Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Federal Employee's Guide to the FEGLI Open Season

A FEGLI Open Season is one of those rare moments in a federal career that you absolutely cannot afford to miss. It's a special, limited-time window that lets eligible federal employees sign up for or increase their life insurance coverage, all without needing a medical exam or a major life event to qualify.

Think of it this way: it's like a special key that unlocks your ability to make critical changes to your Federal Employees' Group Life Insurance. The catch? You might only get to use that key once a decade. Missing this opportunity could mean waiting years for another chance.

What Is a FEGLI Open Season and Why Is It a Big Deal?

Unlike the predictable, annual Federal Benefits Open Season for health insurance and dental plans, a FEGLI Open Season doesn't happen every year. That rarity is precisely what makes it such a major event.

Normally, if you want to enroll or boost your life insurance coverage after your initial hiring window closes, you have two options. You either need a Qualifying Life Event (QLE)—like getting married or having a baby—or you have to pass a physical exam, which is never a guarantee.

A FEGLI Open Season temporarily wipes away those barriers. For a short time, you have the freedom to look at your family's needs and make changes that would otherwise be complicated or even impossible. It’s your golden opportunity to secure the right amount of coverage as your life, family, and responsibilities grow.

To help you quickly grasp the most important points, here's a quick summary.

FEGLI Open Season Key Facts at a Glance

| Aspect | Description |

|---|---|

| What It Is | A rare, limited-time event to enroll in or increase FEGLI life insurance coverage. |

| Key Benefit | No medical exam or Qualifying Life Event (QLE) is required to make changes. |

| Frequency | Extremely infrequent; they are not held on a regular schedule and may be years apart. |

| Who Announces It | The U.S. Office of Personnel Management (OPM). |

| Why It Matters | It's a critical opportunity to adjust your financial safety net for your family. |

Understanding these basics is the first step, but the real power comes from knowing how to act when the time comes.

The Scale of the FEGLI Program

To really appreciate why this matters, consider the sheer size of the program you’re part of. Since its creation back in 1954, the Federal Employees' Group Life Insurance (FEGLI) Program has grown to become the largest group life insurance program in the world.

Today, it provides coverage to over 4 million federal employees, retirees, and their families. This isn't just a small workplace perk; it's a massive financial safety net. A FEGLI Open Season, therefore, impacts millions of families across the nation, giving them a crucial chance to align their life insurance with their current financial lives.

Key Aspects to Understand

If you’re a federal employee, you're likely familiar with the yearly open season for health benefits. It's important to know that the life insurance open season plays by a completely different set of rules, especially when it comes to timing. Our in-depth guide on the Federal Benefit Open Season can help you keep the distinctions clear.

A FEGLI Open Season is less like an annual check-up and more like a once-in-a-decade opportunity. It’s a strategic moment to fortify your family's financial future, not just a routine administrative task.

When the Office of Personnel Management (OPM) finally announces an open season, it means you can:

- Enroll in FEGLI: If you initially waived coverage, you can now sign up for Basic Insurance.

- Increase Your Coverage: You can add or increase your Optional insurance—Options A, B, and C—to better protect your loved ones.

- Act Without Underwriting: This is the big one. You can make these changes without having to submit to a medical exam or prove you're in good health.

Because these opportunities are so few and far between, preparation is everything. Taking the time to understand your options and assess your family's needs before an open season is announced ensures you're ready to act decisively. Think of this guide as your preparation manual.

The Timing is Everything: Why FEGLI Open Seasons Are So Rare

If you're a federal employee, you're probably used to the annual Open Season for health benefits—that predictable fall ritual of reviewing plans and making changes. But when it comes to life insurance, you need to throw that calendar out the window. A FEGLI Open Season is a different beast entirely. It's not a yearly event; it's a rare opportunity that the Office of Personnel Management (OPM) announces only when it sees a specific need.

This is probably the most critical thing to understand about the program. While you can tweak your health plan every single year, the chance to get or increase your federal life insurance—often without a medical exam—might only come around once a decade. Sometimes even less.

Missing that window isn't a small thing. It could mean waiting a very, very long time to get the coverage your family needs.

A Look Back at Past Open Seasons

To really get a feel for how infrequent these are, just look at the history. There have only been a handful of FEGLI open seasons in the last few decades.

- 1999: A crucial window opened for employees to adjust their coverage.

- 2004: Five years later, another opportunity came along.

- 2016: The most recent one happened after a very long wait.

The pattern here is that there is no pattern. These aren't on a set schedule. OPM calls for an open season based on complex factors, like workforce trends and the overall health of the insurance program. It’s this unpredictability that makes it so important to be ready.

Think about that last one in 2016. The one before it was all the way back in 2004, which was tied to the program's 50th anniversary. That’s a 12-year gap. Twelve years is a long time to wait for a chance to increase your life insurance without having to prove you're in perfect health or experiencing a major life event. You can read more about this rare open season for life insurance to see just how significant it was.

That long wait drives home a crucial point: when an open season is finally announced, you have to be ready to move.

So, Why Are They So Uncommon?

The rarity of a FEGLI Open Season isn't random. It’s a deliberate strategy to protect the financial stability of the entire program. Think of it this way: the program is built to handle a steady trickle of new people coming in—mostly new hires, who tend to be younger and healthier. This keeps the risk pool balanced.

An open season, on the other hand, is like opening the floodgates. It lets millions of employees enroll or increase coverage all at once, no questions asked about their health. This sudden influx of people, some of whom might have struggled to get private insurance, introduces a massive amount of risk into the system.

The bottom line is risk management. Allowing millions of people to sign up for life insurance at the same time, without medical screening, could destabilize the largest group life insurance program in the world.

By putting years between these events, OPM ensures the program stays financially sound for the long haul. It keeps premiums stable for all four million people covered and makes sure the benefits will be there when families need them.

What This Means For You

When you boil it all down, the takeaway is simple and direct: you can't afford to be caught off guard. Your next shot at making these kinds of changes could be a decade or more away.

This means you need to be thinking about your life insurance needs before an announcement ever happens. Ask yourself a few key questions periodically:

- Has my family grown? New kids or other dependents change everything.

- What about my debts? Have I bought a house or taken on other major financial commitments?

- What does the future look like? Am I planning for college tuition? Do I have a plan to make sure my spouse is taken care of in retirement?

Waiting for an open season to start pondering these questions is a recipe for a rushed, and likely wrong, decision. The enrollment period itself is usually short, lasting only about a month. If you already have a plan in mind, you can act with confidence when that rare window finally opens. Your family's financial security is riding on it.

A Detailed Breakdown of Your FEGLI Coverage Options

Think of your FEGLI coverage as a financial safety net you build for your family. The program is designed in layers, starting with a solid foundation and then letting you add extra protection based on your unique situation. Let's walk through each piece so you can see exactly how they fit together.

The whole system is built on Basic Insurance, which is the automatic starting point for most new federal employees. From there, you can choose to add up to three different types of Optional insurance. A rare fegli open season is the perfect opportunity to review these layers and make sure your coverage still makes sense for your life today.

The Foundation: Basic Insurance Coverage

Basic Insurance is the cornerstone of the FEGLI program. If you're an eligible employee, you're automatically enrolled in this coverage unless you go out of your way to waive it. It’s designed to provide a solid, foundational amount of life insurance from day one.

So, how much is it? The amount is tied directly to your annual salary. OPM takes your salary, rounds it up to the next highest thousand, and then adds $2,000 to that number.

- For example: If your salary is $81,400, it gets rounded up to $82,000.

- The calculation: $82,000 + $2,000 = $84,000 in Basic life insurance coverage.

There's also a nice kicker called the "Extra Benefit" for employees under age 45, and it comes at no additional cost. This feature can double the payout if you pass away before then. The bonus amount starts to decrease at age 36 and phases out completely by age 45.

Best of all, the government subsidizes this foundational layer, covering one-third of the premium while you're an active employee. This makes it an affordable starting point for just about everyone. If you previously waived this coverage, a fegli open season is your golden ticket to enroll without needing a physical exam.

Option A: A Simple, Standard Addition

Once you have Basic coverage in place, you can start adding optional layers. The first and most straightforward is Option A, which gives you a flat $10,000 of additional life insurance coverage.

It's that simple. There are no salary calculations to worry about—it’s just a fixed amount. Many feds use it to add a little extra cushion for final expenses or small outstanding debts. Just know that the cost for Option A is based on your age and will increase over time.

Option B: Building Customizable Coverage

Now we're getting to the part where you can really tailor your life insurance to your family's needs. Option B lets you buy additional coverage in multiples of your annual salary, from one all the way up to five times your pay. Think of it like buying building blocks of insurance.

The calculation is pretty straightforward: take your annual basic pay, round it up to the next highest $1,000, and multiply it by the number of "multiples" you want (1, 2, 3, 4, or 5).

Let's look at an example: An employee earns $95,500 a year and wants to add 3 multiples of Option B.

- First, the salary is rounded up to $96,000.

- Then, the coverage amount is calculated as $96,000 x 3 = $288,000.

This option provides the most significant amount of coverage and is often the main event during a fegli open season for employees who want to seriously boost their family's financial protection. For a more detailed look at how these options play out, check out our complete guide to Federal life insurance (FEGLI).

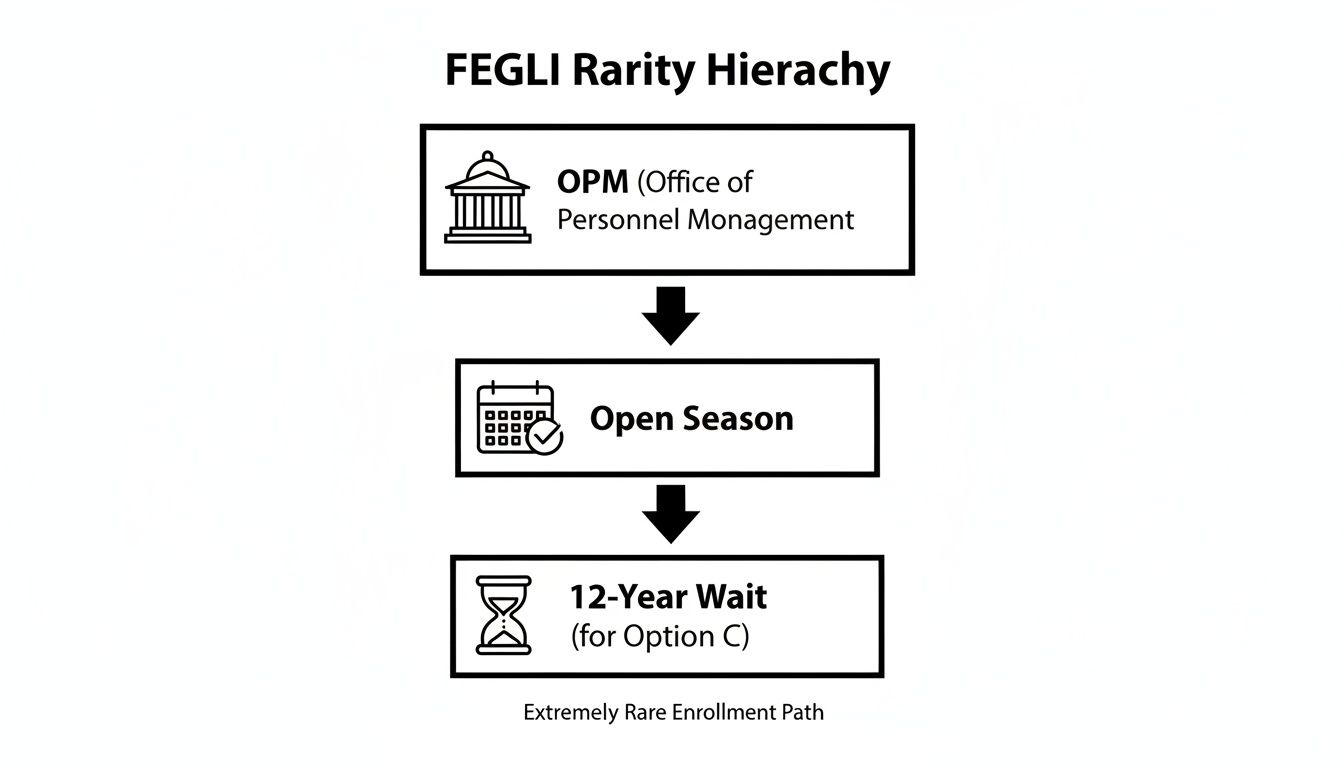

The flowchart below drives home just how uncommon these open enrollment periods are. They are dictated entirely by OPM, and the waits between them can be incredibly long.

This visual really highlights why you need to be decisive when an opportunity like this comes around. If you want to add significant coverage like Option B, this is the time to act—the wait for the next chance could easily be over a decade.

Comparing FEGLI Optional Coverages

To help you see the differences at a glance, we've broken down the three optional coverages side-by-side.

| Coverage Type | Coverage Amount | Who It Covers | Key Feature |

|---|---|---|---|

| Option A | $10,000 | Employee | A simple, fixed-amount addition. |

| Option B | 1 to 5 times your salary | Employee | The most flexible option for substantial coverage. |

| Option C | 1 to 5 multiples | Spouse & Children | Covers your family under a single plan. |

Each option serves a different purpose, from providing a small, fixed benefit with Option A to securing significant, salary-based coverage with Option B, or extending a safety net to your loved ones with Option C.

Option C: Protecting Your Family

Last but not least, Option C is all about covering your eligible family members—your spouse and unmarried dependent children under the age of 22. Just like Option B, you purchase this coverage in multiples.

You can choose from one to five multiples. For each multiple you select, you get:

- $5,000 for your spouse.

- $2,500 for each eligible child.

So, if you elect five multiples, your spouse would be covered for $25,000 (5 x $5,000), and each eligible child for $12,500 (5 x $2,500). What's interesting is that the premium you pay is for the entire family unit and is based on your age, not your spouse's. This makes Option C a very straightforward way to secure a modest amount of life insurance for your entire family under one roof.

What If I Miss an Open Season? Changing Coverage the Hard Way

To really get why a FEGLI Open Season is such a big deal, you have to understand how locked-in your choices usually are. For years, sometimes even decades, you can’t simply decide you need more life insurance and sign up. The door is, for all intents and purposes, closed.

Outside of an open season, you’re stuck with only two ways to get more coverage: experiencing a major "Qualifying Life Event" or proving you’re in good health by passing a physical exam. Both paths are narrow and come with strict deadlines and rules, which really drives home how valuable an open season is. Let's look at how these normally work.

Path 1: Qualifying Life Events (QLEs)

A Qualifying Life Event, or QLE, is a major personal milestone that the government agrees is significant enough to let you revisit your benefits. Think of it as a specific trigger—like getting married or having a baby—that temporarily unlocks your ability to make changes.

These events are very specific and almost always tied to your family. The most common QLEs that let you add or increase FEGLI coverage are:

- Marriage

- The birth or adoption of a child (or acquiring a stepchild)

- Divorce

- Death of a spouse

When one of these things happens, a timer starts immediately. You have just 60 days from the date of the event to get the SF 2817 Life Insurance Election form to your HR office. If you miss that deadline, the window slams shut, and the opportunity is lost.

Path 2: The Medical Exam Gauntlet

So, what happens if your life is stable—no QLEs on the horizon—but you’ve realized your coverage is too low? Your only other shot is to request more insurance and prove you're healthy enough to be a good risk. This is called medical underwriting.

You can submit a Request for Insurance (SF 2822) anytime. But that just starts the process. The Office of Federal Employees' Group Life Insurance (OFEGLI) will review it and, if they move forward, require you to get a physical exam, which you have to pay for yourself.

Here's the catch: Approval is never a sure thing. The insurance carrier digs into your entire health history. If they find anything that makes you seem like a less-than-perfect risk, they will deny your request for more coverage.

This process is exactly why a FEGLI Open Season feels like a golden ticket—it lets you skip the entire medical approval process.

Why Open Season Is a Game-Changer

When you see the hoops you normally have to jump through, it becomes crystal clear why an open season is so important. It’s the one time you can make changes without needing a major life event or worrying about being denied for a pre-existing condition.

The Hurdles You Get to Bypass During an Open Season:

| Standard Method | The Hurdle | How Open Season Is Different |

|---|---|---|

| Qualifying Life Event | You need a specific life event to happen and then must act within a strict 60-day timeframe. | You can enroll or increase coverage without needing any special reason or life event. |

| Medical Exam | You have to pay for a physical and can be denied coverage based on your health history. | No medical exam is needed. Your health is not a factor. |

These rules mean that for the vast majority of your career, your life insurance decisions are pretty much set in stone. A FEGLI Open Season is that rare moment where you are back in the driver's seat, able to protect your family's future on your terms.

How to Strategically Prepare for the Next Open Season

Waiting for the Office of Personnel Management (OPM) to announce a FEGLI Open Season before you start planning is like waiting for a hurricane warning to buy batteries. By then, it’s too late. The enrollment window is frustratingly short, and the decisions you make—or fail to make—will have a massive financial impact on your family for years to come.

The real work happens now, long before any official announcement hits your inbox. Strategic preparation means you can act with speed and confidence when the window finally opens. It involves taking a clear-eyed look at your financial life, what you've currently got, and where you're headed.

This proactive approach turns what is normally a stressful, rushed scramble into a simple administrative task. You won't be reacting; you'll be executing a plan you already have in place to protect your family's future.

Start with a Personal Financial Audit

First things first: you need a complete picture of your family’s actual financial needs. This isn’t just about covering a funeral. It’s about replacing your income so your family can maintain their standard of living long after you’re gone. A solid needs assessment is the foundation of any smart life insurance strategy.

Grab a notepad and start asking some tough questions. This simple exercise will give you a concrete target for your life insurance coverage, taking it from a vague concept to a specific dollar amount.

Your financial audit should figure out the funds needed to cover several key areas:

- Debt Repayment: Tally up your mortgage balance, car loans, credit card debt, and any other outstanding loans. The goal is to have life insurance wipe these clean for your survivors.

- Income Replacement: How many years of your salary would your family really need to stay on their feet? Multiply your annual income by the number of years you want to provide for them.

- Future Education Costs: If you have kids, look up the projected costs of college or vocational training. This is a huge expense that you absolutely need to factor into your coverage.

- Final Expenses: Don’t forget the immediate costs. A funeral, burial, and final medical bills can easily run $10,000 to $15,000 or more.

Once you have this grand total, you'll have a much clearer idea of the insurance gap you’re trying to fill.

Evaluate Your Current Coverage

With your target number in hand, it's time to see what you already have. Pull out your latest Leave and Earnings Statement (LES) and look at what FEGLI coverage you’re currently paying for. This is where a lot of people get a wake-up call.

Look at your Basic, Option A, B, and C elections. Does the total death benefit come anywhere close to the number you just calculated? For most feds, this is the moment of truth where they realize their life insurance is more of a small cushion than a real safety net.

The most common mistake is assuming the default FEGLI coverage is enough. A strategic review almost always reveals a significant gap between the protection you have and what your family would actually need to thrive financially.

This gap analysis is critical. It tells you exactly how much more coverage you need to get during the next FEGLI Open Season.

Compare FEGLI with Private Market Options

Finally, being truly prepared means knowing all your options—both inside and outside the federal system. FEGLI is incredibly convenient, especially during an open season when there’s no medical exam. But it’s not always the most cost-effective choice, especially for younger, healthier employees.

Use the time before an open season to get a few quotes for term life insurance from private companies. You might be surprised to find you can get a whole lot more coverage for a lower monthly premium on the open market. This is particularly true if you're in good health.

When comparing, think about these factors:

- Cost: FEGLI premiums for Option B jump up every five years and can become shockingly expensive once you hit your 50s and beyond.

- Health: If you’re healthy, private insurance will almost certainly be cheaper. If you have pre-existing health issues, the no-questions-asked nature of a FEGLI Open Season is a huge advantage you can't ignore.

- Convenience: Nothing beats the simplicity of FEGLI’s automatic payroll deductions.

Often, the smartest strategy is a hybrid approach. You can use FEGLI for a solid base of coverage and then supplement it with a private term policy to meet your family's full needs without breaking the bank. The only way to know for sure is to do the research ahead of time.

Preparing now empowers you to make the best possible decision for your family. When that next opportunity arrives, you won't be guessing—you'll be executing a well-thought-out plan. For a personalized analysis of your specific situation, you may want to talk with a professional who really understands the ins and outs of federal benefits.

Connecting FEGLI Choices to Your Retirement Security

The choices you make during a FEGLI open season are bigger than just today. They cast a long shadow, directly shaping your financial security well into your retirement years. For many feds, FEGLI is more than just a benefit—it’s a foundational piece of their estate plan and a critical safety net for a surviving spouse.

To keep your FEGLI coverage when you retire, you have to clear one very important hurdle: the "five-year rule." The rule is straightforward but non-negotiable. You must be continuously enrolled in FEGLI for the full five years right before you retire.

Think about that. If you waived coverage years ago and now retirement is on the horizon, an open season is your final opportunity to get back in and start that five-year clock. If you miss this chance, you could lose the ability to have this life insurance in retirement for good.

Post-Retirement Reduction Choices

Once you do retire, you’ll face another crucial decision about your Basic life insurance. You get to choose how its value changes over time. This decision impacts both what you’ll pay in premiums and what your beneficiary will ultimately receive.

You have three paths to choose from:

- 75% Reduction: Your coverage slowly shrinks to just 25% of its original face value. The big upside? Once you turn 65, the premiums for this Basic coverage drop to zero. It's free.

- 50% Reduction: Your coverage reduces to 50% of its original value. You’ll pay a higher premium to keep this larger amount intact.

- No Reduction: Your coverage stays at 100% of its full value for life. As you can imagine, this option carries the highest price tag in retirement.

Making a smart move during a FEGLI open season can give these reduction choices real teeth. If you'd like to dive deeper, you can learn all about your options for federal employee life insurance after retirement in our guide.

A larger initial death benefit means that even with a 75% reduction, the remaining 25% can still represent a substantial, tax-free sum for your loved ones. This makes your open season choices a powerful tool for legacy planning.

For example, imagine you use an open season to add more coverage. Years later, in retirement, that remaining 25% could still be enough to wipe out a mortgage or help pay for a grandchild's college education. A simple decision today becomes the cornerstone of your family’s financial security tomorrow.

Your FEGLI Open Season Questions Answered

When a FEGLI open season comes around, it always stirs up a lot of questions. Let's tackle some of the most common ones we hear from federal employees trying to make sense of it all.

Can Federal Retirees Participate?

This is a big one, and the answer is usually no. Generally, federal retirees (annuitants) are not eligible to enroll or increase coverage during a FEGLI open season. This opportunity is really geared toward current federal employees.

There's a small exception, though. If you happen to retire during an open season, you might be able to make a last-minute change. The catch is that both your retirement date and your election form submission have to fall within that specific open season window.

When Does New Coverage Actually Start?

Once you've made your choices, you have to be patient. Any new coverage you elect during a FEGLI open season doesn't kick in right away. There’s a built-in waiting period of one full year.

To be clear, you have to be in a "pay and duty" status for that entire year for the new coverage to take effect. So, if you enroll in September 2024, don't expect that new life insurance to be active until October 2025.

Is FEGLI Always the Best Deal?

The convenience of a FEGLI open season is hard to beat, especially since you don't need a medical exam. But that doesn't automatically make it the best financial move for everyone. For many younger, healthier feds, a private term life insurance policy can often provide a lot more coverage for a much lower premium.

FEGLI's biggest selling points are guaranteed acceptance and easy payroll deductions. The downside? Its age-banded premiums for the optional coverages can get incredibly expensive as you get older.

It really comes down to a trade-off. You have to weigh the guaranteed approval of FEGLI against the potential cost savings you could find with a private policy. A smart strategy often involves combining them—using a private policy for the bulk of your needs and FEGLI to fill in any gaps, creating a strong, affordable safety net for your loved ones.

Making these decisions can feel overwhelming, but you don't have to figure it out on your own. Federal Benefits Sherpa provides personalized guidance to help you understand your options and plan for a secure future. Book your free 15-minute benefit review at https://www.federalbenefitssherpa.com to get started.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved