Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

What Is a Deferred Compensation Plan A Guide for Federal Employees

At its core, a deferred compensation plan is a simple concept: you earn money now, but you agree to be paid later. This is usually set up to pay out during your retirement years.

The real power behind this arrangement is tax deferral. You don't pay any income tax on that money in the year you earn it. Instead, you pay taxes down the road when you actually receive the cash, which for most people is in retirement when their income—and tax bracket—is lower.

Breaking It Down with an Analogy

Imagine you're a farmer with a big harvest. You could sell all of it right away and pay a hefty tax on that large income. Or, you could store a portion of it in a silo to use during the winter when you aren't harvesting anything.

A deferred compensation plan is your financial silo. You're setting aside part of your current "harvest" (your salary) to be tapped into later. You only get taxed on the grain you take out, not on what's sitting in storage. By the time you start using it in retirement, your "annual harvest" is much smaller, so you often end up keeping more of your money away from the taxman.

The Two Flavors of Deferred Compensation

Every plan out there falls into one of two buckets. It's crucial to know the difference because it has huge implications for the safety of your money and the rules you have to follow.

- Qualified Plans: Think of these as the federally protected, Fort Knox versions. They are heavily regulated by the Employee Retirement Income Security Act (ERISA) to safeguard your savings. Your Thrift Savings Plan (TSP) is a classic example. These plans have strict contribution limits and must be offered fairly to employees, not just a select few.

- Nonqualified Plans (NQDC): These are more like a handshake deal between a company and its top brass. They're far more flexible and can allow for massive contributions beyond what qualified plans permit. The catch? They don't have those federal protections. If the company goes bankrupt, that money is at risk and could be claimed by creditors.

A deferred compensation plan is essentially a promise from your employer to pay you in the future. As a federal employee, your TSP is a promise backed by the full faith and credit of the U.S. government—about as secure as a promise can get.

For federal employees, the conversation almost always centers on the TSP, which is one of the best qualified plans in existence. Seeing where it fits in the wider world of deferred compensation really highlights its advantages. You get the same tax-deferral benefits that private-sector executives use to build wealth, but you also get unparalleled security. That's a powerful combination and the bedrock of a solid federal retirement.

Qualified vs. Nonqualified Plans: A Clear Breakdown

When we talk about deferred compensation, we're really talking about two very different animals: qualified and nonqualified plans. Understanding the distinction is crucial, and it’s a bit like the difference between putting your money in a federally insured bank vault versus giving a friend an IOU.

Your Thrift Savings Plan (TSP) is a classic example of a qualified plan. This "qualified" status means it has to follow a strict set of rules laid out by federal law—specifically, the Employee Retirement Income Security Act, or ERISA. These aren't just arbitrary regulations; they're designed to protect you.

The law requires your TSP money to be held in a trust, completely separate from your agency's finances. This keeps your nest egg safe from creditors and ensures the plan is offered fairly to employees, not just a select group of top brass. It’s a framework built on safety and security.

The World of Nonqualified Plans

On the other side of the fence, you have nonqualified deferred compensation (NQDC) plans. You see these a lot in the private sector, often offered to senior executives or other key players as a way to attract and retain top talent.

Because they don't have to follow the same strict ERISA guidelines, they offer a ton of flexibility. There are no federally mandated contribution limits, which means a corporate CEO can often sock away far more of their income than you can in your TSP.

But that flexibility comes with a very real trade-off: risk.

Unlike your TSP funds, money in an NQDC plan isn't legally protected. It remains on the company's books as a general asset. In the eyes of the law, you're just another unsecured creditor.

A nonqualified deferred compensation plan is simply a contractual promise from your employer to pay you in the future. If that company hits hard times or declares bankruptcy, that promise can be broken, and your deferred earnings could vanish.

This is the fundamental difference. Both types of plans let you postpone taxes, but only a qualified plan like the TSP offers government-mandated protections that shield your retirement savings if your employer goes under.

Comparing Key Differences

To really hammer this home, let's put your TSP side-by-side with a typical NQDC plan you'd find in the corporate world. The comparison makes it pretty clear why the federal system is set up the way it is.

Qualified vs Nonqualified Plans at a Glance

This table lays out the core distinctions between a plan like the TSP, which is built on a foundation of federal protection, and a corporate NQDC plan, which is built on a company's promise.

| Feature | Qualified Plan (e.g., TSP, 401(k)) | Nonqualified Plan (NQDC) |

|---|---|---|

| Asset Security | Protected by federal law (ERISA); held in a trust, safe from creditors. | Unsecured promise; funds are at risk if the employer goes bankrupt. |

| Contribution Limits | Strict annual limits set by the IRS ($23,000 in 2024). | No IRS limits; employers can set their own high (or unlimited) caps. |

| Eligibility Rules | Must be offered broadly to eligible employees without discrimination. | Highly selective; employers can offer them only to executives or key personnel. |

| Tax Treatment | Both offer tax deferral on contributions and growth. | Both offer tax deferral on contributions and growth. |

So, what’s the bottom line? For federal employees, this comparison really highlights the incredible value of the TSP. It gives you the same powerful tax-deferral benefits that corporate executives use to build wealth, but with a level of security that's almost unheard of in the private sector.

How the TSP Functions as Your Deferred Compensation Plan

If you’re a federal employee, the idea of a deferred compensation plan isn't just some financial jargon—it's something you already have. Your Thrift Savings Plan (TSP) is the perfect example of a powerful, government-backed deferred compensation plan. In fact, it’s a best-in-class “qualified” plan, offering wealth-building opportunities similar to what you’d find in the private sector, but with a lot more security.

So, how does it work? It's actually quite simple. Every pay period, a portion of your income goes into your TSP account before it ever hits your bank account. This simple act of "deferring" your compensation lowers your taxable income for the year, giving you an immediate tax break. That money—plus any matching funds from your agency—then gets to grow tax-deferred. You don't owe a dime in taxes on any of it until you start taking it out in retirement.

The Power of Tax-Deferred Growth

This is where the magic really happens. With tax-deferred growth, your investment returns aren't getting whittled down by taxes every year. Instead, 100% of your money stays in the account, working for you and compounding on itself. Over a long federal career, this can make a massive difference in the size of your nest egg. It's the core principle that makes deferred compensation such a potent tool for building wealth.

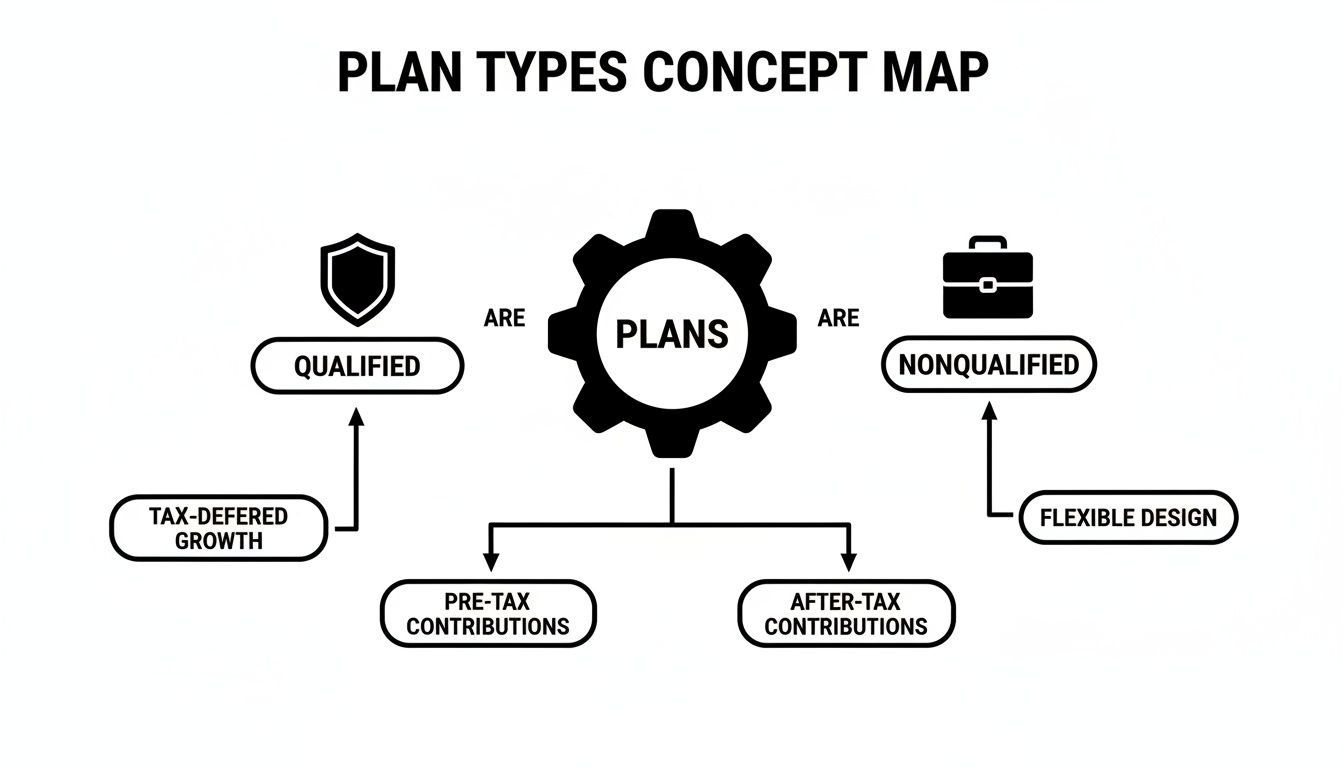

To get a better sense of where the TSP fits into the bigger picture, take a look at this breakdown of the two main types of deferred compensation plans.

This visual shows the clear line between qualified plans like your TSP—which are highly regulated and protected—and the more flexible (but riskier) nonqualified plans you often see in the corporate world.

While the TSP is your go-to, it’s interesting to see just how much nonqualified plans are used in the private sector. By the end of 2021, the top five executives at S&P 500 companies had a mind-boggling $8.9 billion stashed away in these types of accounts. It just goes to show how valuable high earners find tax deferral, and it really underscores why maximizing your own protected plan is so crucial.

The TSP isn’t just another retirement account; it's a strategic tool designed to turn today's earnings into tomorrow's security. Really understanding how the TSP works in detail is the first step to making the most of this incredible benefit. By contributing regularly, you're tapping into a deferred compensation strategy that's the envy of the private sector, all backed by the full faith and credit of the U.S. government.

The Pros and Cons for Your Retirement Strategy

Every financial tool has its trade-offs, and deferred compensation plans are no exception. Getting a handle on these is crucial for building a retirement plan you can count on, especially when you weigh your secure federal benefits against what's available in the private sector.

For federal employees, the advantages of the Thrift Savings Plan (TSP) are powerful and easy to grasp. Pushing income into your TSP lowers your tax bill today, which is a great start. But the real magic is letting that money grow over decades without the annual drag of taxes. When you add in the generous agency match, you’ve got a serious engine for building wealth.

Key Advantages of Your TSP

The single greatest strength of your TSP is its security. It’s a qualified plan, which means it’s governed by strict federal laws like ERISA that provide a rock-solid safety net for your savings.

- Asset Protection: Your TSP funds are held in a trust, totally separate from your agency's finances. This means your retirement money is shielded from government creditors. If the government ever hit a rough patch financially, your nest egg is safe.

- Guaranteed Contributions: Your agency's matching contributions are guaranteed up to 5%. That's essentially free money—a guaranteed return on your investment that you just don't see in many private-sector plans. It dramatically speeds up how quickly your account grows.

- Roth Option Flexibility: With the Roth TSP, you contribute after-tax dollars. The payoff comes in retirement, when you can take 100% tax-free qualified withdrawals. This is an incredible tool for diversifying your future income from a tax perspective.

Understanding the Risks in Nonqualified Plans

To really appreciate the security of the TSP, it helps to glance over the fence at the risks baked into corporate Nonqualified Deferred Compensation (NQDC) plans. At their core, these plans are just a promise from a company to pay an employee later on.

This simple "promise" structure introduces some major risks that federal employees just don't have to worry about.

The core risk of an NQDC plan is that the assets are not protected. If the company goes bankrupt, your deferred compensation becomes just another IOU, and you stand in line with all the other unsecured creditors. You could lose every penny.

This isn't just a theoretical problem; it’s a fundamental design flaw from an employee's perspective. On top of that, many NQDC plans come with forfeiture clauses, often called "golden handcuffs." If an executive decides to leave the company before a certain date, they could be forced to walk away from their entire deferred compensation balance.

Putting these side-by-side really highlights the value of your federal benefits. Don't get me wrong, corporate NQDC plans are incredibly popular for supplementing retirement—a recent study found that 86% of companies offer them for that very reason. You can dive into more of these executive benefit trends from NFP to see for yourself. But while a corporate plan might offer a bit more flexibility, your TSP delivers the same powerful tax benefits with a level of security that is simply unmatched. It ensures the money you've worked so hard for is actually there when you're ready to use it.

How Deferred Compensation Fits Into Your Overall Federal Benefits

It’s easy to think of your Thrift Savings Plan (TSP) as a standalone investment account, but that’s not the whole story. The TSP is really just one gear in your larger federal retirement machine, and it has to work in sync with your FERS pension and Social Security to get you where you want to go.

A question I hear all the time is whether TSP contributions will hurt your pension. Thankfully, the answer is a clear and simple no. Your FERS pension is calculated using your "high-3" average salary before any of your TSP contributions are deducted.

This is a huge advantage. You can max out your TSP contributions, significantly lowering your taxable income today, without it dinging the pension you’ll receive tomorrow. It’s a classic win-win situation for federal employees.

Integrating Your Three Pillars of Retirement

The best way to visualize your federal retirement is as a three-legged stool. For a stable, comfortable retirement, you need all three legs working together.

- FERS Pension: This is your bedrock—a reliable, defined-benefit income stream you can count on.

- Social Security: This acts as your foundational income, based on a lifetime of earnings.

- TSP: This is your flexible nest egg, the part of your savings that you have the most control over.

How you use these three pillars in concert is where the real strategy comes in. For example, you might decide to draw more heavily from your TSP in your early retirement years to bridge the gap before you start collecting Social Security. Or, you could lean on your Roth TSP for tax-free income when you need it, letting your other taxable accounts grow. A holistic approach allows you to smooth out your income and keep your tax bill in check.

You can dive deeper into how all these pieces work together in our guide to federal employee retirement benefits.

The Big Picture on Deferred Compensation

While the TSP is the main deferred compensation tool for feds, it's helpful to see how it fits into the broader landscape. In the private sector, similar plans are a major perk for top executives—in fact, 76% of employers use them to retain key talent. A staggering 90% of participants in those plans consider them essential for saving beyond 401(k) limits.

This just goes to show how powerful these tools are. As a federal employee, you have your own incredibly powerful deferred compensation plan—the TSP—that you should be maximizing alongside FERS to build the future you want. You can find more on these nonqualified plan trends on Principal.com.

Viewing your TSP as an integrated part of your total benefits package—not just a standalone account—transforms it from a simple savings plan into a strategic lever for maximizing your retirement income and minimizing your lifetime tax burden.

Putting It All Together: Your Federal Retirement Action Plan

Knowing the theory behind deferred compensation plans is one thing, but translating that knowledge into a stronger retirement income is where it really counts. For federal employees, this all starts with a close look at your Thrift Savings Plan (TSP) strategy to make sure you’re not leaving free money behind.

The first move is a simple self-audit. Ask yourself: are you contributing enough to get the full 5% agency match? If not, you’re missing out on an immediate 100% return on your investment. That’s the most powerful savings accelerator you have, and it’s an absolute must for building a secure retirement.

Once that’s squared away, see how close you are to hitting the annual contribution limits. For 2024, the limit is $23,000 if you're under 50. If you’re not on track to max it out, think about bumping up your contribution, even if it’s just by 1% at a time. Every dollar you add gets the benefit of tax-deferred growth for years, sometimes decades.

A Quick Readiness Checklist

Use these questions as a quick diagnostic to see if your TSP strategy is truly working for you or if it’s time for a tune-up:

- Agency Match: Am I putting in at least 5% to get every dollar of the government match?

- Annual Limit: Am I on pace to contribute the maximum allowed amount this year?

- Catch-Up Contributions: If I'm 50 or older, am I taking advantage of the additional $7,500 catch-up contribution?

- Fund Allocation: Does my investment mix across the C, S, I, F, and G funds still match my retirement timeline and how much risk I’m comfortable with?

Answering "no" or "I'm not sure" to any of these is a clear sign that your plan needs a little TLC. For a more detailed guide on this, check out our post on maximizing your government matching TSP contributions.

A personalized review can uncover opportunities and risks you might not see on your own. It bridges the gap between your current savings and your future income needs, providing a clear roadmap.

To really get the most out of your financial future, especially when you factor in the tax impact of withdrawals, getting expert advice can be a game-changer. To sort through the complexities and maximize your deferred compensation, engaging with professional tax planning services is an invaluable step. Taking these proactive steps turns your TSP from just another savings account into a powerful engine driving you toward a secure federal retirement.

Your Top Deferred Compensation Questions, Answered

Working through the specifics of federal benefits always stirs up a few questions. Let's tackle some of the most common ones we hear from federal employees about deferred compensation and how it fits into the bigger picture of their financial future.

Getting these details right is a huge step toward building a retirement strategy you can feel confident about.

Can I Have Another Deferred Compensation Plan Besides the TSP?

Yes, you absolutely can—and probably should—supplement your Thrift Savings Plan (TSP). While the TSP is your primary, government-sponsored plan, many federal employees also contribute to an Individual Retirement Account (IRA) to boost their savings. You can choose a Traditional IRA for a potential tax deduction now or a Roth IRA for tax-free withdrawals later.

However, when people ask about other "deferred compensation" plans, they're often thinking of the Nonqualified Deferred Compensation (NQDC) plans common in the private sector. Those are generally not an option for federal employees. For feds, the TSP is the main game in town for deferring your income through an employer plan.

What Happens to My TSP Funds if I Leave Federal Service?

Don't worry, your TSP money is yours to keep. When you leave your federal job, you don't lose your funds; you just get more choices for what to do with them. Each path has its own set of tax rules and financial implications, so it's a decision worth thinking through carefully.

Here are your main options:

- Keep it in the TSP: You can leave your money right where it is and continue to enjoy the TSP's famously low-cost investment funds. The only catch is you can't add any new money to it.

- Roll it over to an IRA: This is a popular choice because it can open up a much wider world of investment options and often gives you more flexibility for making withdrawals.

- Move it to a new employer's 401(k): If you take a job in the private sector, you can often consolidate your retirement savings by moving your TSP balance into your new company's plan.

- Cash it out: You can take a partial or full withdrawal, but be careful here. This move almost always comes with a hefty tax bill and could trigger early withdrawal penalties if you're not yet retirement age.

Think of your TSP account as being portable. Deciding where it lands after you leave federal service is a major financial crossroad. You’ll need to weigh the fees, investment choices, and tax impact of each option.

How Are My TSP Withdrawals Taxed in Retirement?

This all comes down to which type of TSP account your money is in: Traditional or Roth. It’s a critical distinction that will directly affect how much cash you actually have in your pocket during retirement.

Withdrawals from a Traditional TSP are taxed as ordinary income. This makes sense when you remember that you got a tax break on the money when you contributed it. Now, it's the government's turn to get its share.

On the flip side, qualified withdrawals from a Roth TSP are 100% tax-free. You already paid taxes on your contributions upfront, which means everything—your original contributions and all the investment growth—comes out completely free of any tax bill in retirement (as long as you meet the rules). That's an incredibly powerful tool for managing your tax situation down the road.

At Federal Benefits Sherpa, our mission is to make these complex topics clear so you can build a retirement plan with confidence. Schedule your free 15-minute benefits review today to make sure you're heading in the right direction.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved