Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

GEHA Connection Dental Federal Explained

The GEHA Connection Dental Federal plan is a dedicated dental insurance program built from the ground up for federal employees, retirees, and their families. It’s a key player in the Federal Employees Dental and Vision Insurance Program (FEDVIP), designed to deliver dependable, affordable dental care.

Getting to Know the GEHA Dental Federal Program

Picking a dental plan feels a lot like choosing the right tool for a job. For simple maintenance like routine cleanings, a basic wrench gets the job done. But if you’re facing a major project like a crown or a root canal, you need something more powerful and specialized. That's exactly what the GEHA Connection Dental Federal plan aims to be—a specialized tool crafted for the federal community.

The whole point of this plan is to provide steady, budget-friendly dental coverage. This isn't some generic plan you'd find on the open market. It’s been specifically structured to align with the needs of government workers and their families.

Two Tiers to Match Your Needs

GEHA offers two distinct levels of coverage, which is great because it lets you pick the plan that actually fits your family’s dental situation.

High Option: This is the go-to choice if you anticipate more significant dental work on the horizon. Think orthodontics, implants, or multiple crowns. It comes with higher annual maximums and lower out-of-pocket costs for those big-ticket procedures.

Standard Option: This is a solid, cost-effective option for anyone who mainly needs preventive care—your regular cleanings, x-rays, and check-ups—with the occasional basic fix like a filling. The trade-off is a lower monthly premium.

Here’s a simple way to think about it: The Standard Option is like your reliable daily driver for getting around town (routine care). The High Option is the family SUV, ready for long road trips and carrying heavy loads (major dental work).

This two-tier system gives you the flexibility to avoid paying for more coverage than you really need. Getting a handle on this basic structure is the first step toward making a smart choice that fits both your health needs and your wallet. As you weigh your choices, you can see how GEHA stacks up against other carriers in our guide on the best federal employee dental insurance plans. This knowledge is your foundation for navigating your benefits and picking the perfect plan for your family's dental health.

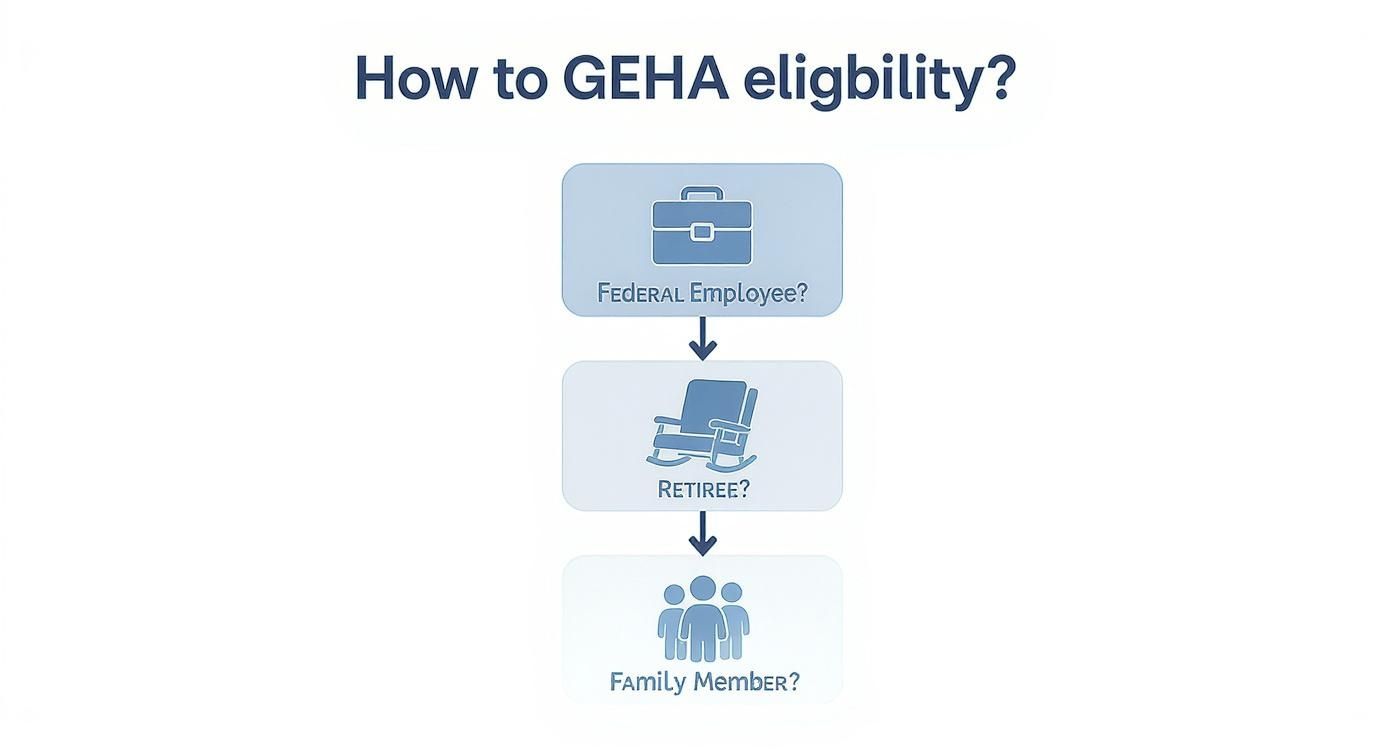

So, you're wondering if you can get in on the GEHA Connection Dental Federal plan. Let's break down who qualifies, because it’s a pretty straightforward system designed for the federal community.

The first thing to know is that this plan is part of the Federal Employees Dental and Vision Insurance Program, or FEDVIP. If you're eligible for federal benefits, you're likely in the right place.

The Main Groups Who Qualify

At its core, GEHA's dental coverage is for people with a direct tie to the federal government. You're almost certainly eligible if you are:

An active federal employee who is eligible for the Federal Employees Health Benefits (FEHB) Program. A key point here: you don't actually have to be enrolled in an FEHB medical plan to get this dental coverage.

A federal retiree (annuitant) who is receiving a government pension.

A survivor annuitant who is receiving a government survivor pension.

Basically, if you work for or retired from the federal government, this plan was created with you in mind. But the coverage doesn't just stop with you.

Can You Cover Your Family?

Yes, and this is one of the plan's biggest perks. You can extend your coverage to your immediate family, which makes managing everyone's oral health much simpler.

Family members who can typically be added to your plan include:

Your legal spouse.

Your children under the age of 26. This includes biological kids, stepchildren, adopted children, and foster children in your care.

The rules are pretty clear-cut, so adding loved ones to your plan is usually a hassle-free process.

A Few Special Cases to Consider

There are always a few unique situations. For instance, if you're a uniformed service member or a family member eligible for TRICARE, you might not be eligible for FEDVIP plans. It's always a good idea to double-check your status if you think there might be an overlap with other benefits.

You'll enroll during the annual Open Season. This is the specific time each year when you can sign up or make changes. For the 2026 plan year, for example, Open Season ran from November 10 to December 8, 2025, with coverage kicking in on January 1, 2026.

This window is your primary chance to enroll or upgrade. Downgrading or canceling mid-year usually requires a qualifying life event, so it's best to get it right during Open Season. For all the fine print, you can always check out the official 2026 GEHA Dental Benefits Guide.

Comparing the High and Standard Plan Options

Choosing between the GEHA Connection Dental Federal High and Standard plans isn't always straightforward. Think of it like deciding between a fully-loaded vehicle and a reliable base model—both get you where you need to go, but one is packed with features for any situation, while the other is focused on efficiency and value. The best fit really comes down to what you and your family expect to need down the road.

The High Option is the fully-loaded choice. It's designed for individuals and families who anticipate needing more than just routine cleanings. If you see crowns, root canals, dental implants, or even orthodontics on the horizon for anyone in your family, this plan’s more extensive coverage can be a real money-saver when those bills come due.

On the other hand, the Standard Option is the practical, budget-conscious base model. It’s an excellent choice if your family’s dental history is pretty quiet and you mainly focus on preventive care like exams, cleanings, and the occasional filling. You get solid, essential coverage with a lower premium, which is perfect for maintaining great oral health without overpaying for benefits you might not use.

Breaking Down the Key Differences

So, how do you decide? Let's get practical and look at how these plans perform when you're faced with common, and often expensive, dental work. The High Option almost always comes with a lower deductible and covers a higher percentage of the cost for major services. That's a huge deal. For example, if your child needs braces, the High Option's more generous orthodontic benefit could literally save you thousands of dollars.

Here’s a simple real-world example: you need a crown.

With the High Option, your out-of-pocket cost will be noticeably lower because the plan picks up a much larger slice of the bill.

With the Standard Option, you'll pay more for that exact same crown, but you’ll have been paying less in premiums every month leading up to it.

This flowchart can help you quickly determine if you're eligible for either of these plans.

As the chart shows, eligibility is pretty clear-cut. If you’re a current federal employee, a retiree, or an eligible family member, you're in the right place.

To help you see the differences side-by-side, we've put together a simple comparison table.

GEHA High Plan vs Standard Plan Feature Comparison

FeatureHigh Option CoverageStandard Option CoverageAnnual Maximum$40,000 per person$2,500 per personOrthodontia Lifetime Max$3,500 per person (adult & child)$2,500 per person (adult & child)Deductible (In-Network)$50 per person / $150 per family$100 per person / $300 per familyMajor Services (Crowns, etc.)Covers 55%Covers 35%ImplantsCovers 55%Covers 35%Preventive CareCovers 100% (3 cleanings/year)Covers 100% (3 cleanings/year)

This table lays it all out—the High Option is built for higher-cost needs with its massive annual maximum and better coverage percentages, while the Standard Option keeps things affordable for routine care.

Coverage Enhancements and Modern Treatments

Both plans do a good job of keeping up with modern dentistry. GEHA regularly updates procedure codes to include the latest treatments, so you’re not stuck with an outdated plan.

The High Option really shines with major work, reimbursing up to 55% for services like crowns and root canals, and covering 50% of orthodontics for all ages. Meanwhile, the Standard Option recently added a third annual cleaning at no extra cost, which is a fantastic perk for those focused on prevention. For the nitty-gritty details, the official OPM plan brochure is your best resource.

At the end of the day, the trade-off is clear: Pay more in premiums for the High Option for peace of mind and lower out-of-pocket costs on major procedures. Or, go with the Standard Option’s lower premium and accept that you'll pay more if a complex dental issue pops up.

If you’re leaning toward the more comprehensive plan but want to be absolutely sure, we've got just the thing. Dive deeper with our guide on what to expect from the GEHA Dental High Option plan to lock in your decision.

How the GEHA Dental Provider Network Works

Let's break down how GEHA's dental network actually operates. At its core, it’s a Preferred Provider Organization (PPO). Think of it as a huge club of dentists who've agreed to give GEHA members special, discounted pricing on their services.

This PPO model is all about giving you freedom of choice while keeping your costs down. Instead of being locked into a tiny list of approved dentists, you get access to one of the largest dental networks in the entire country. That means you have a massive pool of general dentists and specialists to choose from, whether you're at home or traveling.

Finding a Dentist in the Network

Finding a participating dentist is simple. GEHA provides an online "Find a Provider" tool right in your MyGEHA member portal.

Here’s how to use it:

Log into your MyGEHA account. This tailors the search results specifically to your plan.

Head over to the provider search tool.

Type in your location and filter by any specialty you need, like an orthodontist or endodontist.

Browse the results. You'll see a list of local, in-network dentists with all their contact info.

A good tip is to call the office before you book an appointment. Just confirm they are still accepting GEHA patients to avoid any surprises.

In-Network vs. Out-of-Network: What It Means for Your Wallet

This is the most important part to understand. Choosing an in-network dentist is the single best way to manage your dental costs. When you see an in-network provider, you pay a lower, pre-negotiated rate. GEHA pays its portion, and you cover the rest. Simple and predictable.

Things get tricky if you go out-of-network. These dentists haven't agreed to GEHA's pricing and can charge you their full, undiscounted fees. This is where you can get hit with something called balance billing.

Balance Billing Explained: This happens when an out-of-network dentist charges more than what GEHA considers a fair price for a service. The dentist can bill you directly for that difference, leaving you with a much higher, often unexpected, bill.

GEHA has worked hard to prevent this. As of 2025, the Connection Dental Federal plan includes a staggering 588,000 in-network provider locations. This huge network, which even has international options across five enrollment regions, is built specifically to help you find affordable care and steer clear of balance billing. You can dive deeper into the plan's details in the official GEHA dental plan brochure.

A Step-by-Step Guide to the Enrollment Process

Getting signed up for your GEHA Connection Dental Federal plan is actually pretty simple once you know where to go. Unlike many other federal benefits you might handle through your agency, this one has its own specific hub.

For almost all federal employees and retirees, dental and vision plan enrollments are funneled through one central website: BENEFEDS. This is a key detail to remember. You won't be enrolling directly on GEHA's site or through the Office of Personnel Management (OPM) for your dental coverage. Think of BENEFEDS as your dedicated portal for everything related to FEDVIP plans.

Understanding the Enrollment Windows

When it comes to federal benefits, timing is critical. Your main chance to sign up for a new plan or switch your current one is during the annual Open Season.

Open Season usually kicks off on the second Monday of November and wraps up on the second Monday of December. For example, the 2025 Open Season ran from November 10 through December 8, 2025. This is the time to lock in your choices for the following year.

If you let this window close without making a change, you're generally stuck with your current plan (or lack of one) until the next Open Season rolls around, unless a specific life event gives you another opportunity.

How to Enroll During Open Season

Once Open Season begins, the whole process is designed to be straightforward and can be done online. Here’s a quick look at the steps:

Get Your Info Ready: Before you even head to the website, it helps to have your personal details, agency information, and the Social Security numbers and birth dates for any family members you're covering.

Go to the BENEFEDS Portal: Head over to the official BENEFEDS website. You'll either log in to your existing account or create a new one.

Compare Your Options: The portal is great because it lets you see the GEHA High and Standard plans right next to other carriers, making it easy to compare.

Make Your Choice: Pick the plan that makes the most sense for you and your family, then just follow the on-screen instructions to finalize your enrollment.

What Is a Qualifying Life Event?

So, what happens if you need to enroll or change your plan outside of that strict Open Season window? That's where a Qualifying Life Event (QLE) comes in. These are major life changes that trigger a special enrollment period just for you.

Some of the most common QLEs are:

Getting married or divorced

Having a baby or adopting a child

A change in your employment status

When a QLE happens, the clock starts ticking. You typically have 60 days from the date of the event to log into BENEFEDS and adjust your coverage. Getting a handle on how these events impact your benefits is key, and you can learn more by checking out our guide to the Federal Employees Health Benefits (FEHB) program.

How to Maximize Your GEHA Dental Benefits

Getting enrolled in the GEHA Connection Dental Federal plan is a fantastic first step, but the real value comes from actively managing your benefits. Think of your plan less like an emergency safety net and more like a toolkit for keeping your smile healthy and your budget in check. The key is to shift from a mindset of fixing problems to preventing them in the first place.

The single most powerful strategy? Lean heavily into your preventive care benefits. Your plan is deliberately designed to cover routine services—like cleanings, exams, and x-rays—at a very high percentage, often 100%. When you schedule these regular check-ups, you're not just maintaining your oral health; you're spotting small issues before they snowball into expensive, complex procedures.

Becoming a Savvy Healthcare Consumer

Understanding the paperwork is crucial for avoiding any financial surprises down the road. After any visit, GEHA will send you an Explanation of Benefits (EOB). It’s important to know that this isn't a bill. It's a detailed breakdown showing what your dentist charged, what GEHA paid, and what your remaining responsibility is.

Your EOB is your financial roadmap. Learning to read it helps you track your deductible, see how much of your annual maximum is left, and confirm you were charged correctly for services.

For any significant procedure—think crowns, bridges, or orthodontics—always ask for a pre-treatment estimate. Your dentist’s office can submit the proposed treatment plan to GEHA ahead of time. GEHA will then send back a document estimating exactly what they'll cover. This simple step takes the guesswork out of the equation and lets you budget with confidence.

Finally, make sure you’re taking full advantage of your MyGEHA online portal. It's much more than just a place to order a new ID card. It’s your command center for managing your benefits. You can:

Track claims to see their status in real-time.

View your benefits to quickly check coverage for a specific procedure.

Monitor your deductible and see how close you are to meeting it.

By using these simple tools and strategies, you shift from being a passive plan member to an empowered consumer who gets the absolute most out of every benefit available.

Got Questions About GEHA Dental? We've Got Answers.

Even after digging into the details, you're bound to have some practical questions. Let's tackle some of the most common ones that come up about the GEHA Connection Dental Federal plan so you can get the straightforward answers you need.

Does GEHA Cover Cosmetic Procedures?

This comes up all the time, and the short answer is usually no. The GEHA dental plan, like most insurance, is built to cover procedures that are medically necessary to keep your mouth healthy or fix a problem.

Things that are considered purely for looks typically aren't on the covered list. This includes:

Teeth whitening: Whether it's done in the dentist's chair or with a kit you take home.

Veneers: When their only purpose is to improve the appearance of a tooth, not to repair damage.

Cosmetic bonding: Used just to reshape or change the color of an otherwise healthy tooth.

If you're ever on the fence about a procedure, the smartest move is to get a pre-treatment estimate. That way, you'll know exactly what to expect and can avoid any surprise bills.

What Happens to My Coverage When I Retire?

Good news here. Your GEHA dental coverage is designed to stick with you into retirement without any headaches. As long as you’re eligible to keep your Federal Employees Health Benefits (FEHB) plan as a retiree, you can keep your FEDVIP dental plan, too.

The bottom line is your GEHA dental plan can continue right where it left off. You won't need to sign up again or worry about losing coverage, as long as you're a federal annuitant. The only real change is that premiums will come out of your monthly annuity instead of your paycheck.

How Does International Coverage Work?

For federal employees living or just traveling overseas, GEHA has you covered. The plan handles any dentist you see outside the U.S. as an out-of-network provider. In most cases, this means you'll pay the dentist for their services upfront.

Then, you'll need to submit a claim to GEHA for reimbursement. Make sure you hang on to an itemized bill that clearly spells out what services you received and what they cost—GEHA will need that to process your claim.

Can I Switch Plans Outside of Open Season?

Normally, the only time to switch between the Standard and High options is during the annual Open Season, which usually runs from mid-November to mid-December. But life happens, and there are exceptions. You can make a change outside that window if you have a Qualifying Life Event (QLE).

Common QLEs include things like getting married, having a baby, or a spouse losing their job. Just be aware that you're on a clock—you typically have 60 days from the date of the event to log into the BENEFEDS portal and make your changes.

Making sense of your federal benefits is a huge part of planning for a secure future. At Federal Benefits Sherpa, we help federal employees navigate these exact decisions every day. Book your free 15-minute benefit review today at https://www.federalbenefitssherpa.com to make sure you're on the right track.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved