Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

What Is Roth TSP and How Does It Work for Federal Employees

As a federal employee, you have access to one of the most powerful retirement savings tools available: the Roth Thrift Savings Plan (TSP). At its core, the Roth TSP allows you to build a nest egg that you can withdraw from in retirement completely tax-free.

You contribute money from your paycheck after taxes have already been taken out. In exchange for paying those taxes today, every dollar your account earns over the decades—all the growth—is yours to keep, free from federal income tax. This “pay now, not later” approach creates a predictable, tax-free income stream for your future.

Pay Now or Pay Later: The Big Question

Think about your retirement savings like planting an apple tree. With the Roth TSP, you pay tax on the small seed you plant today. It's a known, manageable cost. Then, you let that tree grow for years, and when it’s time to harvest the apples in retirement, the entire bounty is yours, tax-free.

The Traditional TSP works the opposite way. You get a tax break on the seed—your contributions are pre-tax, lowering your taxable income now. But when you retire and start harvesting those apples, you'll owe income tax on every single one.

Ultimately, the choice comes down to one simple question: Do you think your income tax rate will be higher now, or will it be higher in retirement?

Roth TSP vs Traditional TSP Key Differences

Here's a quick snapshot of how the two TSP options stack up against each other when it comes to taxes.

| Feature | Roth TSP | Traditional TSP |

|---|---|---|

| Contributions | Made with after-tax dollars | Made with pre-tax dollars |

| Tax Impact Today | No immediate tax deduction | Lowers your current taxable income |

| Investment Growth | Grows 100% tax-free | Grows tax-deferred |

| Qualified Withdrawals | Completely tax-free in retirement | Taxed as ordinary income in retirement |

This table clearly shows the fundamental trade-off: The Roth TSP offers tax-free income later, while the Traditional TSP provides a tax break today.

The Real Power of Tax-Free Money

Having a bucket of tax-free money in retirement is a total game-changer. It gives you incredible flexibility and certainty in a future where tax rates are anything but certain.

Let’s say you need $50,000 for your annual living expenses. If you pull that from your Roth TSP, you withdraw exactly $50,000. Simple. But if you pull from a Traditional TSP, you might need to withdraw $60,000 or more just to have $50,000 left after taxes are paid. This forces you to drain your savings much faster.

The biggest advantage here is tax diversification. By contributing to both Roth and Traditional accounts, you create options. You can strategically pull from different buckets in retirement to manage your tax bill year by year, depending on your needs and the tax laws at the time.

How Roth TSP Contributions Actually Work

Getting started is simple. You just tell the TSP what percentage of your pay you want to direct to your Roth account. But there are a few key details to keep in mind.

- After-Tax Contributions: The money comes out of your paycheck after federal and state taxes are withheld.

- No Income Limits: Unlike a Roth IRA, the Roth TSP has no income restrictions. Every federal employee can contribute, no matter how much they earn.

- The Agency Match Catch: This is a big one. Even if 100% of your contributions go to the Roth TSP, your agency's automatic and matching contributions will always go into your Traditional TSP balance. You can get a full rundown on these mechanics in our guide on how the TSP works.

While the TSP is unique to U.S. federal employees, seeing how other countries handle retirement savings can offer some interesting perspective. For example, learning What Is Superannuation in Australia? helps highlight the distinct advantages we have here in the federal system.

Getting Money Into Your Roth TSP: The Contribution Rules

Alright, let's talk about how you actually fund your Roth TSP. Think of it as setting up a direct deposit for your future self, but with some very important rules you need to know to get the most out of it.

You tell the TSP what percentage of your basic pay you want to contribute, and the system handles the rest, pulling that amount from each paycheck and dropping it right into your Roth account. The trick is to make sure your contributions stay within the annual limits set by the IRS.

Keeping an Eye on Annual Contribution Limits

Every year, the IRS sets what’s called an "elective deferral limit." This is a hard cap on the total amount of your own money you can put into your TSP accounts for the year. This limit covers both Roth and Traditional TSP contributions combined, but it does not include the money your agency kicks in.

For 2024, that limit is $23,000. If you want to max that out, you’d need to contribute about $885 from each bi-weekly paycheck.

A great strategy many federal employees use is to "set it and forget it." Just calculate the percentage of your pay that gets you to the $23,000 max by the end of the year (over 26 pay periods). This keeps your contributions steady and, more importantly, ensures you get the full 5% agency match on every single paycheck.

Supercharge Your Savings: Catch-Up Contributions After 50

Once you hit age 50 (or are turning 50 within the calendar year), the government gives you a powerful way to accelerate your savings. You can start making additional "catch-up" contributions on top of the regular annual limit.

For 2024, the catch-up limit is $7,500. This is completely separate from the regular $23,000 limit, meaning you could potentially sock away a total of $30,500 for the year. It's a fantastic tool for those who want to make a final push as they approach retirement.

A New Twist for High Earners

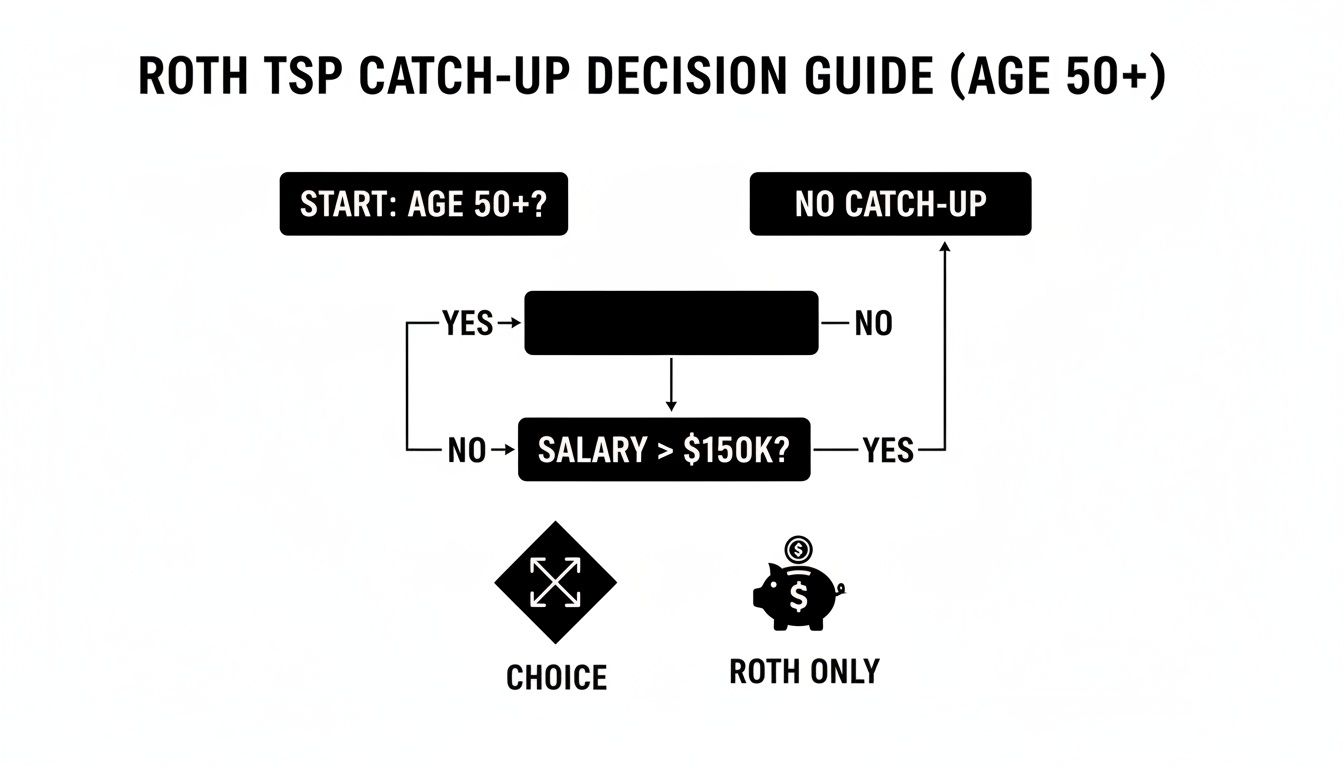

A recent law, the SECURE 2.0 Act, brought a significant change for higher-earning feds. Starting in 2026, if your wages in the prior year were more than $145,000, any catch-up contributions you make must go into your Roth TSP. The government wants to make sure high earners pay taxes on those extra contributions now, not later.

And these limits are always changing. For 2026, the regular limit is set to increase to $24,500 (from $23,500 in 2025). The catch-up amount also gets a bump to $8,000. Just remember, if your 2026 wages are over $150,000, all of that $8,000 catch-up has to be Roth. You can find a full breakdown of the new 2026 TSP and IRA contribution limits on stwserve.com.

Where Does the Agency Match Go?

This is probably one of the most misunderstood parts of the TSP, so let’s clear it up.

- Your Money: You have total control. You can put your contributions into the Roth TSP, the Traditional TSP, or split it between them however you like.

- Their Money: The agency contributions—both the automatic 1% and the matching funds up to 4%—are always deposited into your Traditional TSP account. No exceptions.

This is actually a good thing! It means that even if you go all-in on your Roth TSP, you’ll still be building a Traditional TSP balance from your agency’s money. This automatically diversifies your retirement savings from a tax perspective, giving you both a tax-free bucket (Roth) and a tax-deferred bucket (Traditional) to pull from later on.

Roth TSP vs. Traditional TSP: Choosing Your Strategy

When it comes to choosing between the Roth TSP and the Traditional TSP, it really all comes down to one simple question: Do you want to pay taxes now, or do you want to pay them later? There’s no single right answer—it depends entirely on your personal financial picture and where you see yourself in the future.

Think of it as placing a strategic bet on your own career path and what you expect tax rates to do over time. You're deciding whether your tax bracket will be higher today or when you're retired. Getting this right helps align your TSP contributions with your long-term goals.

The guiding principle is straightforward: pay your taxes when your rate is lowest. If you think you'll be in a higher tax bracket in retirement, the Roth TSP’s “pay now” model is probably your best bet. On the other hand, if you're at the peak of your earning years now and expect a lower income (and tax bracket) in retirement, the Traditional TSP’s “pay later” approach usually makes more sense.

The Case for Roth Early in Your Career

For most new federal employees, jumping into the Roth TSP is a brilliant move. When you're just starting out, you're usually in a lower tax bracket than you'll be after years of promotions and step increases.

Let's say you're a GS-9 just getting your federal career underway. Your income is modest, which means your marginal tax rate is pretty low. By putting money into a Roth TSP, you pay tax on those contributions now, while that rate is manageable. Every dollar you put in then gets to grow for decades, completely sheltered from future taxes. Fast forward to retirement, when you're potentially in a much higher tax bracket, and you can pull out all that money—your original contributions and all the earnings—100% tax-free.

This strategy lets you lock in today's lower tax rate on your retirement savings for good. You're essentially pre-paying your tax bill at a discount, guaranteeing a pot of tax-free money for a future where your income, and maybe even national tax rates, could be much higher.

When the Traditional TSP Shines

Now, let's flip the script. Picture a senior-level employee, maybe a GS-15 at the top of their pay scale. They're in their peak earning years, which also means they're likely in the highest tax bracket they'll ever be in. For this person, the immediate tax deduction from the Traditional TSP can be a huge win.

Every dollar they contribute to their Traditional TSP reduces their taxable income for that year. If you're in the 32% or 35% federal tax bracket, this delivers significant, immediate savings on your tax bill. The logic here is that in retirement, their income will drop, putting them in a lower tax bracket. When they start taking withdrawals, they'll pay taxes at that future, lower rate.

This same "pay now vs. pay later" logic is critical for those over 50 making catch-up contributions, as this flowchart helps illustrate.

As you can see, recent rule changes actually force high-income earners to put their catch-up contributions into the Roth TSP, reinforcing that "pay now" strategy for those with higher salaries.

A Hybrid Approach for Tax Diversification

Here’s the thing: you don't have to go all-in on one or the other. In fact, one of the smartest strategies is to contribute to both the Roth and Traditional TSP at the same time. The TSP lets you split your contributions however you want.

So, why would you do this? It's all about tax diversification.

- Hedge Against Uncertainty: Let's be honest, nobody has a crystal ball. We don't know for sure what tax rates will look like in 10, 20, or 30 years. By having both tax-free (Roth) and tax-deferred (Traditional) buckets of money, you're ready for anything.

- Flexibility in Retirement: This strategy puts you in the driver's seat. In a year where you need to pull out a large sum for a big expense, you can take it from your Roth TSP to avoid bumping yourself into a higher tax bracket. In a leaner year, you can draw from your Traditional TSP and pay taxes at a more comfortable rate.

For example, you might decide to contribute 5% to the Roth TSP and another 5% to the Traditional TSP. This gives you a nice balance—you get an immediate tax break from the Traditional side while also building a source of future tax-free income with the Roth. The key is to look at your career trajectory, make an educated guess about your future, and find the mix that feels right for you.

Roth TSP vs. Roth IRA: What's the Difference?

As a federal employee, you’ve likely heard about two powerful retirement accounts: the Roth TSP and the Roth IRA. They both share that magic "Roth" name, which means tax-free growth and tax-free withdrawals in retirement. But don't let the name fool you—they are very different tools with their own rules, limits, and strategic uses.

Think of it this way: The Roth TSP is like a private, high-speed rail line built exclusively for federal employees. The Roth IRA, on the other hand, is a public subway system open to everyone, but it has different routes and passenger limits. Understanding how each one works is key to building a powerful retirement plan.

Contribution Limits and Income Rules

The biggest difference between the two comes down to who can contribute and how much.

The Roth TSP is part of your employer plan, so its contribution limit is bundled with the Traditional TSP. For 2024, you can put a combined $23,000 into both accounts. If you're age 50 or over, you can add another $7,500 in catch-up contributions.

Here's the most important part: the Roth TSP has no income limitations. It doesn’t matter if you make $50,000 or $500,000 a year—if you’re a federal employee, you can contribute. This is a massive advantage for high earners.

A Roth IRA is a different story. Its contribution limits are much lower—just $7,000 in 2024, plus a $1,000 catch-up contribution. More importantly, your ability to contribute directly gets phased out as your income rises. If you earn too much, you can't contribute at all.

This lack of an income cap makes the Roth TSP an incredibly valuable tool for senior-level federal employees and military members who would otherwise be locked out of direct Roth contributions.

Investment Options and Withdrawal Flexibility

Another major fork in the road is your investment choices. Inside the Roth TSP, your money is invested in the core TSP funds (C, S, I, F, and G). These funds are famous for their rock-bottom administrative costs, which is a huge benefit over the long run.

A Roth IRA, however, throws the doors wide open. You have a nearly endless universe of investment options: individual stocks, bonds, ETFs, thousands of mutual funds, and more. This gives you far more control to build a highly customized portfolio.

The rules for pulling money out also differ. With a Roth IRA, you can withdraw your direct contributions (not the earnings) at any time, for any reason, without taxes or penalties. This offers a level of liquidity the Roth TSP just can't match. To get money from your Roth TSP before retirement, you generally need to meet stricter conditions, like separating from service or proving a financial hardship.

If you're planning for life after federal service, you can learn more about your options in our guide covering how to transfer a TSP to a Roth IRA.

To make these distinctions crystal clear, let's look at them side-by-side.

Comparing Roth TSP and Roth IRA

| Feature | Roth TSP | Roth IRA |

|---|---|---|

| 2024 Contribution Limit | $23,000 (combined with Traditional) | $7,000 |

| "Over 50" Catch-Up | $7,500 | $1,000 |

| Income Limits | None | Yes, phases out for high earners |

| Investment Choices | Limited to core TSP funds | Nearly unlimited (stocks, bonds, ETFs, etc.) |

| Withdrawal of Contributions | Restricted before retirement | Can be withdrawn anytime, tax/penalty-free |

| Employer Match | Eligible for 5% agency match | No employer match available |

This table highlights that while both are great Roth vehicles, they are built for different purposes and offer unique advantages.

Using Both Accounts for a Powerful Tandem Strategy

Here's the best part: you don't have to choose just one. For many federal employees, the smartest approach is to use the Roth TSP and a Roth IRA in tandem.

Here’s a simple, powerful strategy to follow:

- Step 1: Maximize Your TSP Match First. Before you do anything else, contribute enough to your TSP to get the full 5% agency match. This is free money, and you should never leave it on the table.

- Step 2: Fund Your Roth IRA. After securing the match, turn your attention to maxing out a Roth IRA. This gives you investment diversification and a flexible account you can tap into for emergencies if needed.

- Step 3: Return to Your TSP. Once the Roth IRA is fully funded, circle back to your TSP and keep increasing your contributions until you hit the annual maximum.

By combining these two accounts, you can supercharge your savings and put away over $30,000 a year (or more if you're over 50) into tax-advantaged retirement accounts. This tandem approach gives you the best of both worlds: the low-cost simplicity of the TSP and the investment freedom of an IRA, building a truly robust plan for your future.

Strategies for Roth TSP Withdrawals and Conversions

This is where the magic of the Roth TSP really happens. You’ve paid your taxes upfront, and now it’s time to reap the reward: getting your money out completely tax-free. But to do it right, you need to understand a few key rules—especially the one that trips people up the most, the "five-year rule."

Think of the five-year rule as a seasoning period. Before you can take out your earnings tax-free and penalty-free, two things need to be true:

- You have to be at least age 59½ (or disabled, or the account is inherited).

- It’s been at least five years since January 1st of the year you made your very first Roth TSP contribution.

That clock starts on day one of the year you made your initial contribution, and thankfully, you only have to satisfy it once. So, if you put your first dollar into the Roth TSP in December 2024, your five-year waiting period is officially over on January 1, 2029.

What Happens If You Withdraw Early

Of course, life doesn't always stick to the plan. You might need to tap into your funds before meeting both conditions for a qualified withdrawal.

If you take a "non-qualified" distribution, here's how it works: the money you put in—your contributions—always comes back to you tax-free and penalty-free. After all, you already paid tax on it. But any earnings you pull out will get hit with both ordinary income tax and a 10% early withdrawal penalty.

For a deeper dive into all the nuances, you can check out our complete guide to Thrift Savings Plan withdrawal options.

The Power of an In-Plan Roth Conversion

Beyond just taking money out, there's a powerful strategic tool you can use: the in-plan Roth conversion. This lets you move money from your Traditional TSP balance directly over to your Roth TSP balance, all within the same plan.

When you do this, you’re making a trade. You agree to pay income tax on the amount you convert today. In return, that money—and all its future growth—gets to live in the Roth TSP, setting it up for completely tax-free withdrawal later on. It’s a fantastic way to take control of your future tax situation.

An in-plan Roth conversion is like moving your apple tree from the "taxable harvest" section of your orchard to the "tax-free harvest" section. You pay a one-time tax to move it, but every apple it produces from that day forward is yours to keep, no questions asked.

This strategy is especially effective when your income is temporarily lower. Think about a federal employee who retires at 62. They might have a few years of lower income before their FERS pension is in full swing and Social Security kicks in. Converting some of their Traditional TSP funds during this "income gap" means they can pay tax on the conversion at a much lower rate than they would have in their prime earning years or later in retirement.

And here’s some big news for feds. A long-awaited feature is finally on the horizon: starting January 28, 2026, the TSP will allow in-plan Roth conversions. This is a game-changer. The timing is particularly interesting, as the Congressional Budget Office projects a sharp rise in income tax revenues after 2025 when certain tax cuts are scheduled to expire. Having the ability to convert funds before taxes might go up presents a huge planning opportunity.

Conversion in Action: A Retiree Example

Let's look at Maria, who just retired from federal service at age 63. She has a $500,000 Traditional TSP and knows that when she hits 73, Required Minimum Distributions (RMDs) will force her to take taxable withdrawals, potentially pushing her into a higher tax bracket.

Right now, though, Maria’s income is fairly low. She decides to convert $40,000 from her Traditional TSP into her Roth TSP this year. She'll pay income tax on that $40,000, but at her current, lower marginal rate.

What did she accomplish? That $40,000 is now in her Roth TSP, ready to grow completely tax-free. Even better, she’s shrunk her Traditional TSP balance, which means her future RMDs will be smaller. By strategically repeating this process over several low-income years, Maria can dramatically reduce her lifetime tax bill and build a much larger pool of tax-free money for retirement.

When to Seek a Personalized Roth TSP Review

While this guide gives you a solid foundation for the Roth TSP, the real magic happens when you apply these concepts to your own life. General advice can get you started, but a strategy tailored to your federal career, your family, and your specific retirement goals is what truly sets you up for success.

Knowing what a Roth TSP is is the first step. The next, and arguably more important, step is understanding how it fits into your unique financial puzzle. Certain moments in your career and life are perfect checkpoints to pause and re-evaluate your strategy, ideally with a professional who lives and breathes federal benefits.

Think of these as inflection points—moments where a small, smart adjustment today can lead to a much bigger, better outcome down the road.

Key Moments for a Professional Check-In

Trying to navigate your financial future without a map is a gamble, especially when life throws a few curveballs. A personalized review isn't about finding one "right answer," but about crafting a flexible plan that grows and adapts right along with you.

It's probably time to talk to an expert if any of these sound familiar:

You're Approaching Retirement: Once you're within five to ten years of leaving federal service, your whole mindset needs to shift. You're moving from a phase of accumulating wealth to one of preserving it and creating income. A professional can help you fine-tune your TSP allocation, project your retirement income streams, and strategize how to minimize your tax bill.

You Got a Big Pay Raise: A promotion or a significant step increase is fantastic news, but it can easily bump you into a higher tax bracket. This is the perfect trigger to analyze whether your current Roth vs. Traditional contribution mix still makes sense.

Life Just Changed—A Lot: Getting married, having a baby, or buying a house completely rewrites your financial playbook. A quick review ensures your TSP strategy is still aligned with your new responsibilities and long-term goals.

The goal of a personalized review is to turn general knowledge into a concrete action plan. It helps you see not just what the Roth TSP is, but what it can do for you specifically.

Beyond the Basics: What a Review Uncovers

A true personalized review digs much deeper than just the Roth vs. Traditional debate. A financial professional can run projections for different scenarios, model your future tax liabilities with far greater accuracy, and show you how your TSP, Social Security, and FERS pension all work together.

This process helps you get clear, confident answers to the really important questions: How will my withdrawal strategy impact my spouse? Am I set up to take advantage of in-plan Roth conversions later? Are my TSP funds too aggressive—or not aggressive enough—for my timeline?

Getting these answers right is how you make sure you’re squeezing every bit of value out of this incredible retirement tool. It’s how you secure the comfortable future you’ve worked so hard for.

Roth TSP: Your Questions Answered

Once you get the basics of the Roth TSP down, a lot of specific questions tend to pop up. It's one thing to know what it is, but another thing entirely to figure out how it fits into your personal financial plan.

Let's walk through some of the most common questions federal employees have. Getting these details straight can make all the difference in feeling confident about your retirement strategy.

Can I contribute to both a Roth and a Traditional TSP at the same time?

You bet. The TSP is flexible, letting you split your contributions however you see fit. You can direct your money into both Roth and Traditional accounts in any percentage you choose.

For instance, you could put 5% of your paycheck into the Roth TSP and another 5% into the Traditional TSP. The only hard rule is that your total contributions can't go over the annual IRS limit. This "hybrid" approach is a smart way to build tax diversification, giving you a mix of tax-free and tax-deferred money to draw from when you retire.

What happens to my agency match if I only contribute to the Roth TSP?

This is a big one, and it trips a lot of people up. Even if you put 100% of your own money into the Roth TSP, the government's matching contributions will always go into your Traditional TSP account.

That applies to everything—the automatic 1% agency contribution and the additional 4% match. The practical outcome is that almost every federal employee getting a match will end up with both a Traditional and a Roth balance. It’s like a built-in diversification plan.

Can I roll my Roth TSP into a Roth IRA if I leave federal service?

Yes, once you separate from federal service, you can do a direct rollover from your Roth TSP to a Roth IRA. Many people do this to bring all their retirement accounts under one roof and access a wider world of investment options.

Before you make the move, though, weigh your options carefully. The TSP is famous for its rock-bottom administrative fees, which are tough to beat. On the other hand, a Roth IRA gives you nearly unlimited investment flexibility. For many, a rollover is the right call, but it’s not a one-size-fits-all decision.

A key advantage of rolling over is simply making life easier in retirement. When your assets are consolidated, you get a clearer view of your entire portfolio and can manage withdrawals more strategically.

Is there an income limit for contributing to the Roth TSP?

Nope! This is one of the Roth TSP's killer features. There are zero income limitations on contributions.

This is a huge advantage over the Roth IRA, which blocks high-income earners from contributing directly. As a federal employee, your salary doesn't matter—you can contribute up to the annual limit. This makes the Roth TSP an incredibly powerful tool for senior-level Feds and other high earners who want tax-free income in retirement but can't use a Roth IRA.

At Federal Benefits Sherpa, we help federal employees untangle these kinds of complex decisions every day. A personalized review can transform these rules and regulations into a clear, actionable retirement plan. Schedule your free 15-minute benefits review today to ensure you're on the right path.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved