185,302)

Nebraska– 37.2% loss (93,472 → 58,709)

North Carolina– 36.8% loss (435,137 → 274,958)

South Carolina– 35.6% loss (190,842 → 122,939)

Idaho and Nevada essentiallycut their affordable rental stock in halfin one decade.

The Human Cost

When you lose 7.5 million affordable units, where do those people go?

Some double up with family. Some move to worse neighborhoods. Some leave their jobs because they can't afford to live nearby anymore.

And some end up homeless.

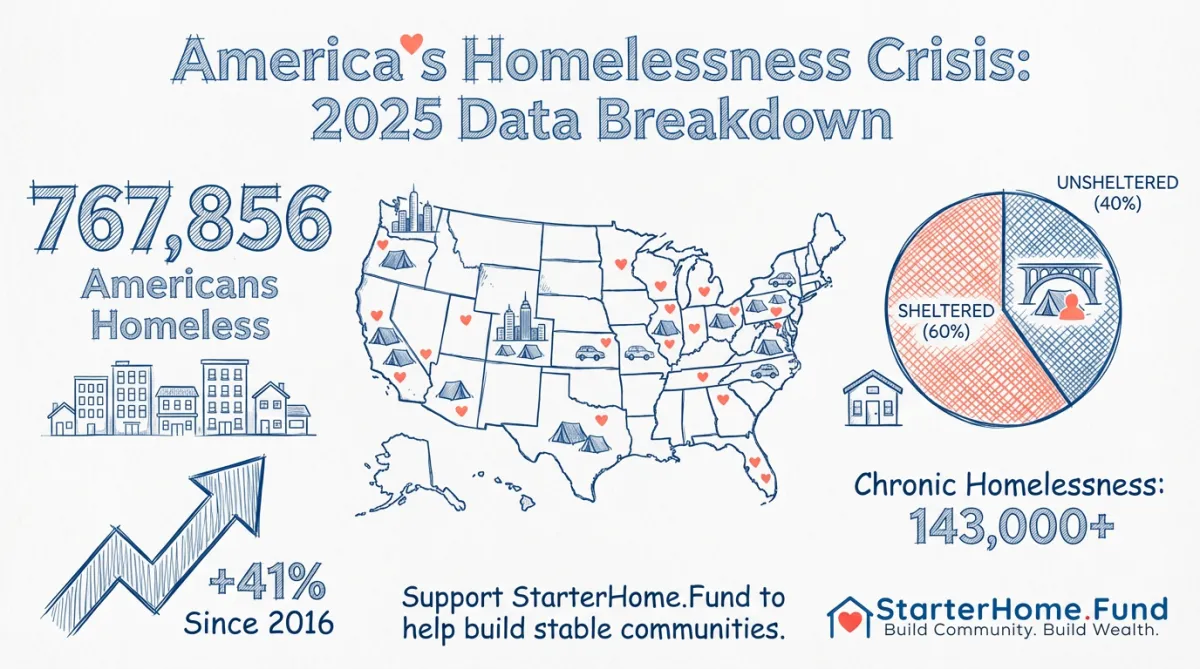

Remember our last article about 768,000 Americans experiencing homelessness?This is why.You can't eliminate one-third of affordable housing and expect people to just "figure it out."

The Market Failure

Here's the brutal truth:The market isn't going to fix this.

Developers make more money building luxury units. Landlords make more money upgrading cheap apartments. Cities make more property tax revenue from high-value properties.

Nobody in the traditional market has an incentive to preserve affordability.

Except investors who see the bigger picture.

The Opportunity Hidden in the Crisis

While affordable units are disappearing through upgrades, something else is happening:

Properties are failing at the bottom of the market.

Nonprofit-owned buildings in foreclosure. LIHTC properties that can't refinance. Distressed multifamily that's one maintenance crisis away from closing.

These properties are hitting the market at$40K-$60K per door.

Everyone else sees distressed assets to flip. We seeaffordable housing stock to preserve.

The model:

Acquire distressed affordable housing before it converts to luxury

Stabilize through ROC conversion or mission-aligned financing

Preserve affordability while delivering 18% returns

Residents gain equity, investors gain returns, communities gain stability

When the market is systematically eliminating affordable housing,the investor who preserves it has a structural advantage.

The Numbers Don't Lie

7.5 million units lost in 10 years = 750,000 per year = 2,055 per day

Every single day, America losesover 2,000 affordable rental units.

You can watch it happen, or you can be part of the solution that also delivers exceptional returns.

The Bottom Line

The affordable rental crisis isn't slowing down. It's accelerating.

While everyone else chases luxury conversions, we're rescuing the properties that keep people housed. And we're delivering 18% AAR while doing it.

Because the biggest market failure is also the biggest market opportunity.

👉Ready to invest in the solution? Join our investor club and earn 18% AAR while preserving affordable housing.

Data Source: Harvard Joint Center for Housing Studies, State of the Nation's Housing 2025