“Our Services — Built to Secure Your Future

“Whether you’re filing taxes, running a business, or building long-term wealth—we’ve got you covered.”

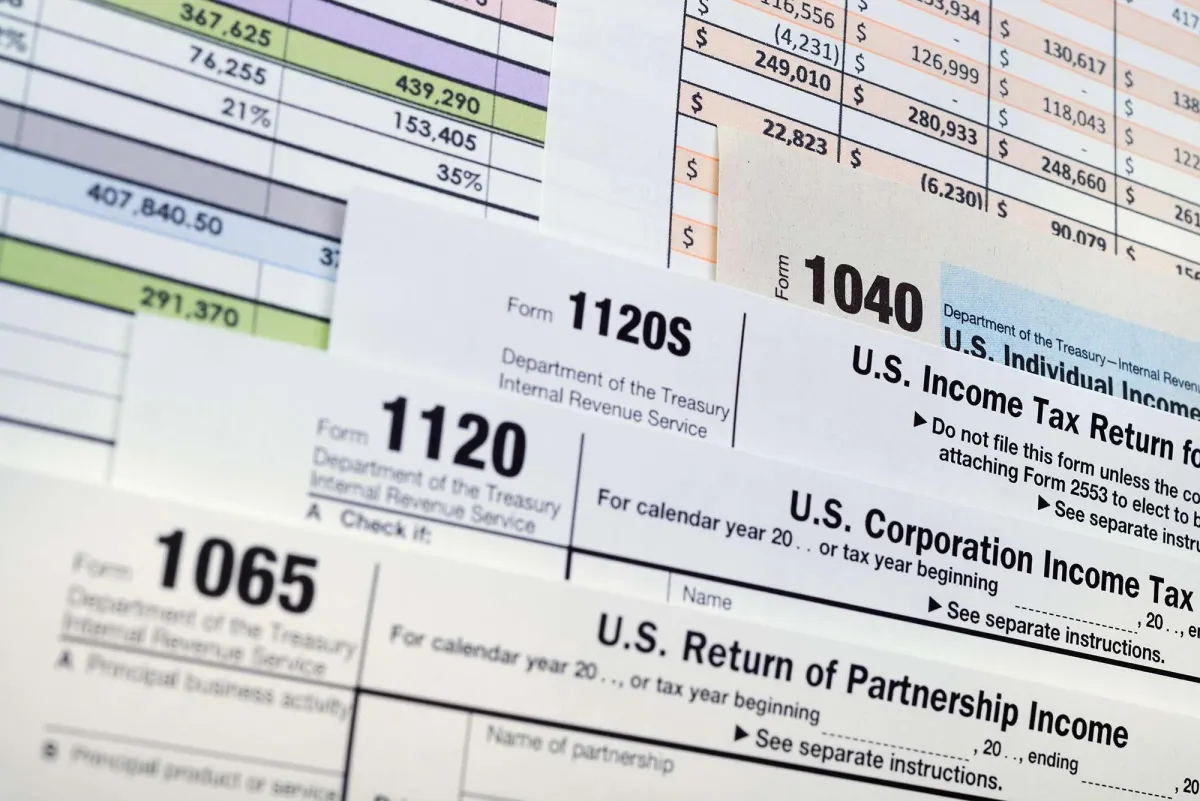

🧾 Section 1: Tax Preparation

“Individual & Business Tax Filing”

From W-2 employees to freelancers and business owners, we handle federal and state returns with precision and speed.

Includes:– Accurate tax filing

– Credits and deduction optimization

– IRS e-file & refund tracking

Image

💼 Section 2: Tax Strategy & Advisory

“Smart Tax Planning for Bigger Savings”

We build year-round strategies to reduce your tax bill and increase your take-home profit—especially for business owners and high earners.

Includes:

– Custom tax savings plan

– S-Corp vs. LLC planning

– Quarterly check-ins

🛡️ Section 3: Insurance Consulting

“Protect What You’ve Built”

Life insurance, retirement coverage, and risk management—designed with tax-smart strategy behind it.

Includes:– Life & retirement insurance reviews

– Legacy planning

– Income protection strategies

🚀 Section 4: Business Formation

“Start Your Business the Right Way”

We’ll help you legally form your business, choose the right tax entity, and stay compliant from day one.

Includes:– LLC or S-Corp setup

– EIN & tax ID registration

– Ongoing compliance tips

“Not Sure Where to Start?”

Book a free call and we’ll walk you through the best service for your situation.

Don't worry, we can help!