ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

Denied Business Credit? Here’s How Truck Drivers, Small Trucking Companies, and Freight Brokers Can Turn it Around

"The road to success is always under construction." - Lily Tomlin

Introduction:

As an independent truck driver, small business trucking company, or freight broker, getting denied business credit can be frustrating, mainly when your business depends on having the cash flow to fuel growth. According to recent reports, as many as one-third of business loan applications are denied. However, knowing the common issues that lead to denials can help you make changes and boost your chances of getting approved next time.

Here are some significant factors that could be affecting your business credit and what you can do to turn things around:

Denied Business Credit? Here’s How Truck Drivers, Small Trucking Companies, and Freight Brokers Can Turn it Around

1. Business Profits

One of the first things lenders look at is your profitability. It could be a red flag if your trucking company operates with tight margins. The key here is to show a healthy profit margin by cutting unnecessary costs, negotiating better fuel prices, or streamlining operations. This will improve your financial health and increase your odds of securing business credit.

2. Business Assets and Liabilities

Having a balanced financial sheet is crucial. Lenders may perceive your business as risky if your company has more liabilities than assets. Focus on strengthening your balance sheet by paying debt and improving asset management. This could mean re-evaluating the trucks you’re leasing or considering the value of your fleet as collateral when applying for credit.

3. Payment History and Credit Profile

Your payment history plays a vital role in credit decisions. Trucking companies with solid payment histories, particularly with fuel cards and suppliers, are more likely to get approved. If you’ve had late payments or credit missteps, don’t worry—many business credit agencies only track data for a few years. Keep current obligations paid on time, and make sure your credit report is accurate by reviewing it regularly.

4. Bank Account Balances

Lenders often check your business bank accounts to gauge your cash flow. Maintaining a minimum of $10,000 in your business account signals stability and helps avoid credit denials. Consider consolidating earnings from multiple clients to maintain healthy balances.

5. Lack of Credit History

Sometimes, the reason for denial is simply a lack of credit history. Many small trucking companies and independent drivers have minimal credit data, making it difficult for lenders to assess risk. Start building your business credit by opening small trade lines with fuel suppliers, maintenance vendors, or insurance providers and ensuring all payments are reported to business credit bureaus.

Conclusion:

If you’ve been denied business credit, there are clear steps you can take to improve your situation. Each factor can work in your favor, from building a healthy profit margin to ensuring accurate payment history. Analyze your credit profile and take action to improve your financial picture. With patience and strategic planning, you can set your trucking business up for success.

#2ezbizcredit #BlueDiamondSolutions #BusinessCredit #TruckingBusiness #FreightBrokers #CreditApproval #SmallBusinessLoans #TruckDrivers #TruckFinancing #BusinessLoanSolutions #TruckingIndustryCredit #FreightBusinessCredit #BoostBusinessCredit #CreditForTruckers #BusinessFunding #TruckingCompanyLoans #ImproveCreditScore #FreightFunding #LoanApprovalTips #BuildBusinessCredit #FleetManagementFinances #TruckingSuccess #BusinessCreditRepair #CreditConsulting #TruckingCreditSolutions

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

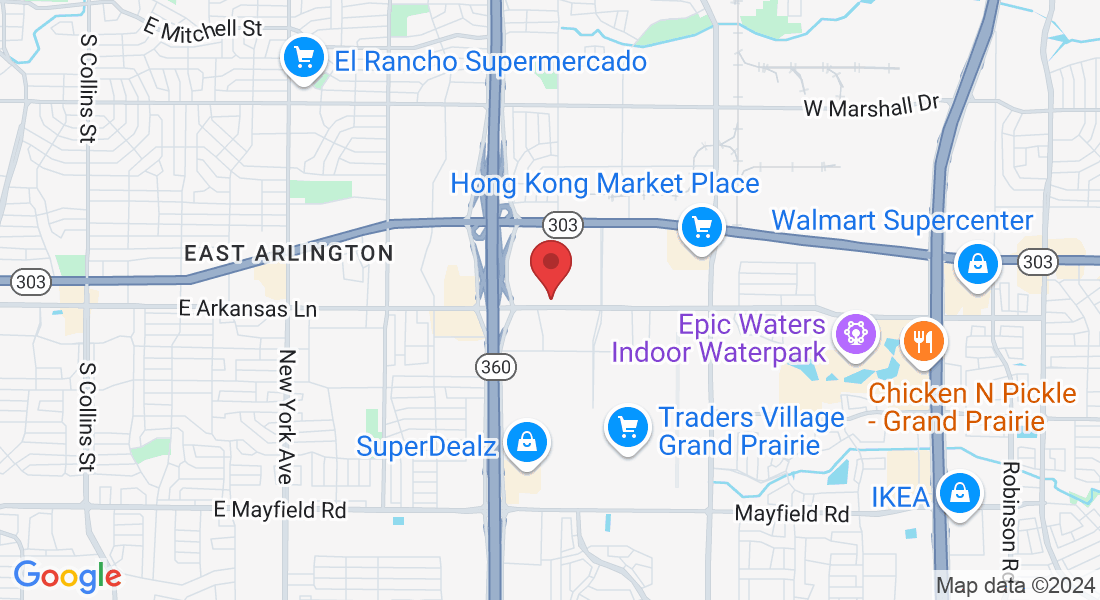

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.