ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

Business Credit Benefits for Truckers

"Success is the result of preparation, hard work, and learning from failure." - Collin Powell

Introduction:

Picture the potential of a $50,000 or more financial boost for your trucking business. Whether you're an independent truck driver, run a small truck, or work as a freight broker, a robust business credit profile can be the key to unlocking essential funding that propels your growth.

Let’s delve into these critical factors and see how they apply to your business.

The 5 Cs of Business Credit: How Understanding These Key Factors Can Improve Your Chances of Loan Approval

Why Business Credit Matters

For truckers and small trucking businesses, business credit is a powerful tool. With a solid credit profile, you'll have nearly limitless borrowing power. Conversely, a weak credit profile can make securing funds for repairs, fleet expansion, or operational costs challenging. This is why savvy businesses in the trucking industry leverage business credit to fuel their success. It's not about needing money to survive but using it strategically to accelerate growth.

The Secret of Business Credit

Many trucking business owners may feel the need to become more familiar with the benefits of business credit or how to build it. However, understanding business credit can be a game-changer for your operations, empowering you with the knowledge to make strategic financial decisions. A robust business credit profile allows lenders to evaluate your business on its merits, not your credit history. This is particularly advantageous if your credit has suffered setbacks.

Even if your credit is stellar, relying on business credit can double your borrowing power. You'll be able to access larger loans or lines of credit. You'll need them specifically for your trucking needs—whether it's for purchasing new trucks, covering maintenance, servicing, or managing fuel costs.

Personal Guarantees and Protection

One of the most significant advantages of business credit is the potential to avoid personal loan guarantees. In case of adversity, your personal assets, such as your home or savings, remain secure. Business credit offers a protective shield, allowing you to concentrate on expanding your trucking business without personal risk.

Enhancing Your Business Credibility

A robust business credit profile also enhances the credibility of your trucking business. Whether you're in negotiations with business owners or suppliers, a solid credit profile enhances the perception of your business as reliable and trustworthy. This can give you a significant advantage in business dealings and negotiations.

Conclusion

Building and maintaining strong business credit is essential for independent truck drivers, small trucking companies, and freight brokers who want to expand their operations and secure funding without personal risk. Understanding and leveraging the benefits of business credit can unlock new opportunities and drive your business forward.

#2ezbizcredit #bluediamondsolutions #TruckingBusinessCredit #TruckingFunding #FreightBrokerCredit #IndependentTruckers #BusinessLoansForTruckers #NoPersonalGuarantee #GrowYourTruckingBusiness

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

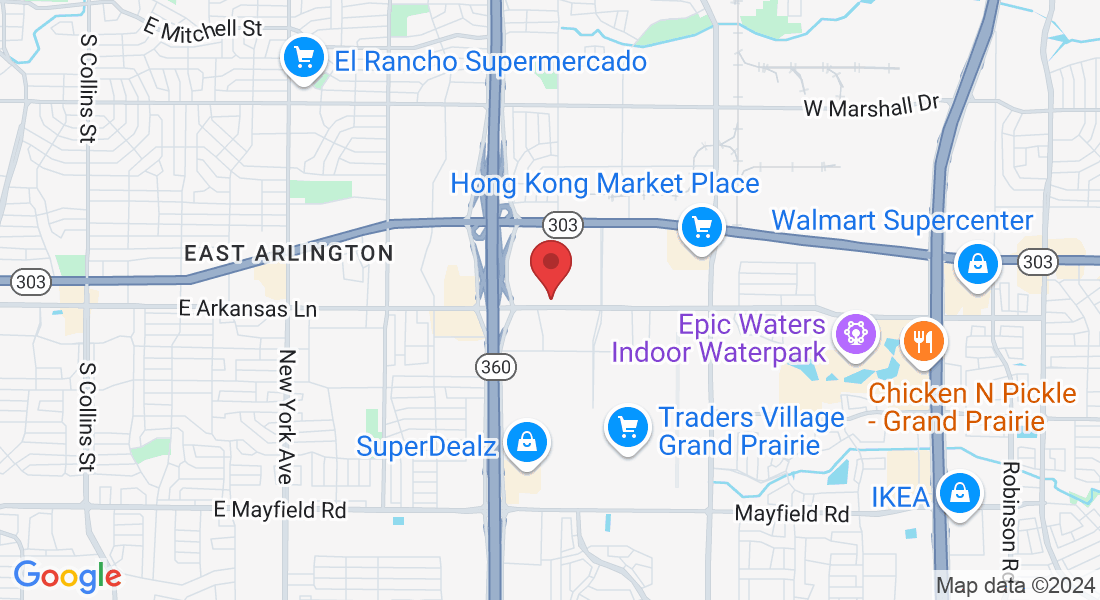

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.