SLASH YOUR WORKERS COMP AND GROUP HEALTH EXPENSES 25 TO 50% OR MORE

EMPIRICAL DATA PROVES THAT WHEN EMPLOYEES HAVE ACCESS TO MORE CARE AND MORE CASH, WORKERS COMP CLAIMS AND HEALTH EXPENSES GO DOWN.

SEVEN STEPS TO SUCCESS

See if you qualify

Meet and review your benefits estimate

Experience the no hassle install

Start receiving benefits month one

Enjoy employee morale and retention

Implement your new, lower workers comp pricing

Redeploy your capital

CONTACT US

By submitting this form, you consent to receive SMS and or email from our business. To unsubscribe, follow the instructions provided in our communications. Msg and data rates may apply for SMS. Your information is secure and will not be sold to third parties.

FREQUENTLY ASKED QUESTIONS

What is an example of Risk Mitigation Tool?

One example is a participatory wellness plan used in conjunction with a workers comp insurance policy. The plan targets specific aspects of wellness that are proven to reduce claims, therefore reduce premiums for workers comp. Through our workers comp insurance partners, we can significantly lower your client's work comp premiums.

Summary of the tools available to employees and their family.

Participatory Wellness

✔ 24/7 Access to health care resources for employee and family at no cost

✔ Mental Health Counseling - for employee or family

✔ Legal - one consultation per issue, unlimited issues

✔ Holistic Coaching with a registered nurse, four sessions per year per member

✔ Identity theft protection and recovery for entire employee household

✔ Health risk assessments Universal Life Insurance

✔ Guaranteed Issue!

✔ Up to $150,000

✔ No physicals or blood work

✔ Guaranteed 3% annual interest rate

✔ Loan and withdrawal options

✔ Employees can take the portable, flexible policy with them

✔ Peace of mind knowing loved ones have extra resources

How do employees qualify?

Employers & Employees receive advantages with the Wellness Plan. These benefits pay for the plan, plus provide 213.d benefits to the eligible employees. These benefit amounts are determined in the following manner:*Part-time employees are excluded based on the IRS codes.*Employees must work at least 36 hours a week to be considered full-time.*The company must offer health insurance

Do employees have to pay out of pocket for life insurance?

No, there is no reduction to employees net pay who are qualified and participating in the program. The policies are portable and can be funded by the employee when they leave / sever employment with the company.

What if we are self insured for Workers Comp?

Excellent! We can still help a great deal. Self insured does not mean "free" right? We can complete a full analysis and STILL save you a bundle. The bottom line is that by improving overall wellness, employee morale and retention improve and productivity is enhanced.

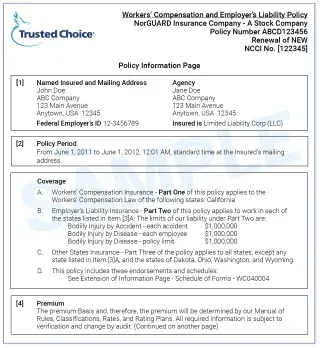

What is a declarations page or dec page?

Declaration Page or Dec Page for a Workers Compensation Policy...The declaration page is the first part of your workers compensation policy. It is the section that describes your estimated payrolls, classifications, discounts, rates and credits on your workers compensation policy. This is also where the insurance company establishes your deposit premium for the policy period. A declaration page is company specific. While the workers comp forms making up a policy are many times very standardized the dec, declaration, pages are very specific to each individual insurance company who issues workers comp policies. The insurance declaration page will generally be broken down into sections.Typically the first section of the page will be listed or shown as Item 1 and will show information about the named insured such as their name, address and entity type. The next section may show as Item 3 and will be detail information concerning the policy itself and will include; Section A, Workers Compensation Insurance, this section will show the specific state in which the workers compensation applies; Section B, employers Liability Insurance, part two shows how this section is applied to work in each state listed in Item 3 and also shows the employers liability limits as chosen by the policyholder; Section C, Other States Insurance, lists each state in which other states coverage applies. Found within Item 4 on the workers compensation declaration sheet will be the premium calculation statement by the company, classifications, descriptions, estimated payroll, rates and estimated annual premium. Also included on the workers comp dec sheet you will find the audit term, usually set as annual but may be another length of time, the policyholders federal ID number and its experience risk ID number as issued by the governing rate making authority for the resident state. The declaration will also show the minimum premium for the policy and all attached endorsements and policy forms. So the workers compensation policy declaration pages include most of the factual information about the insurance policy.

Is this available in all states?

The Participatory Wellness program is! However, there are four states are monopolistic when it comes to workers comp and those states are: WA, OH, WY, ND. Therefore there will be no reduction in Workers Comp in those four states. The company can still enjoy the other cost reduction benefits and improved employee retention and employees will still get the wellness benefits and guaranteed issue life insurance!

585-488-6476 Call or text ~ [email protected]

Copyright © 2023 Sullivan Business Consulting LLC all rights reserved.