Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Navigating Federal Employee Death Benefits

When you lose a loved one, the last thing you want to deal with is a mountain of financial paperwork. Fortunately, federal employee death benefits are designed to create a solid financial safety net for the surviving family of a government worker. This isn't just a single check; it's a collection of support that can include monthly survivor annuities, lump-sum payouts, and life insurance.

What Are Federal Employee Death Benefits?

After a federal employee passes away, their survivors aren't just left to figure things out on their own. The government has a well-established system in place to help provide financial stability during an incredibly tough time.

Think of it as a multi-layered support system. The first thing you need to know is which retirement program the employee was part of—the modern Federal Employees Retirement System (FERS) or the older Civil Service Retirement System (CSRS). This is a critical first step, as the benefits and rules for each are quite different. The whole point is to make sure a spouse, dependent children, or other beneficiaries can access the benefits earned over a lifetime of public service.

The Key Pieces of the Puzzle

These benefits are built to handle both immediate expenses and long-term financial needs. While the exact details can change based on individual circumstances, the overall structure is made up of a few core components that work together.

Here are the main types of support you'll encounter:

Survivor Annuity: This is a recurring monthly payment, much like a pension, that provides a steady, predictable income to a surviving spouse.

Lump-Sum Payments: A one-time payment designed to help with immediate costs. Under FERS, this is specifically called the Basic Employee Death Benefit (BEDB).

FEGLI Life Insurance: This is the payout from the Federal Employees' Group Life Insurance program, which provides a tax-free payment to designated beneficiaries.

Thrift Savings Plan (TSP): The balance from the deceased employee’s TSP account is transferred directly to their named beneficiaries.

All of these benefits are managed by the U.S. Office of Personnel Management (OPM). They are the go-to source for official guidance, forms, and processing claims.

The OPM's survivor benefits portal is the best place to start. It’s where you’ll find everything you need to begin the claims process, whether you're dealing with FERS or CSRS.

To make this easier to grasp, here’s a quick breakdown of how these components fit together.

Key Federal Death Benefit Components at a Glance

Benefit ComponentPrimary PurposeGoverning SystemSurvivor AnnuityProvides a long-term, stable monthly income for a surviving spouse.FERS & CSRSBasic Employee Death Benefit (BEDB)A lump-sum payment to help with immediate financial needs.FERS OnlyFEGLI Life InsuranceA one-time, tax-free payout to named beneficiaries.FERS & CSRSThrift Savings Plan (TSP)The employee's retirement savings, paid out to beneficiaries.FERS & CSRS

Each of these benefits serves a distinct purpose, from immediate cash for funeral costs to long-term income that helps a family maintain its standard of living.

By understanding these distinct components, you can see the full picture of federal employee death benefits. It's not just a single transaction but a carefully structured plan to support your family's long-term financial security after a profound loss. Each piece plays a crucial role in the overall strategy.

Understanding Your FERS Survivor Benefits

If you're one of the millions of federal employees under the Federal Employees Retirement System (FERS), it’s the bedrock of your retirement and survivor benefits. When an employee passes away, FERS provides a financial safety net for their surviving spouse and children, and it works quite differently than the old CSRS system. Getting a handle on these benefits is a critical piece of your family's financial planning.

The main support pillar here is the Basic Employee Death Benefit (BEDB). The best way to think about the BEDB is as a two-part financial care package. It's not just a single check; it’s a combination of a significant lump-sum payment and a portion of the employee's salary, designed to offer both immediate and ongoing support.

This structure gives a family a crucial buffer. It helps cover those immediate, often unexpected, expenses while also setting up a source of income for the road ahead. The whole point is to make sure survivors aren't left in a tough spot financially.

How the Basic Employee Death Benefit Is Calculated

So, how does the government actually figure out this payment? It’s not as complicated as it sounds. The total amount is simply the sum of two distinct parts.

Part One (The Lump Sum): This is a fixed amount that gets adjusted each year for inflation. It originally started at $15,000 but has grown quite a bit over time. After the latest cost-of-living adjustment, this lump-sum piece is now $42,607.52.

Part Two (The Salary-Based Payment): This part is calculated as 50% of the employee's final annual salary. There's a helpful little rule here: if the employee's "high-3" average salary (the average of their highest 36 consecutive months of pay) is more than their final salary, OPM will use that higher number to give the family a better payout.

You just add those two numbers together to get the total BEDB. For instance, if a FERS employee earning a final salary of $90,000 were to pass away, their surviving spouse would receive a lump-sum payment of $87,607.52 (which is $42,607.52 + $45,000).

This two-part formula is the core of FERS survivor benefits. It blends a stable, inflation-proof base with a component tied directly to the employee's career earnings, creating a benefit that truly reflects their years of service.

Who Is Eligible for FERS Survivor Benefits

Receiving these federal employee death benefits isn't automatic. There are a couple of key service and marriage requirements that have to be met for a surviving spouse to qualify.

First off, the deceased employee needed to have completed at least 18 months of creditable civilian service under FERS. This is just to ensure the benefit goes to families of employees who had a baseline level of federal service.

Second, the surviving spouse generally must have been married to the employee for at least nine months before their death. This rule exists primarily to prevent fraudulent, last-minute marriages just to claim benefits. But, life happens, and there are some very important exceptions.

The nine-month marriage rule is waived if:

The employee's death was accidental.

A child was born of the marriage to the employee.

These exceptions provide vital protection for families facing sudden and unexpected tragedy. The Office of Personnel Management (OPM) has detailed guidance on all these rules and the paperwork involved.

Integrating FERS with Other Financial Pillars

It's really important to see FERS survivor benefits as just one piece of a much larger puzzle. They are designed to work alongside Social Security and the Thrift Savings Plan (TSP) to create a comprehensive support system for a federal employee’s family.

Social Security: A surviving spouse and any minor children may also be eligible to receive Social Security survivor benefits.

Thrift Savings Plan (TSP): The employee's entire TSP account balance is paid directly to whomever they designated as their beneficiary.

FEGLI: Any life insurance payouts from the Federal Employees' Group Life Insurance program are also paid directly to the beneficiaries.

There’s another crucial option to know about. If an employee had 10 or more years of service, their surviving spouse gets a choice. Instead of taking the lump-sum BEDB, they can elect to receive a monthly survivor annuity instead. This provides a steady, lifelong income stream, which can be a game-changer. The choice between the lump sum and the annuity is a big one and really depends on your personal financial situation. If you're weighing this decision, you might find it helpful to read our guide on how to calculate annuity payments like a pro.

Understanding how all these different benefits fit together is the key to seeing the full financial shield offered to federal families.

A Closer Look at CSRS Survivor Annuities

While most of today's federal workforce falls under the FERS system, we can't forget about the thousands of retirees and their families still covered by the older Civil Service Retirement System (CSRS). This legacy system has its own set of rules, and it's absolutely critical for these families to understand how federal employee death benefits work under CSRS.

The CSRS survivor annuity is the cornerstone of financial security for a surviving spouse. Think of it like a self-funded insurance plan you set up at retirement. You agree to a small, permanent reduction in your own monthly pension, and in return, you guarantee your spouse a steady, lifelong income after you're gone.

It's a one-time decision you make when you retire. You’re essentially trading a slightly smaller pension check for yourself now for a powerful financial safety net for your loved one later on.

Calculating the Maximum Survivor Annuity

The most popular choice by far under CSRS is the maximum survivor annuity. This option provides your spouse with 55% of your full, unreduced pension. That percentage is set in stone, making it one of the most predictable and reliable benefits available under the old system.

So, how much does this "insurance" cost you? The reduction to your pension isn't just a random number; it’s calculated with a precise formula tied directly to the benefit you're providing.

The reduction is 2.5% on the first $3,600 of your annual pension.

After that, it's 10% on any amount of your annual pension above $3,600.

Let's run through an example to see how this plays out in the real world. Imagine a CSRS employee retires with an earned pension of $60,000 a year.

Figure Out the Spouse's Benefit: The maximum survivor annuity would be 55% of the retiree's $60,000, which comes out to $33,000 per year (or $2,750 per month) for the surviving spouse.

Calculate the Pension Reduction (the "cost"): This is a two-step calculation:

2.5% of the first $3,600 = $90

10% of the rest, which is $56,400 ($60,000 - $3,600) = $5,640

Find the Total Annual Reduction: Add the two pieces together: $90 + $5,640 = $5,730 per year.

Determine the Employee's Final Pension: The retiree's annual pension is now $54,270 ($60,000 - $5,730).

In this scenario, the retiree takes home a slightly smaller pension during their lifetime, but they've locked in a substantial, guaranteed income for their spouse, no matter what happens.

This calculation really gets to the heart of the CSRS survivor benefit. It's a clear and transparent trade: you secure a significant, lifelong annuity for your spouse through a modest, formula-based reduction in your own retirement pay.

Providing for Former Spouses and Children

The CSRS system also has provisions to care for former spouses and dependent children, although the rules here are a bit different from FERS.

A former spouse might be entitled to a survivor annuity, but this is almost always dictated by a court order from a divorce proceeding. If a valid court order explicitly awards a portion of the federal employee death benefits, the employee has to provide it, and the cost is deducted from their pension just like a spousal benefit.

Dependent children can also receive benefits under CSRS. If a deceased employee or retiree has a surviving spouse, any eligible children get a smaller, supplemental benefit. If there's no surviving spouse, the children's benefit is calculated at a higher rate. These payments typically continue until a child turns 18, or up to age 22 if they are a full-time student.

Getting these details straight is essential for good financial and estate planning. It ensures everyone you care about is provided for according to both your wishes and the governing federal regulations.

Navigating Benefits for Duty-Related Deaths

When a federal employee's death is a direct result of a work-related injury or illness, the conversation around benefits changes entirely. These tragic situations fall under a completely different system—one specifically designed for those who make the ultimate sacrifice in the line of duty.

This system is governed by the Federal Employees' Compensation Act (FECA) and is managed by the Department of Labor, not the Office of Personnel Management (OPM). Think of FECA as a specialized form of workers' compensation that provides a more robust set of federal employee death benefits for families navigating this specific type of loss.

Right from the start, it's critical to understand a major distinction. Survivors eligible for FECA compensation will receive these payments instead of the standard OPM survivor annuities we've discussed. You can't receive both. The family must choose which path to take.

How FECA Compensation Is Calculated

So, why would a family choose FECA? The simple answer is that the payments are often significantly more generous. Unlike OPM annuities, which are tied to an employee's earned pension, FECA benefits are calculated directly from the employee's salary at the time of their death.

This approach creates a much stronger financial safety net, particularly for younger employees who hadn't yet had decades to build up a substantial pension. The formula is straightforward:

A surviving spouse with no children receives 50% of the employee's monthly pay.

A surviving spouse with children receives 45% of the monthly pay, plus an additional 15% for each child. The total payment is capped at 75% of the employee's pay.

If there is no surviving spouse, the first child is entitled to 40% of the employee's pay, with an extra 15% for each additional child, again capped at a total of 75%.

These higher percentages, linked directly to salary, typically provide a much more substantial income stream, helping a family maintain financial stability during an impossibly difficult period.

FECA benefits are designed to replace the employee's lost income. This focus ensures that their dedication and sacrifice are met with a corresponding level of support for the family left behind, setting it apart from standard retirement-based survivor benefits.

Special Provisions for High-Risk Roles

The government also recognizes that some federal jobs come with extraordinary risks. For these employees, extra protections are in place. The Federal Employees' Compensation Act (FECA) offers broad death benefits if a federal employee dies from an injury sustained while performing their duty, covering employees across many agencies.

For instance, there are specific provisions for Foreign Service employees. Depending on the circumstances—like whether a death was related to terrorism—the death gratuity calculations can differ. This acknowledges the unique dangers some professionals face. You can find more details about the death gratuity for Foreign Service personnel and its various rules.

This layered approach ensures the benefits reflect the level of risk an employee took on. It's a system built to provide enhanced protection for those serving in the most dangerous conditions, whether here at home or on foreign soil.

Life Insurance and TSP Death Benefit Options

Beyond your pension, two other major assets come into play for your family's financial security: your Federal Employees' Group Life Insurance (FEGLI) and your Thrift Savings Plan (TSP). These aren't part of the survivor annuity system; they stand on their own.

Both provide crucial lump-sum payouts that can give your loved ones immediate financial breathing room and long-term stability. Let's break down how each one works.

Unpacking Your Federal Life Insurance (FEGLI)

FEGLI is the biggest group life insurance program on the planet, and for good reason. It's designed to be straightforward, providing a payout directly to your beneficiaries that is generally free from federal income tax.

Think of your FEGLI coverage as different building blocks. You can stack them to create the exact amount of protection your family needs.

Basic Insurance: This is the foundation. If you're eligible, you're automatically enrolled unless you actively decline it. The payout is your annual basic pay, rounded up to the next $1,000, with an extra $2,000 on top.

Option A (Standard): A simple way to boost your coverage. This adds a flat $10,000 benefit for a very low cost.

Option B (Additional): This is where you can really tailor your coverage. Option B lets you buy life insurance in multiples of your salary—one, two, three, four, or even five times your annual pay. This is the key to providing substantial income replacement for your family.

Option C (Family): This extends coverage to your spouse and eligible kids. You can select up to five multiples, where each multiple gives $5,000 for your spouse and $2,500 for each eligible child.

Choosing the right combination is a big decision. For a much deeper look into how these policies are structured and what they cost, you can check out our guide to federal employee life insurance.

The real power of FEGLI is in its flexibility. By mixing and matching Basic, Option A, B, and C, you can build a life insurance portfolio that fits your family's specific needs—from covering funeral costs to replacing years of your income.

Managing Your Thrift Savings Plan (TSP) Death Benefits

Your TSP isn't just for retirement. It's a major financial asset that will pass directly to your beneficiaries when you die. How you handle the beneficiary designation for this account is one of the most critical estate planning moves you can make.

The most important document here is the Form TSP-3, Beneficiary Designation. This form is king—it overrides anything you’ve written in a will or a trust. If you don't have a valid TSP-3 on file, the government has a strict order of precedence for who gets the money:

First, to your surviving spouse.

If no spouse, then to your child or children in equal shares.

If no children, then to your surviving parents.

If no parents, then to the executor of your estate.

And if none of the above, it goes to your next of kin based on your state's laws.

This default order might not be what you want at all. Keeping your beneficiary form updated is absolutely essential to make sure your money goes to the right people.

Withdrawal Options for TSP Beneficiaries

When someone inherits your TSP, they have a few different ways to receive the money. Each choice has its own tax implications, so it's vital they understand the options to make a smart financial decision.

Withdrawal OptionDescriptionKey Tax ConsiderationLump-Sum PaymentThe beneficiary gets the entire account balance in one single payment.The entire taxable portion is hit with ordinary income tax in the year it's received, which can create a huge tax bill.Installment PaymentsThe beneficiary can set up monthly, quarterly, or annual payments over a specific timeframe.Taxes are only paid on the amount withdrawn each year, which can help keep the beneficiary in a lower tax bracket.Beneficiary Participant AccountA surviving spouse has the special option to roll the inherited TSP into their own TSP or an Inherited IRA.This is often the best route for tax management, as it allows the funds to keep growing tax-deferred.

The right choice really boils down to the beneficiary's personal situation. A lump sum could be perfect for paying off a mortgage right away. On the other hand, a beneficiary participant account is a powerful strategy for preserving that wealth and minimizing the tax hit for years to come.

How to File for Federal Death Benefits

Trying to handle paperwork while you're grieving is the last thing anyone wants to do. It can feel like a mountain of stress. This guide is designed to give you a clear, step-by-step path to follow, hopefully making the process feel a bit more manageable.

Your very first step depends on whether the federal employee was still working or had already retired. If they were an active employee, you’ll need to contact their agency’s human resources office. For retirees, the point of contact is the Office of Personnel Management (OPM). Making that initial call is what officially gets the ball rolling on claiming survivor benefits.

Gathering Your Essential Documents

To keep things moving and avoid frustrating delays, it's a good idea to start gathering the necessary documents as soon as you’re able. OPM needs official, certified copies of these papers to verify who is eligible and process everything correctly.

Here’s a quick checklist of what you'll likely need:

A certified copy of the employee’s death certificate.

If you are the surviving spouse, a certified copy of your marriage certificate.

For any dependent children, you'll need certified copies of their birth certificates.

A certified copy of the divorce decree or any relevant court orders if a former spouse is involved.

Having these documents on hand before you even start the forms will make the whole experience much smoother and can genuinely speed up the timeline.

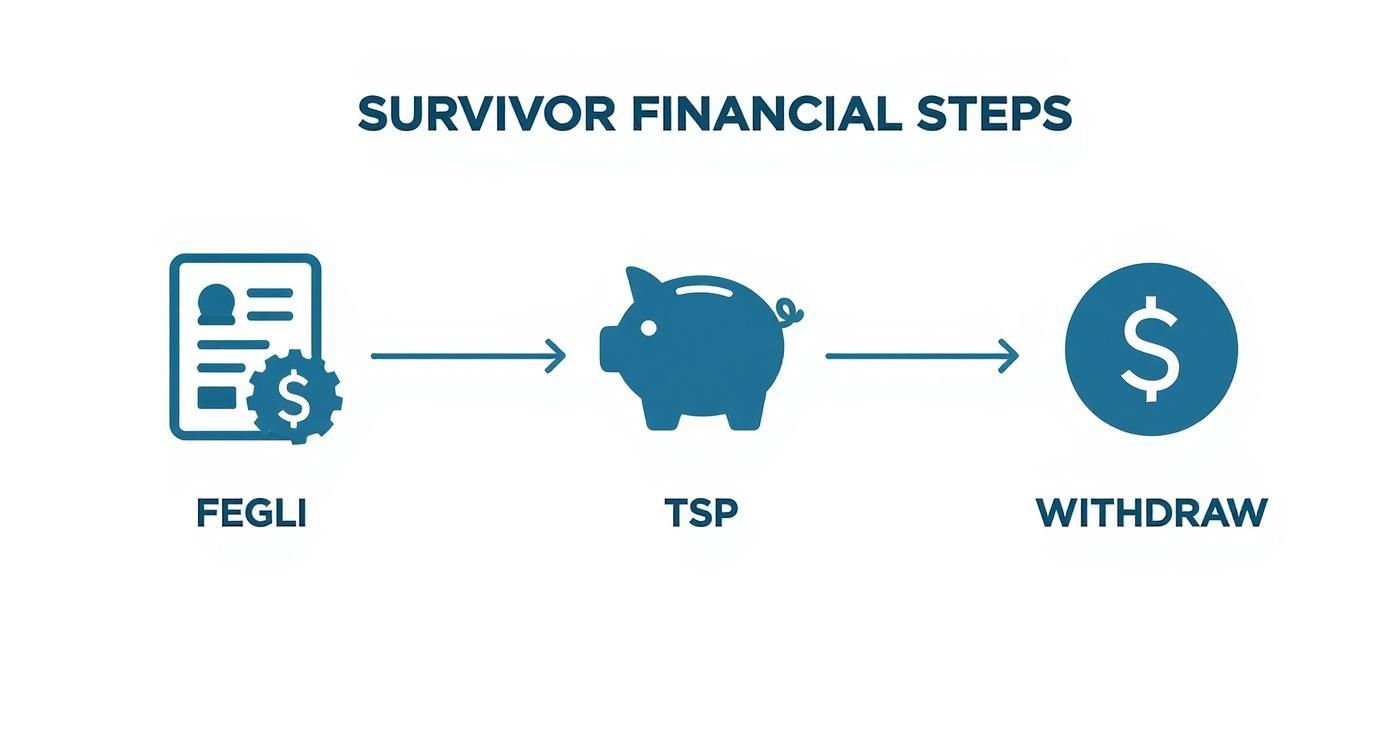

This next visual breaks down the major financial pieces you’ll be dealing with.

As you can see, the path usually involves sorting out the FEGLI insurance and the TSP account before deciding on how to access the funds.

Completing the Correct Application Forms

This part is critical: you must use the right form for the employee's specific retirement system. Submitting the wrong one will cause your application to be rejected, sending you right back to square one.

For CSRS survivors, the correct form is SF 2800, "Application for Death Benefits (CSRS)."

For FERS survivors, you’ll need to fill out Form SF 3104, "Application for Death Benefits (FERS)."

You can find these forms on the OPM website. Take your time filling them out. It’s worth double-checking every detail, especially things like dates and Social Security numbers, because a simple typo can cause major hold-ups.

Your best friend through all of this is organization. Make copies of every single form you submit. Keep a simple log of every phone call or email with OPM or the agency, noting the date and who you spoke to. It creates a paper trail that gives you control and peace of mind.

It also helps to have a solid grasp of all the benefits available. For a wider view, you might want to look over The Federal Employee Benefits Handbook A Quick, Clear Guide. It can give you some valuable context as you navigate this journey.

Got Questions? We’ve Got Answers.

When you're trying to figure out federal death benefits, it's natural to have a few questions pop up. Let's tackle some of the most common ones that federal families ask, so you can have a clearer picture of what to expect.

How Long Until the First Benefit Payment Arrives?

Once you’ve sent in the application and all the supporting paperwork, the waiting game begins. The Office of Personnel Management (OPM) usually tries to get claims processed and the first payment out the door within 30 to 60 days.

But—and this is a big but—that timeline can get thrown off course easily. A simple mistake on a form, a missing marriage certificate, or a more complicated situation like one involving a former spouse can really slow things down. Your best defense is a good offense: double-check everything before you send it in. A little extra time up front can save you a lot of frustrating delays later.

Can My Ex-Spouse Claim These Benefits?

This is a huge point of concern for many, and the answer is: maybe. A former spouse doesn't automatically get a slice of the pie. Their eligibility almost always hinges on a court order.

A divorce decree or a specific Court Order Acceptable for Processing (COAP) must spell out, in no uncertain terms, that the former spouse is entitled to a survivor annuity. If that language isn't there, they generally have no claim. This is designed to protect the benefits for the current spouse or other named beneficiaries.

Will I Have to Pay Taxes on These Benefits?

Ah, the tax question. It’s a critical one, and the answer isn't a simple yes or no. It really depends on which benefit you're receiving.

FEGLI Life Insurance: Good news here. The payout from a Federal Employees' Group Life Insurance policy is typically free from federal income tax.

Survivor Annuities (FERS/CSRS): Think of these monthly payments just like a regular pension. They are considered taxable income and you'll have to report them.

Lump-Sum Payments: The tax rules for one-time lump-sum payments from FERS or CSRS can get tricky. Often, a portion of this payment will be taxable.

Given the financial implications, it's always a smart move to chat with a tax professional. They can help you understand your specific situation and make sure there are no unpleasant surprises come tax season.

Trying to sort through all these rules can feel overwhelming, but you're not in it alone. Federal Benefits Sherpa is here to help federal employees and their families make sense of it all and secure their financial future. Let's talk—book your free 15-minute benefits review today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved