Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Difference between roth and traditional tsp: A Clear Guide for Federal Employees

The real difference between the Roth and Traditional TSP comes down to a single, critical question: would you rather pay taxes now or later? It’s that simple.

With a Traditional TSP, you get a tax break right away. Your contributions are made pre-tax, which lowers your taxable income for the year. The trade-off? You’ll owe income tax on every dollar you withdraw in retirement—your contributions and their earnings.

The Roth TSP flips that script. You contribute with after-tax money, so there's no immediate deduction. But here’s the powerful part: your investments grow completely tax-free, and when you take qualified withdrawals in retirement, they are 100% tax-free.

Roth vs. Traditional TSP: The Core Mechanics

Picking between the Roth and Traditional TSP is one of the biggest financial calls a federal employee can make. It doesn't just affect your paycheck today; it shapes the kind of income you'll have to live on decades from now. There’s no single “right” answer—the best choice depends on your current salary, where you see your career going, and what you think tax rates will look like in the future.

To really get a handle on this, you need to see them side-by-side. Both accounts let you contribute the same amount and invest in the same funds, but how they’re taxed leads to vastly different retirement outcomes. If you want to dig even deeper into post-tax investing, our comprehensive guide on what is a Roth TSP is a great place to start.

Let’s lay out the key differences to see how this all works in practice.

Roth TSP vs Traditional TSP At a Glance

Here’s a quick summary of the most critical differences between your two TSP options. This table cuts through the noise and gives you a clear snapshot of how each choice plays out.

| Feature | Traditional TSP | Roth TSP |

|---|---|---|

| Contribution Taxes | Made with pre-tax dollars. | Made with after-tax dollars. |

| Immediate Tax Impact | Lowers your taxable income today. | No immediate tax deduction. |

| Growth | Grows tax-deferred. | Grows tax-free. |

| Withdrawal Taxes | All withdrawals are taxed as ordinary income. | Qualified withdrawals are 100% tax-free. |

| Agency/Employer Match | All matching funds are deposited here. | Matching funds still go into your Traditional TSP. |

| Required Minimum Distributions (RMDs) | RMDs are mandatory starting at age 73. | No RMDs for the original account owner. |

Getting a grasp on these distinctions is your first step. Each one has a ripple effect on your entire financial plan, from what you owe the IRS each year to how you leave money to your family. This decision isn't just about taxes; it's about when you choose to pay them and how much control you want over your money down the road.

How TSP Contributions and Taxes Really Work

Getting a handle on how your TSP contributions are taxed is the first step toward making this powerful retirement tool work for you. The real choice between a Roth and a Traditional TSP all comes down to a simple question: do you want to pay the taxes now or later?

With a Traditional TSP, you get your tax break today. Contributions are made pre-tax, meaning the money is pulled from your paycheck before any federal or state income taxes are taken out. This instantly lowers your taxable income for the year.

Think of it this way: if you're in the 24% federal tax bracket and contribute $10,000 to your Traditional TSP, you just knocked $10,000 off your Adjusted Gross Income (AGI). That simple move saves you a cool $2,400 on this year's tax bill.

The Roth TSP: Pay Now, Not Later

The Roth TSP flips that script completely. Contributions are made after-tax, so you pay income taxes on your full salary, and then your TSP contribution comes out of what's left.

You won't see an immediate tax deduction here. That same $10,000 contribution to a Roth TSP means you're out the full ten grand from your take-home pay. But the long-term payoff is huge: every penny of your contributions and all their earnings grow and come out in retirement completely tax-free.

Key Insight: Choosing Traditional is a bet that your tax rate will be lower when you retire. Going with Roth means you're betting taxes will be higher down the road, so it makes more sense to get the tax bill out of the way now.

The One Detail Everyone Misses: Agency Matching

Now, here’s a critical point that many federal employees overlook. No matter which option you choose for your own contributions, all agency automatic (1%) and matching contributions are always deposited into your Traditional TSP balance.

This is a hard-and-fast rule. You could put 100% of your own money into the Roth TSP, but your agency's match will still land in the Traditional, tax-deferred bucket.

This means pretty much every federal employee will have a blended retirement account. You'll have your personal Roth funds that are entirely tax-free, but you will still owe income tax on all the agency matching money and its growth when you eventually withdraw it. Don't forget to factor this in when planning for your retirement tax burden. To learn more, check out our guide on maximizing your government matching TSP contributions.

This dual-account reality is actually a good thing. It forces a bit of tax diversification, giving you both tax-free (Roth) and tax-deferred (Traditional) pools of money to draw from. That flexibility is invaluable for managing your income and tax bracket throughout your retirement years.

Accessing Your TSP Funds in Retirement

Saving for retirement is one thing, but figuring out how to get your money out is what really shapes your life after you stop working. The rules around withdrawals, loans, and required distributions highlight a major difference between a Roth and Traditional TSP. Two accounts with identical balances can end up providing very different amounts of spendable income.

Think about it this way: every single dollar you pull from your Traditional TSP is treated as ordinary income and gets taxed. This isn't just a simple tax bill, either. A large withdrawal could easily bump you into a higher tax bracket or even increase how much of your Social Security benefits are taxed.

Now, contrast that with the Roth TSP. As long as you meet the qualifications, every withdrawal is 100% tax-free. That’s predictable, reliable income you can count on, no matter what happens with future tax rates. There's real peace of mind in knowing that taking money out won't come with a surprise bill from the IRS.

The Impact on Loans and Early Access

What happens if you need to borrow from your TSP before you retire? The plan views your Traditional and Roth balances as one big pot of money when it comes to loans. When you take out a TSP loan, it’s pulled proportionally from both your Roth and Traditional pots.

You can't, for instance, tell the TSP to only take the loan from your Traditional balance to protect your tax-free Roth growth. It doesn't work that way. When you pay the loan back, the money goes back into both accounts proportionally, too.

The Ultimate Differentiator: The Roth TSP gives you incredible control over your money later in life. While the Traditional TSP eventually forces you to take taxable withdrawals, the Roth lets you call the shots. You decide if, when, and how much to take out, letting the tax-free growth continue for as long as you want.

Understanding Required Minimum Distributions (RMDs)

One of the biggest perks of the Roth TSP really shines later in life, and it's all about Required Minimum Distributions (RMDs). Once you hit age 73, the IRS requires you to start taking withdrawals from your Traditional TSP—and, of course, pay income tax on that money.

These forced withdrawals are the government's way of finally getting the tax revenue that was deferred all those years. RMDs can create a tax headache, pushing up your income in retirement whether you need the cash or not. This can even affect things like your Medicare premiums.

Here’s where the Roth TSP is a game-changer: it has no RMDs for you, the original owner. This opens up some powerful financial planning strategies.

- Let It Grow: You can leave your entire Roth balance untouched for your whole life, letting it continue to grow completely tax-free.

- Strategic Withdrawals: You’re in the driver's seat. You only take money out when you actually need it, not because a government calendar says you have to.

- Legacy Planning: This makes the Roth TSP an excellent tool for estate planning. You can pass down a significant, tax-free inheritance to your loved ones.

These rules can get complicated, especially when you're trying to map out income for the next 20 or 30 years. To get into the nitty-gritty, you can explore the various Thrift Savings Plan withdrawal options in our complete guide. Getting a firm grip on these rules now is key to making the right decision for your future.

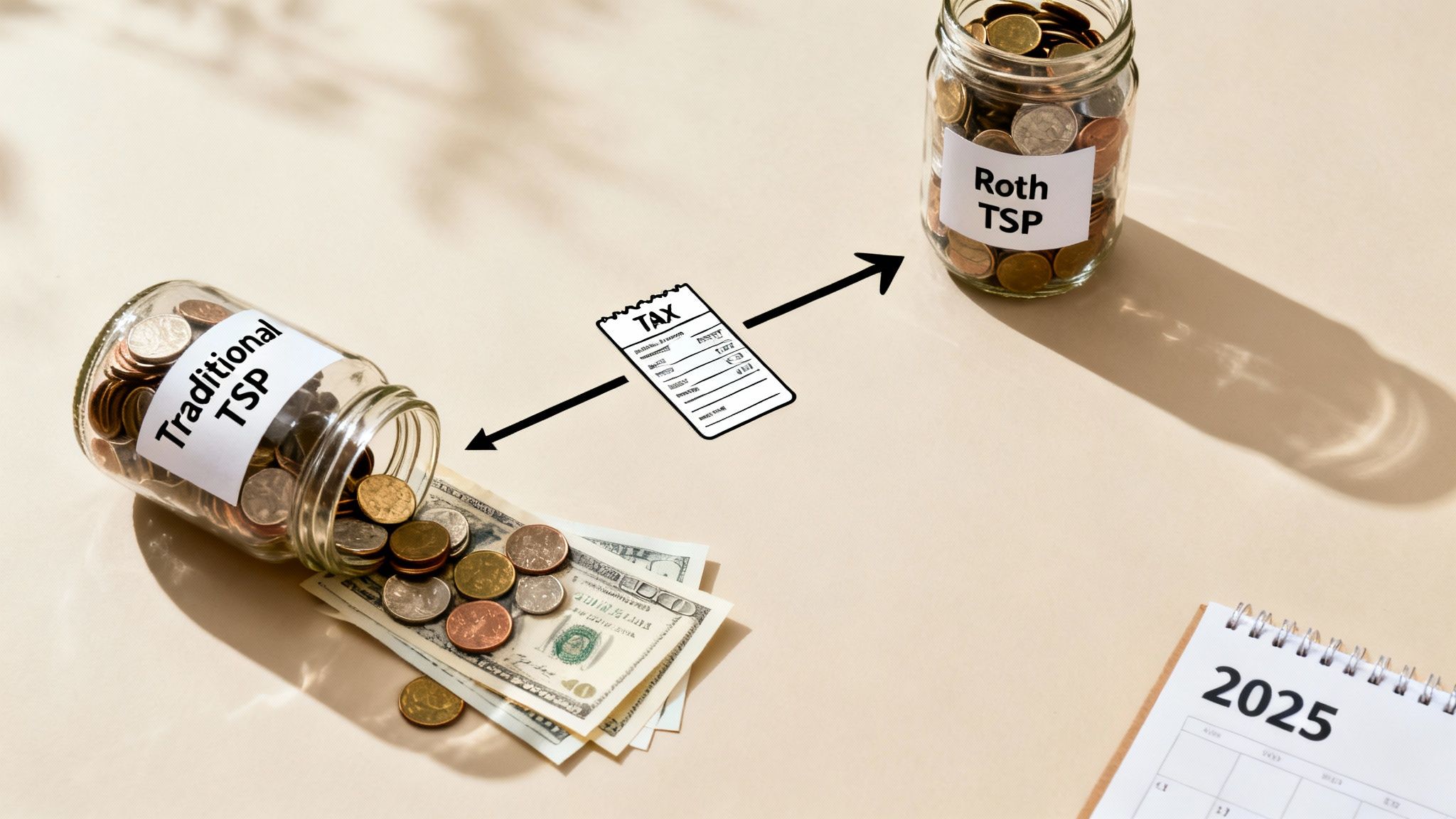

The Strategic Window for In-Plan Roth Conversions

So far, we’ve talked about where to direct your new contributions. But what about the money you already have sitting in your Traditional TSP? There's a powerful strategy for that, too: an in-plan Roth conversion. This move lets you take funds from your pre-tax Traditional TSP and shift them over to your after-tax Roth TSP.

Be warned, though—this isn't a simple transfer. It's a taxable event. The entire amount you convert is added to your taxable income for the year. Move $50,000, and you’ll owe ordinary income tax on that $50,000. The payoff? Once that money is in the Roth side, it grows completely tax-free and comes out tax-free in retirement, just like your regular Roth contributions.

At its core, this is a calculated bet. You’re choosing to pay taxes now, at a rate you know, to avoid paying potentially higher taxes down the road. It’s a strategic decision based on where you think your finances—and U.S. tax policy—are headed.

Why Timing Your Conversion Is Everything

Pulling the trigger on a Roth conversion is a major decision, and its success often comes down to timing. The absolute best time to convert is during a year when your taxable income is lower than normal, creating a temporary dip in your tax bracket.

Think about these moments as golden opportunities:

- Sabbaticals or Leave Without Pay: Taking an extended break from work means your annual income plummets, potentially dropping you into a much lower tax bracket.

- Early Career Years: When you're just starting your federal career, your income might be the lowest it will ever be. This is a fantastic time to convert smaller balances.

- The "Gap Years" Before Retirement: Many feds retire before they start taking Social Security or their FERS pension. Those low-income years are a prime window for strategic conversions.

The idea is to "fill up" the lower tax brackets with the converted income. You'd be paying taxes at 10% or 12% instead of the 22% or 24% you might face in your peak earning years.

This strategy is proactive tax planning at its best. You are intentionally recognizing income today to build a much larger tax-free nest egg for retirement, giving you incredible flexibility when it matters most.

The 2025 Tax Law Deadline on the Horizon

There's a huge, time-sensitive reason to be thinking about this now: the current tax rates. The Tax Cuts and Jobs Act (TCJA) of 2017 gave us temporarily lower income tax rates, but they are set to expire after 2025.

If Congress doesn't act, the Congressional Budget Office projects that federal income tax revenues will jump sharply, which means higher tax rates for most people. This creates a critical planning window for federal employees. Converting before the end of 2025 could allow you to lock in today's lower rates on your Traditional TSP funds for good. You can learn more about how TSP Roth conversions are affected by the 2026 changes on UnitedBenefits.com.

Don't Forget the Five-Year Rule for Conversions

Before you make a move, you have to understand the five-year holding period. Every Roth conversion you do starts its own five-year clock. If you withdraw any of the converted principal before that five-year period is over, you could get hit with a 10% early withdrawal penalty.

This rule exists to stop people from using conversions as a backdoor way to avoid penalties on early withdrawals. It simply means that any money you convert should be money you don't plan to touch for at least five years. This makes it a strategy purely for long-term retirement planning and a key difference between a Roth and Traditional TSP you need to consider.

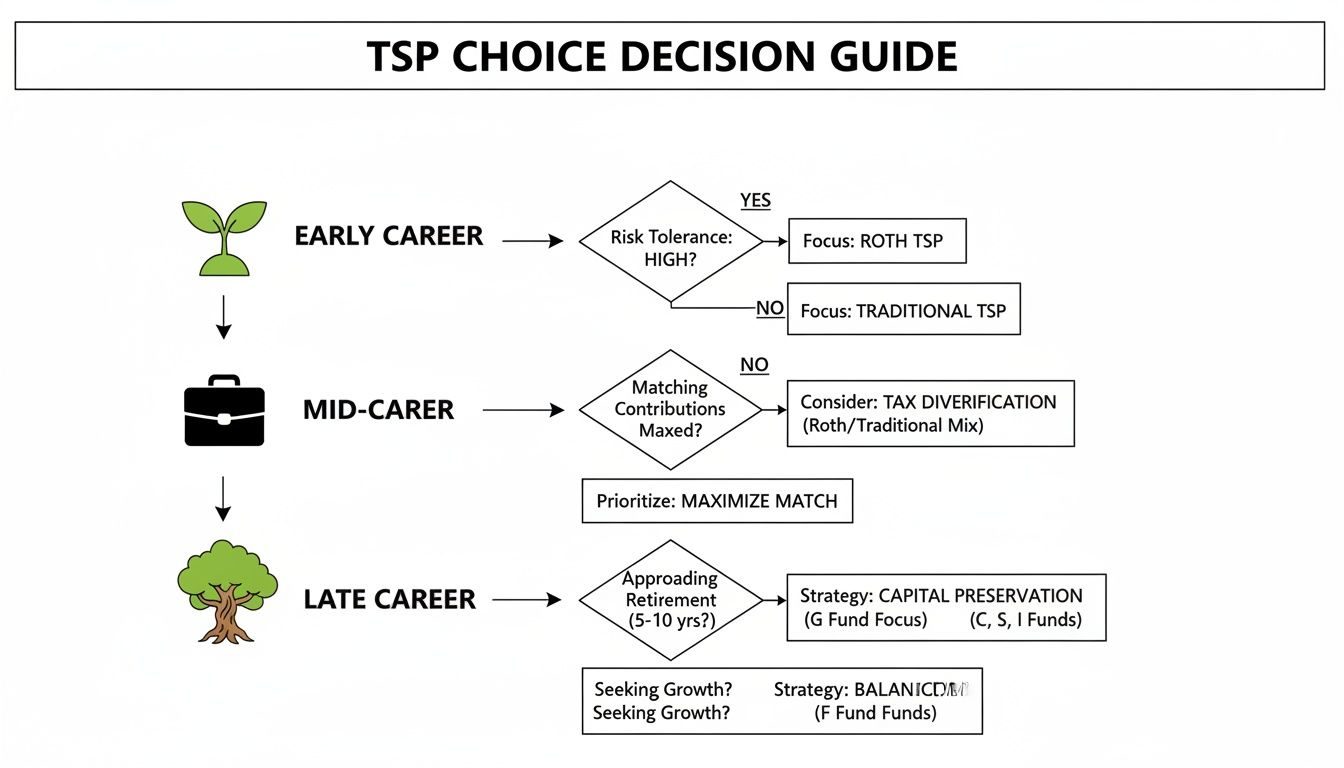

Choosing the Right TSP for Your Career Stage

The textbooks make the difference between a Roth and Traditional TSP sound simple. But knowing how to apply that theory to your real-life situation is where you actually start building wealth. The best choice isn't a "set it and forget it" decision; it changes as your income, career path, and financial goals evolve. What works for a brand new hire could be the completely wrong move for someone just a few years from retirement.

Let's get past the generic advice. We’re going to look at how this decision plays out across the different stages of a typical federal career. By walking through these scenarios, you can get a much clearer picture of which path best lines up with your own long-term financial security.

Early Career Federal Employees: The GS-7 Scenario

If you're just starting your federal career, say as a GS-7, you're probably at the lowest income point you'll ever be. Your path is likely paved with promotions and step increases, which means your salary—and your tax bracket—is almost certain to climb over the next few decades.

This is the classic, textbook case for the Roth TSP. When you contribute to a Roth account now, you’re paying taxes on that money at your current, lower marginal tax rate. You're essentially getting your tax bill out of the way during your lowest-earning years.

Think about it: as that money grows over a 30- or 40-year career, every single penny of that growth is completely tax-free. When you finally retire, likely in a higher tax bracket than you are today, you’ll have a huge bucket of money you can access without paying any taxes.

Strategic Takeaway: For young feds, the Roth TSP is a powerful hedge against future tax rate hikes. Paying a little bit of tax now at a 12% or 22% rate can save you a fortune compared to paying a much higher rate on a much larger balance down the road.

Mid-Career Federal Employees: The GS-13 Balancing Act

Once you hit mid-career, perhaps as a GS-13, the decision gets a bit more complicated. You're likely in your peak earning years, and your marginal tax rate is pretty significant. That immediate tax deduction you get from a Traditional TSP contribution suddenly looks very appealing, potentially saving you thousands on your annual tax bill.

At the same time, you still have a good number of years left before you retire, and the possibility of higher taxes in the future is always a concern. This is where a hybrid approach often makes a ton of sense.

Consider splitting your contributions. You could, for example, put enough into your Traditional TSP to drop your taxable income to a more comfortable level, and then direct the rest of your contributions to your Roth TSP. This strategy gives you the best of both worlds:

- Immediate Relief: You get a valuable tax break right now.

- Future Flexibility: You're also building a pool of tax-free money for retirement.

This blended approach creates what's known as tax diversification. It gives you the power to strategically pull from either your taxable (Traditional) or tax-free (Roth) funds in retirement, which helps you manage your income and stay in a lower tax bracket.

Late Career and High-Income Employees: The SES Perspective

For a high-earning, late-career employee, like a member of the Senior Executive Service (SES), the decision is usually driven by future tax uncertainty and new regulations. While the immediate tax deduction from a Traditional TSP is tempting when you have a high income, the value of creating a tax-free income stream in retirement is massive. A large Roth balance gives you a buffer against future tax hikes and helps prevent your required minimum distributions (RMDs) from pushing you into an even higher tax bracket.

There’s also a significant new rule that directly impacts this group. Starting in 2026, the SECURE 2.0 Act of 2022 will require federal employees aged 50 and over who earned more than $145,000 in the prior year to make all of their catch-up contributions to their Roth TSP. This rule is a game-changer for how many high-income federal workers plan their late-stage savings. You can read more about these TSP contribution changes on the DOI website.

This new mandate essentially forces high earners to build a Roth balance, whether they planned to or not. For these employees, it might make sense to lean into the Roth for their regular contributions as well. Doing so creates a powerful, consolidated pool of tax-free assets that offers the most control and predictability in retirement.

Choosing the right TSP option is highly dependent on where you are in your professional life. Here’s a table to help you think through the decision based on your current career stage.

TSP Recommendation Based on Career Stage

| Career Stage | Primary Consideration | Lean Towards | Rationale |

|---|---|---|---|

| Early Career (GS-5 to GS-9) | Future income and tax bracket are likely to be much higher. | Roth TSP | Pay taxes now at a low rate. All future growth and withdrawals will be 100% tax-free in retirement. |

| Mid-Career (GS-11 to GS-14) | Balancing current tax savings with future tax-free growth. | Hybrid/Split | Get an immediate tax deduction with Traditional contributions while also building a tax-free Roth bucket. |

| Late Career (GS-15/SES) | Minimizing taxes in retirement and managing RMDs. | Roth TSP | A large Roth balance provides tax-free income, won't increase your taxable income, and offers more flexibility. |

| Nearing Retirement | Tax diversification and predictable retirement income. | Both/Strategic | Having both Traditional (taxable) and Roth (tax-free) funds allows for strategic withdrawals to manage your tax bracket. |

Ultimately, this table is a guide. Your personal financial situation, including outside income, spousal income, and state taxes, all play a role. The goal is to align your TSP strategy with your long-term vision for retirement.

Making Your Final TSP Decision

Alright, we've covered a lot of ground. Now it's time to take all that information and make a real-world decision that's right for you. At its core, the choice between a Roth and Traditional TSP is really a bet on your future tax rate compared to your current one.

There's no magic, one-size-fits-all answer here. It's a deeply personal decision. The goal isn't just to crunch numbers but to think about what kind of financial freedom and predictability you want when you finally hang up your hat.

Your Personal Decision Checklist

Before you head over to your agency's payroll system, take a moment to run through these questions. Your answers should give you a pretty clear direction.

- Where do I realistically think my tax bracket will be in retirement? If you're expecting to be in a higher bracket later, the Roth TSP's tax-free withdrawals look incredibly appealing. But if you see your income and tax rate dropping, the immediate tax deduction from the Traditional TSP is hard to beat.

- How much do I value having tax-free income flexibility? A Roth TSP gives you a pot of money you can tap into without triggering a tax bill. That gives you a ton of control over your taxable income year-to-year in retirement.

- Will I actually invest the tax savings from a Traditional TSP? This is a big one. The main perk of the Traditional TSP is that upfront tax break. But if you just end up spending that extra money in your paycheck instead of investing it, you're losing a lot of the long-term benefit.

This flowchart can help you see how your career stage might influence your decision.

As you can see, a common strategy is to lean heavily on the Roth TSP early in your career and then pivot toward a Traditional or a blended approach as your income and tax bracket climb.

Final Takeaway: Remember, your TSP choice isn't set in stone. You can adjust your contribution allocations for future pay periods anytime your salary, life, or financial outlook changes. The most important thing is simply to make an informed choice today.

Once you have a plan, putting it into action is simple. Just log into your agency’s payroll portal—whether that's MyPay, GRB Platform, or another system.

If you’re still feeling stuck or just want a second set of eyes on your strategy, it might be worth booking a free benefit review with a Federal Benefits Sherpa. They can help you build a personalized plan to make sure you're on the right track from the start.

Answering Your Top TSP Questions

When you start digging into the details of the Thrift Savings Plan, a few key questions always seem to pop up. Let's tackle some of the most common ones that federal employees run into when deciding between the Roth and Traditional options.

Can I Contribute to Both a Roth and Traditional TSP at the Same Time?

Absolutely. In fact, many savvy feds do just that. You can split your contributions any way you like between the Roth and Traditional buckets, as long as the total you put in doesn't go over the annual IRS limit.

Think of it as a "hybrid" strategy. This approach gives you powerful tax diversification in retirement—one pot of money that's tax-deferred (Traditional) and another that's completely tax-free (Roth). Having both gives you incredible flexibility to manage your taxable income later in life.

What Happens to My Agency Match if I Only Use the Roth TSP?

This is a big one, and the answer often surprises people. No matter what you do, all agency contributions—both the automatic 1% and your matching funds—go directly into your Traditional TSP balance. This is a hard-and-fast rule of the plan.

So, even if you put 100% of your own pay into the Roth TSP, you’ll still accumulate a Traditional balance from your employer. This is a crucial point for planning because it means nearly every federal employee will have a mix of taxable and tax-free money to work with in retirement.

A common myth is that going all-in on Roth contributions means your entire TSP will be tax-free. The reality is, the agency match always goes into the Traditional side, guaranteeing you a tax-diversified account by default.

Are There Penalties for Converting Traditional TSP Funds to Roth?

There isn't a "penalty" for the conversion itself, but it is a taxable event. When you convert, you have to claim the entire amount as ordinary income for that year and pay the taxes on it.

Where a penalty can kick in is if you touch the converted money too soon. Each conversion has its own five-year clock. If you withdraw that converted principal within five years, you could get hit with a 10% early withdrawal penalty, even if you’re already over age 59½.

With Taxes Seemingly on the Rise, Is the Roth TSP a No-Brainer?

The idea of higher future taxes definitely makes the Roth TSP look attractive, but it's not the automatic winner for everyone. The right move really hinges on your personal financial picture.

For instance, a high-income employee at the peak of their career might get more mileage out of the Traditional TSP's hefty upfront tax deduction, especially if they plan to retire in a state with no income tax. Your own forecast for future income, where you'll live, and what tax rates might look like is what should drive your decision.

Making the right choice for your future can feel complex. At Federal Benefits Sherpa, we specialize in helping federal employees navigate these decisions with confidence. Schedule your free 15-minute benefit review today and get a personalized plan for your retirement.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved