Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Federal Employee Financial Advisor: Guide to TSP & FERS

A standard financial advisor knows their way around stocks and bonds, but ask them about FERS, CSRS, or the TSP, and you might get a blank stare. That knowledge gap can be a serious problem. Generic advice, even when it's well-intentioned, often misses the unique rules and opportunities built just for federal employees.

When it comes to securing your retirement, you need more than general market wisdom. You need a specialist.

Why Generic Financial Advice Fails Federal Employees

Think of it this way: you wouldn't ask your family doctor to perform open-heart surgery. They’re both doctors, of course, but the general practitioner doesn't have the deep, specific expertise needed for such a complex procedure.

Your federal benefits package is the same—it’s a highly specialized system that demands an expert touch. A general financial advisor can give you perfectly good advice on an IRA or a 401(k), but that guidance can fall flat when applied to your federal retirement.

Why? Because they often miss how your pension, survivor benefits, Thrift Savings Plan (TSP), and Social Security all work together. These aren't just separate accounts; they're interconnected gears in a single, powerful machine. A decision you make in one area sends ripples across all the others.

The High Cost of Unspecialized Guidance

Without a solid grasp of federal regulations, a well-meaning advisor could accidentally steer you toward some really poor choices. We’re not talking about small mistakes, either. These can lead to significant financial setbacks down the road.

Here are a few common areas where generic advice can go completely wrong:

TSP Allocation: A typical advisor might not appreciate the unique stability of the G Fund, leading to investment strategies that are either too conservative or far too risky for your situation.

Pension Payouts: Incorrectly calculating your FERS annuity supplement or misunderstanding the nuances of survivor benefit options could literally leave tens of thousands of dollars on the table over your lifetime.

Insurance Decisions: Overlooking the details of Federal Employees Health Benefits (FEHB) and Federal Employees' Group Life Insurance (FEGLI) can mean you end up paying for redundant, expensive coverage in retirement.

The bottom line is this: your federal career has built a financial foundation that looks nothing like one from the private sector. Trying to apply private-sector rules to your public-sector reality is a recipe for missed opportunities and unnecessary risk.

Ultimately, a federal employee financial advisor isn't just another planner. They're a specialist who has dedicated their career to mastering this intricate system. They act as your translator and your strategist, making sure every decision is made with a full picture of its long-term impact.

This specialized focus is what transforms your hard-earned benefits into a secure and prosperous retirement, ensuring you don’t leave your financial future to chance.

Navigating Your Unique Federal Financial Landscape

As a federal employee, your financial world operates on a completely different set of rules than someone in the private sector. Relying on generic financial advice is a bit like using a map of New York City to get around London—the streets might look familiar, but the routes, rules, and destination are worlds apart.

Your entire retirement security is built on a unique three-legged stool, and keeping it balanced is the key to a stable future.

Your FERS or CSRS Pension: This is the bedrock—a defined-benefit plan that provides a predictable income for life, calculated based on your salary and how long you've served.

The Thrift Savings Plan (TSP): This is your 401(k)-style retirement account. The income it generates depends entirely on how much you contribute and the investment choices you make over the years.

Social Security: This is the third leg, adding another layer of income. However, knowing when and how to claim it in coordination with your other benefits is absolutely critical.

A true federal employee financial advisor doesn't see these as three separate buckets of money. They understand them as an interconnected system where one decision directly impacts the others.

How Your Federal Benefits Work Together

Making smart choices means understanding the ripple effects. For instance, picking a retirement date isn't just about hitting a certain age. It's a complex calculation that determines your final pension amount, your eligibility for the FERS Special Retirement Supplement, and how that supplement can bridge the income gap until you start collecting Social Security.

The same goes for your TSP. A generalist advisor might recommend a standard portfolio without truly appreciating the unique role of the G Fund or the specific holdings of the I Fund. An expert knows your TSP investments should complement the guaranteed income from your pension, not just mimic a cookie-cutter model.

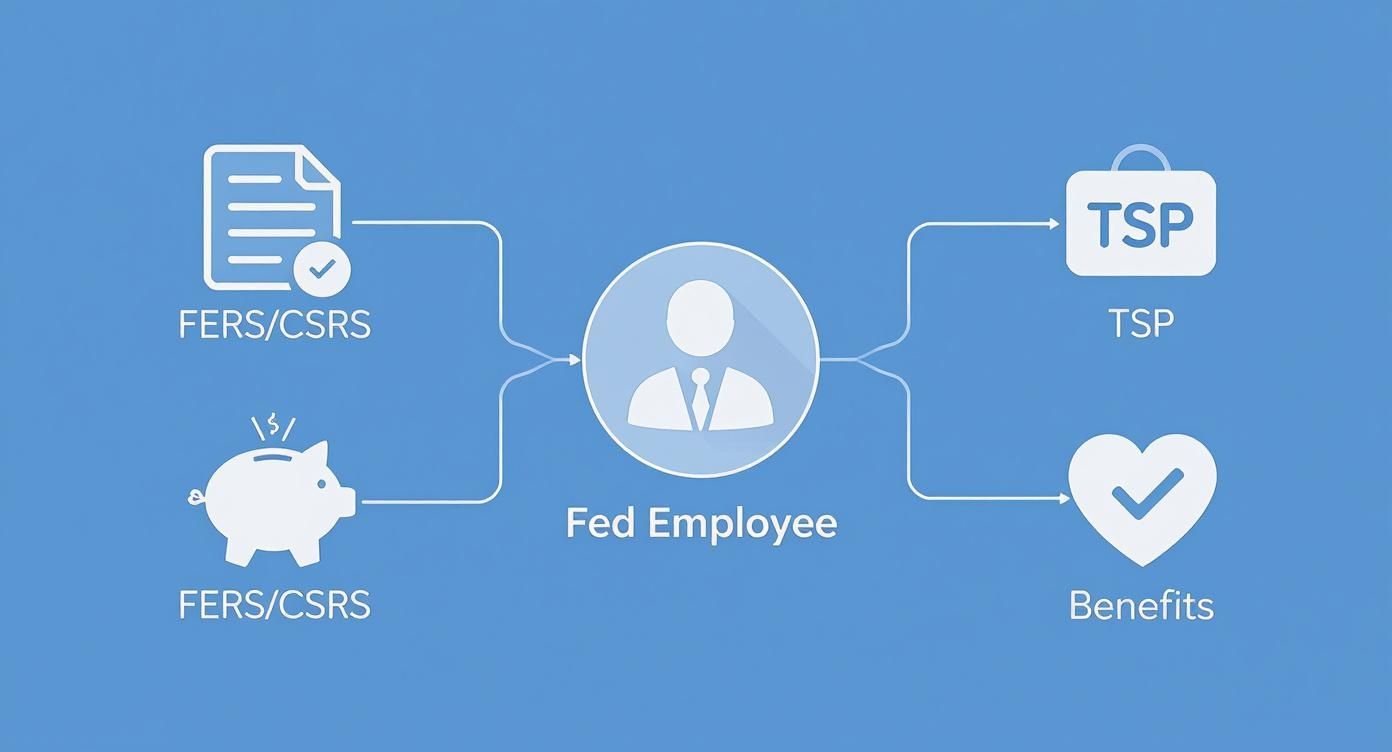

This infographic really brings to life the key areas where a specialist's insight is invaluable.

As you can see, your core benefits like FERS/CSRS, TSP, and various insurance programs all need to be managed in concert to support your personal financial goals.

Why This Specialized Knowledge Is So Crucial Right Now

The demand for this kind of focused guidance is skyrocketing. In the first half of a recent year alone, over 72,000 federal employees filed for retirement—a massive 38% jump from the year before.

This surge means more federal workers are grappling with these high-stakes decisions than ever before, with 62% reporting they need good financial advice now more than ever. You can explore more data on this trend and see why so many are seeking help.

A seemingly small choice, like how you structure a survivor annuity for your spouse, can alter your family's lifetime income by tens of thousands of dollars. A specialist sees the entire financial chessboard, anticipating how one move affects every other piece on the board.

From making the most of your FEGLI life insurance to timing your FEHB transition to Medicare, every decision has a long-term financial domino effect. A professional who speaks this unique language ensures you don't accidentally leave money on the table. They bring the clarity you need to build a retirement you can truly count on.

What a Federal Benefits Expert Actually Does for You

Let's move past the vague idea of "retirement planning" and get into what a federal benefits specialist actually does for you day-to-day. Their job isn’t just to pick investments; it’s to serve as a master strategist for your entire federal compensation package.

Think of them as the general contractor for your financial future. You have all these powerful but separate components—your FERS pension, TSP, Social Security, and various insurance plans. The advisor’s job is to bring them all together, ensuring they work in concert to build a sturdy, reliable retirement structure.

A true federal employee financial advisor translates the dense language of government regulations into a simple, personalized roadmap. They help you see exactly where you are today and, more importantly, the specific steps you need to take to get where you want to go.

Decoding and Optimizing Your Benefits

The real magic happens when a specialist dives deep into your specific situation. They don't rely on generic retirement calculators or one-size-fits-all advice. Instead, they get into the weeds of your career history, your "high-3" salary, and your personal goals. This detailed analysis is what uncovers hidden opportunities and protects you from costly mistakes.

A big part of their value comes from orchestrating how your benefits interact with each other, creating a powerful synergy that you can't achieve by looking at each piece in isolation.

They make sure your TSP withdrawal strategy doesn't accidentally bump you into a higher tax bracket or that your decisions about FEHB coverage now don't create an expensive Medicare gap later. It’s all connected.

Core Services From a Federal Financial Advisor

So, what does this look like in practice? Here are the core, tangible services you should expect from an advisor who truly understands the federal system.

Service AreaDescription of ServiceKey Federal Benefit InvolvedPension MaximizationCalculates your exact pension amount under various retirement scenarios (different dates, "high-3" projections) to pinpoint the most financially advantageous time to leave service.FERS/CSRS PensionTSP Withdrawal StrategyModels different ways to draw income from your TSP to minimize your lifetime tax bill, often coordinating distributions with other income sources.Thrift Savings Plan (TSP)Insurance CoordinationAnalyzes your life insurance needs to determine if you're overpaying for FEGLI and plans your transition from FEHB to Medicare to prevent coverage gaps or penalties.FEGLI & FEHBSocial Security TimingHelps you decide the optimal age to claim Social Security benefits, factoring in the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO) if applicable.Social SecuritySurvivor Benefit PlanningGuides you through the complex and often permanent decisions around providing a survivor benefit for your spouse from your FERS pension.FERS Survivor Annuity

These services form the foundation of a comprehensive federal retirement plan, turning your collection of benefits into a cohesive strategy for long-term security.

From Accumulation to Distribution

A specialist's role evolves with your career. While you're still working, the focus is on accumulation—helping you make smart TSP fund choices, maximize your contributions, and build your nest egg.

But their value becomes even more critical as you approach retirement and shift into the distribution phase. This is the moment of truth. This is where they help you convert all those assets you’ve built up into a predictable, reliable income stream that will last the rest of your life.

A skilled federal employee financial advisor answers the single most important question every retiree has: "How do I make sure I don't run out of money?" By carefully mapping out your income sources against your anticipated expenses, they provide the clarity and confidence you need to finally leave your federal career behind and enjoy the retirement you’ve earned.

How to Choose the Right Financial Advisor

Finding the right expert to guide your federal retirement can feel like a huge task, but a little structure can turn the search from overwhelming into empowering. The real goal isn't just to hire a planner; it's to find a partner—someone who truly speaks your language and is legally bound to put your interests first.

The financial advisory industry is massive and still growing. We're talking about a projected market size of $92.98 billion, with nearly 400,000 professionals in the field. And it's not slowing down, with growth expected to hit 10 percent over the next decade. You can dig deeper into these financial advisor statistics on bizplanr.ai.

What does that mean for you? It means you have plenty of choices. But it also means you have to be extra careful to cut through the noise and find a genuine specialist. Knowing what to look for and what to ask is everything.

Your Advisor Interview Checklist

When you sit down with a potential federal employee financial advisor, remember that you are the one conducting the interview. This is a job interview for one of the most critical roles in your life, so don’t hold back. A great advisor will appreciate your diligence and give you straightforward answers.

Here are the must-ask questions for that first conversation:

Federal Experience: How many federal employees have you actually worked with? Can you walk me through a complex FERS or TSP situation you recently helped a client solve?

Credentials: What are your professional certifications? You're looking for designations like CFP® (Certified Financial Planner™), which shows broad financial planning knowledge, or even better, ChFEBC℠ (Chartered Federal Employee Benefits Consultant℠), which proves they've had specialized training in federal benefits.

Fee Structure: How do you get paid? An advisor needs to clearly state if they are fee-only (meaning you pay them directly, no commissions) or commission-based (meaning they earn money by selling you specific products). There's a big difference.

Fiduciary Duty: Are you a fiduciary at all times? The only acceptable answer is a clear, unhesitating "yes." This is a legal obligation to put your interests ahead of their own, period.

Think of it like hiring any other specialist. You wouldn't call a plumber to rewire your house, right? The same logic applies here—you need an advisor with proven, hands-on experience in the federal system.

Green Flags and Red Flags to Watch For

Beyond the questions you ask, pay close attention to the vibe of the conversation. An advisor's approach reveals a lot about their priorities.

A trustworthy advisor's first goal is to understand you. They should be more interested in your SF-50, your TSP statement, and your family's goals than in pushing a specific investment product.

Keep an eye out for these "green flags," which are strong signs you've found a potential long-term partner:

They Ask Proactive Questions: A great advisor will immediately start asking about your "high-3" salary, your years of creditable service, and your survivor benefit elections before they even think about offering advice.

They Educate, Not Just Sell: They take the time to explain the why behind a recommendation, making sure you actually understand the strategy they're proposing.

They Focus on a Holistic Plan: The conversation isn't just about your TSP. It should naturally expand to include your pension, Social Security, FEHB, and FEGLI, because it's all connected.

On the flip side, be on high alert for these "red flags" that signal a bad fit:

A Quick Product Pitch: If the advisor almost immediately suggests rolling your TSP into a specific annuity or insurance product without doing a deep dive into your entire financial picture, run.

Vague Answers on Fees: Any hesitation, confusion, or overly complex explanation of how they make money is a huge warning sign of a lack of transparency.

Dismissing Federal Nuances: If they say your FERS pension is "just like any other pension" or your TSP is "basically a 401(k)," they simply don't get the critical details that make your benefits unique.

In the end, choosing the right federal employee financial advisor comes down to three things: trust, transparency, and specialized expertise. By arming yourself with the right questions and knowing what to look for, you can confidently find a professional who will help you maximize every dollar of your hard-earned benefits for a secure retirement.

Your Journey with a Federal Financial Advisor

Starting with a financial professional can feel a little daunting, but the process is far more collaborative and down-to-earth than you might imagine. Working with a federal employee financial advisor isn't a transaction; it's about building a long-term partnership with a trusted guide. The entire process is designed to demystify your benefits and give you real confidence in your future.

It all kicks off with a discovery meeting. Forget about a high-pressure sales pitch. This first conversation is a fact-finding mission where the advisor’s main job is to listen and learn about your life, your career, and what you want for your retirement.

You’ll bring in some key documents, like your most recent Leave and Earnings Statement, your TSP statements, and your SF-50 (Notification of Personnel Action). These aren't just pieces of paper; they’re the building blocks of your financial story. From there, the advisor gets to work connecting all the dots.

Building Your Personalized Roadmap

With your documents in hand, the advisor starts to assemble your complete financial picture. They don't just glance at your TSP balance and call it a day. They build a comprehensive model showing how your FERS pension, Social Security, and other assets will all work together throughout your entire retirement.

Think of it like an architect creating a detailed blueprint before a single brick is laid. This deep-dive analysis leads to a plan built just for you.

Initial Analysis: The advisor digs into everything, from calculating your "high-3" salary to figuring out your best FEGLI coverage options.

Strategy Session: You’ll meet again to walk through their findings. They’ll explain their recommendations in plain English, showing you exactly how different decisions could change your future income.

Implementation: Once you’ve settled on a strategy you feel good about, they help you put it all into motion. This could mean adjusting your TSP allocations or helping you prepare the mountain of retirement paperwork.

This initial planning phase is all about turning complexity into clarity. It’s that "aha!" moment when the overwhelming details of your federal benefits finally click into place as part of one cohesive strategy.

An Ongoing Partnership for Life

Here’s the most important part: this is not a one-and-done deal. Your financial life isn't static, so your plan can't be either. A real partnership with a federal employee financial advisor means regular check-ins and support for the long haul.

Life happens. You might get a promotion, your family situation could change, or Congress might pass new laws that affect federal benefits. Any of these events can require a tweak to your financial plan.

Regular reviews make sure your strategy stays on track with your goals, adapting to market changes and personal milestones. This ongoing relationship provides incredible peace of mind, knowing you have an expert in your corner to help you navigate whatever comes next.

Your Top Questions About Federal Financial Advisors, Answered

Stepping into the world of financial planning can feel a little daunting, and that's completely normal. But when you’re a federal employee, your unique benefits package adds another layer of complexity. Let's walk through some of the most common questions we hear, so you can feel confident about your next steps.

A lot of federal employees ask if hiring an advisor is even necessary. It's a fair question. With a solid FERS pension and the TSP, it can feel like your retirement is already set. While those are incredible tools, they don't run on autopilot.

Think of your pension as the foundation of your retirement house. An advisor is the architect who helps you build the rest of it. They’ll help you figure out how to turn your TSP into a reliable paycheck, pinpoint the best time to claim Social Security for the maximum benefit, and make sure your money will last for what could be a thirty-year retirement.

When Should I Hire an Advisor?

This is probably the most frequent question we get, and it's a crucial one. While it’s never truly too late to get good advice, the sweet spot for hiring a federal employee financial advisor is about five to ten years before you plan to retire. This gives you and your advisor plenty of runway to make impactful changes.

Why so early? This period is perfect for:

Course Correction: You have time to fine-tune your TSP contributions and shift your investment strategy to maximize growth before your paychecks stop.

Strategic Planning: An advisor can model different retirement dates, showing you exactly how each scenario impacts your pension and benefits. It’s not always the date you think!

Insurance Optimization: This is your last chance to make smart, long-term decisions about things like FEGLI and FEHB before you’re locked into your choices for good in retirement.

Waiting until you're a year or two out from retirement can really limit your options. It often creates a ton of unnecessary stress during what should be an exciting time. Getting ahead of it is always the best move.

What Does a Federal Financial Advisor Cost?

Let's talk money. The cost of specialized advice is a practical concern for anyone, and it’s important to know how advisors get paid. It generally boils down to two models.

Fee-Only: These advisors charge you a direct fee for their expertise. It might be a flat rate for a comprehensive plan, an hourly charge, or a small percentage of the assets they manage for you. The key thing here is that they do not earn commissions for selling you products.

Commission-Based: These advisors are paid by companies for selling their financial products, like certain insurance policies or annuities.

Most industry veterans will point you toward a fee-only fiduciary. This arrangement strips away potential conflicts of interest, ensuring the advice you get is based purely on what’s best for your financial situation, not on which product pays them the biggest commission.

Is It Hard to Find a Good Advisor?

Finding the right person takes a bit of diligence, but it’s absolutely doable. The demand for quality advice is definitely high—right now, 36% of retirement plan participants in the U.S. work with a financial advisor. At the same time, the industry is seeing a wave of retirements, with 38% of current advisors expected to hang it up within the next decade. You can discover more insights about retirement planning trends to get a feel for the landscape.

What does this mean for you? It just highlights the importance of starting your search early and being selective. When you find someone, ask pointed questions about their specific experience with federal benefits, their credentials, and exactly how they are paid.

A great federal employee financial advisor does more than just manage your money. They provide the peace of mind that comes from knowing the retirement you’ve worked so hard for is in truly capable hands.

Are you ready to turn your federal benefits into a clear and confident retirement strategy? The team at Federal Benefits Sherpa offers a free 15-minute benefit review to help you get started. We specialize in simplifying the complexities of FERS, TSP, and your other benefits to build a plan that works for you. Secure your financial future with Federal Benefits Sherpa today!

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved