ABOUT US

Discover 2EZBizCredit: Your Trusted Partner in Business Funding and Credit Solutions

Dedicated to Excellence and Service

We are on a mission to empower entrepreneurs, inspiring them to achieve their most significant business goals with proper funding. We help business owners find the credit, capital, and support needed to establish and grow a thriving business.

Get access to up to $150k in business credit lines, Traditional Financing such as SBA Financing, and the widest selection of Alternative Business Lending products. Plus we empower your growth with coaching, motivation and accountability, and a community of like-minded business owners. We go beyond just financing – we give you the tools and support needed to take your business to the next level. Let’s work together to fund your dreams a reality.

Our Key Features

Professional Coaching, Tailored Funding Plans, and Anytime Online Access

Live Expert Coaching and Support: Get personalized guidance from our experienced coaches.

Personalized Funding Strategy: Develop a tailored plan to secure the best funding options.

24/7 Online Access: Manage your funding and business credit needs anytime, anywhere.

-- Our Blog --

Boost Your Business Credit: Unlock Loans Without Personal Guarantees for Owner-Operators and Independent Contractors

"Success usually comes to those who are too busy to be looking for it." - Henry David Thoreau

Introduction:

As an independent contractor or owner-operator, the ability to secure business credit can be a game-changer, especially in the trucking industry. Just as your personal FICO score measures your creditworthiness, your business's PAYDEX score does the same for your trucking business

With a high PAYDEX score, you can access loans and credit lines without needing a personal guarantee—a crucial benefit that empowers you to grow your fleet or maintain cash flow on your terms.

What is a PAYDEX Score for Truckers?

The Dun & Bradstreet PAYDEX® score is critical in determining how well your trucking business manages payments to vendors and suppliers. Ranging from 0 to 100 reflects your ability to pay your bills on time. The higher your score, the more likely you are to secure high-limit credit lines to help with fuel, truck maintenance, insurance, and more.

PAYDEX vs. FICO: The Key Differences for Fleet Owners

While personal FICO scores range from 350 to 850 and consider various factors, the PAYDEX score for your trucking business is purely based on your payment history to creditors and vendors. Here's how they differ:

• FICO Scores: Consider factors like credit mix, payment history, and utilization.

• PAYDEX Scores: Focus solely on how well your business pays suppliers and creditors.

For truck drivers and fleet owners, maintaining a PAYDEX score of 80 or higher is not just crucial, it's a gateway to unlocking more significant credit limits and favorable terms. This can mean more trucks on the road, better fuel deals, and smoother operations overall, paving the way for a brighter future for your business.

Why Fleet Owners Need a Strong PAYDEX Score

Your PAYDEX score plays a pivotal role in securing high-limit credit lines for fleet owners and independent contractors. A score of 80 or above gives you access to up to $100,000 or more in business credit without having to tie it to your credit. This means more than just financial freedom-it means the security of knowing you can grow your business without risking your assets.

Steps to Building Your PAYDEX Score

1. Get Your DUNS Number: A DUNS Number from Dun & Bradstreet is essential for your business credit profile. You can visit the Dun & Bradstreet website and follow the instructions for registering your business to obtain one. Establish Trade Credit: Set up accounts with fuel vendors, parts suppliers, or truck maintenance shops that report to Dun & Bradstreet. For example, you can consider opening accounts with significant fuel companies or reputable truck parts suppliers. Pay Early: Paying your bills ahead of schedule boosts your PAYDEX score faster.

2. Monitor Your Score: Monitor your PAYDEX score closely to ensure you're maintaining a strong credit profile for your trucking business.

Why a Strong PAYDEX Score is Vital for Truckers

With a high PAYDEX score, you can:

• Access credit without personal guarantees, keeping your assets safe.

• Get better deals on fuel and truck repairs by negotiating better terms with suppliers.

• Expand your fleet or upgrade your truck with easier access to loans and credit lines.

Key Takeaway for Owner-Operators

Building a strong PAYDEX score is crucial for independent truckers and fleet owners looking to grow. With consistent, timely payments to vendors, you can unlock high-limit credit lines to keep your business running smoothly—without relying on your personal credit. This can lead to more trucks on the road, better fuel deals, and smoother operations overall.

#TruckingBusiness #OwnerOperators #FleetOwners #BusinessCredit #PAYDEXScore #TruckLoans #FleetExpansion #TruckFinancing #FuelCredit #2ezbizcredit #BlueDiamondBusinessSolutions #IndependentContractors #CreditBuilding #TruckersSuccess #FleetGrowth #TruckersCredit #TruckerFinances #SmallFleetBusiness #BusinessCreditForTruckers #TruckOwnerFinancing #TruckDriverFinancing

Ready to take your startup to the next level? Visit 2ezbizcredit to discover how we can help you secure the funding you need without a personal guarantee. Get started today and unlock your business's true potential! 🚀

Contact Details:

Website: www.2ezbizcredit.com

Email: [email protected]

Phone: (833)-995-2110

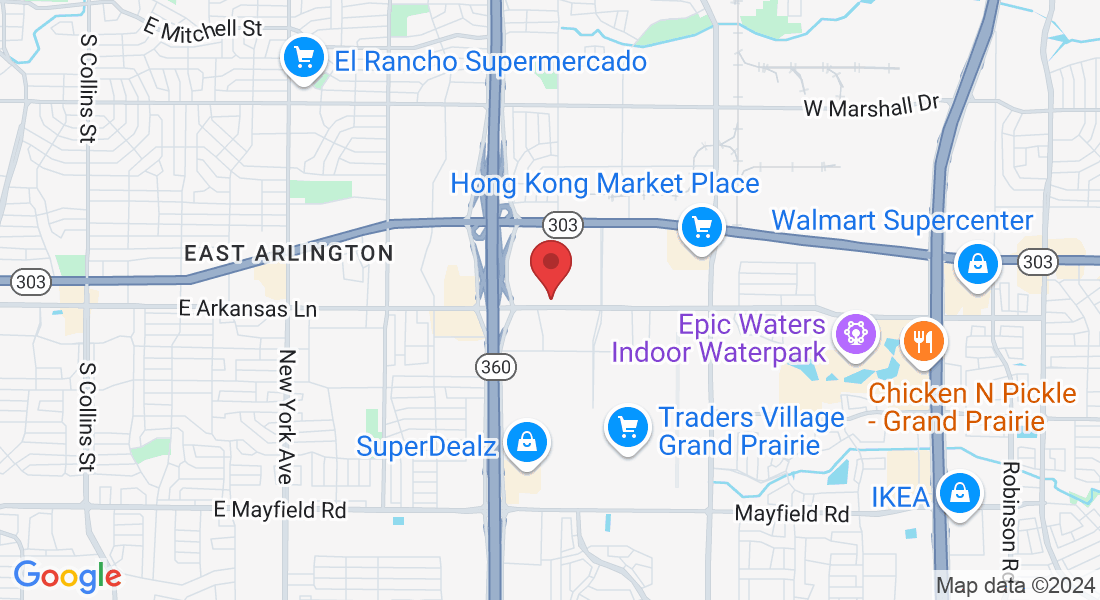

Address: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Social Media:

Facebook: 2ezbizcredit Facebook

LinkedIn: 2ezbizcredit LinkedIn

Twitter: 2ezbizcredit Twitter

Latest News & Article

-- YouTube Videos --

What's Happening: Upcoming Events

Get In Touch

Assistance Hours

Mon – Fri 8:00am – 5:00pm CST

Sat & Sun – CLOSED

Phone Number:

833-995-2110

Post Address and Mail

Email: [email protected]

Address

Office: 2909 E Arkansas Lane Suite C, Arlington, TX 76010

Testimonials

Don't take our words for it, Hear from our clients

George O.

2ezbizcredit transformed our financing approach. With their expert guidance, we secured the funding needed to grow.”

Leon D.

Their business credit builder program is phenomenal. We now have access to significant credit lines without personal guarantees.

Michael T.

Exceptional service! Their team helped us navigate the complex world of business loans, and we got the best rates

Sarah W.

Thanks to 2ezbizcredit, we secured equipment financing seamlessly. Our business is thriving!

© 2024 2ezbizcredit - All Rights Reserved. 2ezbizcredit® is a trademarked brand. Unauthorized use is prohibited. Information on this site is for informational purposes only and does not constitute financial, legal, or professional advice.

By using our services, you agree to our Terms of Service and Privacy Policy. Contact our support team for questions.