ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

3 Key Differences Between Personal and Business Credit Scores

"Understanding the differences between personal and business credit scores is essential for effective financial management." - Unknown

Introduction:

When managing your financial health, it's crucial to understand how personal and business credit scores differ.

Here are three significant distinctions that can impact how you approach credit for yourself and your business:

3 Key Differences Between Personal and Business Credit Scores

1. Time Frame for Risk Assessment

Personal Credit Scores: These scores, based on your past credit behavior, predict your risk of defaulting on an obligation over the next 24 months. They provide valuable insight into how likely you are to be 90 days late on an account, preparing you for potential financial challenges.

Business Credit Scores: In contrast, business credit scores evaluate the risk of your business defaulting on an obligation within the next 12 months. This shorter time frame predicts your business will be 90 days late on an account.

2. What the Score Represents

Personal Credit Scores: These scores are a reflection of an individual's risk of defaulting on credit obligations. They are a direct result of personal credit history, including payment history and credit utilization, and carry significant implications for your financial health.

Business Credit scores represent the risk of a business defaulting on its obligations. They are derived from how the business manages its financial commitments, not the business owner's personal credit habits.

3. Score Range

Personal Credit Scores typically range from 350 to 850, with 850 being the highest possible score. This scale reflects an individual's creditworthiness and ability to manage personal credit. For instance, a score above 700 is generally considered good and can help you qualify for better loan terms, while a score below 600 may limit your borrowing options.

Business Credit Scores often range from 0 to 100, with 100 being the top score. This range measures the business's credit risk and overall financial health, reflecting how well it handles its credit obligations.

Understanding these differences is crucial for managing your personal and business credit effectively. By keeping these distinctions in mind, you can better navigate credit decisions and maintain a solid financial standing for you and your business.

#2ezbizcredit #bluediamondsolutions #PersonalCredit #BusinessCredit #CreditScoreDifferences #CreditManagement #BusinessFinance #CreditScoreRange

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

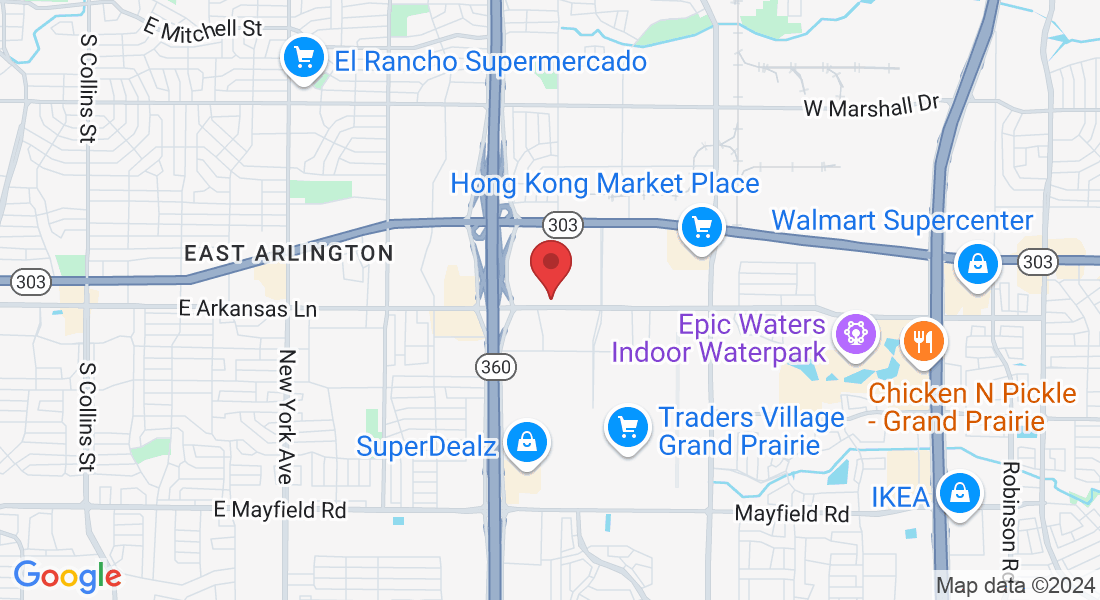

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.