Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

What Is the S Fund in TSP A Clear Guide for Federal Employees

When you're looking at your Thrift Savings Plan (TSP) investment options, you'll see five core funds. The S Fund, which stands for Small Cap Stock Index Fund, is your ticket to investing in a huge slice of the American economy that often gets overlooked.

Think of it this way: the S Fund lets you own a piece of thousands of small and medium-sized U.S. companies. These are the businesses not big enough to be in the S&P 500 index, which the C Fund tracks. In essence, you're investing in the next wave of potential market leaders.

Understanding the S Fund and Its Role in Your TSP

Let's use an analogy to make this crystal clear. Picture the U.S. stock market as a massive financial savanna.

The C Fund invests in the 500 largest, most established companies—the "lions" of the ecosystem like Apple, Microsoft, and Amazon. They are powerful, dominant, and household names.

The S Fund, on the other hand, invests in almost everything else. It holds the thousands of smaller and mid-sized U.S. companies with serious growth potential. These are the agile gazelles and cheetahs of the market—nimble, innovative businesses that could become the giants of tomorrow.

For a quick reference, here's a simple breakdown of what the S Fund is all about.

TSP S Fund at a Glance

CharacteristicDescriptionAsset ClassU.S. StocksCompany SizeSmall to Medium-Sized ("Small/Mid-Cap")Benchmark IndexDow Jones U.S. Completion Total Stock Market IndexPrimary GoalCapture the performance of U.S. companies not in the S&P 500.Role in a PortfolioGrowth and diversification alongside the C Fund.Risk ProfileConsidered high risk, with higher potential returns.

This table shows how the S Fund is specifically designed to round out your U.S. stock holdings, giving you a more complete picture of the market.

Capturing Broader Market Growth

By putting money into the S Fund, you’re not just betting on today's titans; you're also capturing the performance of a much wider segment of the U.S. economy. This is absolutely critical for smart diversification. If you only invest in the C Fund, your entire U.S. stock allocation is tied to the fate of a relatively small number of huge corporations.

The S Fund is the perfect partner to the C Fund. Its benchmark, the Dow Jones U.S. Completion Total Stock Market Index, literally exists to "complete" the S&P 500. When you own both, you effectively own the entire U.S. stock market.

While the big companies in the C Fund often provide stability, the smaller companies in the S Fund can offer much higher growth potential—though this often comes with more volatility.

The Big Idea: The S Fund’s main job is to give you a stake in the thousands of smaller U.S. companies that aren't in the C Fund. This ensures your TSP portfolio is truly diversified across the entire U.S. stock market, not just the top 500.

To see how this all fits together, our simple guide explaining how the TSP works breaks down the purpose of each core fund. Grasping these fundamentals is the first step to building a powerful retirement plan.

A Deeper Look at What the S Fund Invests In

If the C Fund is all about the big players—the household names of the U.S. economy—the S Fund is where you find the next wave of American businesses. So, what exactly are you buying into? The S Fund tracks a specific benchmark: the Dow Jones U.S. Completion Total Stock Market Index.

That name might sound a bit technical, but the concept is actually pretty straightforward. Think of it as the fund designed to "complete" the S&P 500. It essentially holds almost every publicly traded U.S. stock except for the 500 giants in the C Fund.

This means you're investing in the heart of America's growth engine. The S Fund is your ticket to the small and mid-sized companies that make up the backbone of the U.S. economy, covering roughly 3,300 companies in total. These are the scrappy innovators and rising stars poised for growth, operating just outside the shadow of the mega-corporations. For a closer look at its holdings, check out this deep dive into the TSP S Fund.

Understanding Small and Mid-Sized Companies

To really get what the S Fund does, it helps to break down terms like "small-cap" and "mid-cap." These labels simply refer to a company's total market value, or market capitalization.

Small-Cap Stocks: These are smaller public companies. They often have a ton of room to grow, but that potential also comes with more volatility as they fight to carve out their place in the market.

Mid-Cap Stocks: These companies are in a kind of sweet spot. They're past the risky startup phase and have proven business models, but they still have much more growth potential than the large, established giants.

Here’s an analogy: a small-cap company is like a successful local food truck that’s just starting to open brick-and-mortar locations. A mid-cap company is that same business a few years later, now a well-known regional chain with a solid customer base. The S Fund invests in companies all along that growth journey.

Key Takeaway: The S Fund is a powerful diversification tool. It pushes your portfolio beyond the multinational giants and gives you a stake in thousands of small and mid-sized U.S. businesses, where the next generation of market leaders is often found.

Why This Matters for Your Portfolio

By holding both the C Fund and the S Fund, you're essentially owning a slice of the entire U.S. stock market, not just the top 500. The C Fund acts as a stable foundation, while the S Fund adds a powerful engine for potential growth over the long haul.

This combination is what smart diversification is all about. If you only invest in the C Fund, you’re missing out on the innovation and expansion happening across thousands of other companies that drive a massive part of our economy. The S Fund ensures you're right there with them, participating in their success stories, too.

How The S Fund Compares To Other TSP Funds

To really get a handle on the S Fund, you have to see where it fits in the bigger TSP picture. Each of the core funds has a specific job, and they’re designed to work together. Think of it like a team—the S Fund is your high-scoring forward, but you still need defenders and a goalie. Its role becomes much clearer when you see how it complements the others.

You wouldn't build a house with just one tool, and you shouldn't build your retirement with just one fund. Understanding the whole toolkit is key.

The Five Core TSP Funds: A Quick Overview

The Thrift Savings Plan gives you five individual funds to choose from, and each one comes with its own unique risk-and-return profile. Getting these fundamentals down is the first step to building a portfolio that actually matches your timeline and goals.

Let's break down how the S Fund stacks up against its peers.

How the S Fund Compares to Other Core TSP Funds

This table gives you a side-by-side look at the five core funds. Pay attention to how the S Fund's role as an "aggressive growth" engine contrasts with the stability offered by the bond funds.

FundWhat It Invests InPrimary Risk LevelPortfolio RoleS FundU.S. small and mid-sized company stocksHighAggressive GrowthC FundU.S. large company stocks (S&P 500)HighGrowth & StabilityI FundInternational stocks from developed countriesHighInternational DiversificationF FundU.S. government and corporate bondsLowIncome & StabilityG FundUnique U.S. Treasury securitiesLowestCapital Preservation

As you can see, the S, C, and I Funds are all stock funds built for growth, though they go about it in different ways. On the flip side, the F and G Funds are bond funds, designed to provide stability and preserve your capital.

Stocks vs. Bonds: An Important Distinction

The most basic split in the TSP is between stocks (the S, C, and I Funds) and bonds (the F and G Funds). It’s a classic trade-off. Stock funds own pieces of actual companies, so they offer much higher potential returns but come with a lot more volatility and risk. Bond funds are basically loans you make to governments or corporations—they pay you back with interest, offering lower returns but far more stability.

Key Insight: The S Fund sits firmly on the aggressive side of the risk spectrum. If the G Fund is the anchor of your portfolio—keeping you safe in a storm—the S Fund is the main sail, designed to catch powerful economic winds and propel you forward.

For federal employees with decades until retirement, leaning into growth-focused funds like the S Fund can be a powerful wealth-building strategy. As you get closer to retirement, the focus typically shifts toward protecting what you've built, meaning you'll likely want more in the steady F and G Funds.

The S Fund and Its Stock Siblings: C and I

Even among the stock funds, the differences are important. The C Fund invests in America's largest, most established "blue-chip" companies. The S Fund, as we know, focuses on the smaller, up-and-coming U.S. companies with more room to grow.

Here's the cool part: when you combine the C Fund and the S Fund, you essentially own the entire U.S. stock market.

The I Fund adds another layer—geography. It invests in companies in developed countries outside the United States. This diversification is crucial because it can help cushion your portfolio if the U.S. economy hits a rough patch while international markets are doing well.

These aren't just academic differences; they have real-world implications for how you should allocate your money. If you prefer a more hands-off approach, you can learn more about how the Lifecycle Funds automatically blend these core funds in our guide on the TSP Lifecycle Income Fund. Each fund plays a vital part, and understanding their roles is what empowers you to make smarter decisions for your financial future.

Navigating the S Fund's Risk and Reward Profile

When it comes to investing, higher growth potential almost always comes with higher volatility. The S Fund is a textbook example of this classic trade-off. If you choose to invest in it, you're strapping in for a ride that can be much more turbulent than what you’d find in the steadier G or F Funds. Getting comfortable with this dynamic is the key to using the S Fund to your advantage.

Volatility is just a fancy word for how dramatically an investment's price swings up and down over a short period. Since the S Fund holds stocks of smaller, less-established companies, its value can react much more sharply to economic news, market shifts, and general investor mood. While those swings can feel unsettling day-to-day, they are also the very engine that drives those potentially higher long-term returns.

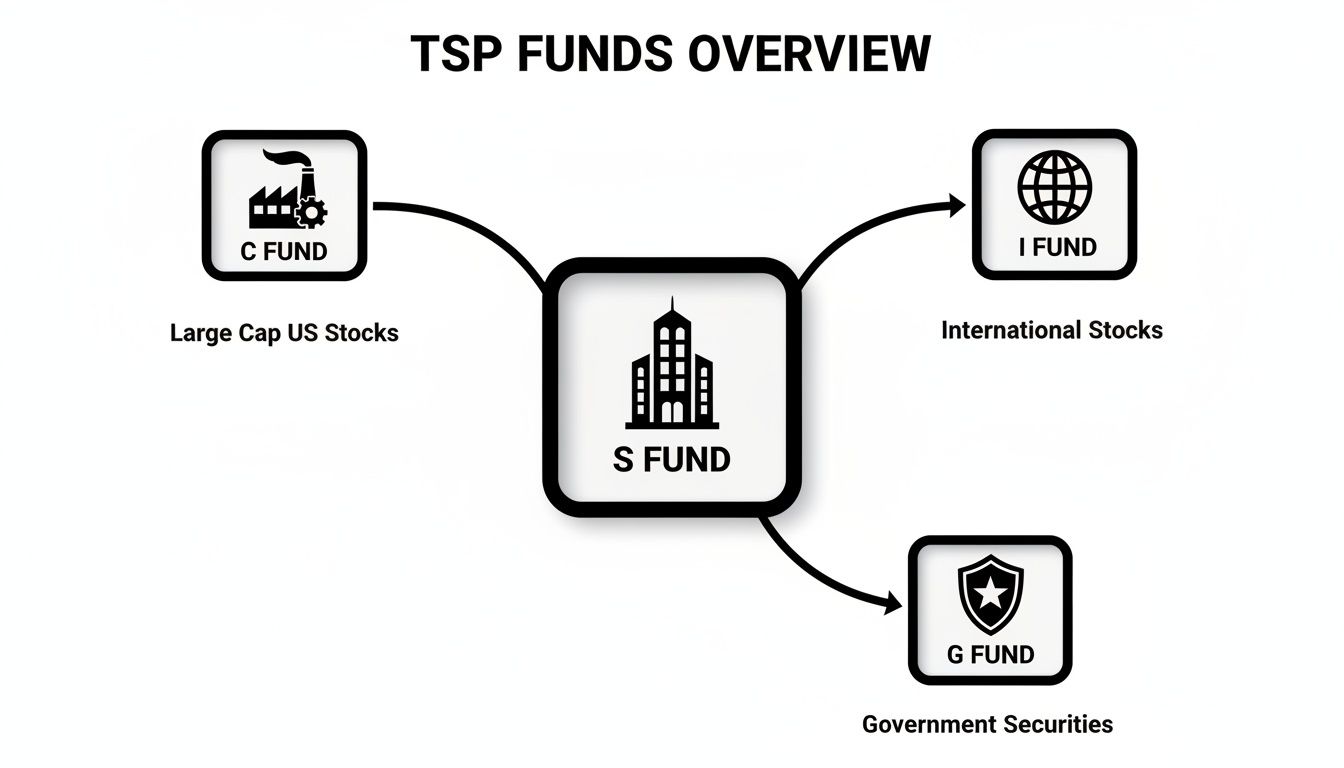

This image shows you where the S Fund fits into the bigger TSP picture, right alongside the C, I, and G funds.

As you can see, the S Fund is a core building block for growth, but it plays a very different role than the rock-solid G Fund or the large-company-focused C Fund.

Embracing Long-Term Growth Through Short-Term Swings

The secret to successfully investing in the S Fund is simple: think long-term. Market noise and sudden downturns aren't just possible; they're guaranteed. The investors who get spooked and sell during a dip are the ones who lock in their losses. Those who stay the course, however, are often rewarded when the market eventually turns around.

Think back to the wild ride of 2020. When the COVID-19 pandemic first hit, markets took a nosedive. But investors who held their ground saw an incredible rebound. That year, the S Fund delivered a jaw-dropping 31.85% gain, powered by the recovery of small-cap stocks as economic stimulus and vaccine news created a wave of optimism. In December alone, it jumped 7.24%, which just goes to show how quickly fortunes can turn for those with patience. You can read a full recap of the S Fund's remarkable 2020 performance on 401kspecialistmag.com.

This history teaches a vital lesson. The S Fund’s risk profile is a good match for investors with a long time horizon—we’re talking five years at a bare minimum, but ideally much longer. That gives your investment enough time to ride out the inevitable storms and capture the powerful growth cycles.

The Bottom Line: The S Fund demands patience. Its path isn't a smooth, straight line up; it's a series of peaks and valleys. Success requires a steady hand and the discipline to focus on its capacity for substantial growth over a full career, not its performance from one month to the next.

Historical Performance Insights

While we all know past performance never guarantees future results, looking back at historical data gives us some valuable context. Over many long stretches, small and mid-sized company stocks have managed to outperform their large-cap cousins in the C Fund. But it's also true that there are long periods where the opposite happens.

This cyclical nature is exactly why a balanced approach is so important. Instead of trying to guess which fund will be the star performer next year, a diversified strategy that includes both the C and S Funds lets you benefit from the strengths of each. This approach helps smooth out your overall returns and keeps you from making the common mistake of chasing last year's winner, which can really hurt your results in the long run.

Weaving the S Fund Into Your Retirement Strategy

Understanding what the S Fund is all about is the first step. Now, let’s get practical and figure out how to actually use this powerful growth fund to build your retirement nest egg.

The right way to use the S Fund really boils down to two things: your stage in your federal career and your personal comfort level with the stock market's ups and downs.

Think about it this way. If you’re a young fed with 30 years to go, time is your best friend. A healthy allocation to growth-oriented funds like the S Fund can act as a powerful engine for building serious wealth. When your retirement date is decades away, you can afford to ride out the market’s inevitable swings.

On the other hand, if you're getting ready to hang up your hat, your main goal shifts to protecting what you’ve built. For you, a much smaller slice of the S Fund might act as a "growth kicker"—giving your portfolio a little boost without putting your savings at major risk.

Portfolio Examples for Different Career Stages

Let's make this more concrete with a couple of sample portfolios. These aren't one-size-fits-all recommendations, but they clearly show how the S Fund's role can shift as you move through your career.

Aggressive Growth Portfolio (Early Career)

This kind of mix is geared toward someone with 20+ years until retirement who is willing to take on more risk for potentially higher returns.

40% C Fund: The foundation of large, stable U.S. companies.

30% S Fund: Your engine for small and mid-sized U.S. growth.

30% I Fund: Exposure to companies outside the United States.

Balanced Portfolio (Mid-to-Late Career)

This allocation is a better fit for an employee nearing retirement. It strikes a balance between growing your money and protecting it.

30% C Fund: Your core U.S. stock holdings.

15% S Fund: A smaller piece for continued growth potential.

15% I Fund: A dose of international exposure.

40% G & F Funds: Stability and income from government and corporate bonds.

Key Takeaway: Your S Fund allocation isn't something you set once and then ignore for 30 years. It should evolve right along with your financial situation and as your retirement date gets closer.

Since its creation in 2001, the S Fund has proven itself as a small/mid-cap workhorse, often delivering strong returns. And with incredibly low fees of around 0.059%, it lets you keep more of your money working for you compared to many private-sector funds. A great strategy for making the most of your regular TSP contributions is dollar-cost averaging, which can help smooth out the bumps of market volatility over time.

The Simpler Alternative: Lifecycle (L) Funds

If the idea of picking your own fund percentages feels overwhelming, don't worry—the TSP has a built-in solution. The Lifecycle (L) Funds are essentially pre-mixed portfolios.

Each L Fund holds a diversified mix of the five core TSP funds, including the S Fund. They are designed to automatically get more conservative as your target retirement date approaches, shifting money from stocks to bonds for you. This gives you a hands-off way to get S Fund exposure that's always tailored to your career stage.

If you'd rather be in the driver's seat, you can learn more about building your own mix in our guide to the top TSP investment strategies for federal employees.

Of course. Here is the rewritten section with a more natural, human-written tone.

Clearing Up Common S Fund Misconceptions

Bad advice can derail even the best-laid retirement plans. When it comes to the TSP, the S Fund seems to attract more than its fair share of myths, leading to allocation decisions that can really hurt your long-term growth.

Let's cut through the noise and tackle these flawed ideas head-on.

One of the biggest misconceptions I hear is that the S Fund is just "too risky" for the average federal employee. While it's certainly more volatile than the G Fund, this black-and-white thinking misses the whole point of investing. Risk isn't something you run from; it's something you manage.

For someone with decades left before retirement, the very volatility of the S Fund is what fuels its potential for impressive long-term growth. Sidestepping it completely means you're leaving a powerful wealth-building engine sitting on the sidelines.

"You Only Need the C Fund"

This one is particularly damaging. The idea that you can just dump everything into the C Fund and call it a day ignores one of the most fundamental principles of smart investing: diversification. The C Fund is great—it covers the 500 biggest U.S. companies. But the S Fund holds the next 3,300+ small and mid-sized companies.

Key Insight: Think of it this way: owning both the C and S Funds gives you a stake in virtually the entire U.S. stock market. Choosing to ignore the S Fund means you’re turning your back on thousands of innovative businesses that are a massive part of the American economic engine.

History has shown us time and again that market leadership changes. There have been long stretches where small-cap stocks (the S Fund) have run circles around large-cap stocks (the C Fund), and vice versa. Instead of trying to pick the winner each year, owning both ensures you're positioned to capture growth no matter where it comes from. It’s a simple, logical way to build a more resilient portfolio for the long haul.

Your Next Steps and S Fund Action Plan

Knowing what the S Fund is and how it works is great, but that knowledge doesn't do much for you until you put it into practice. Real wealth is built by taking action. Now that you understand what the S Fund is in TSP, let's translate that insight into a clear, actionable plan for your own account.

First things first: log into your TSP account. Get a clean look at where your money is right now. Don't worry about whether it's "right" or "wrong"—just take a snapshot. How much is sitting in the S Fund? What about its stock market cousins, the C and I Funds?

With that picture in mind, take an honest look at where you are on your career path. Are you a new federal employee with 30 years to go, or is retirement just around the corner? Someone with decades ahead of them can generally afford to take on the risk of a higher S Fund allocation, while someone nearing their retirement date might want to dial it back in favor of stability.

Creating Your Action Plan

After reviewing your current holdings and your timeline, it's time to decide if you need to make a change. There's no magic formula here. The "best" allocation is the one that's right for your personal goals and your ability to stomach market volatility.

Here's a simple checklist to walk you through it:

Review Current Allocation: Log in to the TSP website and see your exact fund breakdown.

Assess Your Timeline: How many years do you have until you plan to retire? This is the most critical factor.

Define Your Risk Tolerance: Can you handle the S Fund's inevitable ups and downs to capture its long-term growth potential?

Make Adjustments (If Needed): If your current mix doesn't align with your goals, use the TSP website to make an interfund transfer.

Set a Reminder: Put a note on your calendar to check in on your allocation at least once a year. Life changes, and your plan should, too.

Remember, the goal is not to chase last year's top performer but to build a balanced, long-term strategy. A well-considered plan you can stick with is far more powerful than reacting to short-term market news.

When to Seek Personalized Guidance

If you’re looking at all this and feeling a bit lost or overwhelmed, that’s completely normal. It’s also a good sign that it might be time to get a second opinion from an expert.

A financial professional who specializes in federal benefits can help you connect the dots between your personal situation and a concrete TSP strategy, making sure your investments are truly working toward the retirement you've envisioned.

At Federal Benefits Sherpa, we specialize in helping federal employees navigate these exact decisions. If you want to ensure your TSP strategy is optimized for your future, we invite you to schedule a free 15-minute benefits review to get personalized, expert guidance. Learn more and book your session at the Federal Benefits Sherpa website.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved