Choosing when to start taking Social Security is one of the biggest retirement decisions a federal employee can make. It's a choice that can feel like trying to solve a puzzle with a thousand moving pieces.

The truth is, your claiming strategy is a powerful lever you can pull to shape your financial future. The timing you choose can permanently increase or decrease your lifetime income, and the best decision comes down to your unique situation—your federal pension, your health, and what your family needs.

Why Your Social Security Strategy Matters

Deciding when to claim your Social Security is more than just circling a date on the calendar. It's one of the most critical financial choices you'll make as you transition from public service into retirement. Think of it as pouring the foundation for your financial house. A hasty decision could mean less income for the rest of your life, while a well-thought-out plan can lock in decades of security and peace of mind.

For federal employees, the stakes are even higher. Your situation isn't the same as someone in the private sector because you have to factor in specific government rules that can completely change your benefit picture. These regulations add extra layers of complexity, which means a one-size-fits-all approach just won't cut it when your federal career is in the mix.

Key Factors for Federal Employees

To make a smart claiming decision, you need to see how all the different parts of your retirement fit together. It’s not about one single number; it's about how multiple income streams and rules interact. Missing even one piece of the puzzle can lead to some expensive surprises down the road.

Here are the big things to keep in mind:

Unique Government Provisions: Rules like the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) can slash your expected Social Security benefits. Many federal retirees don't find this out until it's too late.

Pension Coordination: You have to understand how your Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS) pension works alongside Social Security. These aren't separate pots of money; they need to function as a single, cohesive retirement plan.

TSP Distribution Timing: The timing and size of withdrawals from your Thrift Savings Plan (TSP) can directly influence how your Social Security benefits are taxed, which affects how much money you actually get to keep.

The goal here is to replace confusion with confidence. Once you get a handle on these core concepts, you can build a strategy that's tailored to your federal career and what you want out of retirement.

This guide is designed to be a clear roadmap. We’ll start with the basics—claiming early, at full retirement age, or delaying—and then move into more advanced strategies involving spousal benefits. We'll also break down how to coordinate all your federal retirement assets seamlessly.

For a deeper dive into the specifics, you can learn more about how Social Security works for federal employees in our complete guide. By the time you're done, you'll have the practical knowledge to make a decision that feels right for you.

Understanding the Three Core Claiming Timelines

Every federal employee’s Social Security decision really comes down to one big question: when should you start taking benefits? Think of it as deciding when to harvest a crop. Your timing is critical and will permanently lock in the size of your monthly check for the rest of your life.

Let's walk through the three fundamental paths you can take.

The Early Option: Claiming at Age 62

You can start your Social Security benefits as early as age 62. It's no surprise this is the most popular age to file—it provides an immediate income stream, which can be a lifesaver if you need to retire early or just want a financial bridge.

But this convenience comes with a very real, and permanent, cost. When you claim at 62, you are accepting a significant, lifelong reduction to your monthly benefit. For anyone born in 1960 or later, your Full Retirement Age (FRA) is 67. If that's you, claiming at 62 means your benefit is permanently slashed by 30%. This isn't a temporary hit; it's a cut you'll live with forever.

The Social Security Administration's own rules are clear: for every month you claim before your FRA, your check gets smaller, forcing a direct trade-off between getting money sooner and getting more money later.

The Baseline Option: Claiming at Full Retirement Age

Your Full Retirement Age (FRA) is the magic number where you become eligible for 100% of your primary insurance amount (PIA)—the full benefit you've earned based on your work history. Again, for federal employees born in 1960 or later, your FRA is 67.

Waiting until this age is often considered the standard or "neutral" choice. You get the full amount you're entitled to—no penalty for starting early, but no bonus for waiting, either. This strategy strikes a sensible balance, helping you avoid that permanent haircut from an early claim without forcing you to dip into your TSP or other assets to delay benefits even longer.

What is a "Breakeven" Age? This is a key concept. The breakeven age is the point where the total lifetime dollars you get from delaying Social Security finally overtake the total dollars you would have received by claiming early. If you live past this age, waiting to claim was the more profitable decision.

The Maximum Payout Option: Delaying until Age 70

If your goal is to squeeze every possible dollar out of the system, delaying your claim past FRA all the way to age 70 is the most powerful move you can make. It's a strategy built on patience.

For every single year you hold off past your FRA, the Social Security Administration rewards you with delayed retirement credits. These credits beef up your future benefit by a guaranteed 8% per year.

So, if your FRA is 67, waiting until 70 means you rack up three full years of these credits. The result? A monthly benefit that is 124% of what you would have gotten at your FRA. The compounding effect here is huge. For example, if your FRA was 66, waiting until 70 would boost your checks to 132% of your full benefit, transforming a decent payout into a serious financial anchor in retirement. You can understand how timing impacts your financial future by looking at various Social Security projections.

To see how these choices play out, let's look at a quick comparison.

Social Security Claiming Ages Compared

This table shows the financial impact of claiming Social Security at different key ages based on a hypothetical Full Retirement Age (FRA) benefit of $2,500 per month.

Claiming AgePercentage of Full Benefit ReceivedMonthly Benefit AmountKey Consideration6270%$1,750Provides immediate income but locks in a permanent 30% reduction in benefits.67 (FRA)100%$2,500The baseline option; you receive your full, unadjusted retirement benefit.70124%$3,100Maximizes your monthly income with a 24% increase over your full benefit.

As the table makes clear, the difference in monthly income is substantial. Your decision should be based on your personal financial needs, health, and overall retirement plan.

Let’s put this into a real-world federal employee scenario.

Example Scenario: A Federal Employee's Choice

Imagine a federal employee, Sarah. Her FRA is 67, and her full benefit (her PIA) is calculated to be $2,500 per month. Here's how her decision plays out:

Claims at Age 62: Her benefit is cut by 30%, leaving her with $1,750 per month.

Claims at FRA (Age 67): She gets her full, baseline benefit of $2,500 per month.

Claims at Age 70: Her benefit grows by 24%, giving her a powerful $3,100 per month.

The gap between starting at 62 versus waiting until 70 is $1,350 every single month. That's an extra $16,200 per year, for life. Getting this first decision right is the foundation for every other Social Security strategy we’ll discuss.

Navigating WEP, GPO, and Your Federal Pension

For most Americans, claiming Social Security is a fairly straightforward decision about timing. But for federal employees, especially those under the Civil Service Retirement System (CSRS), the path is a lot more complex. Two little-known rules—the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)—can dramatically change the numbers.

Think of these as specific detours on the federal retirement map. Ignoring them can lead to a nasty surprise and a significant income shortfall you weren't planning for. Understanding how they work isn’t just a good idea; it’s absolutely critical to building a retirement plan you can count on.

Demystifying the Windfall Elimination Provision

The Windfall Elimination Provision (WEP) is designed to adjust your own Social Security benefit—the one you earned from working in the private sector. It primarily affects people who will receive a pension from work where they didn't pay Social Security taxes (like CSRS) but also worked other jobs long enough to qualify for Social Security.

Here’s the logic behind it: The Social Security benefit formula is progressive, meaning it's weighted to give lower-income workers a higher percentage of their pre-retirement earnings back. Without WEP, a high-earning federal employee would look like a low-wage worker to the Social Security Administration, simply because their years of federal service aren't on the books. WEP corrects this by using a modified formula.

WEP never completely eliminates your benefit. The reduction has a ceiling. For 2024, the maximum monthly reduction is $587, but the actual amount depends on how many years you had "substantial earnings" where you did pay into Social Security.

Crucially, the benefit estimate on your Social Security statement from SSA.gov does not factor in WEP. You'll need to use the SSA’s own online WEP calculator to get a realistic picture of what you'll actually receive.

Understanding the Government Pension Offset

If WEP is a haircut, the Government Pension Offset (GPO) can be a buzzcut. This rule is far more severe and impacts any spousal or survivor benefits you might be eligible to collect from your spouse's Social Security record.

The GPO formula is brutally simple: your spousal or survivor benefit is reduced by two-thirds of your non-covered government pension. For many CSRS retirees, this reduction completely wipes out the entire spousal or survivor benefit.

Let's walk through an example:

GPO in Action: Suppose you have a $3,000 monthly CSRS pension. Two-thirds of that is $2,000.

The Offset: If you were eligible for a $1,500 monthly survivor benefit from your late spouse's record, the $2,000 GPO reduction would completely eliminate it ($1,500 - $2,000 = $0).

This is a massive planning point for married couples. If one spouse is a CSRS employee, you cannot assume a Social Security survivor benefit will be there. You have to plan for the GPO’s impact, as it can fundamentally alter the financial security of the surviving spouse.

The Interplay with FERS, CSRS, and Your TSP

Your federal retirement is really a three-legged stool: your pension (FERS or CSRS), Social Security, and your Thrift Savings Plan (TSP). A smart claiming strategy means getting all three to work together in harmony.

For FERS employees, Social Security is an integral part of the system. In fact, many FERS retirees are eligible for a bridge payment to cover the gap between retirement and age 62. You can explore our complete guide on what the FERS supplement is to see how that works.

This is where your TSP comes in as a powerful coordination tool. The way you draw money from your TSP directly impacts how much of your Social Security benefit you'll lose to taxes.

Provisional Income: The IRS calculates something called "provisional income" to see if your benefits are taxable. It includes your adjusted gross income, tax-free interest, and 50% of your Social Security benefits.

TSP's Role: Every dollar you pull from a traditional TSP counts as income. This can easily push you over the income thresholds ($25,000 for single filers, $32,000 for joint filers), causing up to 85% of your Social Security benefits to become taxable.

A great strategy is to use your TSP funds as a bridge, allowing you to delay claiming Social Security until age 70 for the biggest possible check. But this requires careful tax management. By planning your TSP withdrawals—perhaps by using a Roth TSP balance first or keeping withdrawals low—you can keep your provisional income down and maximize the net, after-tax income that ends up in your pocket.

Advanced Claiming Strategies for Married Couples

When you’re married, deciding when to claim Social Security isn't just about you—it’s a team sport. The choices you make together will echo through your retirement years, especially for the spouse who lives longer. A coordinated approach opens up powerful strategies that a single person simply can't use.

The most critical of these is what I call the survivor benefit strategy. This single decision can create a vital financial safety net when one spouse passes away, ensuring the survivor has the largest possible income stream for the rest of their life.

The Power of Maximizing Survivor Benefits

The idea here is incredibly simple but has a profound impact. The higher-earning spouse delays claiming their Social Security benefit for as long as they can, ideally right up to age 70. This allows their benefit to grow significantly thanks to delayed retirement credits.

When that spouse eventually passes away, the surviving spouse can then switch over to that maximized benefit. Instead of being left with their own, smaller check, they inherit the largest possible monthly payment—one that's also adjusted for inflation for life. It provides a level of financial stability that’s tough to replicate with any other retirement asset.

Think of this strategy as a form of longevity insurance for your marriage. It’s designed to protect the spouse who is likely to live longer—which, statistically, is often the wife—from the financial shock of losing a big chunk of the household's retirement income.

Let's walk through a real-world example to see just how powerful this can be for a federal couple.

Scenario: A Federal Couple's Coordinated Plan

Let's meet Tom and Maria. Tom, the higher earner, has a Full Retirement Age (FRA) benefit of $2,800. Maria's FRA benefit is $1,800.

The "Go-It-Alone" Approach: Imagine Tom and Maria don't coordinate. They both just decide to claim their benefits as soon as they hit their FRA of 67.

Tom's Benefit: $2,800 per month

Maria's Benefit: $1,800 per month

Total Household Income: $4,600 per month

Now, let's say Tom passes away first. Maria’s $1,800 benefit stops, and she steps up to his $2,800 survivor benefit. The household income plummets from $4,600 to $2,800, a jarring 40% drop.

The "Maximize Survivor Benefits" Strategy: This time, they plan together. Tom agrees to delay his benefit until age 70, while Maria claims hers at FRA to keep some income flowing.

By waiting, Tom’s benefit grows by 24% to $3,472 per month.

Maria claims her $1,800 per month benefit at age 67.

Once Tom finally claims at 70, their total household income becomes $5,272 per month.

Here’s where it gets powerful. If Tom passes away, Maria’s $1,800 payment stops, but she inherits his maximized survivor benefit of $3,472 a month. The household income drops from $5,272 to $3,472, a much more manageable 34% reduction.

More importantly, Maria's lifelong income is now $672 higher every single month ($8,064 per year!) than it would have been if they hadn't coordinated.

This one strategic decision provides a much larger and more resilient financial cushion for the surviving spouse. It’s a perfect example of why it's so important to explore how to maximize Social Security as a couple. By planning together, Tom and Maria built a much stronger financial future for whichever one of them lives longer.

How Working in Retirement Impacts Your Benefits

A lot of federal employees don't just stop working cold turkey. They often slide into retirement, maybe picking up part-time work or a consulting gig. It’s a fantastic way to keep your mind sharp and your wallet full, but you need to be careful if you plan on claiming Social Security early while still earning a paycheck.

This is where something called the Retirement Earnings Test comes into play. It’s a rule from the Social Security Administration (SSA) that only affects you if you claim your benefits before your Full Retirement Age (FRA) and keep working. If you earn over a certain amount, the SSA will hold back some of your benefits.

Don't panic—this isn't a penalty or a tax. Think of it as a temporary hold. The money isn't gone forever; it actually comes back to you later in a different form.

Understanding the Earnings Test Thresholds

The earnings test has two different income limits, and which one applies to you depends on how close you are to your FRA. For anyone trying to figure out the best time to claim, these numbers are critical.

In the years leading up to your FRA year: There’s a specific annual earnings limit.

In the calendar year you actually hit your FRA: That limit jumps up significantly, and the rules become a bit more forgiving.

The best part? Once you officially reach your Full Retirement Age, the earnings test vanishes completely. You can earn as much as you want from that day forward, and it won’t reduce your Social Security check by a single penny.

A huge misconception is that the benefits withheld from the earnings test are lost for good. That's simply not true. At your FRA, the SSA recalculates your benefit to credit you for any months you didn't receive a payment, which means you get a higher monthly check for the rest of your life.

How the Withholding and Recalculation Works

The math behind the test is pretty simple. In the years before you reach FRA, the SSA will withhold $1 in benefits for every $2 you earn over the annual limit. During the year you do reach FRA, they only withhold $1 for every $3 you earn above that higher limit (and they only look at your earnings in the months before your birthday).

Managing your income around these limits is a smart move for any working federal employee nearing retirement. You can discover more insights on retirement changes from Franklintempleton.com.

The recalculation is what really matters here. Let's say your earnings were high enough that the SSA withheld six full months of your benefits. When you hit your FRA, they essentially act as if you had delayed claiming by those six months. This results in a permanent upward adjustment to your monthly benefit, ensuring you get that withheld money back over your lifetime, assuming you live a long and healthy retirement. It’s a system designed to let you work without permanently hurting your long-term financial security.

Building Your Personal Social Security Action Plan

All right, let's turn all this theory into a concrete decision. This is where the rubber meets the road—where you take everything we've discussed about claiming ages, federal rules, and spousal benefits and apply it to your life.

Crafting your own plan isn't about finding some secret, one-size-fits-all answer. It's about finding the strategy that fits your retirement goals like a glove.

First things first, and this is non-negotiable: go create your ‘my Social Security’ account on the SSA’s official website. This portal is your direct line to your personalized benefit estimates, based on your actual earnings history. Don't play guessing games with generic online calculators. These are the real numbers you need to get started.

Assess Your Complete Financial Picture

With your official SSA estimates in hand, it's time for an honest look at your entire financial situation. Your Social Security plan doesn't exist in a vacuum; it’s a critical piece of a much larger puzzle. In fact, think about the powerful ripple effects of starting your retirement planning today—this is one of those cornerstone decisions.

To build your personal profile, start by asking yourself a few tough but essential questions:

Health and Longevity: How's your health? What does your family history look like? A frank answer here is crucial for figuring out if waiting until 70 is a realistic breakeven point for you.

Total Retirement Income: Look at the whole picture. How will your FERS or CSRS pension and your TSP distributions fit alongside Social Security? You need to map out every income stream to see how they all interact.

Spousal Coordination: What are your spouse's earnings, health, and potential benefits? A coordinated claiming strategy, especially one designed to maximize survivor benefits, is often the most impactful financial move a married couple can make.

Risk Comfort Level: How do you feel about tapping into your TSP to allow you to delay Social Security for that bigger check later? Or does the security of an earlier, guaranteed income stream feel better?

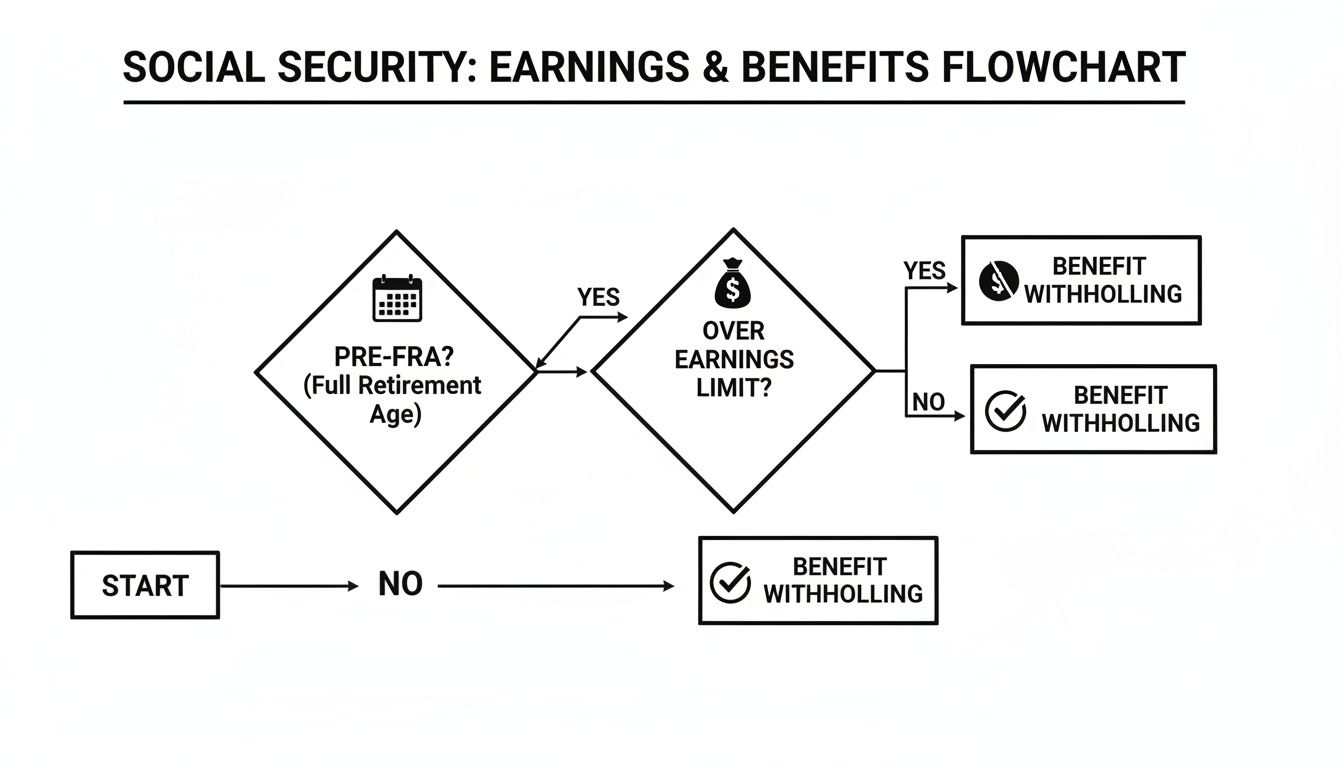

This chart breaks down a common question: what happens if you keep working while collecting Social Security before your Full Retirement Age? It shows exactly when the earnings test kicks in and benefits get withheld.

As you can see, the earnings test only matters before you hit FRA. That’s a key piece of information if you plan to continue working part-time in your early retirement years.

By systematically thinking through these personal factors, you start to filter out the noise. The dozens of potential strategies shrink down to the one or two that truly align with your financial reality and life expectations. The goal is to move from theory to a practical, personalized action plan.

Ultimately, you’ll use these insights to run the numbers on different scenarios. Compare the total lifetime income from claiming at 62 versus 70. Factor in any WEP or GPO reductions you might face. See how your choice changes the math for your spouse.

This process empowers you to make a final decision based not on anxiety or what a neighbor did, but on solid data and a clear-eyed view of your own needs.

Frequently Asked Questions

When you're a federal employee, figuring out Social Security isn't always straightforward. The standard advice often doesn't account for government-specific rules. Let's tackle some of the most common questions we hear from feds.

How Does My CSRS Pension Affect My Social Security?

If you have a Civil Service Retirement System (CSRS) pension, you’re playing by a different set of rules. Two big ones come into play here.

The first is the Windfall Elimination Provision (WEP). This can take a bite out of your own Social Security benefit, especially if you have fewer than 30 years of "substantial earnings" in a job where you paid Social Security taxes.

Then there's the Government Pension Offset (GPO). This one can slash—or even wipe out—any spousal or survivor benefits you might have been counting on from your spouse's work history. Don't guess on this; use the official Social Security calculators to see how these provisions might affect your numbers.

Are My Social Security Benefits Taxable?

More than likely, yes. A portion of your Social Security benefits can be hit with federal income tax. It all comes down to what the IRS calls your "combined income."

This isn't just your regular income. It’s a specific formula: your Adjusted Gross Income + any non-taxable interest + half of your Social Security benefits. For federal retirees, your FERS or CSRS pension and any money you pull from your Thrift Savings Plan (TSP) count toward that total. This means federal employees often find themselves in a bracket where up to 85% of their Social Security benefits become taxable. A smart withdrawal strategy is crucial.

Can I Change My Mind After I Start Claiming?

You have a very small window for a do-over. In the first 12 months after you start receiving benefits, you can withdraw your application. But there's a catch: you have to pay back every single penny you and your family received.

There’s a more practical option if you’ve already reached your Full Retirement Age (FRA). You can voluntarily suspend your benefits and let them grow again, all the way up to age 70. During that suspension, you'll earn delayed retirement credits, which means a bigger monthly check for the rest of your life once you turn them back on. It’s a great move if you decide to go back to work or your financial picture changes.

For answers to broader retirement-related questions beyond Social Security, you may find additional resources in their general retirement planning FAQs.

Navigating these complex federal rules requires a clear, personalized plan. Federal Benefits Sherpa specializes in helping federal employees build retirement strategies that account for every detail, from WEP and GPO to TSP coordination. Schedule your free benefits review today to ensure you're on the right track at https://www.federalbenefitssherpa.com.

Social Security Claiming Strategies for Federal Employees

Choosing when to start taking Social Security is one of the biggest retirement decisions a federal employee can make. It's a choice that can feel like trying to solve a puzzle with a thousand moving pieces.

The truth is, your claiming strategy is a powerful lever you can pull to shape your financial future. The timing you choose can permanently increase or decrease your lifetime income, and the best decision comes down to your unique situation—your federal pension, your health, and what your family needs.

Why Your Social Security Strategy Matters

Deciding when to claim your Social Security is more than just circling a date on the calendar. It's one of the most critical financial choices you'll make as you transition from public service into retirement. Think of it as pouring the foundation for your financial house. A hasty decision could mean less income for the rest of your life, while a well-thought-out plan can lock in decades of security and peace of mind.

For federal employees, the stakes are even higher. Your situation isn't the same as someone in the private sector because you have to factor in specific government rules that can completely change your benefit picture. These regulations add extra layers of complexity, which means a one-size-fits-all approach just won't cut it when your federal career is in the mix.

Key Factors for Federal Employees

To make a smart claiming decision, you need to see how all the different parts of your retirement fit together. It’s not about one single number; it's about how multiple income streams and rules interact. Missing even one piece of the puzzle can lead to some expensive surprises down the road.

Here are the big things to keep in mind:

Unique Government Provisions: Rules like the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) can slash your expected Social Security benefits. Many federal retirees don't find this out until it's too late.

Pension Coordination: You have to understand how your Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS) pension works alongside Social Security. These aren't separate pots of money; they need to function as a single, cohesive retirement plan.

TSP Distribution Timing: The timing and size of withdrawals from your Thrift Savings Plan (TSP) can directly influence how your Social Security benefits are taxed, which affects how much money you actually get to keep.

This guide is designed to be a clear roadmap. We’ll start with the basics—claiming early, at full retirement age, or delaying—and then move into more advanced strategies involving spousal benefits. We'll also break down how to coordinate all your federal retirement assets seamlessly.

For a deeper dive into the specifics, you can learn more about how Social Security works for federal employees in our complete guide. By the time you're done, you'll have the practical knowledge to make a decision that feels right for you.

Understanding the Three Core Claiming Timelines

Every federal employee’s Social Security decision really comes down to one big question: when should you start taking benefits? Think of it as deciding when to harvest a crop. Your timing is critical and will permanently lock in the size of your monthly check for the rest of your life.

Let's walk through the three fundamental paths you can take.

The Early Option: Claiming at Age 62

You can start your Social Security benefits as early as age 62. It's no surprise this is the most popular age to file—it provides an immediate income stream, which can be a lifesaver if you need to retire early or just want a financial bridge.

But this convenience comes with a very real, and permanent, cost. When you claim at 62, you are accepting a significant, lifelong reduction to your monthly benefit. For anyone born in 1960 or later, your Full Retirement Age (FRA) is 67. If that's you, claiming at 62 means your benefit is permanently slashed by 30%. This isn't a temporary hit; it's a cut you'll live with forever.

The Social Security Administration's own rules are clear: for every month you claim before your FRA, your check gets smaller, forcing a direct trade-off between getting money sooner and getting more money later.

The Baseline Option: Claiming at Full Retirement Age

Your Full Retirement Age (FRA) is the magic number where you become eligible for 100% of your primary insurance amount (PIA)—the full benefit you've earned based on your work history. Again, for federal employees born in 1960 or later, your FRA is 67.

Waiting until this age is often considered the standard or "neutral" choice. You get the full amount you're entitled to—no penalty for starting early, but no bonus for waiting, either. This strategy strikes a sensible balance, helping you avoid that permanent haircut from an early claim without forcing you to dip into your TSP or other assets to delay benefits even longer.

The Maximum Payout Option: Delaying until Age 70

If your goal is to squeeze every possible dollar out of the system, delaying your claim past FRA all the way to age 70 is the most powerful move you can make. It's a strategy built on patience.

For every single year you hold off past your FRA, the Social Security Administration rewards you with delayed retirement credits. These credits beef up your future benefit by a guaranteed 8% per year.

So, if your FRA is 67, waiting until 70 means you rack up three full years of these credits. The result? A monthly benefit that is 124% of what you would have gotten at your FRA. The compounding effect here is huge. For example, if your FRA was 66, waiting until 70 would boost your checks to 132% of your full benefit, transforming a decent payout into a serious financial anchor in retirement. You can understand how timing impacts your financial future by looking at various Social Security projections.

To see how these choices play out, let's look at a quick comparison.

Social Security Claiming Ages Compared

This table shows the financial impact of claiming Social Security at different key ages based on a hypothetical Full Retirement Age (FRA) benefit of $2,500 per month.

Claiming AgePercentage of Full Benefit ReceivedMonthly Benefit AmountKey Consideration6270%$1,750Provides immediate income but locks in a permanent 30% reduction in benefits.67 (FRA)100%$2,500The baseline option; you receive your full, unadjusted retirement benefit.70124%$3,100Maximizes your monthly income with a 24% increase over your full benefit.

As the table makes clear, the difference in monthly income is substantial. Your decision should be based on your personal financial needs, health, and overall retirement plan.

Let’s put this into a real-world federal employee scenario.

Example Scenario: A Federal Employee's Choice

Imagine a federal employee, Sarah. Her FRA is 67, and her full benefit (her PIA) is calculated to be $2,500 per month. Here's how her decision plays out:

Claims at Age 62: Her benefit is cut by 30%, leaving her with $1,750 per month.

Claims at FRA (Age 67): She gets her full, baseline benefit of $2,500 per month.

Claims at Age 70: Her benefit grows by 24%, giving her a powerful $3,100 per month.

The gap between starting at 62 versus waiting until 70 is $1,350 every single month. That's an extra $16,200 per year, for life. Getting this first decision right is the foundation for every other Social Security strategy we’ll discuss.

Navigating WEP, GPO, and Your Federal Pension

For most Americans, claiming Social Security is a fairly straightforward decision about timing. But for federal employees, especially those under the Civil Service Retirement System (CSRS), the path is a lot more complex. Two little-known rules—the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO)—can dramatically change the numbers.

Think of these as specific detours on the federal retirement map. Ignoring them can lead to a nasty surprise and a significant income shortfall you weren't planning for. Understanding how they work isn’t just a good idea; it’s absolutely critical to building a retirement plan you can count on.

Demystifying the Windfall Elimination Provision

The Windfall Elimination Provision (WEP) is designed to adjust your own Social Security benefit—the one you earned from working in the private sector. It primarily affects people who will receive a pension from work where they didn't pay Social Security taxes (like CSRS) but also worked other jobs long enough to qualify for Social Security.

Here’s the logic behind it: The Social Security benefit formula is progressive, meaning it's weighted to give lower-income workers a higher percentage of their pre-retirement earnings back. Without WEP, a high-earning federal employee would look like a low-wage worker to the Social Security Administration, simply because their years of federal service aren't on the books. WEP corrects this by using a modified formula.

Crucially, the benefit estimate on your Social Security statement from

SSA.govdoes not factor in WEP. You'll need to use the SSA’s own online WEP calculator to get a realistic picture of what you'll actually receive.Understanding the Government Pension Offset

If WEP is a haircut, the Government Pension Offset (GPO) can be a buzzcut. This rule is far more severe and impacts any spousal or survivor benefits you might be eligible to collect from your spouse's Social Security record.

The GPO formula is brutally simple: your spousal or survivor benefit is reduced by two-thirds of your non-covered government pension. For many CSRS retirees, this reduction completely wipes out the entire spousal or survivor benefit.

Let's walk through an example:

GPO in Action: Suppose you have a $3,000 monthly CSRS pension. Two-thirds of that is $2,000.

The Offset: If you were eligible for a $1,500 monthly survivor benefit from your late spouse's record, the $2,000 GPO reduction would completely eliminate it ($1,500 - $2,000 = $0).

This is a massive planning point for married couples. If one spouse is a CSRS employee, you cannot assume a Social Security survivor benefit will be there. You have to plan for the GPO’s impact, as it can fundamentally alter the financial security of the surviving spouse.

The Interplay with FERS, CSRS, and Your TSP

Your federal retirement is really a three-legged stool: your pension (FERS or CSRS), Social Security, and your Thrift Savings Plan (TSP). A smart claiming strategy means getting all three to work together in harmony.

For FERS employees, Social Security is an integral part of the system. In fact, many FERS retirees are eligible for a bridge payment to cover the gap between retirement and age 62. You can explore our complete guide on what the FERS supplement is to see how that works.

This is where your TSP comes in as a powerful coordination tool. The way you draw money from your TSP directly impacts how much of your Social Security benefit you'll lose to taxes.

Provisional Income: The IRS calculates something called "provisional income" to see if your benefits are taxable. It includes your adjusted gross income, tax-free interest, and 50% of your Social Security benefits.

TSP's Role: Every dollar you pull from a traditional TSP counts as income. This can easily push you over the income thresholds ($25,000 for single filers, $32,000 for joint filers), causing up to 85% of your Social Security benefits to become taxable.

A great strategy is to use your TSP funds as a bridge, allowing you to delay claiming Social Security until age 70 for the biggest possible check. But this requires careful tax management. By planning your TSP withdrawals—perhaps by using a Roth TSP balance first or keeping withdrawals low—you can keep your provisional income down and maximize the net, after-tax income that ends up in your pocket.

Advanced Claiming Strategies for Married Couples

When you’re married, deciding when to claim Social Security isn't just about you—it’s a team sport. The choices you make together will echo through your retirement years, especially for the spouse who lives longer. A coordinated approach opens up powerful strategies that a single person simply can't use.

The most critical of these is what I call the survivor benefit strategy. This single decision can create a vital financial safety net when one spouse passes away, ensuring the survivor has the largest possible income stream for the rest of their life.

The Power of Maximizing Survivor Benefits

The idea here is incredibly simple but has a profound impact. The higher-earning spouse delays claiming their Social Security benefit for as long as they can, ideally right up to age 70. This allows their benefit to grow significantly thanks to delayed retirement credits.

When that spouse eventually passes away, the surviving spouse can then switch over to that maximized benefit. Instead of being left with their own, smaller check, they inherit the largest possible monthly payment—one that's also adjusted for inflation for life. It provides a level of financial stability that’s tough to replicate with any other retirement asset.

Let's walk through a real-world example to see just how powerful this can be for a federal couple.

Scenario: A Federal Couple's Coordinated Plan

Let's meet Tom and Maria. Tom, the higher earner, has a Full Retirement Age (FRA) benefit of $2,800. Maria's FRA benefit is $1,800.

The "Go-It-Alone" Approach: Imagine Tom and Maria don't coordinate. They both just decide to claim their benefits as soon as they hit their FRA of 67.

Tom's Benefit: $2,800 per month

Maria's Benefit: $1,800 per month

Total Household Income: $4,600 per month

Now, let's say Tom passes away first. Maria’s $1,800 benefit stops, and she steps up to his $2,800 survivor benefit. The household income plummets from $4,600 to $2,800, a jarring 40% drop.

The "Maximize Survivor Benefits" Strategy: This time, they plan together. Tom agrees to delay his benefit until age 70, while Maria claims hers at FRA to keep some income flowing.

By waiting, Tom’s benefit grows by 24% to $3,472 per month.

Maria claims her $1,800 per month benefit at age 67.

Once Tom finally claims at 70, their total household income becomes $5,272 per month.

Here’s where it gets powerful. If Tom passes away, Maria’s $1,800 payment stops, but she inherits his maximized survivor benefit of $3,472 a month. The household income drops from $5,272 to $3,472, a much more manageable 34% reduction.

More importantly, Maria's lifelong income is now $672 higher every single month ($8,064 per year!) than it would have been if they hadn't coordinated.

This one strategic decision provides a much larger and more resilient financial cushion for the surviving spouse. It’s a perfect example of why it's so important to explore how to maximize Social Security as a couple. By planning together, Tom and Maria built a much stronger financial future for whichever one of them lives longer.

How Working in Retirement Impacts Your Benefits

A lot of federal employees don't just stop working cold turkey. They often slide into retirement, maybe picking up part-time work or a consulting gig. It’s a fantastic way to keep your mind sharp and your wallet full, but you need to be careful if you plan on claiming Social Security early while still earning a paycheck.

This is where something called the Retirement Earnings Test comes into play. It’s a rule from the Social Security Administration (SSA) that only affects you if you claim your benefits before your Full Retirement Age (FRA) and keep working. If you earn over a certain amount, the SSA will hold back some of your benefits.

Don't panic—this isn't a penalty or a tax. Think of it as a temporary hold. The money isn't gone forever; it actually comes back to you later in a different form.

Understanding the Earnings Test Thresholds

The earnings test has two different income limits, and which one applies to you depends on how close you are to your FRA. For anyone trying to figure out the best time to claim, these numbers are critical.

In the years leading up to your FRA year: There’s a specific annual earnings limit.

In the calendar year you actually hit your FRA: That limit jumps up significantly, and the rules become a bit more forgiving.

The best part? Once you officially reach your Full Retirement Age, the earnings test vanishes completely. You can earn as much as you want from that day forward, and it won’t reduce your Social Security check by a single penny.

How the Withholding and Recalculation Works

The math behind the test is pretty simple. In the years before you reach FRA, the SSA will withhold $1 in benefits for every $2 you earn over the annual limit. During the year you do reach FRA, they only withhold $1 for every $3 you earn above that higher limit (and they only look at your earnings in the months before your birthday).

Managing your income around these limits is a smart move for any working federal employee nearing retirement. You can discover more insights on retirement changes from Franklintempleton.com.

The recalculation is what really matters here. Let's say your earnings were high enough that the SSA withheld six full months of your benefits. When you hit your FRA, they essentially act as if you had delayed claiming by those six months. This results in a permanent upward adjustment to your monthly benefit, ensuring you get that withheld money back over your lifetime, assuming you live a long and healthy retirement. It’s a system designed to let you work without permanently hurting your long-term financial security.

Building Your Personal Social Security Action Plan

All right, let's turn all this theory into a concrete decision. This is where the rubber meets the road—where you take everything we've discussed about claiming ages, federal rules, and spousal benefits and apply it to your life.

Crafting your own plan isn't about finding some secret, one-size-fits-all answer. It's about finding the strategy that fits your retirement goals like a glove.

First things first, and this is non-negotiable: go create your ‘my Social Security’ account on the SSA’s official website. This portal is your direct line to your personalized benefit estimates, based on your actual earnings history. Don't play guessing games with generic online calculators. These are the real numbers you need to get started.

Assess Your Complete Financial Picture

With your official SSA estimates in hand, it's time for an honest look at your entire financial situation. Your Social Security plan doesn't exist in a vacuum; it’s a critical piece of a much larger puzzle. In fact, think about the powerful ripple effects of starting your retirement planning today—this is one of those cornerstone decisions.

To build your personal profile, start by asking yourself a few tough but essential questions:

Health and Longevity: How's your health? What does your family history look like? A frank answer here is crucial for figuring out if waiting until 70 is a realistic breakeven point for you.

Total Retirement Income: Look at the whole picture. How will your FERS or CSRS pension and your TSP distributions fit alongside Social Security? You need to map out every income stream to see how they all interact.

Spousal Coordination: What are your spouse's earnings, health, and potential benefits? A coordinated claiming strategy, especially one designed to maximize survivor benefits, is often the most impactful financial move a married couple can make.

Risk Comfort Level: How do you feel about tapping into your TSP to allow you to delay Social Security for that bigger check later? Or does the security of an earlier, guaranteed income stream feel better?

This chart breaks down a common question: what happens if you keep working while collecting Social Security before your Full Retirement Age? It shows exactly when the earnings test kicks in and benefits get withheld.

As you can see, the earnings test only matters before you hit FRA. That’s a key piece of information if you plan to continue working part-time in your early retirement years.

Ultimately, you’ll use these insights to run the numbers on different scenarios. Compare the total lifetime income from claiming at 62 versus 70. Factor in any WEP or GPO reductions you might face. See how your choice changes the math for your spouse.

This process empowers you to make a final decision based not on anxiety or what a neighbor did, but on solid data and a clear-eyed view of your own needs.

Frequently Asked Questions

When you're a federal employee, figuring out Social Security isn't always straightforward. The standard advice often doesn't account for government-specific rules. Let's tackle some of the most common questions we hear from feds.

How Does My CSRS Pension Affect My Social Security?

If you have a Civil Service Retirement System (CSRS) pension, you’re playing by a different set of rules. Two big ones come into play here.

The first is the Windfall Elimination Provision (WEP). This can take a bite out of your own Social Security benefit, especially if you have fewer than 30 years of "substantial earnings" in a job where you paid Social Security taxes.

Then there's the Government Pension Offset (GPO). This one can slash—or even wipe out—any spousal or survivor benefits you might have been counting on from your spouse's work history. Don't guess on this; use the official Social Security calculators to see how these provisions might affect your numbers.

Are My Social Security Benefits Taxable?

More than likely, yes. A portion of your Social Security benefits can be hit with federal income tax. It all comes down to what the IRS calls your "combined income."

This isn't just your regular income. It’s a specific formula: your Adjusted Gross Income + any non-taxable interest + half of your Social Security benefits. For federal retirees, your FERS or CSRS pension and any money you pull from your Thrift Savings Plan (TSP) count toward that total. This means federal employees often find themselves in a bracket where up to 85% of their Social Security benefits become taxable. A smart withdrawal strategy is crucial.

Can I Change My Mind After I Start Claiming?

You have a very small window for a do-over. In the first 12 months after you start receiving benefits, you can withdraw your application. But there's a catch: you have to pay back every single penny you and your family received.

There’s a more practical option if you’ve already reached your Full Retirement Age (FRA). You can voluntarily suspend your benefits and let them grow again, all the way up to age 70. During that suspension, you'll earn delayed retirement credits, which means a bigger monthly check for the rest of your life once you turn them back on. It’s a great move if you decide to go back to work or your financial picture changes.

For answers to broader retirement-related questions beyond Social Security, you may find additional resources in their general retirement planning FAQs.

Navigating these complex federal rules requires a clear, personalized plan. Federal Benefits Sherpa specializes in helping federal employees build retirement strategies that account for every detail, from WEP and GPO to TSP coordination. Schedule your free benefits review today to ensure you're on the right track at https://www.federalbenefitssherpa.com.

Fed Benefit