Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

What Is A TSP Roth And How It Maximizes Tax-Free Growth

What Is Roth TSP?

When you hear “Roth TSP,” think of a Thrift Savings Plan account where you sock away after-tax dollars, much like a Roth IRA. You pay taxes up front, watch your balance grow without worrying about future levies, and then pull it out in retirement without losing a cent to federal income tax.

This option appeals especially to folks who expect to be in a higher tax bracket down the road or simply value the certainty of tax-free withdrawals.

How Roth TSP Works

Back in 2012, the Moving Ahead for Progress in the 21st Century Act quietly added this feature to the Thrift Savings Plan. Now, any U.S. federal employee or uniformed service member can choose to send a portion of their paycheck into a Roth TSP, rather than sticking purely with traditional, pre-tax contributions.

It’s essentially a Roth IRA living inside your TSP account, giving you an extra lane for tax diversification. For example, a study shows about 25% of new contributions flowed into Roth buckets by 2023: Vanguard’s research report.

Tax-Free Growth: Your earnings compound without future federal taxes.

No Required Minimum Distributions: You’re not forced to start withdrawals at age 73.

Tax Diversification: Blends neatly with a traditional TSP to balance your retirement-income strategies.

Key Takeaway: Choosing Roth contributions can hedge against rising tax rates and give you extra flexibility when you retire.

The screenshot below shows the structure of the Thrift Savings Plan from Wikipedia.

Roth TSP Quick Facts

Here’s a concise look at the core features defining a Roth TSP account for federal employees:

FeatureRoth TSPContribution TypeAfter-Tax DollarsWithdrawal TaxationTax-Free in RetirementRequired Minimum DistributionsNot Required

With these highlights in mind, you can see why many federal workers mix Roth and traditional contributions—diversifying tax treatment today to smooth out income in retirement.

Understanding Roth TSP Concepts

Imagine you’re about to drive coast to coast and must choose between paying tolls up front or at the final booth. Opting for Roth contributions is like paying those tolls before you set out. You lock in your tax rate today and enjoy a tax-free ride once you retire.

When the Roth TSP first rolled out in 2012, only 5% of new contributions went into the Roth side. Fast forward to 2018, and that share climbed to 15%. By 2023, it had jumped to 25%, underscoring how many savers value the idea of tax-free income down the road. For a deeper dive into these shifts, check out Roth Conversion Trends.

Picking a Roth TSP contribution feels a bit like choosing between a prepaid toll pass and coins for every toll booth. You pay more out of pocket now, but future withdrawals of contributions and earnings are tax-free.

Five Year Holding Rule

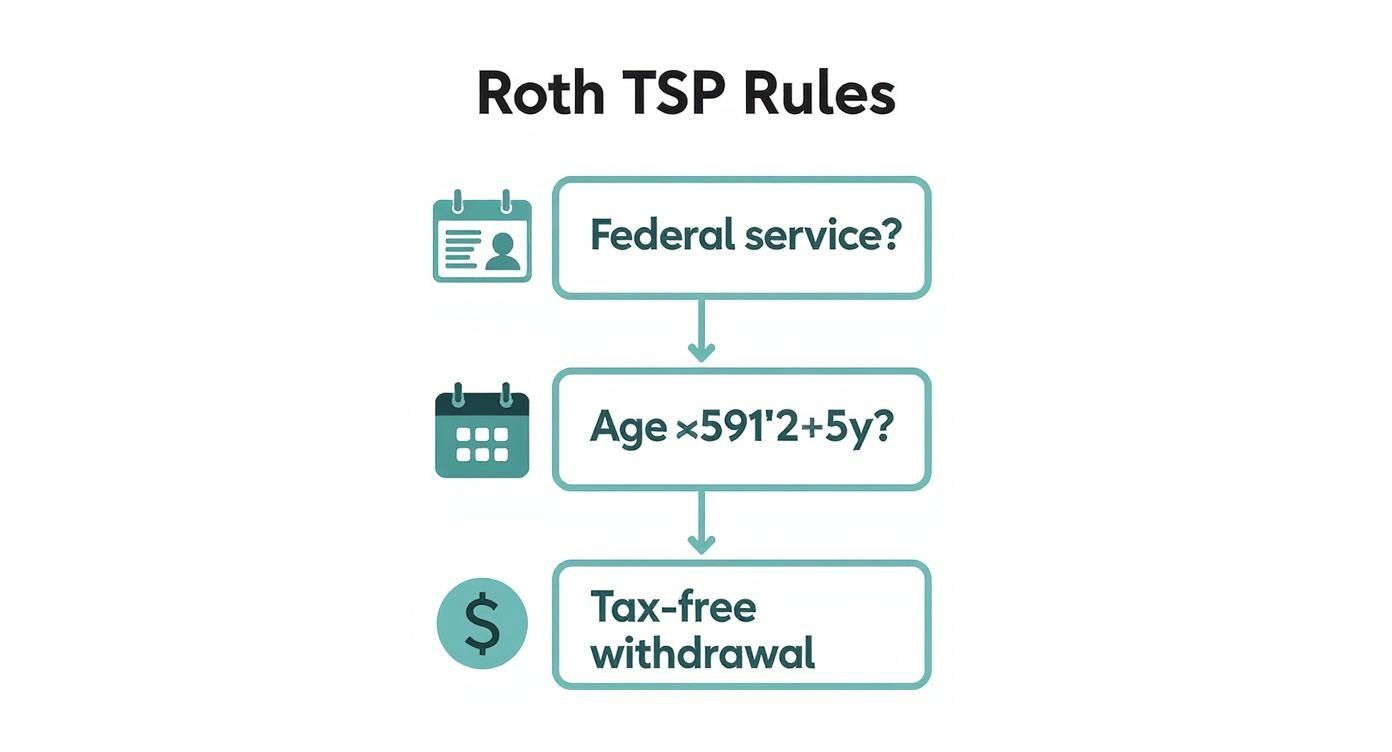

Before you tap into those Roth funds without a tax bill, you must meet two critical milestones:

Five consecutive tax years since your very first Roth TSP contribution

Reach age 59½

Once both are in place, every dollar you pull out—earnings and all—won’t add a penny to your tax return.

Comparing Tax Impact

FeatureRoth TSPTraditional TSPTax Payment TimingUpfront with each depositAt withdrawalRequired Minimum DistributionsNot requiredRequired after age 73

Expert Insight: Paying taxes now can act as a hedge against potential rate hikes in the future.

For many federal employees and service members, blending Roth and traditional contributions delivers tax diversification benefits and peace of mind. Mixing both strategies smooths out taxable income later—like balancing your plate with protein and veggies.

This approach also slots neatly alongside Social Security planning and pensions, creating a more resilient retirement blueprint.

How Roth TSP Contributions Grow

Imagine planting a few seeds each spring and watching them transform into a thriving garden. That’s how your Roth TSP contributions work over time: small, regular deposits that blossom into a tax-free retirement fund.

By channeling a set portion of each paycheck into your Roth TSP, you tap into compounding—where every dividend or interest payment buys more shares. Over decades, those reinvested gains can turn modest inputs into a substantial nest egg.

ScenarioAnnual ContributionTime FrameAverage ReturnEstimated BalanceHypothetical Case$10,00030 years7%$1.02 million

Account TypeAverage 2023 ReturnTraditional TSP6.8%Roth TSP7.2%

These figures assume consistent payroll contributions and a steady market environment. For a deeper dive into Roth TSP returns versus traditional balances, check out the analysis from Duane Morris.

Step By Step Example

Choose Your Contribution Rate

Decide what percentage of each paycheck you’ll dedicate to the Roth TSP.Select Your Funds

Pick from lifecycle funds, index portfolios, or government securities based on your comfort with risk.Watch Compounding in Action

Every dividend or interest payment buys additional shares automatically, fueling future growth.

Over a 30-year span, this pattern of small, consistent investments—and reinvested gains—can create outcomes that far outpace one-off lump sums.

Consistent Contributions: Schedule a fixed amount each pay period.

Reinvested Gains: Let dividends and interest rebuild your balance.

Time Horizon: Give the market enough runway to work its magic.

Tailoring Your Portfolio

With the Roth TSP, you have access to the same core funds as the traditional plan. This flexibility lets you match investments to your retirement timeline:

Lifecycle Funds: Gradually shift from growth to stability as you near retirement.

Index Funds: Track major market benchmarks with low fees.

Government Securities: Add a conservative anchor to your mix.

“Time is your greatest ally. Starting Roth TSP contributions early harnesses compounding and tax-free growth simultaneously.”

By understanding how these pieces fit together—and by beginning sooner rather than later—you’ll set yourself up for a powerful, tax-free retirement resource.

Roth TSP Tax Rules And Eligibility

Think of a Roth TSP as a federal-worker version of a Roth IRA. The IRS sets the contribution ceiling, and the TSP slots you right into that framework.

In 2023, you can funnel up to $22,500 of your basic pay into a Roth TSP. Employees aged 50 or older may tack on a catch-up contribution of $7,500, lifting the total limit to $30,000.

Contribution Limits And Income Requirements

Unlike private-sector Roth IRAs, there’s no income test for your Roth TSP. If you’re a federal employee or uniformed service member enrolled in the TSP, you qualify.

How much you set aside depends solely on your basic pay and IRS limits:

100% of basic pay, subject to the annual cap

$7,500 extra catch-up for anyone age 50+

Matching contributions treat Roth deposits just like traditional ones

Tax Treatment Trade-Off

Roth contributions mean you pay taxes up front in exchange for tax-free withdrawals down the road. That shrinks your take-home pay today but locks in future growth.

“Once you pay tax on each dollar contributed, all future earnings and withdrawals are untaxed—if rules are met.”

For example, on a $60,000 salary with a 10% Roth election, you invest $6,000 per year, taxed now but withdrawn tax-free in retirement. Many service members use lower-rate deployment years to max out catch-up room, boosting their long-term gains.

Distributions And RMD Differences

Qualified Roth TSP distributions are penalty-free once you reach 59½ and have held your first Roth deposit for five years.

To qualify:

Be at least 59½

Complete a five-year holding period

Unlike Roth IRAs, Roth TSP balances are subject to required minimum distributions at age 73. You can roll your Roth TSP into a Roth IRA, however, to avoid those RMDs altogether.

With these rules in hand, you’ll know whether the Roth TSP fits your retirement strategy.

Comparing Roth And Traditional TSP

Deciding between a Roth TSP and a traditional TSP comes down to a simple question: when do you want to pay taxes? It’s a bit like choosing between grabbing a sale price at the store or paying full price now and getting a gift card later.

Pre-Tax Benefit vs After-Tax Investment

Traditional contributions shrink your taxable income in the year you make them. Roth contributions, on the other hand, let your money grow tax-free for withdrawals in retirement.Growth Comparison

In 2023, the traditional TSP averaged 6.8%, while the Roth side saw about 7.2% growth.Required Minimum Distributions

Traditional TSP owners must begin RMDs at age 73. Roth balances stay in the plan without RMDs.

Of course, Roth withdrawals only become tax-free after you hit age 59½ and satisfy the five-year clock. That means you’ll need to weigh short-term cash needs against long-term tax savings.

Many federal employees strike a balance by splitting contributions. This mixed approach can smooth out uncertainty in future tax rates and give you both immediate relief and a tax-free cushion down the road.

Roth vs Traditional TSP Comparison

Below is a quick look at how these two account types handle taxes and withdrawals:

AspectRoth TSPTraditional TSPTax Payment TimingUpfront contributionsDeferred until withdrawalWithdrawal Tax TreatmentTax-free after requirementsOrdinary income taxedRequired Minimum DistributionsNone inside planBegin at age 73

By laying out the differences side by side, you can map them to your own retirement goals—whether that’s lowering taxable income today or banking on tax-free growth later.

Real World Roth TSP Use Cases

Federal employees at every career milestone tap the Roth TSP to meet their goals.

Below are three real-life profiles showing how different strategies play out—from building an early nest egg to managing taxes right up to retirement.

Young Service Member Scenario

A junior service member kicks off with a 5% Roth contribution, aiming squarely at stocks for growth.

During deployments, when their taxable income dips, they route extra savings into the Roth without feeling the pinch.

Contribution Strategy: 5% of basic pay

Growth Focus: Equity-tilted lifecycle funds

Projected Balance: $200,000 over 10 years

“Tax-free growth compounds best when you start young.”

Small, steady deposits now can snowball into a healthy retirement stash. It also sets up future flexibility in managing taxable versus tax-free income.

Mid Career Civil Servant Scenario

A GS-12 splits contributions 50/50 between Roth and traditional TSP to balance today’s tax hit with tomorrow’s tax-free bucket.

They fine-tune the mix each year as tax brackets shift, aiming to smooth out liabilities now and maximize after-tax cash later.

Roth Portion: 6% of pay

Traditional Portion: 6% of pay

Tax Impact: Even withholding across paychecks

This dual approach creates a hedge—some funds grow tax-deferred, others grow tax-free.

Near Retirement Employee Scenario

At age 62, one federal worker goes all-in on Roth and taps tax-free withdrawals under the five-year rule.

With a $350,000 Roth balance, they pull $30,000 annually to cover living expenses without adding to taxable income.

Withdrawal Strategy: $30,000 per year

Balance at Start: $350,000

Rule Met: Five-year holding period

Each of these stories highlights a different way to leverage the Roth TSP. Choose the scenario that best matches your career stage and tax objectives.

Frequently Asked Questions

Can I convert my existing TSP to Roth?

Absolutely. Starting January 2026, you’ll be able to move traditional, pre-tax TSP contributions into a Roth TSP through an in-plan conversion. You’ll settle the tax bill in the conversion year, then watch your funds grow tax-free.

“Think of an in-plan conversion as swapping a small tax payment today to sidestep larger surprises down the road.”

How Do Rollovers Into a Roth TSP Work?

If you decide to leave federal service, you can roll your traditional TSP funds into a Roth IRA or back into a Roth TSP account. You’ll owe taxes on the converted sum, but once it’s done, it’s like laying stepping stones toward a tax-free shoreline.

After-Tax Rollover: Cover the tax bill from outside funds to keep your savings intact.

No RMDs: Roth accounts aren’t subject to required minimum distributions.

Timing Tips: Target lower-income years to minimize the tax impact.

When To Switch Agencies

Your Roth TSP balance moves with you if you switch federal jobs. Simply log into your new agency’s TSP portal, link your accounts, and continue with your existing investment choices. It’s a lot like bringing your favorite tools into a new workshop.

Backdoor Roth Strategy

High earners often face contribution limits on Roth IRAs, but the backdoor Roth lets you slip in through the side door. Contribute to a traditional IRA, then convert it to a Roth IRA, bypassing the income caps. Many federal employees pair this technique with their TSP to build a more tax-diverse portfolio.

QuestionKey InsightConvert Existing TSPAvailable starting 2026Rollover RulesTaxes due on conversion; use outside funds if possibleAgency SwitchYour account follows youBackdoor Roth BenefitGreat for high earners aiming to expand tax-free buckets

These tips should clear up common questions and guide your Roth TSP decisions. Feel free to revisit your strategy each year.

Let us help simplify your planning now. For personalized advice, contact Federal Benefits Sherpa: Federal Benefits Sherpa today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved