Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Fehb Retiree Health Insurance Guide: fehb retiree health insurance Essentials

For federal employees, your FEHB retiree health insurance is one of the most valuable benefits you'll ever earn. It's the key that allows you to carry your health coverage with you into retirement, but unlocking it requires meeting one critical rule: the "5-Year Rule." This isn't just a suggestion; it's a hard-and-fast requirement for continuous enrollment in an FEHB plan right before you retire.

Securing Your Health in Retirement with FEHB

When you're mapping out your retirement, you're juggling a lot of different pieces—your pension, TSP, Social Security. But arguably, nothing is more critical than locking in your long-term health coverage. The best way to think about your Federal Employees Health Benefits (FEHB) plan is as a bridge from your working years to a secure and healthy retirement. This isn't just another line item on a benefits statement; it's a foundational part of your future financial and personal well-being.

The FEHB program is massive, standing as the largest employer-sponsored health insurance plan in the country. It currently provides coverage for more than 8.2 million federal employees, retirees, and their families. This scale is a testament to how vital the program is to the federal community.

Why FEHB Planning Starts Now

So many federal employees make the mistake of waiting until their last year or two of service to think about FEHB retiree health insurance. This is a recipe for disaster. The choices you make about your health plan today directly determine whether you'll even be eligible to keep it in retirement. Proper planning makes sure that bridge to retirement is solid, giving you the peace of mind you deserve.

This guide is designed to cut through the confusion. We'll break down the often-complex rules and processes into simple, actionable steps, helping you build a retirement strategy you can feel confident about. The goal here is simple: to give you the knowledge you need to secure the benefits you've worked so hard to earn.

To get the full picture, it helps to understand how the program works for active feds. For a complete overview, take a look at our comprehensive guide to the Federal Employees Health Benefits program (FEHB).

The real magic of FEHB in retirement is continuity. You get to keep the same doctors, the same network, and the same quality of benefits you had during your career, all while the government continues to subsidize a large portion of your premiums.

As you plan for your long-term health needs, it’s also wise to think about your end-of-life medical preferences. Taking the time for understanding advance directives and living wills is a crucial step that can spare your family from making incredibly difficult decisions down the road. It's a proactive measure that rounds out a complete healthcare strategy for your future.

The Unbreakable 5-Year Rule for FEHB Eligibility

When it comes to your FEHB retiree health insurance, there's one rule that truly matters above all others: the 5-Year Rule. Think of it as the master key that unlocks your ability to carry health benefits into retirement. This isn't a suggestion or a guideline; it's a hard-and-fast requirement from the Office of Personnel Management (OPM).

Simply put, you must be continuously enrolled in an FEHB plan for the five full years immediately before your retirement date. A break in that coverage, even for a single day inside that five-year window, can mean forfeiting this incredible benefit for good.

The government's logic here is pretty clear. They heavily subsidize your health premiums in retirement, and this rule ensures the benefit is reserved for committed, long-term federal employees. It stops someone from jumping on a plan right before they retire just to get the perk.

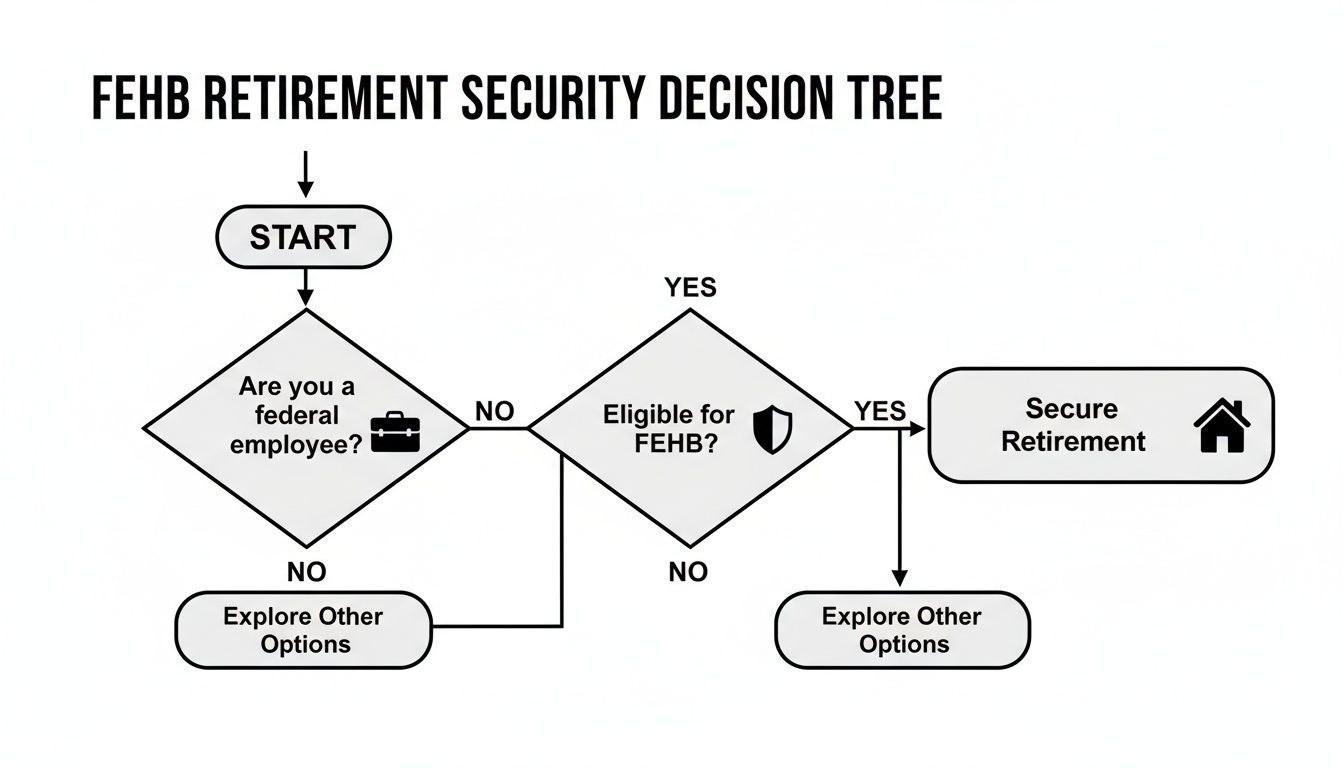

This decision tree shows just how fundamental this rule is to your retirement planning.

As you can see, being a federal employee and enrolling in FEHB are the first steps, but meeting the 5-year requirement is the critical gate you must pass through to secure your benefits.

What "Continuous Enrollment" Really Means

When OPM says "continuous," they mean it literally—no gaps allowed. You must be covered under an FEHB plan for the 60 consecutive months right up to the day you retire. This coverage can be under your own enrollment or as a family member on another fed’s FEHB plan, but it absolutely must be unbroken.

Let's look at a common mistake:

Scenario: A long-time employee, Robert, plans to retire on December 31, 2028. He’s been enrolled in FEHB since 2010 but decides to waive coverage during the 2024 Open Season to save a little cash, figuring he'll just hop back on in 2025.

Outcome: Bad move. Even if Robert re-enrolls, he broke the chain. That one-year gap means he is no longer eligible to keep his FEHB coverage in retirement.

This story highlights just how unforgiving the rule is. A small financial decision made years before you leave can have massive, permanent consequences.

The Immediate Annuity Requirement

The second piece of the puzzle is that you must be entitled to an immediate annuity. This just means your pension payments have to start within 31 days of your separation from service. If you leave your federal job but decide to put off collecting your annuity until a later date (a deferred retirement), you lose the ability to continue your FEHB.

These two requirements are a package deal:

Continuous Coverage: You need FEHB coverage for the five years leading up to your last day.

Immediate Annuity: You must start collecting your pension right after you stop working.

Being able to keep your exact same health plan is a hallmark of the federal benefits package, a lifeline for many of the 8.3 million people covered. But access is guarded by these strict rules. To learn more about managing your plan as retirement approaches, it's worth taking time to explore insights on FEHB open season considerations for retirees.

To bring this concept to life, let’s look at how the 5-Year Rule plays out in different situations.

How the FEHB 5-Year Rule Applies in Practice

This table shows how small differences in your career path can dramatically affect your eligibility.

Employee Scenario5-Year Rule Met?Outcome for Retiree FEHBConsistent Fed: Maria has worked for the government for 25 years and has been in the same FEHB plan for the last 10.YesEligible. She has been continuously covered for more than the required 5 years.Late Enrollee: David has 30 years of service but only enrolled in FEHB 3 years before his retirement date.NoIneligible. He does not meet the 5-year continuous coverage requirement.Coverage Gap: Sarah was covered for 8 years, then waived FEHB for one year to join her spouse’s private plan. She re-enrolled 2 years before retiring.NoIneligible. The one-year gap broke her continuous coverage. Her 5-year clock reset when she re-enrolled.Spousal Coverage: John was covered under his wife’s (also a fed) FEHB family plan for 15 years before enrolling in his own plan 2 years ago.YesEligible. His coverage was continuous, even though the specific enrollment changed. It's the coverage, not the enrollee, that matters.

As you can see, the rule is rigid. It’s all about maintaining that unbroken chain of coverage leading up to your retirement.

Are There Any Exceptions to the Rule?

While the 5-Year Rule is incredibly strict, OPM has carved out a few very narrow exceptions.

The most common one applies to employees whose first chance to enroll in FEHB was less than five years before they retired. In that specific case, you only need to be enrolled continuously from your very first opportunity to sign up.

Other rare exceptions might apply to certain people returning to federal service after a break, but these are reviewed case-by-case and are far from guaranteed. You should never plan your retirement around getting one.

The only foolproof strategy is this: enroll in an FEHB plan at least five years before your target retirement date and never, ever let it lapse. Treat that coverage like an unbreakable promise to your future self.

How to Transition Your FEHB Coverage into Retirement

So, you've confirmed you meet the 5-Year Rule. That's a huge milestone. The next step is making sure your FEHB retiree health insurance makes the jump from your active career to your retirement annuity without any hiccups.

Fortunately, this is one of the smoothest parts of the retirement process. You don’t have to shop for a new plan or go through a new round of medical underwriting. This is one of the most powerful benefits of the FEHB program: continuity. You stick with the very same plan, with the same network of doctors and hospitals you're used to.

Even better, you keep paying the same premium share you did as an employee. The government continues to pay its portion—typically 72-75% of the total premium—which is a massive financial leg up in retirement.

The transition itself is mostly handled for you. Your agency's HR office gets the ball rolling on the paperwork, which eventually makes its way to the Office of Personnel Management (OPM). From there, OPM will simply start deducting your share of the health insurance premiums directly from your monthly annuity check.

Your Final Open Season: A Strategic Moment

Think of your last Open Season as an active federal employee as your final, most important opportunity to get your health plan exactly right for retirement. This is your chance to lock in the coverage that will serve you best for the long haul.

During this window, you can switch to a completely different plan, change your enrollment from Self Only to Self Plus One or Self and Family, or even cancel your coverage if you choose. Once you're retired, your options for making changes become much more limited.

For example, maybe you know you'll want a plan that works hand-in-glove with Medicare once you turn 65. Your final Open Season is the perfect time to make that switch. If you wait, you could find yourself stuck in a plan that isn't the best fit for your new life.

Making Changes Outside of Open Season

While Open Season is the main event, life happens. Fortunately, certain Qualifying Life Events (QLEs) can give you a special enrollment period to change your FEHB plan even after you've retired.

Here are a few common QLEs that open the door for a plan change:

Getting married or divorced: This allows you to add a new spouse or remove an ex-spouse from your plan.

A family member loses other coverage: If your spouse loses their insurance from their job, you can add them to your FEHB plan.

Moving out of your plan’s service area: If you have an HMO and move across the country, a QLE allows you to pick a new plan that serves your new location.

Becoming eligible for Medicare: This is a big one. It's a QLE that lets you switch to an FEHB plan designed to complement Medicare, which can often lead to significant savings on your total healthcare costs.

A word of caution: A QLE opens a very specific, limited window to act—usually starting 31 days before the event and ending 60 days after. If you miss that window, you're back to waiting for the next Open Season.

Suspending FEHB for Other Coverage

For some retirees, another health plan might look like a better deal. The FEHB program gives you the flexibility to suspend your coverage in certain situations, allowing you to come back to it later if your circumstances change. This isn't the same as canceling; think of it as hitting the pause button.

You can typically suspend your FEHB coverage for two main reasons:

TRICARE or CHAMPVA: If you're eligible for military health benefits like TRICARE or coverage through the VA (CHAMPVA), you can suspend FEHB.

Medicare Advantage (Part C): You also have the option to suspend FEHB to enroll in a Medicare Advantage plan.

Pressing pause on your FEHB retiree health insurance can save you money on premiums, but it's a decision that requires serious thought. The great thing is the safety net it provides. If you later lose that other coverage, or just decide you want to leave your Medicare Advantage plan, you have the right to re-enroll in FEHB. Knowing you can always fall back on a high-quality FEHB plan is a powerful benefit.

Managing FEHB and Medicare Costs in Retirement

Let's get right to it. For most federal retirees, the biggest question about FEHB retiree health insurance is a simple one: "What's this going to cost me?" Getting a handle on your premiums and, just as importantly, how your plan works with Medicare is the key to managing your healthcare budget for the long haul.

The good news is the payment process is seamless. Your FEHB premiums were taken out of your biweekly paycheck while you worked, and now they’ll simply be deducted from your monthly annuity check. No new paperwork, no bills to remember.

But here’s something to keep on your radar: a major demographic shift is putting pressure on these costs. The federal workforce is getting older—42% of employees are over 50, compared to just 33% in the private sector. This trend is expected to push premiums higher in the coming years, which makes having a smart cost-management strategy more critical than ever.

The Power of Pairing FEHB with Medicare

When you hit age 65 and are eligible for Medicare, your whole healthcare world changes. This is where a lot of retirees get tripped up, asking if they really need both FEHB and Medicare. The answer for almost everyone is a firm yes, and the reason is all about teamwork.

Think of it this way: Medicare becomes the primary player on your healthcare team. Once you’re enrolled in Medicare Part A (for hospitals) and Part B (for doctors and medical services), Medicare steps up to the plate first and pays its share of the bills.

So where does that leave your FEHB plan? It shifts into the role of an incredible secondary payer. Your plan doesn’t go away; it transforms into a powerful supplement that picks up many of the costs Medicare leaves behind. This coordination is the secret to getting truly fantastic coverage.

When FEHB and Medicare join forces, they create a financial safety net far stronger than either one could provide alone. Your FEHB plan fills in the gaps—covering the deductibles, copayments, and coinsurance that Medicare doesn’t.

The result of this tag-team approach is that you often end up with virtually 100% coverage for most of your medical care. The money you save on out-of-pocket costs can easily be more than what you pay for your monthly Medicare Part B premium.

Why You Can’t Afford to Skip Medicare Part B

Medicare Part A is typically premium-free for federal retirees, but Part B comes with a monthly premium. It's tempting to try and save a few bucks by skipping it, thinking, "My FEHB plan is good enough." This is almost always a huge financial mistake.

Here’s the catch: if you’re 65 or older with FEHB but you decline Medicare Part B, your FEHB plan has to act as your primary insurance. The problem is, many FEHB plans are designed with the expectation that you will have Medicare. As a result, they may pay far less for your care, leaving you on the hook for big bills that Medicare would have easily covered.

On top of that, delaying your Part B enrollment means you’ll likely face a permanent late enrollment penalty, making your premiums more expensive for the rest of your life. For these reasons, enrolling in Medicare Part B as soon as you are eligible is one of the smartest things you can do for your FEHB retiree health insurance strategy. For a deeper dive, check out our guide on how FEHB and Medicare work together for federal retirees.

How to Maximize Your Savings

Once you have both FEHB and Medicare, you open the door to even more savings. During the annual Open Season, you can often switch to a lower-cost FEHB plan. Many carriers offer specific plans built for retirees on Medicare that have lower premiums because they are designed purely to supplement what Medicare already covers.

Here’s a real-world example of how the financial coordination works:

You visit your doctor: Let's say it's a specialist who accepts Medicare.

Medicare pays first: Medicare processes the claim and pays its share, which is typically 80%.

FEHB pays second: Your FEHB plan then steps in to cover most, if not all, of the remaining 20%.

Your final cost: You’re often left paying little to nothing out-of-pocket.

Finally, a complete financial plan for retirement healthcare should also consider other potential expenses. It's wise to look into long-term care insurance options to protect your assets from the high cost of extended care. By smartly coordinating all your benefits, you can build a solid defense against whatever health challenges come your way.

Protecting Your Loved Ones with Survivor Benefits

Planning for your FEHB retiree health insurance isn't just about you. It's about building a safety net for the people you care about most. Your FEHB plan can be a lifeline for your family long after you're gone, but it only works if you take the right steps when you retire.

Here’s the thing: this protection isn't automatic. For a surviving spouse to keep their FEHB coverage after you pass away, there's one absolute, non-negotiable requirement from OPM: you must elect a survivor annuity when you fill out your retirement paperwork.

Think of it as paying a small premium now for priceless peace of mind later. When you choose a survivor annuity, you agree to a small reduction in your monthly pension. In exchange, you guarantee that your spouse will not only receive a portion of your annuity but, crucially, can keep their FEHB health coverage for the rest of their life.

The Survivor Annuity: Your Key to Continued Coverage

Choosing the survivor annuity is easily one of the most important decisions you'll make at retirement. If you skip it, your spouse's FEHB coverage evaporates upon your death. That could leave them scrambling for new, and likely much more expensive, health insurance at the worst possible time.

Let's look at what this decision really means:

A Reduction in Your Pension: To fund this benefit, your FERS or CSRS annuity will be slightly reduced. The exact amount depends on the survivor level you pick (usually full or partial).

Guaranteed Spousal Income: Your surviving spouse gets a monthly check for life, providing a foundation of financial stability.

Uninterrupted Health Coverage: This is the real game-changer. Your spouse can stay on their FEHB plan indefinitely, simply paying their premium share from their new survivor annuity check.

You're essentially weighing a slightly smaller check for yourself against a lifetime of health security for your partner. For the vast majority of federal families, that's a trade-off worth making every single time.

Electing a survivor annuity is the only way a surviving spouse can stay on FEHB after the retiree's death. It's the cornerstone of your family's long-term security plan.

Protecting Other Family Members

The rules also provide a path for former spouses and dependent children to keep their coverage, but the requirements are very specific and must be followed to the letter.

Coverage for a Former Spouse

A former spouse can sometimes continue their FEHB coverage, but this right has to be established by a court order, like a divorce decree. That court order must explicitly grant them a survivor annuity and the right to keep their FEHB coverage. You can't just arrange this informally—it requires official legal paperwork.

Coverage for Dependent Children

Your unmarried kids under age 26 can also stay on a family plan after you die, as long as at least one family member (like your surviving spouse) is still covered by that plan. Their eligibility continues as long as they meet the dependency rules.

These decisions carry a lot of weight and require a solid understanding of the rules. To get a better handle on how all the pieces fit together, you can dig into our guide to federal employee survivor benefits. It’s a great resource for getting the clarity you need to protect the people you love.

Your Action Plan for a Secure Retirement

Alright, we've covered a lot of ground. Now comes the most important part: turning all this knowledge into a real-world strategy to lock in your FEHB retiree health insurance. It can feel like a lot to juggle, but if you break it down based on how close you are to retirement, it becomes much more manageable.

This isn't just about checking off boxes on a form. It’s about being proactive and protecting one of the most valuable benefits you've earned over your career. By taking these steps, you can sidestep the common mistakes that trip people up and make sure your health coverage is ironclad for the long haul.

Your Checklist: 10+ Years From Retirement

With plenty of time on your side, the name of the game is building a solid foundation. This is your chance to confirm you're on the right track and make smart, long-term decisions without the pressure of a looming deadline.

Confirm Your 5-Year Enrollment: First things first, are you currently enrolled in an FEHB plan? If not, make sure you sign up during the next Open Season to get that crucial 5-year clock ticking.

Review Your Plan Choice: Think about the future. Is the plan you have today the one you want in retirement? This is the perfect time to explore other options that might be a better fit for your health needs and financial goals down the road.

Start Learning Now: Use this time to get comfortable with the big concepts. Dig into how FEHB and Medicare work together and really understand why electing a survivor annuity for your spouse is such a critical decision.

Your Checklist: 5 Years Out

The 5-year mark is where things get serious. Every decision you make from this point forward directly impacts your ability to keep your health insurance in retirement.

This is it—you are officially inside the mandatory 5-year continuous enrollment window. If your FEHB coverage lapses for even one day from now until you retire, you will lose it for good. It's time to double-check everything.

Your focus should now shift from planning to verification.

Verify Continuous Coverage: Don't just assume you've been covered. Track down your SF 50s (Notification of Personnel Action) and confirm, with your own eyes, that you have been continuously enrolled in FEHB for the past five years.

Solidify Survivor Plans: This is the time for a real conversation with your spouse about electing a survivor annuity. Make sure you both understand how the annuity reduction works and, more importantly, the incredible peace of mind it provides.

Your Checklist: Your Final Year

You're in the home stretch! In your last year, your attention turns to finalizing the paperwork and coordinating with your agency's HR department to ensure a smooth transition.

Final Open Season Review: Take advantage of your last Open Season as an active employee. This is your last, best chance to switch plans if you need to make a final adjustment.

Prepare for Medicare: If you're turning 65, get ready to enroll in Medicare Part A and Part B. Your Initial Enrollment Period usually starts three months before your 65th birthday, so don't miss that window.

The Retirement Application: When you fill out your retirement application, be incredibly careful. The section where you elect your survivor annuity benefits is one of the most important decisions you'll make, and it's almost always irrevocable.

Walking this path takes some diligence, but a secure retirement is absolutely achievable. With this timeline in hand, you can confidently protect the benefits you've worked so hard for. Here at Federal Benefits Sherpa, this is what we do—we help federal employees build these kinds of personalized roadmaps, making sure no stone is left unturned.

Got Questions About FEHB in Retirement? We’ve Got Answers.

As you get closer to retirement, you'll find that a lot of specific, "what-if" questions pop up. It's completely normal. These are often the little details that can feel overwhelming, but getting them sorted out brings a huge sense of relief.

Let's walk through some of the most common questions we hear from federal employees, so you can move forward with confidence.

Can I Still Use My Health Savings Account (HSA) After I Retire?

If you've been using a High Deductible Health Plan (HDHP) with an HSA, you know how powerful that tax-free medical savings account can be. The good news is you don't lose it in retirement, but the rules do change once Medicare enters the picture.

The moment you enroll in Medicare Part A or Part B, you can no longer contribute new money to your HSA. That's a hard and fast IRS rule. However, every dollar already in your account is still yours to use, tax-free, for qualified medical expenses for the rest of your life. Think of it as a pre-funded healthcare spending account you can tap into whenever you need it.

What Happens to My FEHB if I Get Divorced After Retirement?

A post-retirement divorce is a major Qualifying Life Event (QLE), which gives you a window to adjust your FEHB coverage. You can switch your plan from Self and Family or Self Plus One down to Self Only. You generally have 60 days from the date of the final divorce decree to make this change.

What about your ex-spouse? For them to continue receiving FEHB coverage, it’s not enough to just agree to it. That right must be spelled out in the official court order or divorce decree.

A quick heads-up: OPM doesn't recognize informal or verbal agreements. If it's not in the legal paperwork, your former spouse will lose their FEHB coverage.

Do I Really Need to Sign Up for Medicare Part D?

For almost every federal retiree, the answer is a simple no. Your FEHB plan’s prescription drug coverage is almost certainly "creditable." In plain English, that means it’s as good as, or even better than, a standard Medicare Part D plan.

Signing up for a separate Part D plan is not only redundant but can create a messy web of overlapping coverage. Just stick with your FEHB plan for prescriptions—it’s designed to work seamlessly even after you’re on Medicare Parts A and B.

What if I Retire Before I'm 65?

This is a common scenario, and the answer is refreshingly simple. If you retire before you're eligible for Medicare, nothing changes with your FEHB plan. It just keeps working as your primary insurance, exactly as it did while you were employed. You’ll pay your premiums, and your plan will pay claims. That’s it.

Then, as you get close to your 65th birthday, you'll enter your Initial Enrollment Period for Medicare. That's your cue to sign up for Parts A and B. This ensures your coverage will coordinate perfectly with your FEHB plan down the road and helps you avoid any nasty late-enrollment penalties.

Working through these kinds of specific situations is what makes for a truly secure retirement plan. At Federal Benefits Sherpa, we help you map out these details based on your personal circumstances. To make sure your benefits are perfectly aligned for your future, schedule your complimentary benefits review today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved