Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Your FERS Retirement Calculator Guide

A FERS retirement calculator is one of the most practical tools you can have in your corner. It takes all the complex pension rules and turns them into a straightforward financial forecast you can actually use. By plugging in key details—like your salary, years of service, and when you hope to retire—you can start to see what your future annuity might look like. It’s the first real step toward making smart decisions for your life after federal service.

Why a FERS Calculator Is Your Most Important Planning Tool

Let's be honest, planning for federal retirement can feel pretty abstract. It's a lot of rules, acronyms, and far-off dates. A FERS retirement calculator cuts right through that fog, giving you a tangible estimate of your future income. It's more than just a number-cruncher; think of it as a strategic guide that lets you visualize your financial future with some real confidence.

The Federal Employees Retirement System (FERS) is built on three main components. The real magic is seeing how they all work together, and a calculator is the best way to get that complete picture.

The Three Pillars of FERS

Your total retirement income under FERS isn't just one check. It’s a combination of three distinct sources working in tandem:

FERS Basic Benefit: This is your pension, plain and simple. It's a defined-benefit plan calculated with a specific formula based on your years of service and "High-3" average salary. This forms the predictable, steady foundation of your retirement income.

Social Security: Since you pay into Social Security as a federal employee, you'll receive those benefits just like anyone in the private sector. A good calculator helps you factor these expected payments into your overall plan.

Thrift Savings Plan (TSP): This is the government's version of a 401(k). The final amount you have depends on what you've contributed, your agency's matching funds, and how your investments have performed.

A FERS retirement calculator is designed to pull all these pieces together. It shows you how your pension, Social Security, and TSP savings combine to create your total retirement income stream. Without it, you're pretty much guessing how everything will fit.

The FERS framework, which has been in place since 1987, is a core part of federal employee compensation. It provides a reliable income stream that has helped millions of public servants transition into a secure retirement.

This system is a huge part of the federal benefits package. To give you some perspective, in 2022, federal pension plans covered about 2.7 million active civilian employees and paid out roughly $91.5 billion to retirees and their families. The average annual benefit was around $33,436, which shows just how much financial support the system provides. You can dig into the full data on federal pension benefits to see the broader economic impact. This context really drives home why forecasting your own benefits with a calculator is so critical for solid, long-term planning.

Gathering Your Essential Pension Data

Any FERS retirement calculator is only as good as the numbers you feed it. Think of it like a pre-flight check before you launch into retirement planning—getting the details right from the start is crucial. If you just guess, you'll get a fuzzy, unreliable picture. Precision now means a solid benchmark for your future.

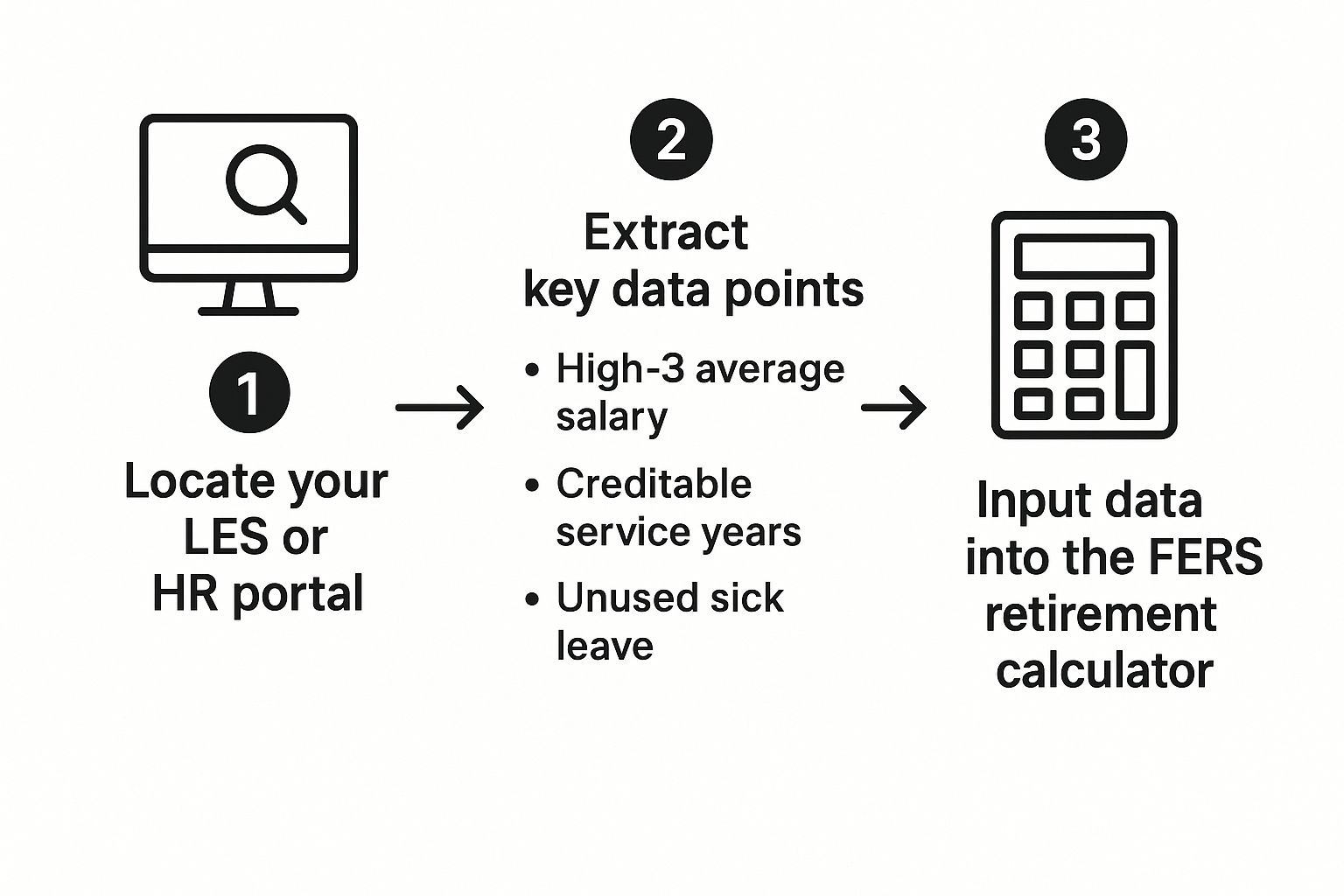

The whole process really just comes down to locating a few key pieces of information, pulling the exact numbers, and plugging them into the calculator.

This flowchart gives you a nice visual of how straightforward it is to find your data and use it to get a clear estimate.

As you can see, this isn't about guesswork. It’s all about methodically pulling specific figures from your official records to give the calculator what it needs.

Finding Your Core Numbers

So, where do you find this stuff? The most critical pieces of information are right there on your Leave and Earnings Statement (LES). You can also find them in your agency's online HR portal, like myEpp. These are your official records, so they’re the gold standard for accuracy.

Before you start, you'll need to hunt down three specific figures:

Your High-3 Average Salary: This is the average of your highest basic pay over any three consecutive years of your service. For most feds, this will be your final three years, but the calculator needs that specific average dollar amount, not just your current salary.

Creditable Service: This is the total time you've worked that actually counts toward your pension. It’s mostly your civilian service, but it can also include certain types of military service if you’ve made the required deposits.

Unused Sick Leave: Don't forget about this one! Your accumulated sick leave balance gets converted into additional creditable service at retirement, which can give your annuity a small but welcome boost.

A classic mistake is to just plug in your current salary instead of your actual High-3 average. This almost always inflates your pension estimate and sets you up for disappointment. Take the extra five minutes to find the correct figure in your HR records. It's worth it for a realistic projection.

Why Each Data Point Matters

Each of these numbers plays a very specific role in the FERS pension formula. Your High-3 salary is the foundation of the entire calculation. Your years of creditable service act as the multiplier. Even something that seems small, like unused sick leave, adds a little extra to that multiplier, nudging your final annuity payment higher.

For example, a federal employee with a High-3 of $95,000 and 30 years of service will get a very different pension than someone with a $92,000 High-3 and 28 years of service. The numbers might look close, but the formula is sensitive to these details.

This is why using precise, verified data is non-negotiable. By gathering these details carefully, you give the FERS retirement calculator the power to provide a clear, actionable preview of your financial future.

Getting Your Hands Dirty: A Walkthrough of the FERS Calculator

Alright, you've gathered all your important documents. Now for the fun part: plugging those numbers into a FERS retirement calculator and seeing what your future pension might look like. We’ll walk through a realistic example together to make this crystal clear.

Let's meet Alex, a federal employee who’s starting to map out retirement. We'll use Alex's details to fill in the calculator, showing you exactly how each piece of information influences the final number. This isn't about memorizing formulas; it's about understanding the inputs.

The Office of Personnel Management (OPM) is the official source for all things FERS, and their guidelines are what these calculators are built on.

As you can see on the OPM site, FERS is a three-part system. The calculator focuses on the first piece—your Basic Benefit—but understanding how they all connect is key.

The Big Three: Salary, Service Dates, and Sick Leave

First things first, you'll need to input the core numbers that form the bedrock of your pension calculation. Getting these right is non-negotiable for an accurate estimate.

Let's start with Alex's High-3 average salary, which is $98,500. Remember, this is the average of your highest 36 consecutive months of basic pay, not just your current salary. Next, Alex will enter the Service Computation Date: March 1, 1996. The planned Retirement Date is March 31, 2026.

Finally, don't forget your sick leave! Alex has saved up 800 hours of unused sick leave. When added to the total service time, this gives the final pension a nice little bump—in this case, adding about four and a half months of creditable service.

Fine-Tuning Your Estimate with Special Elections

Beyond the basic numbers, a good calculator lets you account for the personal decisions that will shape your retirement income. These options can seem confusing, but they're critical for a realistic forecast.

The FERS Annuity Supplement

This is a big one for early retirees. Alex plans to retire at age 60 with 30 years of service, making them eligible for the FERS Annuity Supplement. Think of it as a temporary payment that bridges the gap until you can start drawing Social Security at age 62.

To qualify, you generally need to:

Retire with an immediate, unreduced annuity.

Be younger than 62.

Have at least 30 years of service at your Minimum Retirement Age (MRA), or 20 years at age 60.

Alex will make sure to check this box in the calculator. Missing this step is a common mistake that can make your initial retirement years look much tighter financially than they actually will be.

The Survivor Benefit Election

Here's where you have to make a significant choice. Alex wants to ensure their spouse is taken care of, so they need to decide on a survivor benefit. The options are typically a full survivor annuity (50% of your pension) or a reduced one (25%).

Making this election will reduce your monthly pension payment while you're alive. The calculator is brilliant for this, as it will instantly show you the financial impact of each choice.

Choosing a survivor benefit is a trade-off between your own monthly income and your spouse's long-term financial security. A calculator removes the guesswork, letting you see the exact numbers behind what can be a very emotional decision.

Factoring in Cost-of-Living Adjustments (COLAs)

The last key input is an estimate for future Cost-of-Living Adjustments (COLAs). To be safe, Alex inputs a conservative estimate of 2.0% per year. This feature helps project how your pension's purchasing power might hold up against inflation over the long haul.

By carefully entering all these details, Alex has turned a generic calculator into a powerful, personalized planning tool.

Making Sense of Your Pension Estimate

Alright, you've punched in all your numbers, hit "calculate," and now a bunch of figures are staring back at you. This is the moment of truth. But what do these numbers actually mean for your life after you hang up your federal hat? Let's translate this raw data into something you can actually use.

That first big number—your gross monthly annuity—always looks pretty good, but it's really just the beginning of the story. To get a real sense of your future finances, we need to dig into the details and figure out what you’ll actually take home.

From Gross Annuity to Net Take-Home Pay

The first number that jumps out is your gross monthly annuity. This is the product of that core FERS formula: your High-3 salary, your years of service, and that 1% (or 1.1%) multiplier. It’s a solid starting point, but it's not what will land in your bank account each month.

Before you see a dime, several deductions will come right off the top. Think of it just like your current paycheck.

Federal Income Tax: Yep, Uncle Sam still gets his share. Your pension is taxable income.

Survivor Benefit Costs: If you chose to provide a survivor annuity for your spouse—a decision I almost always recommend—the premium for that coverage gets deducted here.

Health and Life Insurance Premiums: The cost of keeping your Federal Employees Health Benefits (FEHB) and any Federal Employees' Group Life Insurance (FEGLI) will also be taken out.

The number that really matters for your budget is the net annuity. A quality FERS calculator will help you estimate these deductions, giving you a much more realistic preview of your retirement cash flow.

Using Your Estimate to Answer the Big Questions

With a clear, realistic estimate in hand, you can start tackling the important questions. This is where the real power of this exercise lies—it forces you to square your retirement dreams with your financial reality.

Does that net income comfortably cover the lifestyle you have in mind? If the number feels a little tight, don't panic. The calculator has just done you a huge favor by giving you a heads-up while you still have time to act.

This is your cue to make adjustments. Maybe it means bumping up your TSP contributions to build a bigger nest egg. Or perhaps it makes sense to work a few more years to increase both your High-3 salary and your years of service.

Your pension estimate isn't a final judgment. It's a diagnostic tool. Use it to find the gaps in your plan now so you can make smart moves for a more secure future.

It's also worth remembering just how solid the FERS system is. Pension plans worldwide are feeling the strain from aging populations and economic volatility. A recent analysis of 52 global pension systems, covering 65% of the world's population, put a spotlight on the strength of well-funded plans like ours.

Countries like the Netherlands and Denmark earned top marks for their system's health, with the Netherlands scoring an impressive 85.4. You can dive into the findings from the Mercer CFA Institute Global Pension Index 2025 to see how different systems stack up. This global perspective really drives home the reliability of the FERS benefits you’re counting on.

At the end of the day, your FERS estimate is more than a number—it’s your roadmap. It gives you the clarity to navigate your final years in federal service with confidence, making sure your decisions are built on hard data, not just hope.

Modeling Different Retirement Scenarios

Running one pension calculation gives you a single data point. The real magic happens when you start running multiple scenarios. This is where a good FERS retirement calculator transforms from a simple tool into your personal strategy session, letting you actively shape your financial future.

This is your chance to play with the numbers and ask those critical "what-if" questions. By adjusting the inputs, you can see firsthand how seemingly small decisions today can have a massive impact on your income down the road.

Exploring Early vs. Later Retirement

One of the first things most feds want to know is how their retirement date affects the bottom line. What if you decide to hang it up three years earlier than you originally planned? The calculator will instantly show you the hit your annuity takes from having fewer years of service and likely a lower High-3 salary.

Now, flip that script. Model what happens if you stick it out for just two or three more years. You’ll see how the combination of more service credit and a higher High-3 average can cause a serious jump in your monthly pension. Seeing the numbers in black and white often makes the decision of exactly when to retire feel much less abstract.

The Impact of Promotions and Survivor Benefits

Beyond just your retirement date, a calculator is invaluable for weighing the financial consequences of other major career and life decisions. This is how you can truly understand the trade-offs you're considering.

Late-Career Promotions: Got a promotion recently, or is one on the horizon? Plug in that hypothetical future salary to see exactly how it boosts your High-3 and supercharges your final pension amount.

Survivor Benefit Costs: Are you wrestling with the decision to elect a full or partial survivor benefit for your spouse? A calculator lets you instantly see the difference in your monthly take-home pay for each option, making the choice much clearer.

Maximizing Sick Leave: Wondering if it's worth working a few extra months to cash in your unused sick leave for more service credit? Model it. You can quickly find out if that small pension bump is worth the extra time on the job.

Think of modeling different scenarios as stress-testing your retirement plan. By comparing the hard numbers side-by-side, you can confidently choose the path that best aligns with what you want for your future.

It's also worth remembering that your FERS pension is an incredibly stable asset. The global pension fund market is a massive ecosystem, with total assets projected to hit an astonishing $58.5 trillion by 2025. This huge pool of money highlights just how important well-funded retirement systems are. If you're interested in the bigger picture, the Global Pension Assets Study 2025 offers some fascinating insights.

By taking the time to compare these scenarios, you're not just guessing—you're building a retirement strategy that's resilient and built just for you.

Clearing Up Common Questions About FERS Calculators

Even the best FERS retirement calculators can leave you with a few lingering questions. As you start playing with different retirement dates and scenarios, you’ll naturally wonder about accuracy, potential pitfalls, and how things like the FERS supplement fit into the picture.

Let’s walk through some of the most common sticking points I see federal employees run into. Getting these sorted out will give you the confidence that you’re not just crunching numbers, but actually understanding the story they tell about your financial future.

Just How Accurate Are These Calculators, Really?

The accuracy of any FERS retirement calculator hinges entirely on one thing: the quality of the information you put in. Garbage in, garbage out, as they say.

If you plug in your precise High-3 salary, your exact service dates, and your up-to-date sick leave balance, the estimate you get will be incredibly close to what the Office of Personnel Management (OPM) will calculate for you.

That said, you should always treat the result as a high-quality estimate. The final, official number will only come from OPM after you’ve formally submitted your retirement application. Think of the calculator as an essential planning tool, not the final word.

Your calculator is your best friend for strategic planning, but it's not a substitute for the official OPM adjudication process. The goal is to get within 1-2% of the final number, which is more than enough to make solid financial decisions.

What are the Most Common Mistakes to Watch Out For?

After helping countless federal employees, I've noticed that most errors boil down to just a few key areas. If you pay close attention to these inputs, you’ll sidestep the common frustrations and get a far more reliable result.

Getting the High-3 Salary Wrong: This is the big one. So many people just punch in their current salary instead of calculating the actual average of their highest 36 consecutive months of pay. They are rarely the same number.

Forgetting to Add Unused Sick Leave: Don't leave money on the table! This is a frequent oversight. Your unused sick leave balance is converted directly into additional creditable service, which can give your final pension a nice little bump.

Ignoring the FERS Annuity Supplement: If you’re planning to retire before age 62 and are eligible for the supplement, make sure you account for it. Forgetting to factor it in can make your projected early retirement income look a lot smaller than it will actually be.

Double-checking these three things is the quickest way to improve the quality of your estimate. It’s like proofreading your retirement plan before you turn it in.

Planning your federal retirement means navigating complex rules and making decisions that will last a lifetime. At Federal Benefits Sherpa, we specialize in making this process clear and manageable, offering personalized guidance to help you maximize your benefits. Let us help you build a confident path to a stress-free retirement. Schedule your free 15-minute benefit review today at https://www.federalbenefitssherpa.com.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved