Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

A Guide to Rollover 401k to TSP for Federal Employees

If you're a federal employee and have a few old 401(k)s floating around from previous jobs, one of the best things you can do is roll them into your Thrift Savings Plan (TSP). This isn't just about tidying up your finances; it's a strategic move to consolidate your retirement funds into one powerful, low-cost account, giving you a much clearer picture of your financial future.

Why Rolling Your 401(k) to the TSP Is a Savvy Move

Trying to keep track of multiple retirement accounts is a headache. Each one has a different login, its own set of investment choices, and—most importantly—its own fee schedule. Bringing all those old accounts under the TSP umbrella gives you two huge wins right off the bat: simplicity and serious cost savings.

This isn't just a niche strategy; it's a massive trend. Recently, U.S. households moved a mind-boggling $1 trillion in retirement plan rollovers. Even more telling is that rollovers into new employer plans like the TSP shot up to $160 billion. People are clearly waking up to the benefits of consolidating into simple, reliable options like the TSP.

The Real Power Is in the Low Fees

Honestly, the biggest reason to consolidate into the TSP is the rock-bottom expense ratio. It’s hard to overstate how significant this is.

Your typical 401(k) plan might be charging you anywhere from 0.5% to 1% in fees each year. That might not sound like much, but the TSP's fees are just a tiny fraction of that.

Think about what that means over time. A 1% fee on a $100,000 account costs you $1,000 every single year. With the TSP, that same fee would be around $55. Compounded over a 20- or 30-year career, that difference can easily translate into tens of thousands of extra dollars for your retirement.

By consolidating, you're not just organizing your accounts; you're actively plugging a leak in your retirement savings. Fewer fees mean more of your money stays invested and working for you.

To see the difference in black and white, here's a quick comparison of the key features.

At a Glance Comparing Your 401(k) and the TSP

| Feature | Typical 401(k) Plan | Thrift Savings Plan (TSP) |

|---|---|---|

| Annual Fees | Often 0.5% - 1.0% or higher | Exceptionally low, typically under 0.07% |

| Investment Choices | Can be overwhelming, sometimes with hundreds of options of varying quality. | Simple menu of core funds (C, S, I, F, G) and Lifecycle (L) Funds. |

| Simplicity | Managing multiple accounts from past jobs can get complicated quickly. | One account, one login, one statement. Makes tracking your progress easy. |

| Loan Options | Varies by plan, but can have restrictive terms or high interest rates. | Offers straightforward General Purpose and Residential loan options. |

Looking at it this way, the advantages of moving your money into the TSP become crystal clear. You're trading complexity and high costs for simplicity and efficiency.

A Clearer, Simpler Retirement Strategy

Beyond just saving money on fees, bringing everything into one place gives you much-needed clarity. Instead of trying to piece together a coherent strategy across different platforms, you get one streamlined portfolio.

This makes it so much easier to:

- Manage your asset allocation: You can see your entire investment mix in one place, ensuring it matches your goals without having to juggle balances across accounts.

- Track your performance: No more logging into three different websites to see how you're doing. You get a single, unified view of your progress.

- Simplify required minimum distributions (RMDs): When you hit retirement age, calculating and taking RMDs from a single account is vastly simpler than doing it for multiple plans.

As you consider making this move, it's also smart to be aware of the various legal protections for your 401k and how they compare to the TSP. By consolidating, you gain the simplicity and robust framework of a single, well-managed plan.

To get a better feel for the plan itself, you can learn more about how the Thrift Savings Plan works in our simplified guide here: https://federalbenefitssherpa.com/post/how-does-the-thrift-savings-plan-work-simplified

Getting Your Ducks in a Row Before the Rollover

Before you even think about filling out a single form, a little prep work can save you a world of headaches. Think of this as the "measure twice, cut once" approach to moving your money. Getting these initial details right ensures your 401(k) funds move into the TSP smoothly, without any frustrating detours or delays.

First things first, let's make sure you're actually eligible. This is a hard-and-fast rule you can't get around: to roll a 401(k) into the TSP, you must be a currently employed federal civilian or a member of the uniformed services. If you've already separated or retired, you can't move new money into your TSP account.

You also need an active TSP account ready to receive the funds. If you're new to federal service, double-check that your account is fully set up and that you can log in before you start this process.

Your First Call: The Old 401(k) Provider

With your eligibility confirmed, it's time to pick up the phone and call your old 401(k) administrator. This is a critical fact-finding mission. You need to know their exact process, their timeline, and any quirks they might have before you tell the TSP that money is on the way.

Don't just ask if they "do rollovers." You need specifics. Some companies are slick and digital; others are still working with fax machines and snail mail. Their process directly impacts how long this will take.

My Advice: Have your most recent 401(k) statement in front of you when you call. They’ll almost certainly ask for your account number or other details to verify it's you.

Here are the non-negotiable questions you need to ask their representative.

Key Questions for Your 401(k) Administrator:

- Can you process a direct trustee-to-trustee rollover to the Thrift Savings Plan? (This is the method you want, as it keeps the money out of your hands and avoids tax headaches).

- Once you have the completed paperwork, what's your typical processing time?

- Is your process entirely online, or will I need to mail or fax physical forms?

- Are there any rollover fees or account closure fees I should know about?

- Can you confirm the exact payee name for the rollover check? (It should be made out to the "Thrift Savings Plan").

- Do you require a "letter of acceptance" from the TSP? (The TSP doesn't issue these, so if they say yes, you'll need to work through that with them).

The answers you get here will help you map out a realistic timeline. If they tell you it’s a 4-week manual process, you know not to panic when the money doesn't show up in your TSP in three days.

Gathering Your Paperwork

Once you've gotten the intel from your old provider, it's time to pull together your documents. Having everything organized will make filling out the official rollover form (Form TSP-60) much easier. More importantly, it ensures accuracy—a single wrong digit in an account number can send the whole process back to the starting line.

Here’s the short list of what you'll need:

- Your Most Recent 401(k) Statement: This is your most important document. It has your account number, the administrator's contact info, and the breakdown of your Traditional (pre-tax) and Roth (post-tax) money.

- Your TSP Account Number: You can find this on any TSP statement or by logging into your account on the TSP website.

- Contact Info for the 401(k) Provider: Get the specific mailing address for their rollover department, not just their general corporate address.

With this information in hand, you’re officially ready to kick off the rollover. You’ve done the crucial prep work for a clean, stress-free transfer, putting you one step closer to consolidating your retirement funds into the powerful, low-cost TSP.

Choosing Your Rollover Method: Direct vs. Indirect

When you’re ready to roll your old 401(k) into your TSP, you’ll hit a fork in the road. You can go one of two ways: a direct rollover or an indirect one. On the surface, they both seem to get your money from point A to point B, but the path you choose has massive consequences for your taxes and your sanity.

Think of it like this: the direct rollover is the smooth, freshly paved highway. The indirect rollover? That’s a winding country road with hidden potholes and a strict time limit. Let’s break down why one is almost always the right choice.

The Safest Route: The Direct Rollover

I’ve guided countless federal employees through this process, and the direct rollover is the method I recommend nearly every single time. It's clean, simple, and virtually impossible to mess up from a tax standpoint.

Here’s how it works: you simply instruct your old 401(k) provider to transfer your funds straight to the Thrift Savings Plan. The check is made payable to the TSP, not to you, so the money never even touches your personal bank account. This one simple fact keeps the IRS happy because they don't see it as a distribution you could have spent.

Key Takeaway: A direct rollover completely sidesteps the mandatory 20% tax withholding and the dreaded 60-day rule. It's the set-it-and-forget-it option for a stress-free transfer.

Most people I talk to want to consolidate their accounts to make life easier. In fact, studies show the top reasons for rollovers are to 'simplify my finances' (40%) and to 'consolidate for better planning'. A direct transfer accomplishes exactly that without creating a new set of problems. You can learn more about these rollover trends and why so many people are bringing their accounts under one roof.

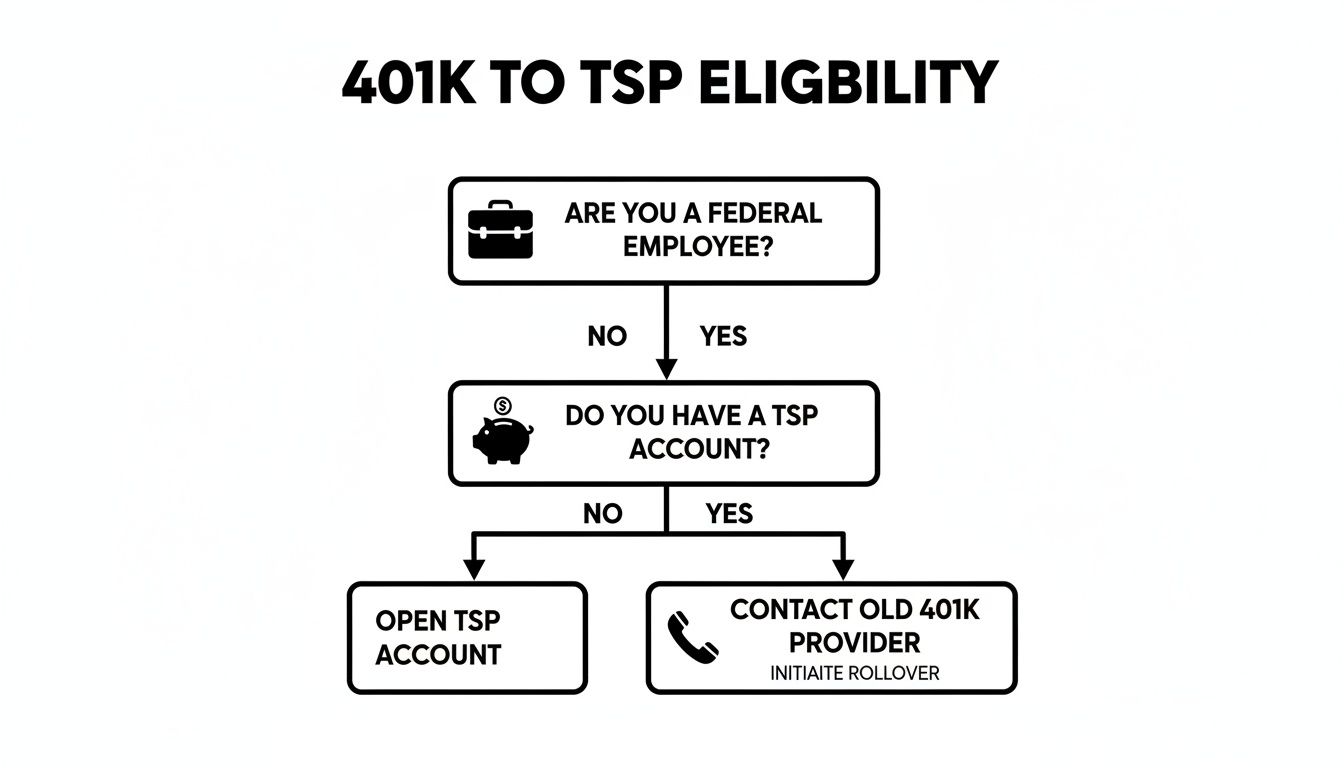

This flowchart lays out the basic decision tree to get you started.

As you can see, the path for an eligible employee starts with a simple action: contacting your old provider. This is the first step in kicking off a smooth direct rollover.

The Risky Path: The Indirect Rollover

Now for the other option—the indirect rollover. This route puts you in the driver’s seat, but it comes with a lot of responsibility and some serious risks if you don't follow the rules perfectly.

With an indirect rollover, your old 401(k) company sends a check made out to you. But here's the catch: they are legally required to withhold 20% of your balance for federal taxes right off the top. This isn't optional.

So, if your 401(k) balance is $100,000, the check you get in the mail will only be for $80,000. The other $20,000 has already been sent to the IRS on your behalf.

The Critical 60-Day Rule

The moment you receive that money, a countdown begins. You have exactly 60 calendar days to get the entire original amount into your TSP account. This is where the biggest trap lies.

To complete the rollover properly, you have to deposit the full $100,000, even though you only received $80,000. That means you have to find $20,000 from your own pocket to make up the difference and complete the deposit.

