Blogs

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Blog title place here

We understand that every federal employee's situation is unique. Our solutions are designed to fit your specific needs.

Your Guide to the Federal Long Term Care Insurance Plan

The Federal Long Term Care Insurance Plan, or FLTCIP as it's commonly known, is a dedicated group insurance program set up for the federal family. It’s designed to tackle a very specific, and often very expensive, problem: the cost of long-term care services.

These aren't the kinds of things your regular health insurance typically touches. We're talking about help with daily living activities that many people eventually need, making this plan a critical financial safety net established by the U.S. Office of Personnel Management (OPM).

Getting to the Heart of FLTCIP’s Purpose

The best way to think about the Federal Long Term Care Insurance Plan is as a specialized shield for your life savings. Its entire reason for being is to protect your assets from being wiped out by the staggering costs of long-term care.

This is a key distinction. Your health insurance is for doctor's appointments and hospital stays. Long-term care insurance steps in for what's called "custodial care."

Essentially, it helps pay for assistance with the fundamental tasks of daily life—what the industry calls Activities of Daily Living (ADLs). This includes things like bathing, dressing, eating, or just getting from one room to another. It also covers care needed due to severe cognitive issues, such as Alzheimer's disease. The FLTCIP is just one part of the puzzle; you can see how it fits into the bigger picture in the comprehensive federal employee benefits handbook.

What Kind of Care Are We Talking About?

The plan was built with flexibility in mind, covering a broad spectrum of services and settings. The idea is to let you get care where you feel most comfortable, whether that's in your own home or in a specialized facility.

Here are the main types of care it covers:

In-home care: This could be a visiting nurse, a therapist, or a home health aide who comes to you.

Assisted living facilities: These are residential communities where you can get support with your daily routine.

Nursing home care: For those who need a higher level of skilled nursing and medical attention.

Hospice and respite care: This includes end-of-life care and services that give a primary caregiver a much-needed break.

The most important takeaway here is that your standard health insurance and even Medicare offer very little in the way of long-term care benefits. This is a huge, expensive gap in coverage that FLTCIP was specifically created to fill.

An Important Update: New Applications Are on Hold

Right now, one of the most critical facts about FLTCIP is that OPM has temporarily suspended all new applications. If you're not already in the plan, you can't sign up for new coverage. Even current members can't apply to increase their benefits.

This decision was made to allow OPM to assess the program's long-term financial health amidst a volatile market. For anyone currently weighing their long-term care strategy, this suspension makes exploring other options more essential than ever.

Who Actually Qualifies for FLTCIP Coverage?

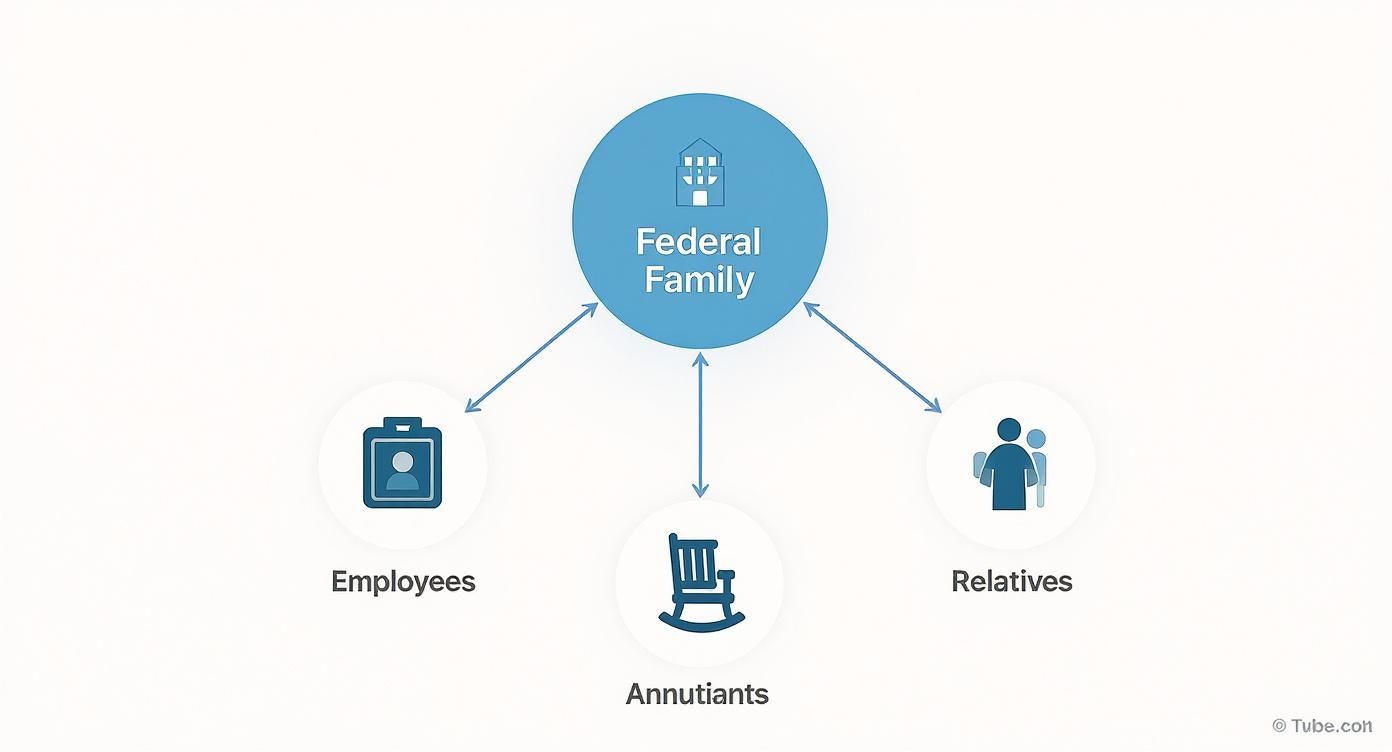

It’s a common myth that the Federal Long Term Care Insurance Plan is only for current, active federal employees. The truth is, the eligibility net is cast much wider, covering people at all stages of their federal career and even extending to their families. Figuring out if you or a loved one fits into this "federal family" is the first step.

The program was intentionally designed to be inclusive, though it's important to remember that new applications are currently on pause. Still, understanding these rules is crucial for when the program eventually reopens its doors.

The Core Groups Who Are Eligible

At its foundation, the FLTCIP is open to most people working for the U.S. Federal Government and the U.S. Postal Service. But your eligibility doesn't necessarily end when your federal career does.

Active Federal and Postal Service Employees: If you're an employee who is eligible for the Federal Employees Health Benefits (FEHB) Program, you can generally apply. The key word here is eligible—you don't actually have to be enrolled in FEHB to qualify for FLTCIP.

Federal and Postal Service Annuitants: Already retired? If you're receiving an annuity from a federal civilian retirement system, you can still apply. This keeps the door open for long-term care planning long after you've clocked out for the last time.

Active and Retired Uniformed Service Members: This is a big one. It covers members of the Army, Navy, Air Force, Marine Corps, Coast Guard, Space Force, and the Commissioned Corps of both the National Oceanic and Atmospheric Administration and the Public Health Service. Eligibility is there for you whether you're on active duty or already retired.

What About Family Members?

This is where the rules can get a bit fuzzy for people, but it’s also one of the program's most powerful features. The FLTCIP allows certain relatives of eligible federal employees and retirees to apply for their own coverage, which makes sense since long-term care is rarely just an individual issue.

The FLTCIP really shines in how it acknowledges the wider family circle. It's not just a plan for the employee; it's a potential safety net for the people they care about most.

So, who counts as a "qualified relative"?

Spouses: The current spouse of an eligible federal employee or retiree.

Domestic Partners: This includes both same-sex and opposite-sex domestic partners.

Adult Children: Your kids who are at least 18 years old can apply for their own policy. This covers natural children, adopted children, and even stepchildren.

Parents and Parents-in-Law: The parents, stepparents, and parents-in-law of an eligible employee can also apply. This is a huge help for many in the "sandwich generation" who are worried about how to manage care for their aging parents.

It's important to know that every relative applies on their own. They have to fill out their own application and go through the same underwriting process to see if their health qualifies them for coverage. This broad eligibility makes the federal long term care insurance plan a surprisingly flexible tool for family-wide financial planning.

How Your FLTCIP Coverage Actually Works

It's one thing to have a federal long term care insurance plan, but it's another to really get how the money pays out when you actually need it. This isn't like winning the lottery where a pile of cash just shows up. The FLTCIP is a structured benefit designed to pay for specific care costs right when you need help with daily life.

Let’s break down what your policy is made of, in simple terms. Think of your coverage as a personal savings account, but one that’s specifically for long-term care. You decide how much goes in (your total benefit) and the maximum you can withdraw each day. This structure makes sure the funds are there for the long haul.

The Building Blocks of Your Benefits

When you first enroll, you’ll make a couple of key decisions that define your entire policy. These choices directly shape how much your plan will pay per day and, ultimately, how long those payments will last. The two main levers you control are the Daily Benefit Amount and the Benefit Period.

The FLTCIP is designed to cover a wide net of people connected to the federal government—not just current employees, but also retirees and even qualified family members.

This setup creates a valuable safety net that can extend to your entire family, which is a unique aspect of this federal program.

Here's how your choices create that pool of money:

Daily Benefit Amount (DBA): This is the maximum amount your policy will reimburse for your care in a single day. If you choose a $200 DBA, that’s your daily spending cap for covered services, whether it’s for a home health aide or a stay in a nursing facility.

Benefit Period: This is the minimum amount of time your benefits are guaranteed to last if you use your full DBA every single day. Common options are two, three, or five years, and some plans used to offer a lifetime benefit.

Here's the simple math: Your total pool of money is just your Daily Benefit Amount multiplied by your Benefit Period. So, a $200 DBA with a three-year benefit period (1,095 days) gives you a total benefit pool of $219,000 to work with.

Activating Your Coverage: The Waiting Period

Before your benefits actually start paying out, you have to get through a waiting period. You can think of it as a deductible, but it’s measured in time, not dollars.

This is a set number of days—typically 90 days—that must pass while you are eligible for benefits before the insurance company starts reimbursing you for care. You’re on the hook for your care costs during this initial period. Once you’ve satisfied the waiting period, your FLTCIP coverage kicks in and starts paying for eligible expenses, up to your daily limit.

Protecting Your Future with Inflation Protection

This might be the single most important feature of your federal long term care insurance plan. You could be buying your policy decades before you ever need to use it, and we all know one thing for sure: the cost of care is going to go up. A lot.

Inflation protection is designed to solve this problem by automatically increasing your Daily Benefit Amount over time. It helps your coverage keep pace with the rising costs of labor and medical services.

Without it, a $200 daily benefit that seems perfectly reasonable today could be woefully inadequate 20 or 30 years down the road. This feature is absolutely critical to making sure your financial shield is still strong when you finally need it.

Breaking Down the Cost of FLTCIP Premiums

Let's get right to the big question: what does a federal long term care insurance plan actually cost? The short answer is, there's no one-size-fits-all price. Your premium is a custom number, calculated based on who you are and the specific coverage you decide to build.

It’s a bit like buying a car. The base model has a starting price, but once you start adding a more powerful engine, a sunroof, or that premium sound system, the final cost changes. Your FLTCIP premium works the same way—it directly reflects the level of financial protection you want.

The Main Drivers of Your Premium Cost

Your premium isn't just a number pulled from a hat. It's carefully calculated based on risk and the benefits you choose. A good rule of thumb is that the younger and healthier you are when you apply, the lower your premium will be for the rest of your life. That's because the insurer has more time to collect premiums before you're likely to ever need care.

Here are the primary things that will shape your monthly payment:

Your Age When You Apply: This is easily the biggest factor. A 45-year-old will lock in a much lower rate than a 65-year-old for the exact same coverage.

Your Health at Application: You’ll go through an underwriting process where they review your health history. Certain pre-existing conditions can lead to a higher premium or, in some cases, might mean you're not approved for coverage.

The Coverage You Select: This is where you have the most control. Picking a larger Daily Benefit Amount, a longer Benefit Period, or stronger inflation protection will naturally increase your premium.

It all comes down to a trade-off between today's cost and tomorrow's protection. A lower premium means less coverage down the road, while a higher premium secures a much stronger financial safety net for your future.

Here’s a simple table to show how your choices can pull your premium in one direction or the other.

Estimated FLTCIP Premium Factors

FactorLow Premium ImpactHigh Premium ImpactAge at ApplicationApplying in your 40s or 50sApplying in your 60s or laterHealth StatusExcellent health, no chronic conditionsPre-existing conditions or a complex health historyDaily BenefitLower amount (e.g., $150/day)Higher amount (e.g., $300/day)Benefit PeriodShorter duration (e.g., 2-3 years)Longer duration (e.g., 5 years or lifetime)Inflation ProtectionAutomatic Compound Inflation Option (ACIO)Future Purchase Option (FPO) or no inflation protection

As you can see, the choices you make during enrollment have a direct and significant impact on your monthly cost.

A Realistic Look at Premium Increases

This is a critical point that everyone needs to understand: FLTCIP premiums are not guaranteed to stay the same forever. Over the years, many enrollees have seen their premiums go up, sometimes significantly. This isn't a problem unique to the federal plan; it reflects a major trend across the entire long-term care insurance industry.

These adjustments happen when the original math—based on things like life expectancy and the cost of care—doesn't match up with reality. As people live longer and care costs rise faster than anyone predicted, insurers have to raise premiums to make sure there's enough money to pay out all future claims. Knowing this is a possibility is key to setting realistic expectations for your long-term budget. It's just as important as understanding the factors that can influence your pension; you can find more detail in our guide on how to calculate pension benefits.

How Benefit Choices Affect Your Bottom Line

Your decisions at the outset have a real, tangible impact on your costs. For instance, industry data shows a 65-year-old male buying a policy with $165,000 in level benefits might pay an average annual premium of $1,750.

But if that same person adds a feature for his benefits to grow by 5% each year to keep up with inflation, the premium can jump to $4,255. This is a perfect example of how much robust inflation protection can cost. You can discover more insights about these long-term care insurance facts to see how different factors come into play. It proves that building a more powerful financial shield requires a larger upfront investment in your federal long term care insurance plan.

Navigating Enrollment and Filing a Claim

Knowing the ins and outs of your federal long term care insurance plan is just as crucial as understanding what it covers. There are really two sides to this coin: the process of getting into the plan, and the process of activating your benefits when you need them.

Whether you're hoping to enroll down the road or you're a current policyholder planning for the future, getting a handle on these procedures is key. Let's break down what you need to know about each.

The Current State of Enrollment

Right off the bat, here's the most important thing to know about enrollment: the Office of Personnel Management (OPM) has currently paused all new applications for the FLTCIP. If you're not already in the program, you can't sign up right now.

This suspension happened because the long-term care market has been incredibly volatile, making it tough to set premiums that are both fair and sustainable. In fact, these pressures led OPM to extend the pause for another 24 months starting in late 2024. For the official word, you can always check the FLTCIP program status directly with OPM.

When the program eventually reopens for applications, you can expect the process to involve a detailed application (either online or on paper) and a thorough health underwriting review. For now, the best bet is to keep an eye on the official FLTCIP website for any news.

How to File a Claim and Activate Your Benefits

If you're already an enrollee, activating your benefits starts the moment you realize you need help with everyday life. Think of filing a claim as officially raising your hand to say, "I'm ready to start using the coverage I've been paying for."

The process is designed to confirm your eligibility and get the payments flowing from your policy. Here’s how it generally works, step-by-step:

Notify the Insurer: Your first move is to get in touch with the FLTCIP administrator, Long Term Care Partners, and let them know you need to start a claim. They’ll get you the right forms and walk you through the initial steps.

Get Medical Certification: A licensed healthcare practitioner will need to certify your condition. This means they must formally state that you can't perform at least two of the six Activities of Daily Living (ADLs) on your own, or that you have a severe cognitive impairment, like Alzheimer's.

Create a Plan of Care: This same practitioner will work with you to create a formal Plan of Care. This is essentially a roadmap that details the specific care and services you need. The plan is used to ensure the support you receive is covered under your policy.

Complete the Waiting Period: Once your claim is approved, a clock starts on your 90-day waiting period. This is like a deductible, but measured in time instead of dollars. You'll cover your own care costs during this three-month window. After those 90 days are up, the FLTCIP starts reimbursing you for your covered expenses, up to the daily benefit amount you chose.

FLTCIP Compared to Other Long Term Care Solutions

Since new applications for the federal long term care insurance plan are currently on hold, it’s a good time to take a step back and look at the whole picture. The FLTCIP is a solid program, but it’s just one piece of the puzzle. Getting a handle on how it compares to private insurance and public benefits is crucial for making a smart decision that will protect you down the road.

Think of it like this: the FLTCIP is a specialized group plan, kind of like a benefit you get through your employer. Private insurance, on the other hand, is the open market. You'll find a much wider range of options and price tags, but it also means you've got more homework to do to find what works for you.

FLTCIP Versus Private Long Term Care Insurance

When you put the federal plan side-by-side with private policies, a few things jump out right away. Private insurance often gives you more wiggle room in how you design your plan. You can find hybrid policies that blend life insurance with long-term care benefits, or plans with different waiting periods and triggers for when your benefits kick in.

That said, the approval process for private plans can sometimes be tougher than the FLTCIP's was. The federal program was built for a large, stable pool of employees, which used to offer some real advantages. Now that the FLTCIP isn't accepting new applicants, the private market is really the only path forward for anyone seeking new coverage. This is a big change for federal employees who once had a clear, employer-sponsored option.

Your health benefits are a cornerstone of your financial security. Just like you'd compare different health plans, it's vital to weigh all your long-term care options to find the one that truly protects your future.

The Misconception About Medicare and Medicaid

Here’s a common—and dangerous—misunderstanding: many people assume that Medicare or Medicaid will automatically cover their long-term care needs. This simply isn't true. Knowing what these programs actually do, and more importantly, what they don’t do, is essential.

Medicare’s Limited Role: Let's be clear: Medicare is not long-term care insurance. It might cover a short stint of skilled nursing care after a qualifying hospital stay (for up to 100 days), but it doesn't pay for the ongoing custodial care most people need. That means help with everyday activities like bathing, dressing, or eating is not covered.

Medicaid as a Safety Net: Medicaid does cover long-term care, but it’s a program for people with very few financial resources. To qualify, you have to "spend down" almost all of your assets. It’s a critical safety net, but it's not something you plan for; it's what happens when you've exhausted all other options.

The numbers here are staggering. By 2025, Medicaid and CHIP together enrolled over 77 million people, making Medicaid the single largest payer for long-term care in the U.S. Meanwhile, over 54% of eligible beneficiaries have moved to Medicare Advantage plans, which can sometimes offer small, limited long-term care perks. You can discover more insights about these Medicare trends on kff.org. These statistics show the massive scale of public programs, but they also underscore their specific and often restrictive roles.

Ultimately, the right choice comes down to your personal finances and your goals for the future. Relying on Medicare is a losing strategy, and using Medicaid means you’ll have to drain your life savings first. For most federal employees, having a dedicated insurance plan—whether it's a private policy or a pre-existing federal long term care insurance plan—is still the best way to protect your hard-earned assets. This is just as important as your health insurance. To see how all the pieces of your benefits puzzle fit together, take a look at our guide to the Federal Employees Health Benefits Program (FEHB).

Your Top FLTCIP Questions, Answered

Thinking about the federal long term care insurance plan can bring up a lot of questions, especially with all the recent changes. Let's walk through some of the most common things federal employees ask about the program.

Can I Still Apply for FLTCIP Right Now?

Unfortunately, no. The Office of Personnel Management (OPM) has put a temporary hold on all new applications for the FLTCIP. This pause gives them time to take a hard look at the program's long-term financial health.

This suspension also means that current enrollees can't apply to increase their coverage. To stay in the loop on when applications might reopen, your best bet is to keep an eye on the official FLTCIP website.

Are My FLTCIP Premiums Guaranteed for Life?

Premiums are not set in stone. In fact, FLTCIP has a track record of increasing premiums over the years, which is a common trend across the entire long-term care insurance industry.

These rate hikes are a necessary evil, designed to make sure the program has enough funds to cover its promises to policyholders as healthcare costs climb and people live longer.

When you're planning your retirement budget, it's smart to assume that your federal long term care insurance plan premiums could go up. Factoring this in from the start is a key piece of solid financial planning.

What Happens if I Leave Federal Service?

Good news here—your FLTCIP coverage is completely portable. You can take it with you when you leave your federal job, whether you're retiring or moving to the private sector.

You'll just need to switch from payroll deductions to paying the insurance carrier directly. This ability to keep your coverage no matter where your career takes you is one of the program's biggest advantages.

Does FLTCIP Cover Care from a Family Member?

Yes, it often can, but there are some specific rules you need to know. The plan can cover care from an informal caregiver, like a family member, as long as that person meets certain criteria.

Specifically, the caregiver can't be your spouse or domestic partner, and they can't be living with you when you first start needing care. It’s always best to check your individual policy documents to understand exactly how this works for you.

At Federal Benefits Sherpa, our goal is to help you navigate the complexities of your benefits and build a retirement you can feel confident about. If you're looking for clarity on your financial future, schedule your free 15-minute benefit review today.

Dedicated to helping Federal employees nationwide.

“Sherpa” - Someone who guides others through complex challenges, helping them navigate difficult decisions and achieve their goals, much like a trusted advisor in the business world.

Email: [email protected]

Phone: (833) 753-1825

© 2024 Federalbenefitssherpa. All rights reserved