ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

Top Funding Sources for Independent Contractors, Owner-Operators, and Fleet Owners: Your Role in the Trucking Industry

Top Funding Sources for Independent Contractors, Owner-Operators, and Fleet Owners: Your Role in the Trucking Industry

As an independent contractor, owner-operator, or fleet owner, managing your business's finances can often feel like a never-ending journey. Whether you need cash flow for repairs, fuel costs, or fleet expansion, having access to suitable funding sources can provide a sense of relief and security, potentially making or breaking your trucking business.

Here's a Diverse Range of Top Funding Sources to Consider:

Business Credit Cards

Business credit cards are a versatile tool, offering quick access to funds for daily operations, including fuel and repairs. Many cards provide high limits, giving you more financial flexibility.

Asset-Based Funding

To secure funding, leverage your assets—like trucks, trailers, and equipment. Asset-based financing doesn't rely on your credit score, making it an excellent option if your credit isn't ideal.

Equipment Leasing

Expand your fleet without draining your savings. Equipment leasing allows you to lease the trucks or trailers you need without significant upfront costs.

Factoring

Need cash fast? Factoring allows you to sell unpaid invoices to a third party at a discount for immediate cash flow. This is ideal for covering short-term costs like fuel and payroll.

Lines of Credit

A line of credit provides revolving access to funds, usually with lower interest rates than business credit cards. This is great for emergencies or when you need a safety net.

SBA Loans

If you want to expand your trucking business, SBA-backed loans offer favorable terms with less risk to lenders. These loans are beneficial for fleet owners planning significant upgrades.

Merchant Cash Advances

For trucking businesses that process credit card payments, merchant cash advances offer an easy way to borrow against future sales. They are perfect for covering short-term needs like maintenance and payroll.

Microfinance Loans

Microfinance loans are available for businesses needing smaller funding, typically between $500 and $35,000. They have more straightforward qualifying criteria, making them accessible for newer owner-operators.

Grants

Government and industry-specific grants are available for trucking companies looking to invest in new technology or sustainability initiatives. Unlike loans, you don't have to repay a grant.

"The road to success is always under construction." – Lily Tomlin

Final Thoughts

Independent contractors, owner-operators, and fleet owners have many funding options. The right funding solution can help your trucking business stay on the road, grow, and handle unexpected expenses.

#2ezbizcredit #BlueDiamondBusinessSolutions #OwnerOperatorFunding #FleetOwnerLoans #TruckingBusinessFinance #IndependentContractorFunding #FactoringForTruckers #TruckEquipmentLeasing #SBAloans #AssetBasedLending #BusinessCreditForTruckers #TruckDriverFinance #TruckFundingSolutions #TruckingCashFlow

Are you seeking the proper funding to keep your trucking business moving forward? Visit 2ezbizcredit.com today to discover your best financing options and keep your fleet running strong!🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

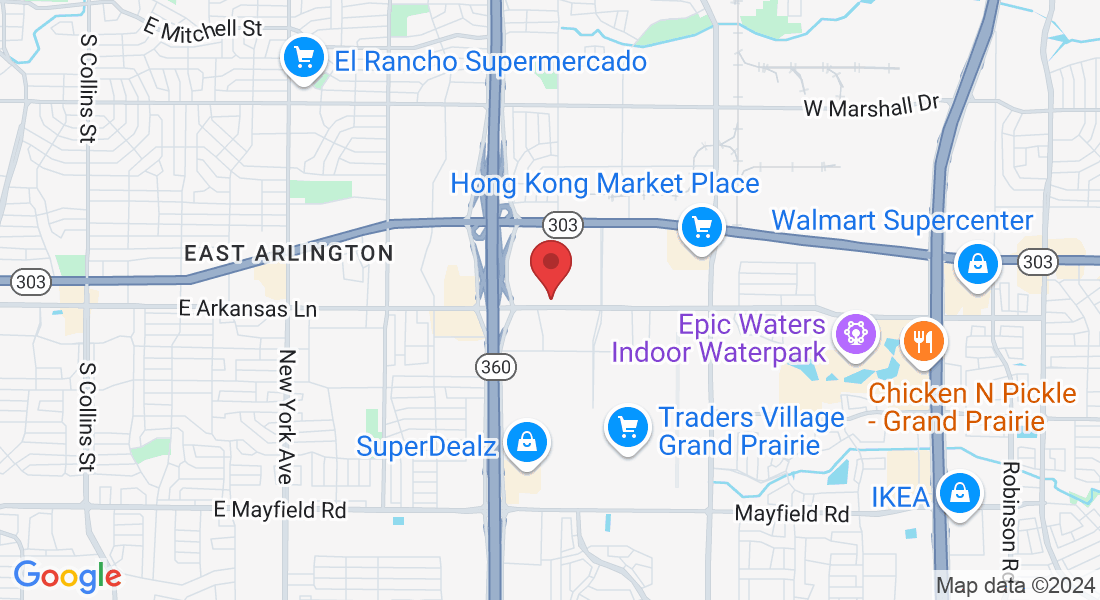

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.