If you manage to do this within the 60-day window, you’ll get that $20,000 back as a tax refund when you file your return. But if you miss that deadline, even by a day, the consequences are painful.

What Happens If You Miss the Deadline?

- The whole amount becomes taxable income. The IRS will treat the entire $100,000 as a distribution, adding it to your income for the year.

- You get hit with a penalty. If you’re under 59½, a 10% early withdrawal penalty gets tacked on.

- You lose your savings. That money is now permanently out of its tax-sheltered retirement account.

A Real-World Example of an Indirect Rollover Gone Wrong

I’ve seen this happen, and it’s not pretty. Let’s take a federal employee, Sarah, who has $50,000 in an old 401(k) and decides on an indirect rollover.

- Her provider withholds 20% ($10,000) and mails her a check for $40,000.

- Life gets in the way. Sarah is busy with work and family, and the 60-day deadline slips her mind. On day 65, she realizes her mistake and tries to deposit the money, but it’s too late.

- The IRS now considers the full $50,000 a taxable distribution.

- If Sarah is in the 24% federal tax bracket, she suddenly owes $12,000 in income tax on that money.

- And since she’s only 45, she’s also on the hook for a 10% early withdrawal penalty of $5,000.

All told, Sarah's simple mistake ended up costing her $17,000 in taxes and penalties. The $10,000 that was withheld helps cover part of that bill, but she still has to write a check to the IRS for another $7,000. This is a financially devastating and completely avoidable error. That’s why the direct rollover is almost always the superior choice when you complete a rollover 401k to TSP.

Navigating Traditional and Roth Rollover Rules

When you roll an old 401(k) into your TSP, it's not just a single pot of money moving from one place to another. You're actually moving specific types of money, and understanding the tax character of those funds is absolutely critical.

We're talking about the two main flavors of retirement savings: Traditional (pre-tax) and Roth (post-tax). You have to handle these correctly, or you could find yourself with a nasty, unexpected tax bill.

The cardinal rule here is simple but unbreakable: money has to stay with its own kind. Think of it as the "like-to-like" rule.

- Money from your Traditional 401(k)—the pre-tax dollars you haven't paid income tax on yet—must go into your Traditional TSP.

- Money from your Roth 401(k)—the post-tax dollars you've already paid tax on—must go into your Roth TSP.

This isn't just a suggestion; it's a hard and fast rule. The TSP system is built to keep these two accounts completely separate to maintain the integrity of their tax treatment. Getting this right is fundamental to your long-term financial plan.

What If My 401(k) Has Both Types of Money?

This is a really common scenario, especially with more modern 401(k) plans. If your old account is a mix of Traditional and Roth funds, your previous plan administrator will handle it by splitting the transfer.

You'll either get two separate checks or see two separate electronic transfers sent to the TSP. One will be for the Traditional balance, the other for the Roth balance.

When you're filling out your rollover forms (specifically, Form TSP-60), you have to declare the exact amount for each type of money. The TSP will then take those amounts and deposit them into the correct side of your account—Traditional or Roth.

My Advice: Your most recent 401(k) statement is your best friend here. It will have a clear breakdown showing the exact dollar amount in your pre-tax bucket and your Roth bucket. Use those numbers to fill out your forms to the penny.

Taking a few extra minutes to be precise here saves a ton of headaches. It helps ensure your rollover 401k to TSP goes through smoothly without getting kicked back for corrections.

A More Advanced Strategy: The Roth Conversion

While the standard "like-to-like" rollover is the most common path, there's another, more strategic option you can use: a Roth conversion. This is the one time you can deliberately move pre-tax money into a post-tax account.

So, how does it work? You take your Traditional 401(k) funds and, instead of rolling them into the Traditional TSP, you direct them into your Roth TSP.

But here's the catch: this is a taxable event. The entire amount you convert gets added to your ordinary income for the year you do it. If you convert $50,000, you’ll owe income taxes on that $50,000 at your marginal rate when you file your taxes.

Why on earth would anyone choose to pay a big tax bill now? It's all about the future. Once that money is safely in your Roth TSP, every penny of its future growth is completely tax-free. More importantly, all your qualified withdrawals in retirement will be 100% tax-free.

If you want to go deeper, you can learn more about how a TSP Roth maximizes tax-free growth in our detailed article.

When Does a Roth Conversion Actually Make Sense?

Deciding to pull the trigger on a Roth conversion is a major financial decision. You're making a calculated bet that paying taxes at your current rate will be better than paying them at a future, and potentially higher, rate in retirement.

This can be a brilliant move in a few specific situations:

- You're in a low-income year. Maybe you took some time off between jobs or had other circumstances that put you in a lower tax bracket. A lower marginal rate means the tax hit from the conversion will be much softer.

- You expect taxes to go up. If you believe your income will be higher in retirement or that federal tax rates will rise in general, paying the tax now could save you a small fortune later on.

- You're focused on estate planning. Roth accounts are a fantastic tool for leaving a legacy. The original owner doesn't have Required Minimum Distributions (RMDs), and your heirs can inherit the account completely tax-free.

Before you even think about a conversion, you have to run the numbers and be honest about your financial situation. Can you comfortably pay the resulting tax bill without raiding your emergency fund or other savings? This is one of those times when getting a second opinion from a professional can make all the difference.

Common Rollover Mistakes and How to Avoid Them

Even with the best of intentions, a simple mistake during a rollover can lead to frustrating delays or, worse, a surprise tax bill. Trust me, I've seen it happen more times than I can count. Sidestepping these common pitfalls is the key to getting your money where it belongs without any headaches.

The most common error is also the simplest: getting account information wrong. A single mistyped digit in your old 401(k) account number or your TSP account number can send the entire process back to square one. This usually happens when people are rushing and working from memory instead of having their official statements right in front of them.

Another easy slip-up is the name on the check. For a direct rollover, the check must be made payable to the "Thrift Savings Plan," not to you personally. If your old provider cuts the check to you, the TSP will reject it, and you'll have to start the whole process over.

The Dangers of an Indirect Rollover

This is where the most financially damaging mistakes happen. As we talked about earlier, the indirect rollover comes with a mandatory 20% federal tax withholding and a very strict 60-day deadline. Two errors here can be absolutely devastating.

First, people often miscalculate the 60-day window. The clock starts the moment you receive the funds, and it's 60 calendar days, not business days. It’s a small detail that can lead to a missed deadline and major tax consequences.

The second, and far more costly, mistake is failing to make up for that 20% that was withheld for taxes.

Let's say a federal employee is rolling over $50,000 indirectly. They get a check for $40,000, with the other $10,000 sent straight to the IRS. They correctly deposit the $40,000 into their TSP within the 60 days but completely forget they need to come up with another $10,000 from their own pocket to complete the full rollover.

In that scenario, the IRS treats the $10,000 shortfall as a taxable distribution. If that employee is under 59½, they’ll owe income tax on that amount plus a 10% early withdrawal penalty. A simple oversight just turned a routine transfer into a very expensive problem.

Your Final Pre-Submission Checklist

Before you mail anything or hit that "submit" button, take five minutes to run through this final checklist. It can save you weeks of hassle down the road.

- Double-Check Every Number: Pull out your most recent 401(k) and TSP statements. Compare the account numbers you wrote on Form TSP-60 to what’s on the statements. Are they identical?

- Verify the Dollar Amounts: Do the Traditional and Roth amounts you listed on the form match your 401(k) statement to the penny?

- Confirm the Payee: If you're doing a direct rollover, have you confirmed with your old provider that the check will be made out to the "Thrift Savings Plan"?

- Keep Copies: Scan or photocopy every single form you submit. This documentation is your lifeline if anything goes sideways.

One of the best reasons to consolidate into the TSP is to simplify your financial life. Unlike many IRAs with their complex and often costly investment choices, the TSP’s straightforward fund lineup is a huge plus. A rollover 401k to TSP also doesn't count against your annual contribution limits, which is a fantastic way to boost your retirement savings. You can see a breakdown of how TSP rollovers compare to other options on Finhabits.com.

Bottom line: if you have any doubts, don't guess. A quick call to your old 401(k) company or the ThriftLine Service Center can give you the clarity you need to move forward with total confidence.

Confirming Your Funds and Investing in the TSP

You've navigated the paperwork, and the check is in the mail. So, what happens next? The final, and arguably most important, step is to make sure your money gets put to work inside your TSP account.

First things first, you’ll want to log into your account on the TSP website and keep an eye out for the funds to post. Don't panic if you don't see the money right away. Transfers aren't instantaneous and can sometimes take a couple of weeks to show up in your account.

Once you see the new balance, give it a quick double-check. If you rolled over both Traditional and Roth money, confirm that the funds landed in the correct Traditional TSP and Roth TSP buckets. It's a simple verification that can prevent headaches down the road.

Putting Your Rolled-Over Money to Work

Here's a critical point many people miss: just because the money is in your TSP account doesn't mean it's invested. By default, new rollover funds are often placed into the age-appropriate Lifecycle (L) Fund. While that’s a decent starting point, you have full control to allocate these assets based on your personal investment strategy. The goal is to get this capital invested so it can start growing for your future.

One of the best things about the TSP is its simplicity. You won't be overwhelmed by hundreds of mutual funds. Instead, you have five core individual funds to choose from:

- G Fund: Government securities with principal protection.

- F Fund: A fixed-income bond index fund.

- C Fund: Tracks the S&P 500 stock index.

- S Fund: Covers small- and mid-cap stocks.

- I Fund: Invests in an international stock index.

If you prefer a "set it and forget it" approach, the Lifecycle (L) Funds offer a diversified mix that automatically adjusts to become more conservative as you get closer to your target retirement date.

This is where the real magic happens. By moving your money from an old 401(k) and actively investing it in the TSP, you’re tapping into one of the most powerful and low-cost retirement plans on the planet.

As a federal employee, you benefit from incredibly low administrative expenses—we're talking just $0.36 per $1,000 invested annually. To put that in perspective, on a $500,000 account, your fees would only be $180 for the entire year. That’s a massive saving that leaves more of your hard-earned money to compound over time.

Deciding on the right fund allocation is a personal choice that depends entirely on your age, risk tolerance, and when you plan to retire. If you're looking for more guidance on building a solid investment plan, our guide on how to use the TSP for smart federal savings is a great place to start.

Common Questions About Rolling Your 401(k) into the TSP

Even with a solid plan, a few questions always pop up when you're moving retirement money. Let's tackle some of the most common ones we hear from federal employees just like you.

I've Left Federal Service. Can I Still Roll My Old 401(k) In?

Unfortunately, no. This is one of the TSP's hard-and-fast rules. You must be a current federal employee or uniformed service member with an open TSP account to be eligible for a rollover.

Once you’ve separated from service, the door to adding new money—including rollovers from other plans—closes for good.

How Long Does This Whole Process Take?

The timeline really hinges on how quickly your old 401(k) provider moves. In my experience, a direct, trustee-to-trustee transfer is your best bet for a smooth process.

You can typically expect it to take anywhere from two to four weeks from the moment you start the paperwork until the funds land in your TSP account. An indirect rollover might seem faster upfront, but you're then on the hook to meet that critical 60-day deadline yourself.

Will This Rollover Eat into My Annual Contribution Limit?

Not at all. This is a huge relief for many people. The IRS sees a rollover as a transfer of existing retirement funds, not a new contribution for the year.

This means the rollover has no impact on your ability to max out your annual TSP contributions directly from your paycheck.

For many feds, consolidating old accounts into the TSP just makes life simpler, whether you're new to service or getting close to retirement. The TSP is set to notify over 303,000 participants about Required Minimum Distributions (RMDs) in 2025. Rolling in old 401(k)s now can not only streamline your RMD calculations later but also increase your potential for tax-free Roth growth. You can find more helpful information on TSP rollovers at Finhabits.com. Ultimately, this move gives you one central account, making it far easier to coordinate RMDs, Social Security, and healthcare decisions down the road.

Trying to piece together your federal benefits can feel overwhelming, but you're not on your own. Federal Benefits Sherpa provides personalized gap analysis reports and retirement planning to make sure you're getting the most out of your TSP and other valuable benefits.

Take the next step toward securing your financial future. You can book a free 15-minute benefit review with us today at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved