New Blog Post

The $595,000 Income Problem - Who Can Actually Afford to Buy a Home Anymore?

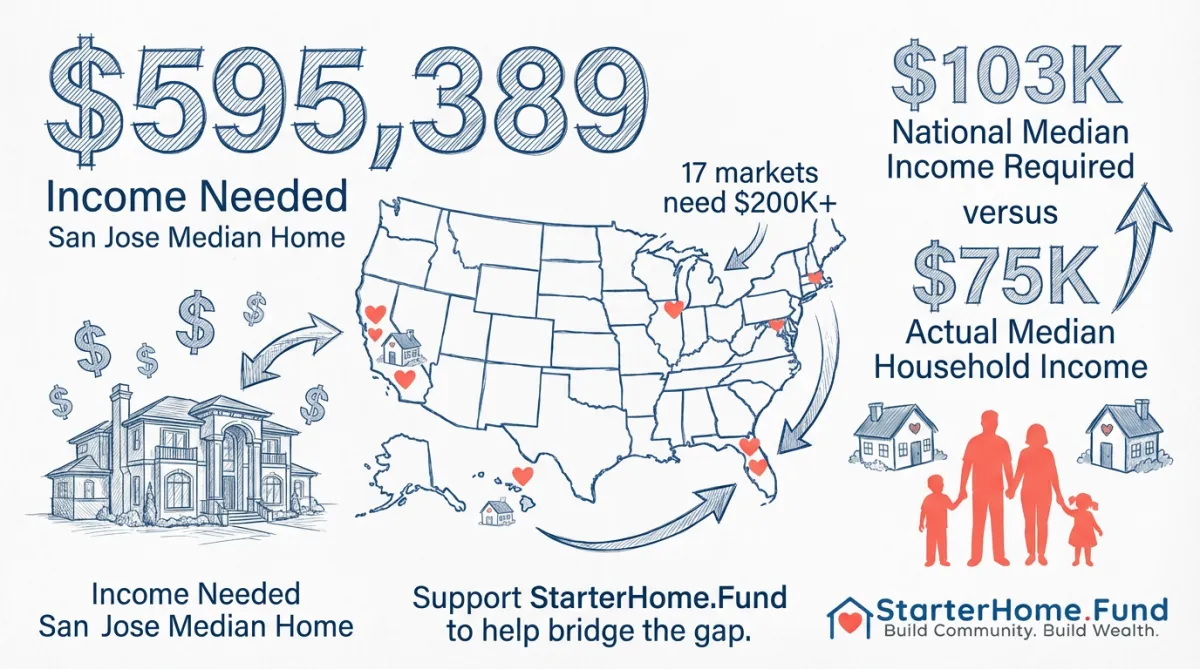

San Jose needs a $595K salary to buy a median home. And it’s not alone.

The New Reality of American Homebuying

Here’s a number that should stop you in your tracks:

$595,389

That’s the annual income you need to afford the median home in San Jose. Not a mansion. Not a luxury property. The median single-family home.

Monthly payment? $15,381.

And if you think that’s an outlier, think again.

The Markets Where Homeownership is Dead

According to Harvard’s Joint Center for Housing Studies latest data, 17 major metropolitan areas now require a six-figure income just to afford the median home. Many need well over $200,000.

The Top 10 Most Expensive Markets (by income required):

San Jose, CA – $595,389 income needed | $2.02M median price

Anaheim-Santa Ana, CA – $430,384 | $1.45M

San Francisco Bay Area – $392,709 | $1.32M

Honolulu, HI – $330,697 | $1.17M

San Diego, CA – $306,747 | $1.04M

Salinas, CA – $288,158 | $955K

San Luis Obispo, CA – $280,653 | $953K

Oxnard-Ventura, CA – $277,669 | $932K

Naples, FL – $264,020 | $865K

Los Angeles, CA – $256,034 | $863K

Notice a pattern? California dominates. But Florida, Hawaii, and Washington are creeping in.

What About “Affordable” Markets?

Even the national median tells a brutal story:

Median income required nationwide: $102,739

Median home price: $328,700

That means the typical American metro area requires a household income over $100,000 just to afford the median home.

A decade ago, that would’ve sounded absurd. Today, it’s the baseline.

The Math That Doesn’t Work

Let’s break down what this means in real terms.

The median US household income is around $75,000. The median income required to buy a home is $102,739.

That’s a $27,000+ gap between what people earn and what they need to afford housing.

And in expensive markets? The gap is a chasm:

San Jose: You need to earn 8x the national median income

Anaheim: 5.7x

San Francisco: 5.2x

These aren’t markets. They’re exclusion zones.

Markets Requiring $200K+ to Enter

17 metropolitan areas now require a minimum household income over $200,000:

Anaheim, CA – $430K

San Francisco, CA – $393K

Honolulu, HI – $331K

San Diego, CA – $307K

Naples, FL – $264K

New York City, NY – $244K

Boston, MA – $229K

Seattle, WA – $231K

And the list keeps growing.

What This Means for Investors

Here’s the opportunity nobody’s talking about:

The market is pricing out the majority of buyers. But people still need housing.

When homeownership becomes impossible, two things happen:

Rental demand explodes

Alternative ownership models become viable

This is where Resident Owned Communities (ROC), manufactured housing, and affordable multifamily come in.

The economics are simple:

Properties in foreclosure at $40K-$60K per door

Median households can’t afford to buy

Stabilize properties through mission-aligned financing

Provide pathways to ownership that actually work

Exit at $150-$200/door while residents gain equity

When the median home requires a $103K income and the median household earns $75K, the traditional homeownership model is broken.

We’re not trying to fix it. We’re building a better one.

The Bottom Line

If you’re waiting for prices to “come back down” so normal families can afford homes again, you’re going to wait a very long time.

The affordability crisis isn’t a temporary blip. It’s structural.

The question isn’t whether things will change. It’s whether you’ll be part of the solution—and profit from it.

👉 Join our investor club. Earn 18% AAR while solving the affordability crisis. Drop “AFFORD” in the comments or DM me.

Data Source: Harvard Joint Center for Housing Studies, State of the Nation’s Housing 2025