Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Guide to Federal Employee Deferred Retirement

Sometimes, life takes you in a new direction before you’re ready to retire from federal service. You might get a can't-miss private sector job offer, or maybe you need to move for family reasons. You’re not old enough for an immediate pension, but what happens to all those years you’ve put in?

This is where deferred retirement comes in. It’s a way for federal employees who leave government work to still claim a pension later on, provided they've put in at least five years of creditable service.

Think of it as hitting the 'pause' button. You're not cashing out or walking away empty-handed. Instead, your earned pension benefits are put on hold, safely kept for you until you reach the right age to start collecting them.

What Is a Federal Employee Deferred Retirement

Let's paint a picture. You’ve built a solid career in federal service, but a fantastic opportunity pops up that you just can't ignore. The catch? You're years away from being eligible for an immediate retirement annuity. The idea of losing the pension you've worked so hard to build is a tough pill to swallow.

This is exactly why deferred retirement is such a powerful tool.

Instead of taking a refund of your retirement contributions (and losing the government's matching funds), you let your benefits mature on the sidelines. The Office of Personnel Management (OPM) holds your earned pension in trust. It simply waits for you to hit the minimum age to activate it, giving you a steady monthly income stream years, or even decades, after you've left your government job.

The Core Concept of Pausing Your Benefits

Your federal pension is a bit like a long-term savings plan. Every paycheck, both you and your agency contributed to it. When you leave with enough service time, opting for deferred retirement means you're leaving that money invested with the government instead of cashing it out early.

The key term here is being "vested."

Vesting means you have a legal right to a future benefit. Under the Federal Employees Retirement System (FERS), you become vested once you complete five years of creditable civilian service.

A deferred retirement is for former employees who were vested (had at least 5 years of creditable civilian service) when they separated from federal service but were not eligible for an immediate retirement benefit.

This is a critical distinction. It's the line between someone who has earned a future pension and someone who resigns early and can only get a refund of their personal contributions.

Who Is This Option Designed For

Deferred retirement isn't for every federal employee. It’s designed for a specific set of circumstances and is completely different from retiring immediately from your position.

This path is a perfect fit for people who are:

Changing Careers Mid-Stream: You’ve met the five-year service requirement but are nowhere near your Minimum Retirement Age (MRA) and want to jump to the private sector.

Relocating for Personal Reasons: Life happens. You might need to leave your federal job because of a spouse's career, to be closer to family, or for other personal needs.

Exploring New Challenges: You're an ambitious professional ready to try a different industry, but you want to make sure the retirement benefits you earned in public service aren't lost.

Ultimately, a federal employee deferred retirement acts as a financial bridge. It connects the hard work from your past federal career to your future financial security, making sure those years of dedication continue to pay off down the road.

So, Do You Qualify for a FERS Deferred Retirement?

Leaving your federal job doesn't automatically mean you can collect a pension later. To qualify for a deferred retirement, you have to hit two specific, non-negotiable milestones before you separate. Think of these as the gatekeepers to your future annuity.

The rules are pretty straightforward. They’re designed to make sure that only federal employees with a certain amount of skin in the game can claim a pension down the road. You need to have enough service time, but you also need to leave before you're eligible to retire right away. Let's dig into what that really means.

The Five-Year Service Rule Is a Hard Line

The single most important piece of the puzzle is your total creditable service. You absolutely must have at least five years of creditable civilian service when you walk out the door. This is the magic number that makes you "vested" in the FERS system.

Being vested is a huge deal. It means you've officially earned the right to a future pension, even if you don't stick around long enough to collect it immediately. It's the government's way of locking in its promise to you based on your service.

If you leave with less than five years, you won't be eligible for a deferred annuity. Period. Your only move is to ask for a refund of your FERS contributions. You’ll get your money back, but you’ll forfeit every dollar the government contributed on your behalf. You'd be walking away from a future pension for good.

Leaving Before You're Eligible for an Immediate Pension

The second requirement is all about timing. A deferred retirement is specifically for people who leave federal service before they're old enough to start collecting an immediate pension.

This means you have to separate before you meet one of the standard age and service combinations for an immediate retirement, which are:

Age 62 with at least 5 years of service

Age 60 with at least 20 years of service

Your Minimum Retirement Age (MRA) with at least 30 years of service

That MRA is a key number here. It’s the earliest you can retire, and it floats between age 55 and 57 depending on when you were born. The whole point of a deferred retirement is that you leave before hitting these milestones. If you want to dive deeper into these rules, check out our guide on federal retirement eligibility explained.

A deferred retirement is fundamentally for someone who is vested (5+ years of service) but not yet age-eligible for an immediate pension. If you already meet the age and service rules to retire, you’d simply file for that instead.

Putting It All Together: Real-World Scenarios

Sometimes, examples make things click. Let's look at a few scenarios to see how these rules play out for different federal employees.

Scenario 1: The Career Changer

An employee is 40 years old with 8 years of service. They get a great offer in the private sector and decide to take it. Since they have more than five years of service but are nowhere near retirement age, they are a perfect candidate for a deferred retirement. They can apply for their pension once they turn 62.Scenario 2: The Short-Term Employee

An employee is 35 years old and has put in 4 years of service. They leave to start a business. Because they haven't met the five-year vesting rule, they are not eligible for a deferred retirement. Their only choice is to request a refund of their FERS contributions.Scenario 3: The Near-Retiree

An employee is 58 years old with 28 years of service, and their MRA is 56. They are already eligible for an immediate retirement (specifically, an MRA+10 annuity), so a deferred retirement isn't even on the table for them. They could start drawing a pension, even if it's slightly reduced, right away.

How Your Deferred Retirement Pension Is Calculated

Figuring out a future pension can seem daunting, but the formula for a Federal Employees Retirement System (FERS) annuity is actually quite simple. It really just comes down to multiplying three key numbers together to find out what you'll get each year.

Let’s walk through this calculation step-by-step. Once you understand the moving parts, you can get a surprisingly accurate picture of your future federal pension, which is a huge help for long-term financial planning.

The Three Core Parts of the FERS Formula

Your annual FERS pension is built on a straightforward equation. Think of it as your high-three salary, multiplied by your years of service, and then multiplied by a set percentage.

Here's the basic formula:

High-3 Average Salary x Years of Creditable Service x FERS Multiplier = Annual Pension

Each piece of this puzzle has a specific job. Your "High-3" sets the earnings baseline, your service years reflect your time on the job, and the multiplier is a fixed rate defined by FERS rules.

Understanding Your High-3 Average Salary

The first and most important part of the equation is your High-3 Average Salary. This is simply the average of your basic pay during the 36 consecutive months when you earned the most. For most feds, that’s just their last three years of work.

Here’s the catch for anyone considering deferred retirement: that number is frozen in time. The moment you leave federal service, your High-3 salary is locked in for good.

This means your High-3 isn't adjusted for inflation while you're gone. An $80,000 salary when you leave at age 45 is still considered $80,000 when you apply for your pension at 62—even though its actual buying power will be much lower by then.

This "inflation erosion" is probably the biggest financial drawback to a deferred retirement and something you absolutely have to plan for.

Years of Service and the FERS Multiplier

The next two parts of the formula are much more direct. Your Years of Creditable Service is just the total time you've spent in a qualifying federal job. This covers all your full-time and part-time civilian work, and sometimes even military service if you've made the required deposit.

Finally, the FERS Multiplier is the percentage that determines your benefit rate. For nearly all deferred retirement scenarios, this multiplier is 1%.

There's a special provision for a 1.1% multiplier, but it's very unlikely to apply to a deferred retirement. To get that bump, you have to retire at age 62 or older with at least 20 years of service. Since deferred retirement means you left service early, you won't meet that specific requirement.

A Practical Calculation Example

Let's put this all together with an example. We'll use a hypothetical federal employee, Alex, who leaves government for a new opportunity in the private sector.

Here's how we'd calculate his deferred annuity using the FERS formula.

Sample FERS Deferred Annuity Calculation

This table shows how the formula works for Alex's situation, breaking down each component to see how it contributes to his final pension amount.

Calculation ComponentExample ValueWhat It Means for YouHigh-3 Average Salary$90,000This is the average of your highest 36 months of pay, locked in when you leave.Years of Creditable Service15 yearsThis is the total time you worked for the federal government.FERS Multiplier1% (or 0.01)For deferred retirement, this is almost always the standard 1% multiplier.Annual Pension Calculation$13,500The result of multiplying the three components above ($90,000 x 15 x 0.01).

So, what does this mean for Alex?

When he finally becomes eligible and applies for his deferred pension, he’ll receive $13,500 per year. That works out to $1,125 a month before any deductions, like taxes or survivor benefit costs.

To run the numbers for your own situation, you can use a retirement calculator for FERS, your ultimate planning tool. It lets you play with different scenarios based on your specific career path and salary history.

Comparing Deferred Retirement To Other Exit Strategies

https://www.youtube.com/embed/hM4rro-W6qo

Deciding to leave federal service is a huge moment in your career, and a federal employee deferred retirement is just one of several ways you can go. Each path has its own financial realities and will shape your lifestyle in different ways. Getting a handle on the trade-offs is absolutely critical to making a choice you'll be happy with down the road.

To do this right, you need to see how these strategies stack up against one another. The three main ways to leave federal service are deferred retirement, immediate retirement, or simply resigning and cashing out your contributions.

The Big Three Federal Exit Options

Let's break these down. Think of them as three different doors leading out of your federal career—and what's behind each door in terms of money, timing, and benefits is completely different.

Deferred Retirement: This is for when you leave before you're old enough to retire but have at least five years of service under your belt. Your pension is essentially "paused" and held for you until you hit an eligible age, which is usually 62.

Immediate Retirement: This is the traditional path. You’ve met the exact age and service requirements, so you can start drawing your pension the month after you leave your job.

Resignation with a Refund: You leave federal service (often with less than five years of service) and ask for a lump-sum refund of your personal FERS contributions. Be warned: taking this action means you forfeit any future claim to a pension.

The biggest difference between them comes down to timing and your access to lifelong benefits. Immediate retirement offers instant, steady income and lets you keep your health coverage. Deferred retirement provides future income but forces you to give up those crucial benefits. A refund gives you cash now but slams the door on your pension for good.

Health And Insurance Benefits A Critical Distinction

For many federal employees, the decision comes down to one single, massive factor: health insurance. The ability to carry your Federal Employees Health Benefits (FEHB) plan into retirement is, without a doubt, one of the most valuable perks of a federal career.

This is where deferred retirement reveals its biggest downside.

To continue your FEHB coverage into retirement, you must be eligible for an immediate annuity and have been continuously enrolled in a plan for the five years leading up to your separation. Deferred retirement does not meet this requirement.

Losing FEHB eligibility is a huge financial risk. You'll be on your own to find and pay for health insurance from the day you leave federal service until you qualify for Medicare at age 65. This can be a huge, unpredictable expense. Likewise, you also lose the ability to keep your Federal Employees' Group Life Insurance (FEGLI) coverage.

Federal Retirement and Separation Options Compared

To help you see the differences clearly, here's a side-by-side comparison of the three main options.

FeatureDeferred RetirementImmediate RetirementResignation (Refund)Pension AnnuityYes, begins at a future date (e.g., age 62)Yes, begins immediately after separationNo, you forfeit all pension rightsFEHB (Health)Not eligible to continue coverageEligible to continue with 5-year ruleNot eligible to continue coverageFEGLI (Life)Not eligible to continue coverageEligible to continue with 5-year ruleNot eligible to continue coverageTiming of IncomeDelayed until a specific ageBegins the month after you retireImmediate, one-time lump sumIdeal CandidateLeaves mid-career with 5+ years of serviceCareer federal employee meeting age/service rulesLeaves early in career, doesn't plan to returnTSP AccessCan leave funds invested or roll overCan leave funds, roll over, or take paymentsMust roll over or take a distribution

This table lays out the core trade-offs. Your personal circumstances, financial stability, and future plans will ultimately determine which path is right for you.

It's also worth noting there's another option called Discontinued Service Retirement, which applies in specific situations like a reduction-in-force. You can learn more by reading our guide to Discontinued Service Retirement to see if it might fit your situation.

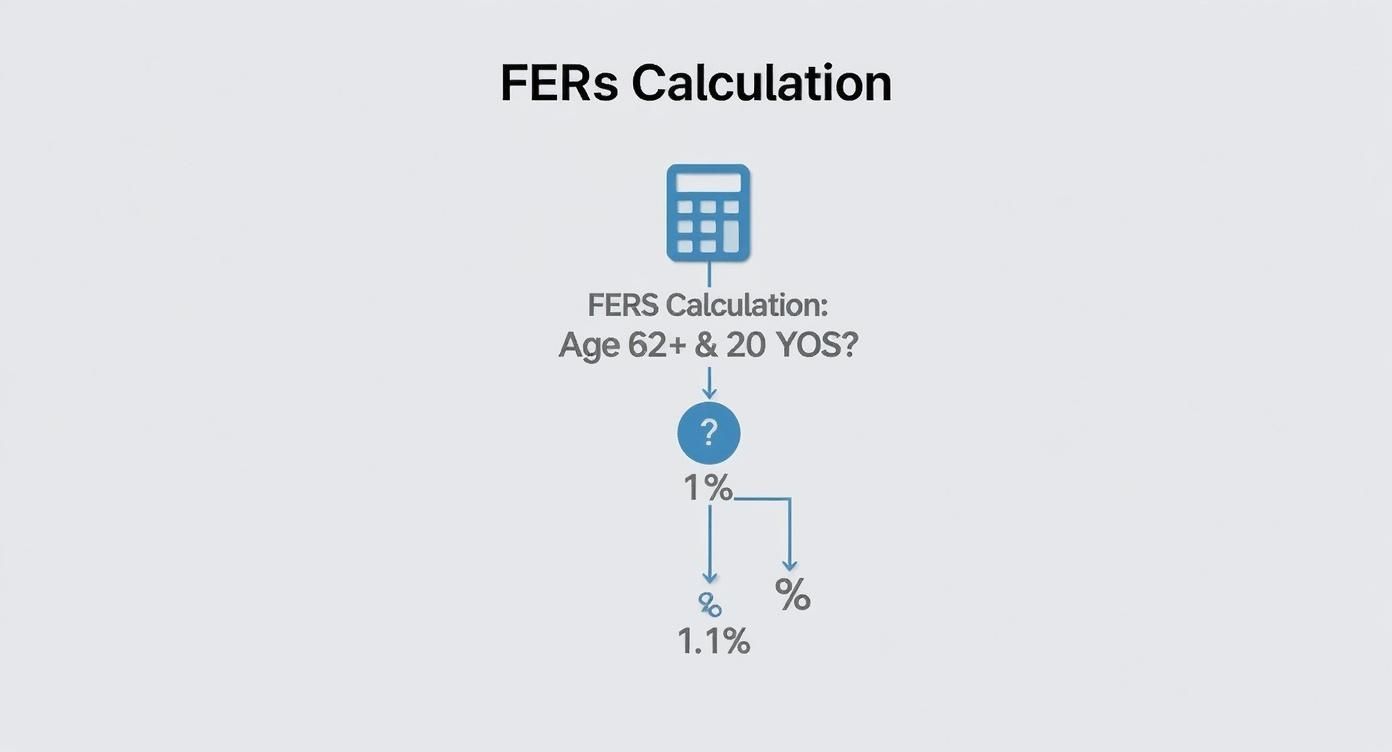

The decision tree below helps visualize a key part of the FERS calculation, showing how your age and years of service affect your pension multiplier.

As this flowchart shows, there's a special rule that gives a higher 1.1% multiplier to employees who retire at age 62 or older with 20 or more years of service—a valuable bonus that deferred annuitants typically can't access.

Navigating the Application Process and Timelines

When you're leaving a federal job for immediate retirement, the paperwork is just part of the offboarding process. But with a federal employee deferred retirement, things work differently. You don't apply for your pension when you leave; you apply years, or even decades, later when you're finally old enough to start drawing on it.

This time gap makes it absolutely critical to keep your service records in a safe, accessible place. Seriously. Your future self will thank you for keeping a detailed file with every SF-50 and service computation date. When the time comes to finally claim your annuity, that paperwork is pure gold.

Kicking Off the OPM Application

Here’s the thing you have to remember: the responsibility to start the process is entirely on you. The Office of Personnel Management (OPM) isn't going to send you a birthday card when you turn 62 reminding you to apply. You have to be proactive and contact them to get the ball rolling.

The best practice is to reach out to OPM 60 to 90 days before you want your annuity payments to begin. This isn't just a suggestion; it gives them the breathing room they need to find your old records, verify everything, and process your application without a last-minute scramble.

To get started, you’ll need to fill out the RI 92-19, Application for Deferred or Postponed Retirement. This is the official form that tells OPM you’re ready to activate the pension benefits you earned all those years ago.

The Reality of OPM Processing Delays

I can't stress this enough: applying early is a strategic move. OPM is notorious for its processing backlogs, and wait times can be unpredictable. Recent events have only made this worse, making that 90-day head start more important than ever.

For example, a major federal deferred resignation program in 2025 created a massive wave of retirement claims. As of October 2025, OPM was swamped with over 20,344 new claims but only managed to process 8,751. This pushed their backlog to an eye-watering 34,587 pending cases. As a result, the average processing time ballooned from 44 days to 79 days almost overnight. You can read the full story on OPM's retirement backlog on GovExec.com.

This data highlights a critical truth: external factors can severely impact how quickly your application is processed. Submitting your paperwork well in advance is the single best way to protect yourself from unforeseen delays and ensure your payments start on time.

A Step-By-Step Checklist for Applying

To keep you on track during this final, crucial phase, here’s a simple checklist. It breaks down the process into clear, manageable steps to help make sure everything goes smoothly.

Gather Your Records: Pull together all your SF-50s (Notification of Personnel Action). Don't forget any documents related to military service buy-backs or other creditable service.

Contact OPM Early: Get in touch with OPM at least 90 days before you want your payments to start.

Complete the Correct Forms: Carefully and accurately fill out the RI 92-19 application. Be sure to include any other forms needed, like those for survivor benefits or tax withholding.

Submit and Follow Up: Mail your completed application to the address OPM provides. Give it a few weeks, then call to confirm they've received it and it's in the queue for processing.

By following these steps and planning ahead, you can successfully navigate the red tape and finally start receiving the retirement benefits you earned through your years of dedicated federal service.

Got Questions About Deferred Retirement? You're Not Alone.

Thinking about deferred retirement brings up a lot of "what if" scenarios. It’s a very different path than immediately starting your pension, and the rules can be tricky. The biggest sticking points usually involve benefits you’ve grown accustomed to, like health insurance.

Let's walk through some of the most common questions federal employees have. Getting clear on these details now can save you from major headaches years down the road when it’s time to start collecting your annuity.

Can I Keep My Federal Health Insurance (FEHB)?

This is the big one, and unfortunately, the answer is no. It's probably the single most significant drawback of choosing a deferred retirement.

To keep your Federal Employees Health Benefits (FEHB) into retirement, the government requires two things: you must be eligible for an immediate annuity, and you must have been covered by FEHB for the five years leading up to your retirement date. With deferred retirement, you don't meet that "immediate" annuity requirement, which means you lose access to FEHB. You'll be on your own to find health coverage until you're old enough for Medicare.

What Happens to My Thrift Savings Plan (TSP) Account?

Good news here: your TSP is your money, and it stays with you. After you leave your federal job, you have a few choices for what to do with your account.

Keep it put: You can simply leave your money in the TSP. It will stay invested and hopefully continue to grow, but you can no longer contribute to it.

Roll it over: You can move the entire balance to an Individual Retirement Account (IRA) or, if you get another job, to your new employer’s 401(k).

Start withdrawals: Depending on your age and the rules, you can begin taking payments from your account.

The main thing to remember is that once you separate from service, your TSP becomes an investment account you manage, not a savings account you add to.

Your Thrift Savings Plan is a portable asset. While you can't add new money to it after leaving your federal job, you retain full control over the existing funds and their investment direction.

Will My Pension Get Cost-of-Living Adjustments (COLAs) While I Wait?

Here’s another critical point: your pension is frozen in time during the deferral period. The High-3 salary that your annuity is based on is locked in on the day you walk out the door. It won't increase to keep up with inflation while you’re waiting to start your payments.

Once you actually start receiving your annuity, then it will be eligible for future FERS Cost of Living Adjustments (COLAs). But for all those years in between, its purchasing power will slowly erode. This is a massive financial factor to weigh in your decision.

The federal retirement landscape is always shifting. For example, between January and June 2025, OPM saw a huge spike in retirement applications, with over 70,000 feds calling it a career. That was a nearly 40% jump from the year before, mostly due to new buyout offers. It just goes to show how quickly things can change. You can read more about these trends in federal retirement at Brookings.edu.

Figuring out these details is what separates a good retirement from a great one. At Federal Benefits Sherpa, we help federal employees navigate these complex choices every day. Schedule a free 15-minute benefit review to make sure you’re on the right path at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved