Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

GEHA Health Savings Account a Complete Guide

Let's break down what a GEHA Health Savings Account (HSA) really is. At its core, it’s a special savings account that works hand-in-hand with a High Deductible Health Plan (HDHP) offered to federal employees.

Think of it less like a traditional health plan and more like a personal savings account, but one built specifically for your healthcare costs. The real magic is in the tax benefits: the money you put in is tax-deductible, it grows tax-free, and you can take it out tax-free to pay for qualified medical expenses.

What Is a GEHA Health Savings Account Anyway

Imagine your GEHA HSA as a powerful financial tool that just happens to be disguised as a healthcare plan. It’s so much more than a way to cover doctor visits. This is a strategic asset that you own and control, letting you save for medical needs—both now and in the future—while enjoying some serious tax perks.

This account is only available when you're enrolled in a GEHA High Deductible Health Plan (HDHP). The two go together, creating a fantastic one-two punch for managing your healthcare finances smartly.

The Core Components of Your GEHA HSA

The true value of a GEHA HSA is baked into its design. It's not just about spending; it's about building a financial buffer for your health. Here’s a look at how the pieces come together:

You Own It: This is a big deal. Unlike a Flexible Spending Account (FSA), the HSA is your personal account. The money is yours to keep, whether you switch jobs, change to a different health plan, or retire.

Funds Roll Over: Forget the "use it or lose it" pressure. Every dollar you don't spend this year stays right in your account, ready for you next year and beyond. It just keeps growing.

GEHA Contributes: To get you started, GEHA actually deposits money directly into your HSA. This is a fantastic head start that immediately helps offset your out-of-pocket costs.

This mix of personal ownership, triple-tax advantages, and direct GEHA contributions makes the HSA an incredibly valuable part of your benefits package. It's both a safety net for those unexpected medical bills and an investment tool for your long-term financial well-being.

Once you grasp these fundamentals, it's clear the GEHA Health Savings Account is more than just a place to park cash for co-pays. It's a key part of a solid financial plan, offering flexibility for today's needs while building a resource for the future. Many feds also find that pairing a strong health plan with great dental coverage is a smart move. You can learn more by reading our guide to the GEHA dental high option plan to see how these benefits can complement each other.

Are You Eligible for a GEHA HSA? Let's Check

Before you can jump in and start using a GEHA Health Savings Account, you have to make sure you meet a few specific requirements straight from the IRS. Think of it as the velvet rope for a financial VIP section—you need the right qualifications to get in. The most important one? Your health plan.

To open an HSA, you must be enrolled in a qualified High Deductible Health Plan (HDHP). GEHA’s HDHP is built from the ground up to pair with an HSA, making it the perfect key to unlock this savings powerhouse. HDHPs work by trading lower monthly premiums for a higher deductible, meaning you cover more of your initial healthcare costs out-of-pocket before insurance kicks in.

The Must-Have Eligibility Checklist

Having the right health plan is the big first step, but there are a few other boxes you need to tick. The IRS put these rules in place to prevent conflicting health coverage from muddying the waters.

Here’s a quick rundown to see if you qualify to open and contribute to a GEHA HSA:

No Other conflicting health coverage: You can't be covered by another health plan that isn’t an HDHP. This is a common snag for couples, so if you're on your spouse’s traditional PPO or HMO, you won't be eligible.

Not enrolled in Medicare: If you’re enrolled in Medicare (any part—A, B, or D), you can't contribute to an HSA. You can still use the funds you already have, but you can’t add more.

Can't be claimed as a dependent: You must be financially independent, meaning no one else can claim you as a dependent on their tax return.

No general-purpose FSA or HRA: Having a standard, use-it-for-anything Flexible Spending Account (FSA) or Health Reimbursement Arrangement (HRA) will disqualify you. The exception is a limited-purpose FSA that only covers dental and vision, which is usually okay.

It's a really good idea to give this list a quick review each year. Life happens. Maybe your spouse’s benefits change, or you’re approaching Medicare eligibility. These changes can directly affect your ability to keep contributing to your GEHA HSA.

Once you’ve confirmed you meet these criteria, you’re all set to start building your tax-advantaged healthcare fund. Understanding these ground rules from the start means you can move forward with confidence and unlock the full financial potential this account offers federal employees.

Making the Most of Your HSA: Contributions and Tax Breaks

This is where the real magic of your GEHA Health Savings Account comes into play. It’s one thing to have the account, but it's another thing entirely to use it strategically to maximize your savings and leverage its incredible tax structure. Think of your HSA less like a simple savings account and more like a powerful financial tool for your health.

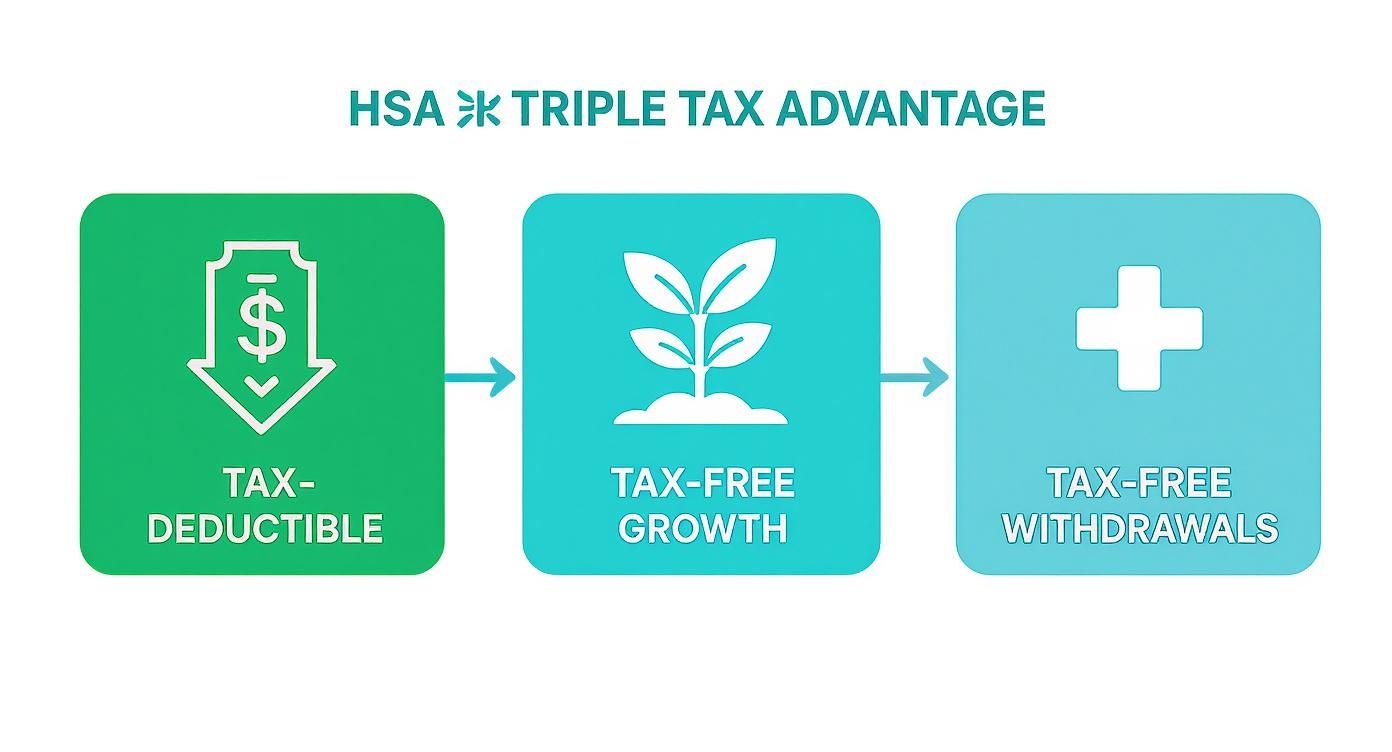

The secret sauce is something called the triple tax advantage. It’s a concept you’ll hear a lot about, and for good reason—it’s what makes an HSA stand out from almost any other savings or investment account you can find.

The Triple Tax Advantage: A Three-Way Win

Imagine getting a financial leg-up at every single step of the savings process. That's exactly what this is. Each benefit builds on the others, creating a powerful compounding effect that can seriously boost your healthcare nest egg.

Here’s the breakdown:

Contributions are Tax-Deductible: Every dollar you contribute to your GEHA HSA lowers your taxable income for the year. Simple as that. You end up paying less to Uncle Sam right off the bat.

Your Money Grows Tax-Free: Once the money is in your account, it can grow without being taxed. Whether it's just earning interest or you have it invested, all those earnings are 100% yours, tax-free.

Withdrawals are Tax-Free: When you need the money for a qualified medical expense—anything from a doctor’s co-pay to new glasses—you can pull it out completely tax-free. No penalties, no taxes.

This triple-threat is what makes the GEHA HSA so valuable. It’s the most tax-efficient way to save, grow, and spend money on healthcare, which means more of your hard-earned cash stays right where it belongs: with you.

Know Your Contribution Limits

To get the most out of your HSA, you need to know the rules of the road, and that starts with the annual contribution limits. The IRS sets these numbers, and they can change each year to keep up with inflation.

For 2025, you can contribute up to $4,300 for self-only coverage or a hefty $8,550 for family coverage. It's no wonder these accounts are popular; over 80% of federal employees with HSAs get a contribution from their employer, which is a huge perk. You can see more about the explosive growth of HSAs on 401kspecialistmag.com.

And if you're getting closer to retirement, there's an extra bonus built in for you.

The "Catch-Up" Contribution for Savers 55+

Are you 55 or older? If so, the IRS lets you put an extra $1,000 per year into your HSA. It's called a catch-up contribution, and it’s a fantastic way to give your savings a final push before retirement, a time when medical expenses tend to creep up.

Let's put that into perspective. An individual with family coverage who is 55 or older could contribute up to $9,550 in a single year ($8,550 base + $1,000 catch-up). If both you and your spouse are over 55 and each have your own HSA, you can both add an extra $1,000 to your respective accounts.

How GEHA Helps Pad Your Account

One of the best parts of the GEHA plan is that you’re not in this alone. GEHA gives your savings a serious head start with direct contributions, which they call a premium pass-through.

This is GEHA’s money, deposited straight into your HSA for you throughout the year. It’s an effortless way to build your balance and reduce what you have to pay out-of-pocket. When you add your own contributions on top of GEHA's pass-through and any catch-up funds, you can build a really solid healthcare fund surprisingly quickly.

Understanding How Your HDHP and HSA Work Together

Think of your GEHA High Deductible Health Plan (HDHP) and your Health Savings Account (HSA) as a financial power couple. They aren't two separate benefits you have to juggle; they're designed to work in perfect sync. The HDHP is your big-picture safety net for major medical expenses, while your GEHA health savings account is the flexible, tax-advantaged tool you use for day-to-day healthcare costs.

Let's walk through a real-world example. Imagine you wake up with a nasty flu and head to an urgent care clinic. This is where the teamwork between your HDHP and HSA really shines.

Navigating Your Deductible

Every HDHP has an annual deductible. That's simply the amount you need to pay out-of-pocket for medical care before your insurance plan starts paying the lion's share of the bills. Once you hit that number, your plan’s cost-sharing benefits kick in. This is a core concept for anyone trying to get the most out of the federal health insurance options guide.

But here’s the game-changer: you don’t have to drain your regular checking account to meet that deductible. Instead, you use the pre-tax money you’ve saved in your HSA. That urgent care bill, the prescription that followed, and any other qualified medical expenses can all be paid for with a swipe of your HSA debit card.

This approach is so powerful because of what's known as the triple tax advantage. It’s the secret sauce that makes an HSA one of the best savings vehicles out there.

Simply put, you get a tax break when you put money in, it grows completely tax-free, and you pay zero taxes when you take it out for medical costs. It’s a win-win-win.

GEHA's Head Start and Your Financial Safety Net

One of the best perks of the GEHA plan is that they don't just leave you to fund the HSA on your own. GEHA gives you a massive head start by contributing funds directly into your account throughout the year.

These contributions, often called a premium pass-through, give you an immediate balance to start chipping away at your deductible from day one. It's like your employer is pre-funding your initial healthcare costs for you.

To give you an idea, for a federal employee with the 2025 GEHA HDHP (Self Only coverage), the plan contributes up to $1,000 directly into their HSA. That's a huge help when you consider the plan's $1,800 deductible.

And for your peace of mind, every HDHP has a built-in financial guardrail: the out-of-pocket maximum. This is the absolute ceiling on what you’ll pay for covered medical services in a given year.

The out-of-pocket maximum is your ultimate financial protection. For the 2025 self-only plan, this is $6,000. No matter what medical curveballs life throws your way, you know your spending is capped.

This table provides a quick snapshot of how these key numbers work together for GEHA’s plan.

GEHA HDHP and HSA At-a-Glance

FeatureSelf Only CoverageSelf Plus One / Family CoverageAnnual Deductible$1,800$3,600GEHA Annual HSA Contribution$1,000$2,000Out-of-Pocket Maximum$6,000$12,000

As you can see, GEHA’s contribution covers a significant portion of the deductible right from the start. This combination ensures that while you have a higher deductible, you're armed with tax-free funds and a hard limit on your financial risk, giving you both control and security.

Putting Your GEHA HSA Funds to Work

Having money in your GEHA Health Savings Account is a great start, but really understanding how to use it is what turns it from just another account into a powerful financial tool. This account is built for flexibility, giving you a pool of tax-free money to cover a surprisingly wide range of healthcare needs.

The most straightforward way to tap into your HSA is for those day-to-day medical costs. You'll get an HSA debit card, which makes paying for doctor visits, prescriptions, and lab work incredibly simple—just swipe it at the time of service. You also have the option to pay with your own money first and then reimburse yourself from the HSA later, which gives you total control over your cash flow.

What Your HSA Can Cover

The list of qualified medical expenses is much broader than most people realize. It goes way beyond just your annual check-up. Your GEHA health savings account can be used for all sorts of services that are crucial for your overall health.

Medical Services: This covers the big stuff like hospital bills and specialist visits, but also things like lab work and physical therapy.

Dental Care: Think cleanings, fillings, root canals, and even orthodontia like braces. Basically, most non-cosmetic dental work is fair game.

Vision Expenses: Need new glasses or contact lenses? Even prescription sunglasses? Your HSA has you covered.

Prescriptions: This includes both your prescribed medications and many common over-the-counter items.

Think of it as your dedicated, tax-advantaged fund for just about anything that keeps you healthy. This flexibility is what makes it so valuable, letting you handle both routine care and unexpected medical bills without wrecking your regular budget.

One of the best perks of the GEHA plan is that they give you a head start. In 2025, the GEHA HDHP comes with a $1,000 premium pass-through (PPT) for self-only coverage. This gets deposited directly into your HSA as $83.33 each month. If you have a family plan, that amount doubles to $2,000 annually. This contribution effectively lowers your out-of-pocket premium costs and kickstarts your savings. You can find more expert insights on FedWeek.com about why these accounts are so beneficial.

Beyond Spending: Investing Your HSA

Now, this is where your GEHA HSA shows its hidden superpower: you can invest the money. Once your balance hits a certain minimum, you can start investing a portion of your funds in things like mutual funds, much like you would with a 401(k). This is what truly separates an HSA from any other savings account out there.

By investing, you transition your HSA from a simple spending account into a powerful, tax-free growth engine for your future. The returns you earn are completely tax-free, and they can be withdrawn tax-free for medical expenses down the road.

This investment feature makes the HSA an incredible tool for long-term financial planning. It’s not just for covering today’s dental bill—it’s about building a substantial, tax-advantaged nest egg designed specifically for your healthcare costs in retirement. When you combine smart spending for today with strategic investing for tomorrow, you really unlock the full potential of your account.

Turning Your HSA Into a Retirement Powerhouse

While your GEHA Health Savings Account is fantastic for covering today's medical bills, its real power is unlocked when you start thinking long-term. If you can shift your mindset from a simple spending account to a wealth-building tool, you can turn your HSA into a major player in your financial future.

This isn't like a Flexible Spending Account (FSA) where you have to scramble to spend your money by the end of the year. The money in your HSA is yours to keep, forever. It never expires and rolls over year after year, which is the key to letting it grow.

Putting Your Money to Work Through Investing

The secret sauce for maximizing your HSA is treating it less like a checking account and more like a retirement account. Too many people just let their HSA contributions sit in cash, earning next to nothing. By investing those funds in mutual funds or other options available through your HSA provider, you put your money to work for you.

The real magic here is compound growth. When you invest, your earnings start earning their own money. Over decades, even small, consistent contributions can snowball into a massive nest egg specifically for tax-free healthcare expenses in retirement.

This strategic approach is what turns the GEHA HSA from a good healthcare tool into what many financial experts call the ultimate retirement account. Its triple-tax advantage makes it an even better vehicle for medical costs than a 401(k) or TSP.

The Incredible Flexibility You Get After Age 65

Once you hit retirement age, your HSA becomes one of the most flexible accounts you own. The rules are designed to give you options, no matter what your financial picture looks like.

Here's what happens after you turn 65:

Tax-Free Medical Spending: You can continue to pull money out 100% tax-free for any qualified medical, dental, or vision expenses for the rest of your life.

Penalty-Free "Any Reason" Withdrawals: The game-changer is that you can also withdraw funds for any other reason—a vacation, a new car, helping out your grandkids—without the usual 20% penalty. These non-medical withdrawals are just taxed as regular income, making your HSA function exactly like a traditional TSP or 401(k).

This dual-purpose design makes the GEHA HSA an incredibly powerful and versatile asset. It's the perfect complement to your other retirement accounts, giving you a dedicated health fund and a backup source of income. Figuring out how all these accounts work together is crucial; you can learn more about advanced strategies in our guide to transferring your TSP to a Roth IRA.

GEHA HSA FAQs: Your Questions Answered

Once you start digging into the details of your GEHA Health Savings Account, a few questions always seem to pop up. Let's tackle some of the most common ones so you can manage your account like a pro.

What Happens if I Leave My Job?

This is a big one. People often worry, "If I leave federal service or change health plans, do I lose my HSA money?" The answer is a resounding no.

That money is 100% yours. It's your personal savings account, not a benefit tied to your employer. The entire balance follows you, wherever you go, to any job, or even into retirement.

Can I Use It For My Family?

Absolutely. You can use the funds in your HSA to pay for qualified medical expenses for your spouse and your tax dependents. This is true even if they aren't covered by your specific GEHA health plan. It’s a flexible way to handle the whole family's healthcare costs from a single, tax-advantaged account.

How Is an HSA Different From an FSA?

This is a critical distinction that trips many people up. The two accounts might seem similar, but they operate very differently.

Think of it like this: An HSA is your personal health savings account that you own. The money rolls over year after year, and you can even invest it for long-term growth. An FSA, on the other hand, is an employer-owned spending account with a strict "use-it-or-lose-it" rule.

Understanding this difference is key. The GEHA HSA gives you long-term financial control and flexibility that an FSA simply can't match.

At Federal Benefits Sherpa, our mission is to help federal employees navigate these powerful tools to build a truly secure retirement. If you're ready to make sure you're getting the absolute most out of your benefits, schedule a free review with us. Learn more at Federal Benefits Sherpa.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved