WHAT DO OUR CLIENTS SAY?

A Client's Journey to Success with DB Credit Repair

As a millennial educator, with very little formal knowledge about financial and credit literacy, Darren quickly helped me and my family in one of the most pressing situations of our lives. By providing me top quality credit education and repair, it is evident that Darren clearly cares about his community and will help bridge the Financial Wealth Gap one customer at a time. He is worth every penny! Whether you want a car, an apartment, a house, or just planning for the future. Do it! DB Credit Repair is for the people! No gimmicks, No scams. True top quality services.

Working with DB credit repair has been an amazing experience! Darren acts as a supportive coach throughout the process, demonstrating a professional attitude that guides you through every step. He truly understands your situation and prepares you for the financial freedom that everyone deserves. The service provided is top-notch and efficient.

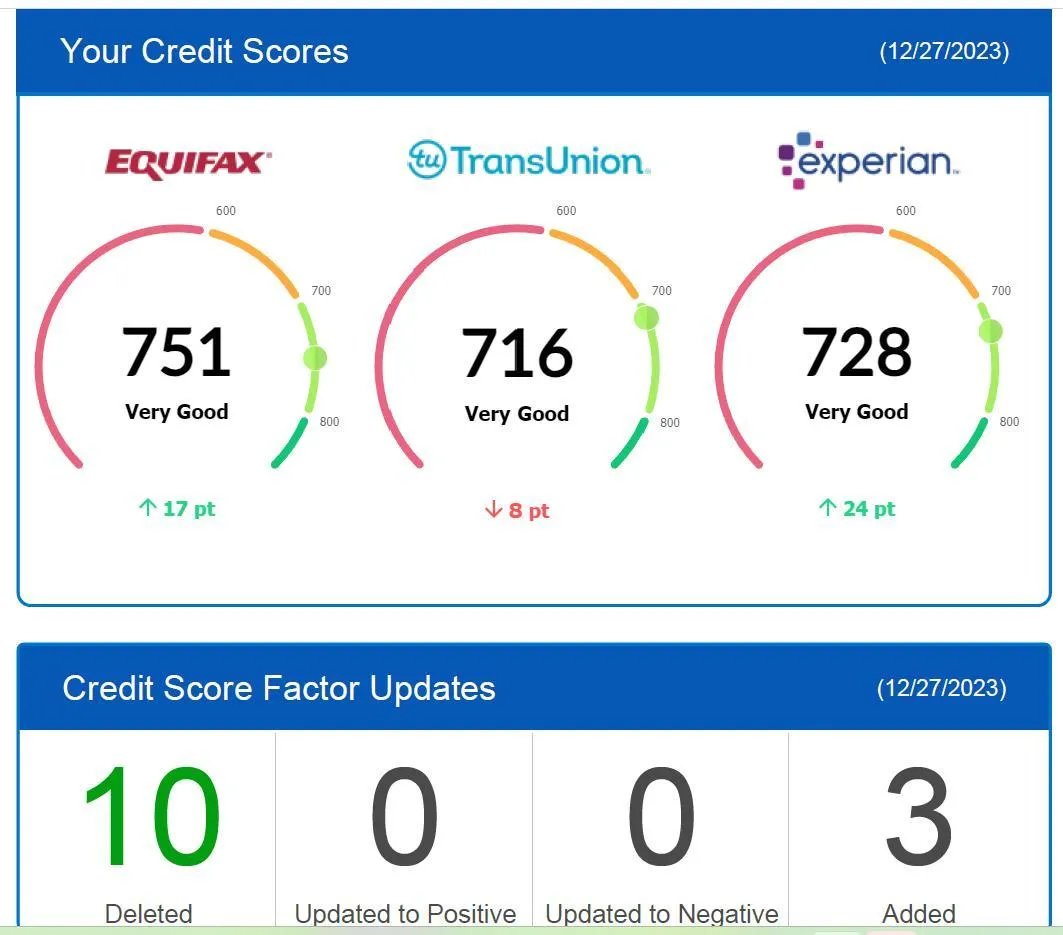

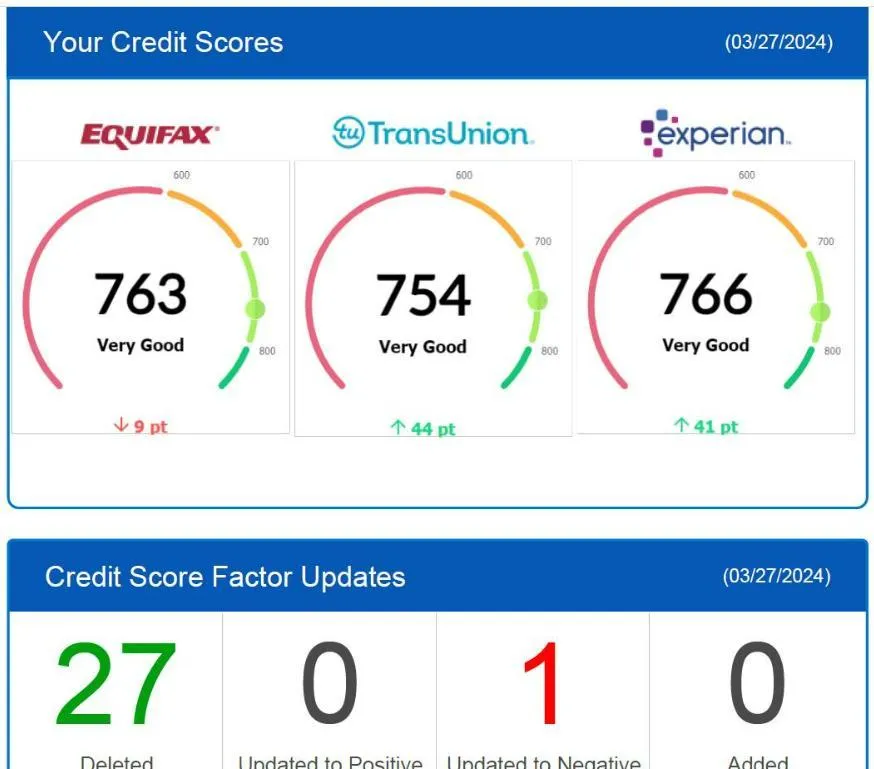

DB Credit Repair deserves my utmost appreciation for their outstanding service. The team displayed remarkable professionalism and efficiency while assisting me in the intricate process of credit repair. Their guidance was comprehensive, and they delivered prompt and tangible results. Thanks to their expertise and dedication, my credit score has improved significantly, granting me access to opportunities I never thought possible. I wholeheartedly recommend DB Credit Repair to anyone seeking to take charge of their financial future and achieve their credit goals.

I appreciated the personalized approach I received from DB Credit Repair. They took the time to understand my specific situation and goals. They developed a customized plan and worked diligently to achieve results. Their hard work and dedication paid off, and my credit score is now in much better shape.

DB Credit Repair Turned My Credit Score Around!

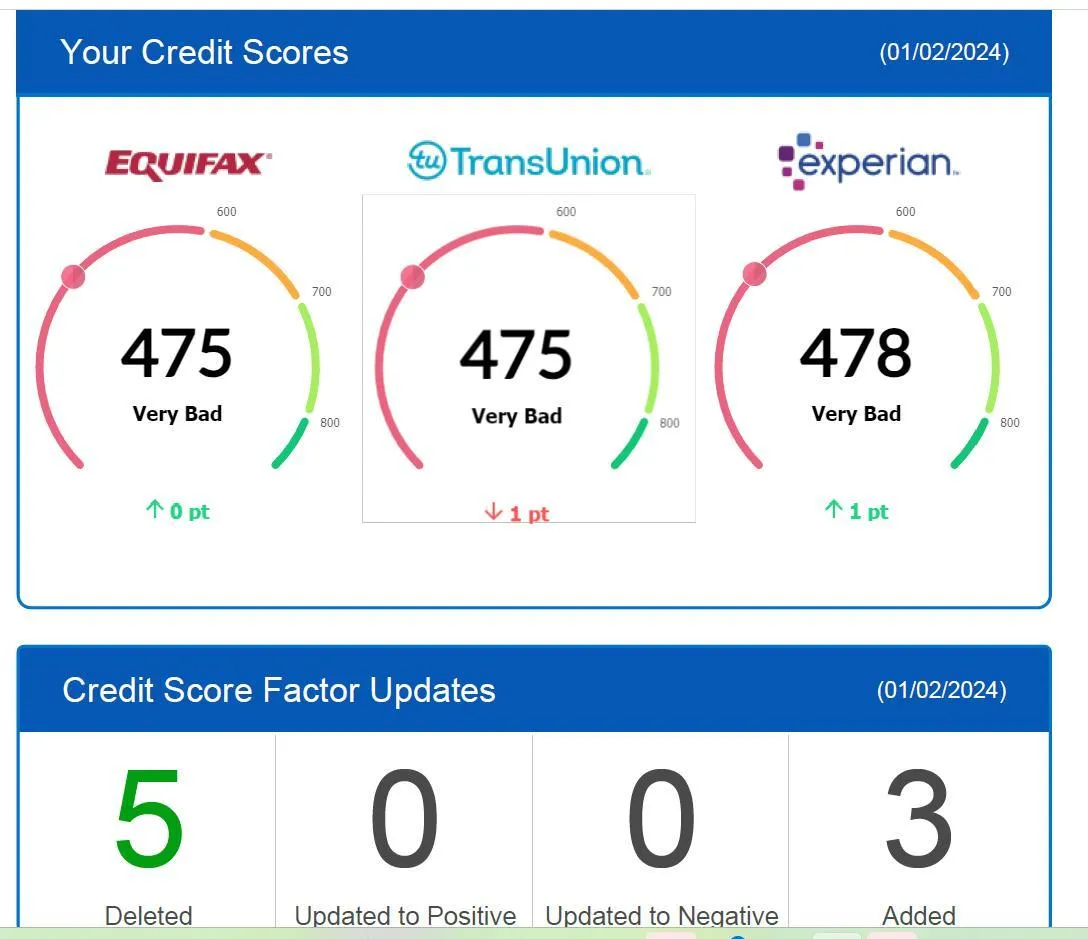

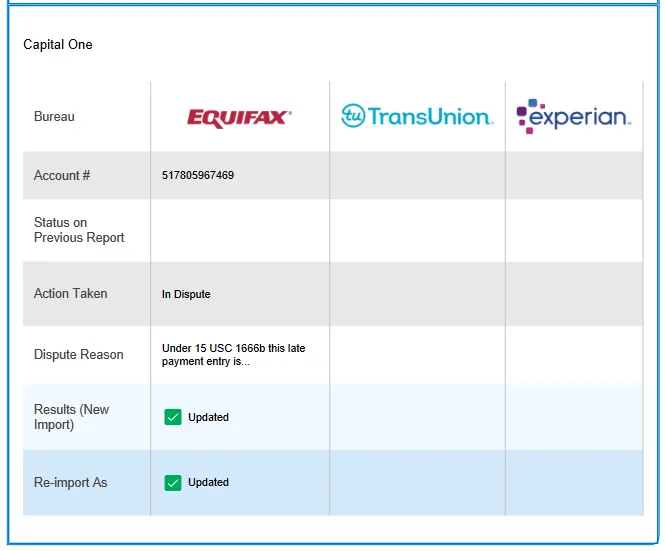

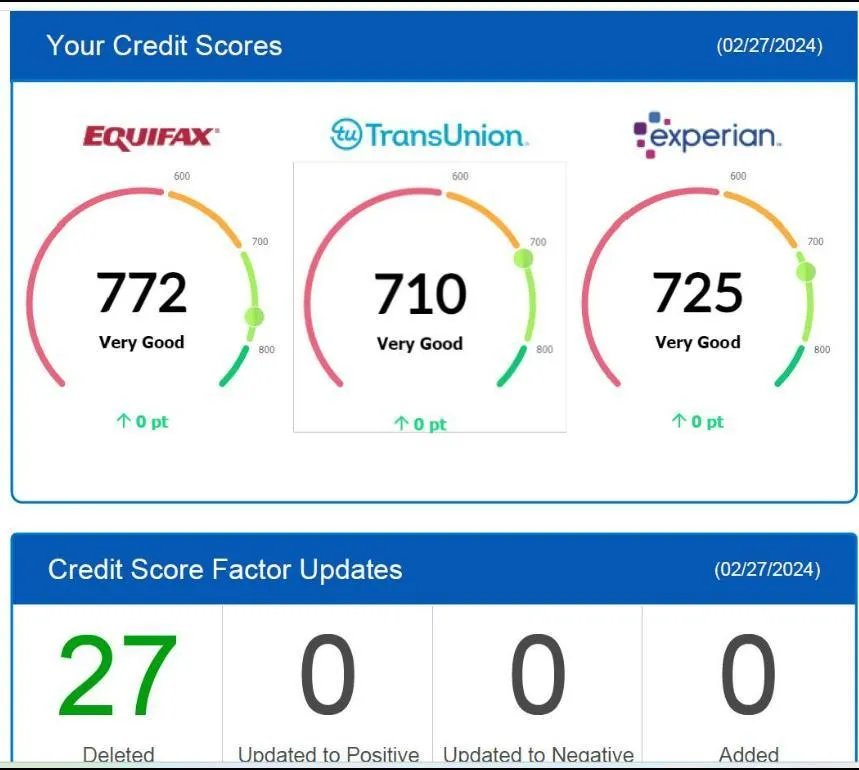

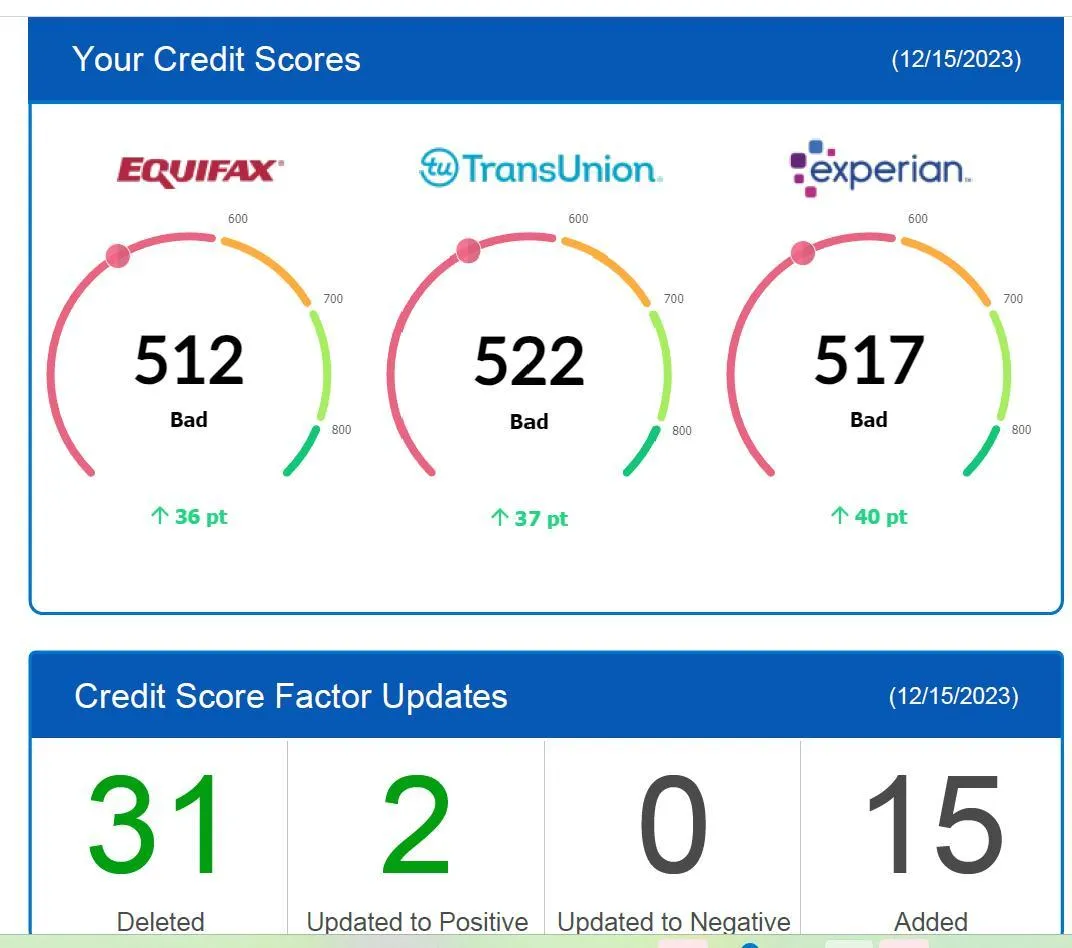

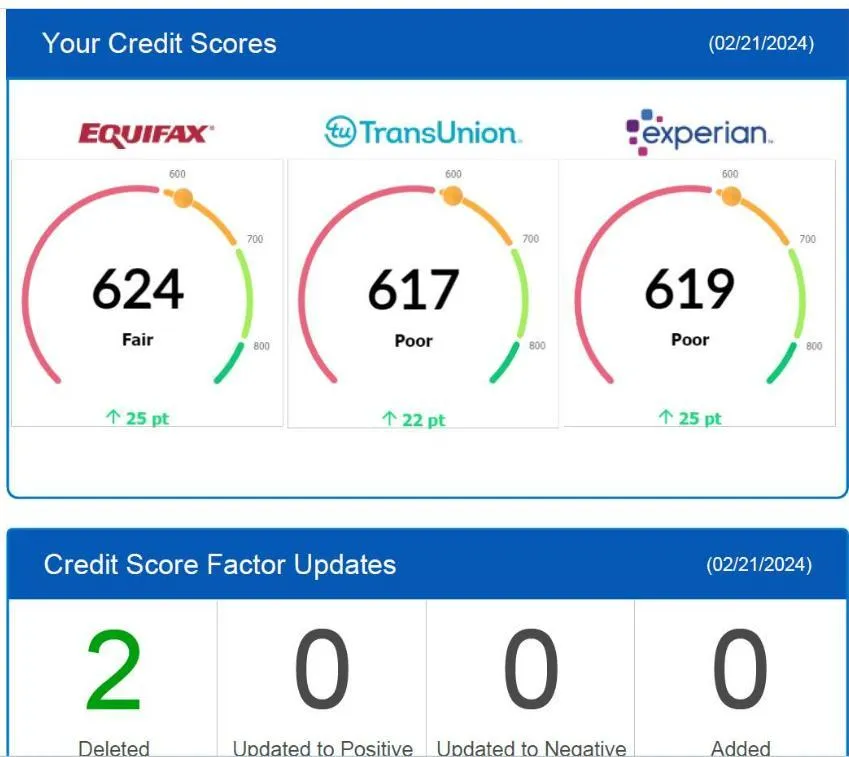

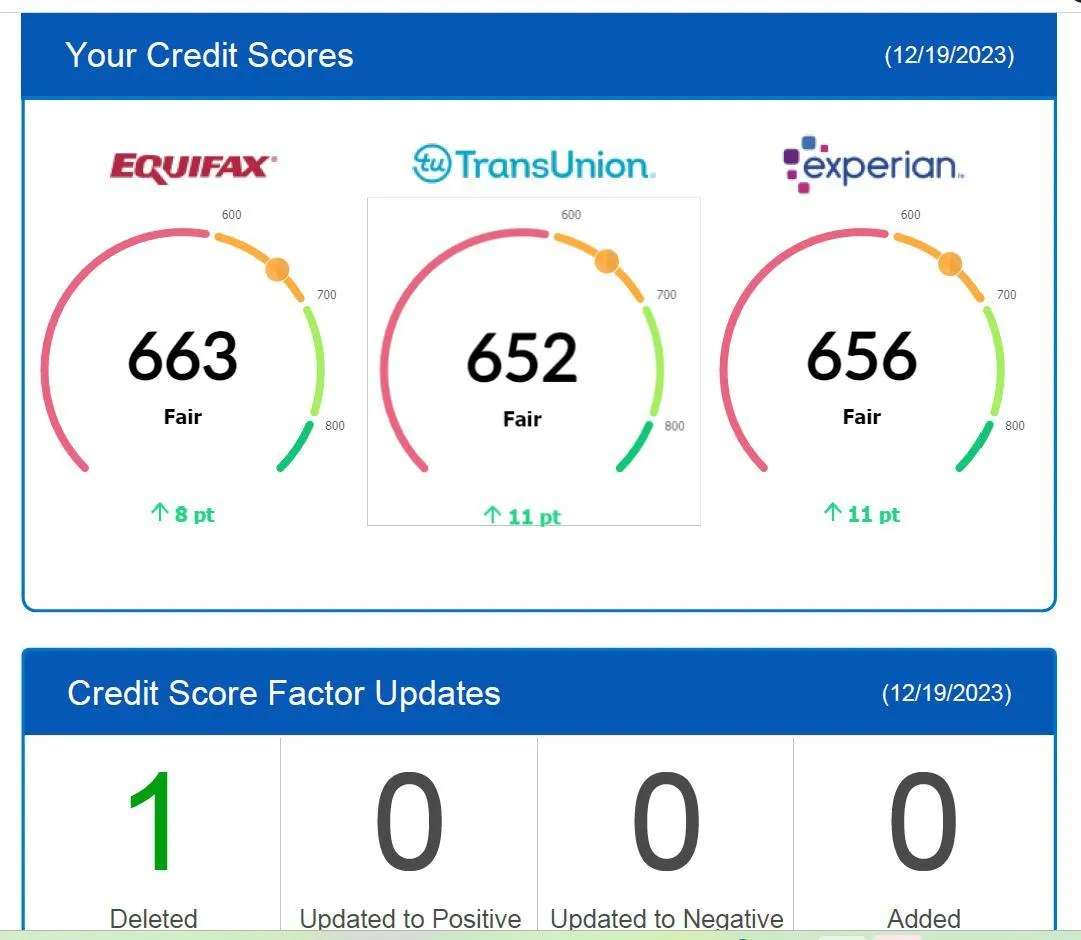

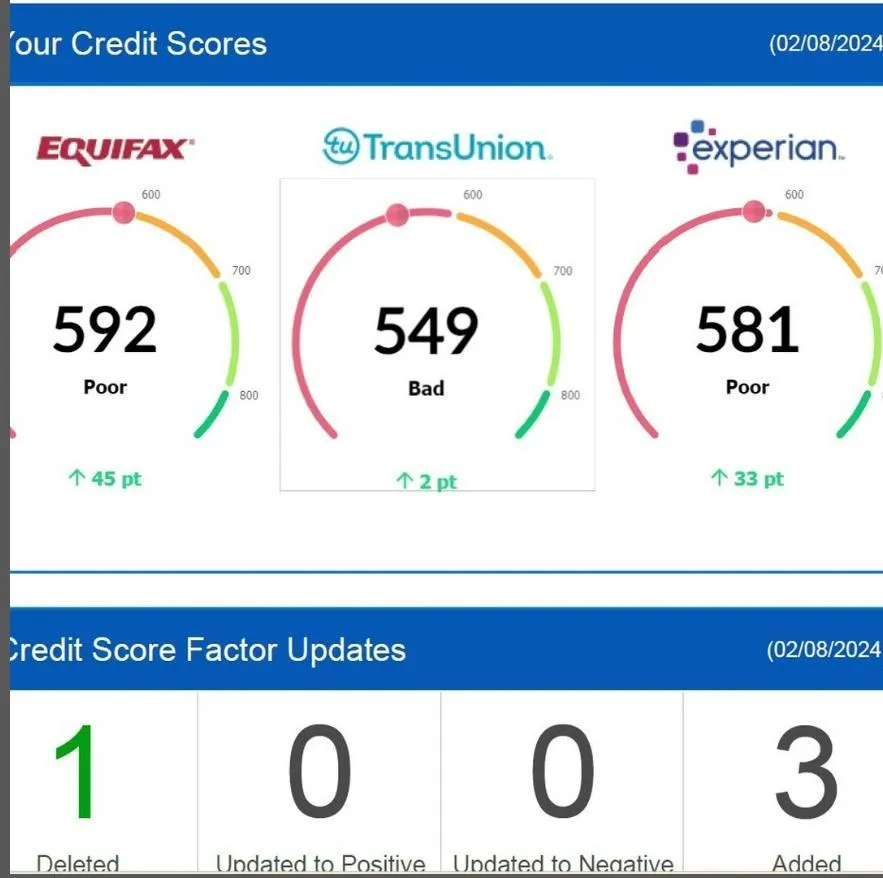

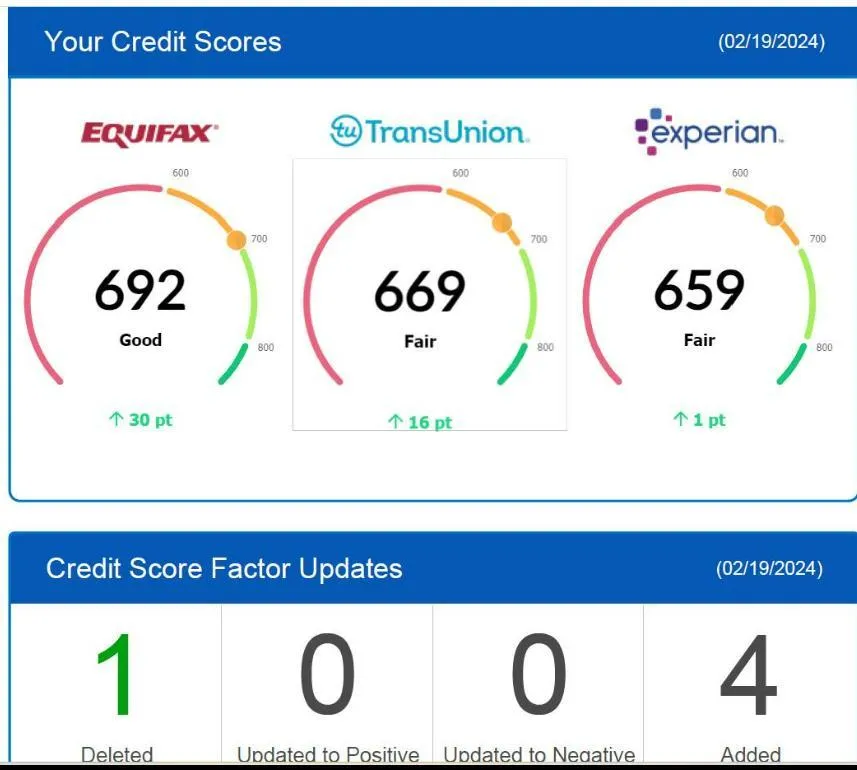

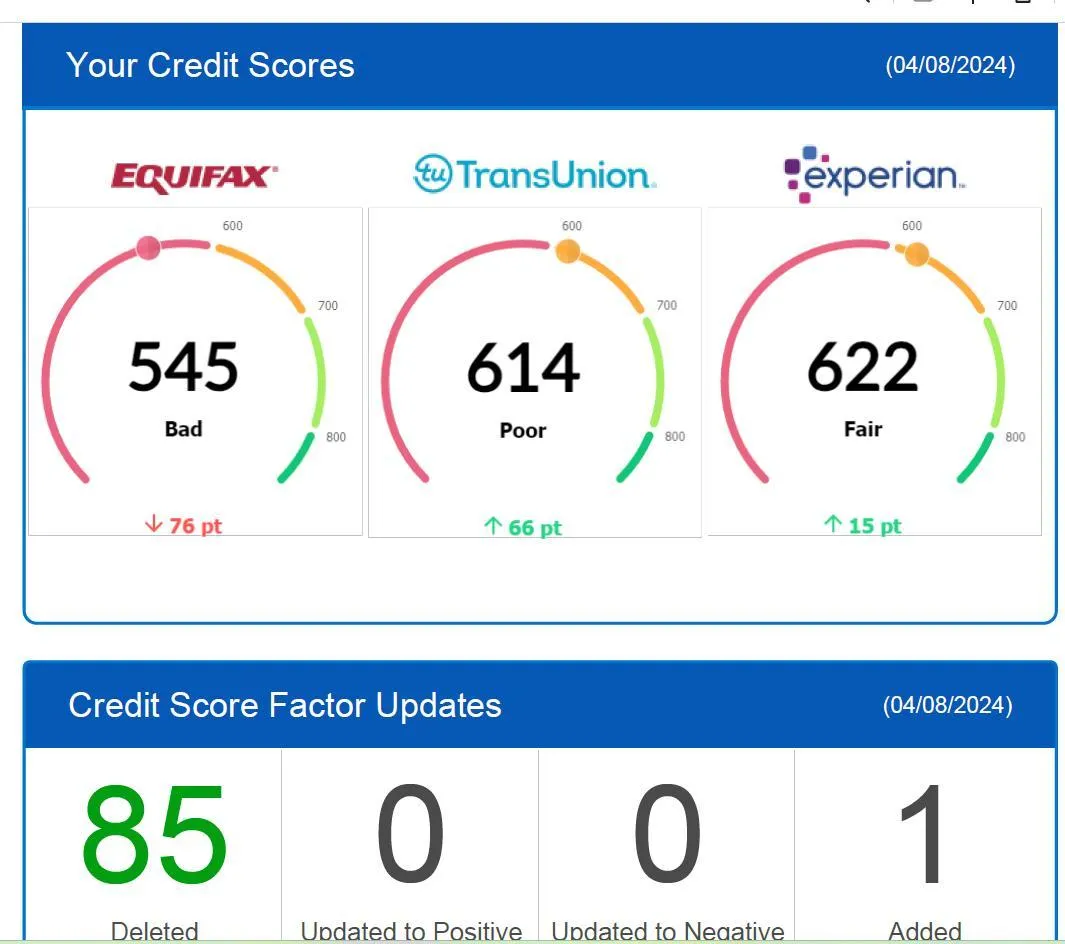

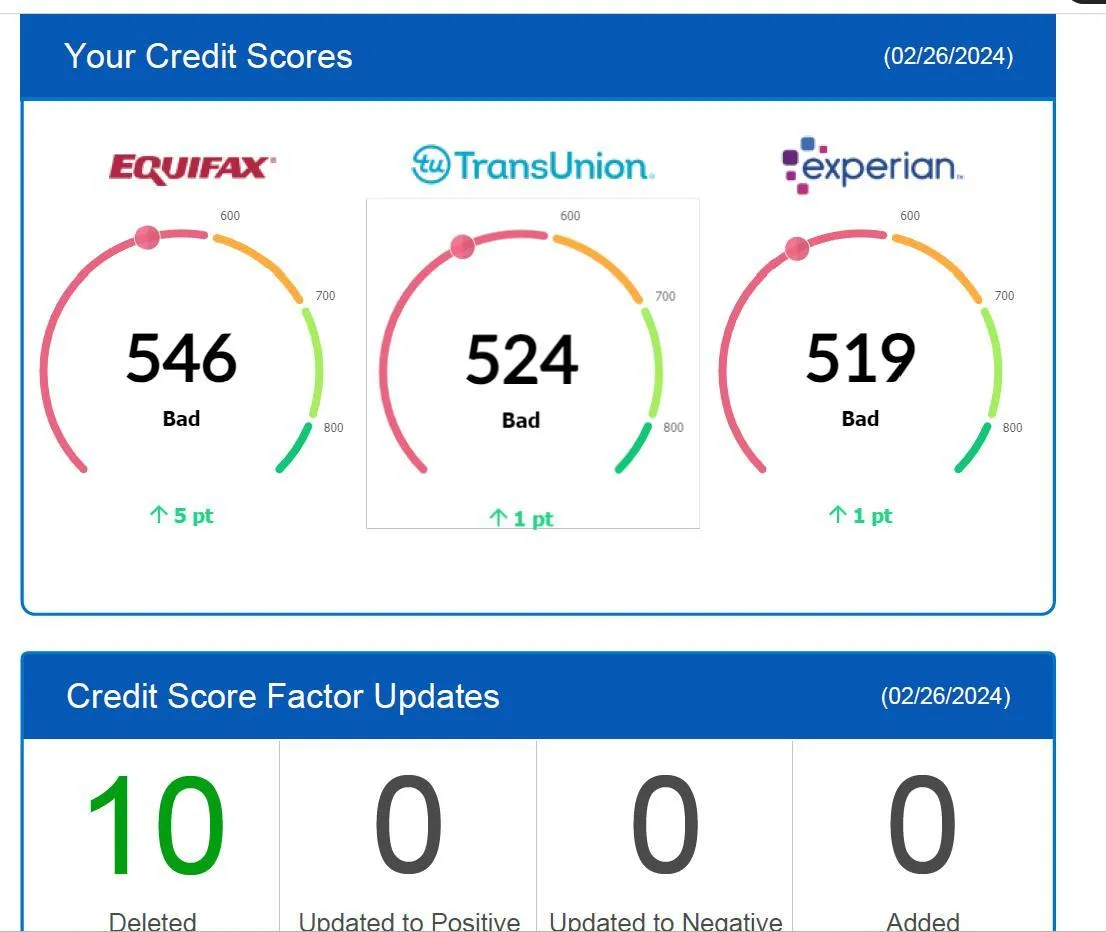

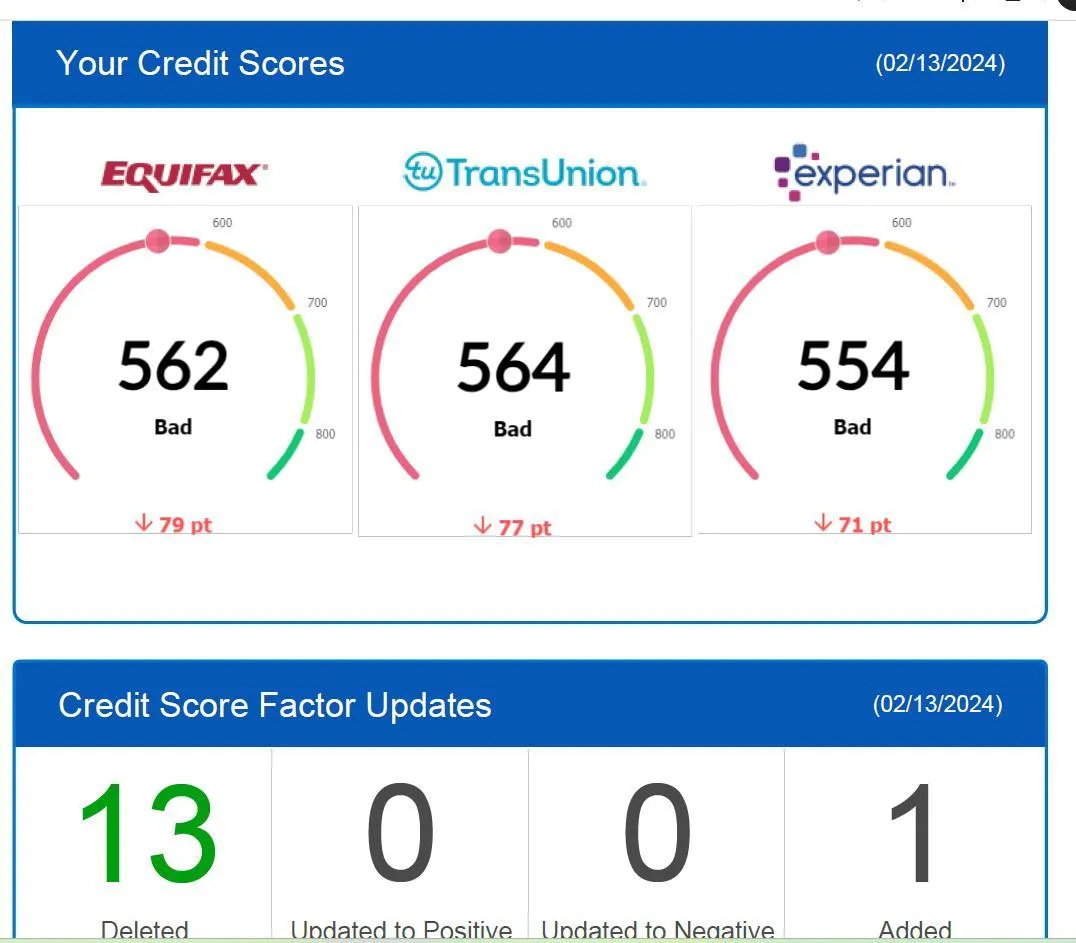

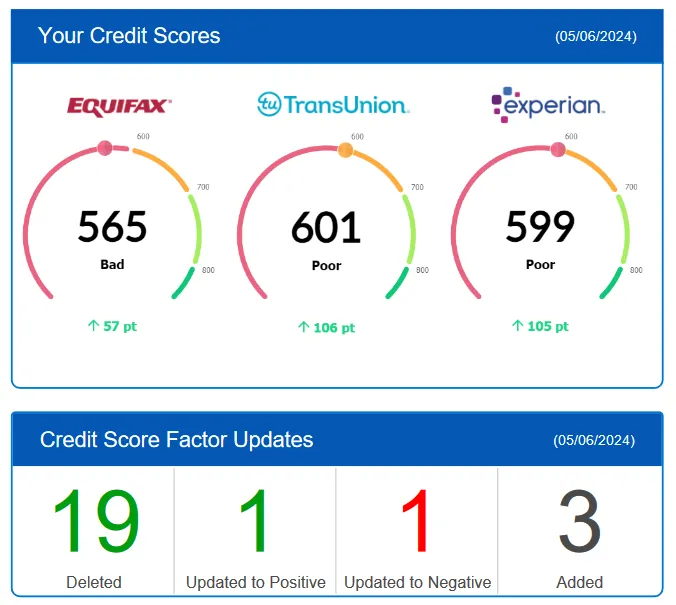

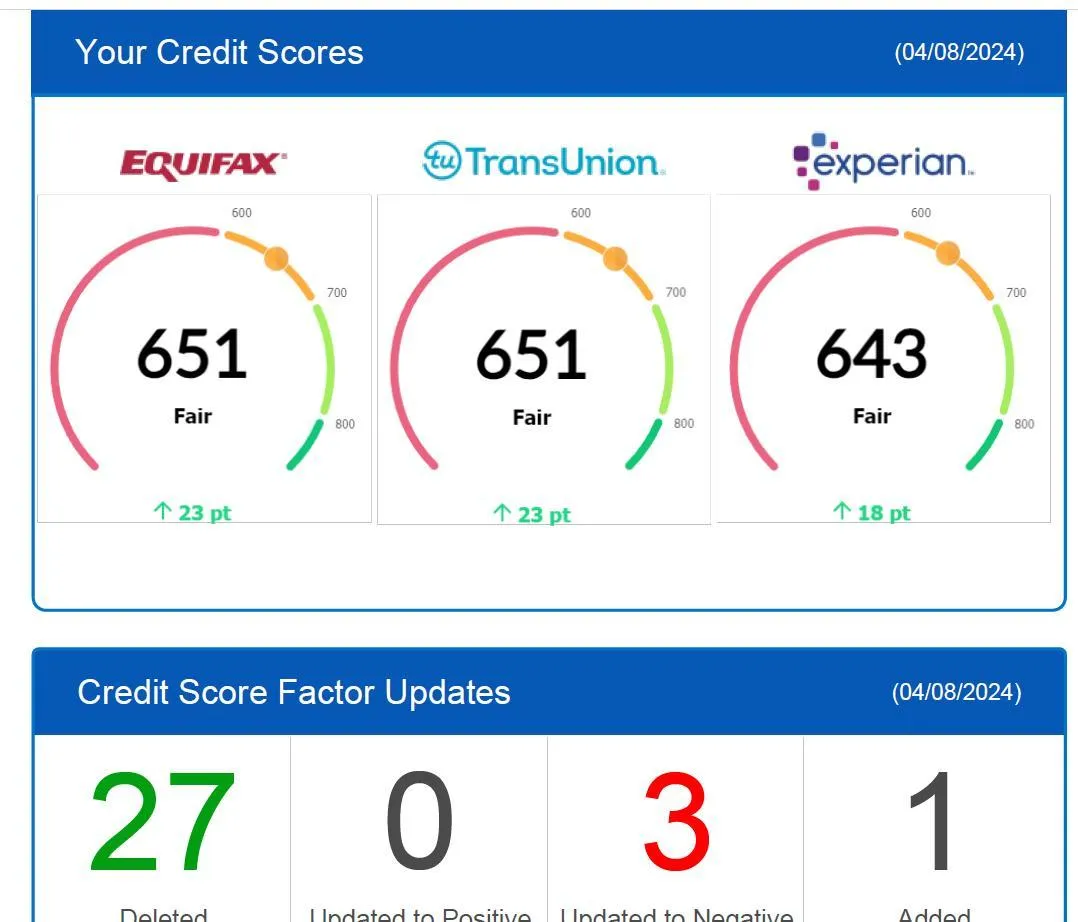

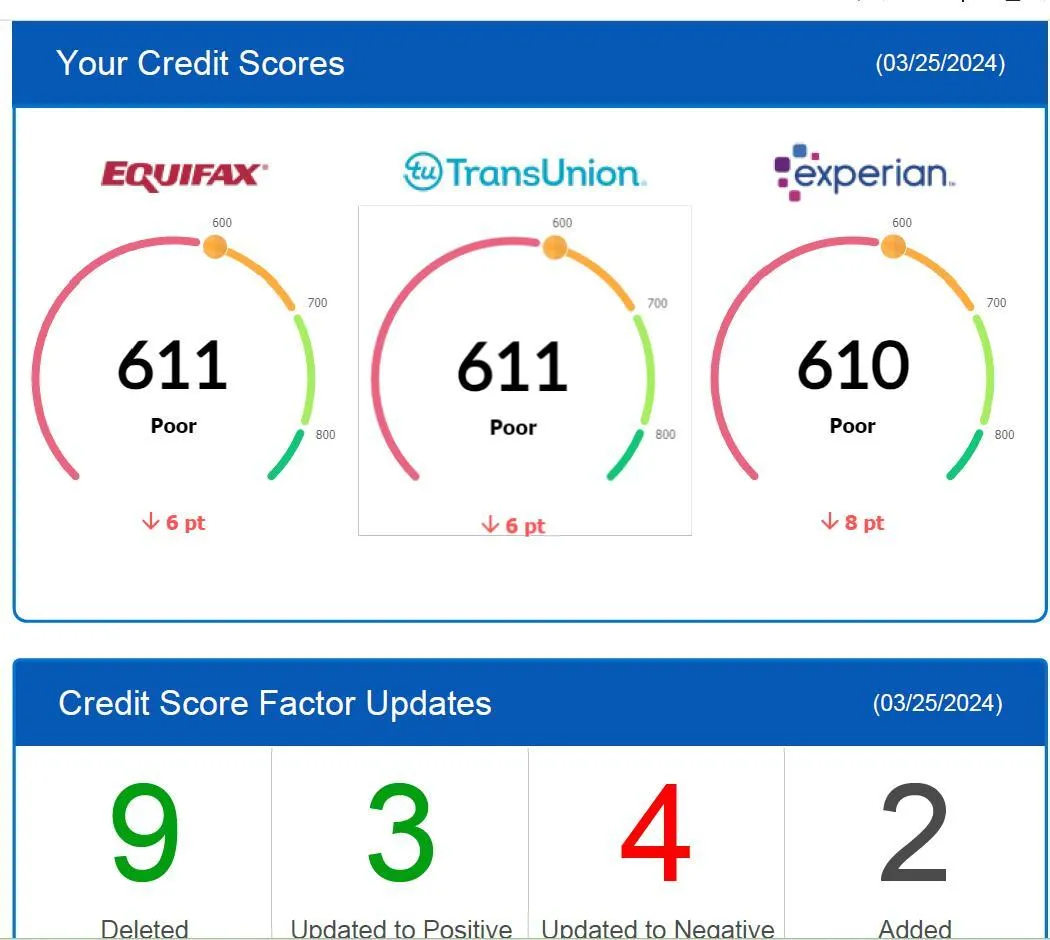

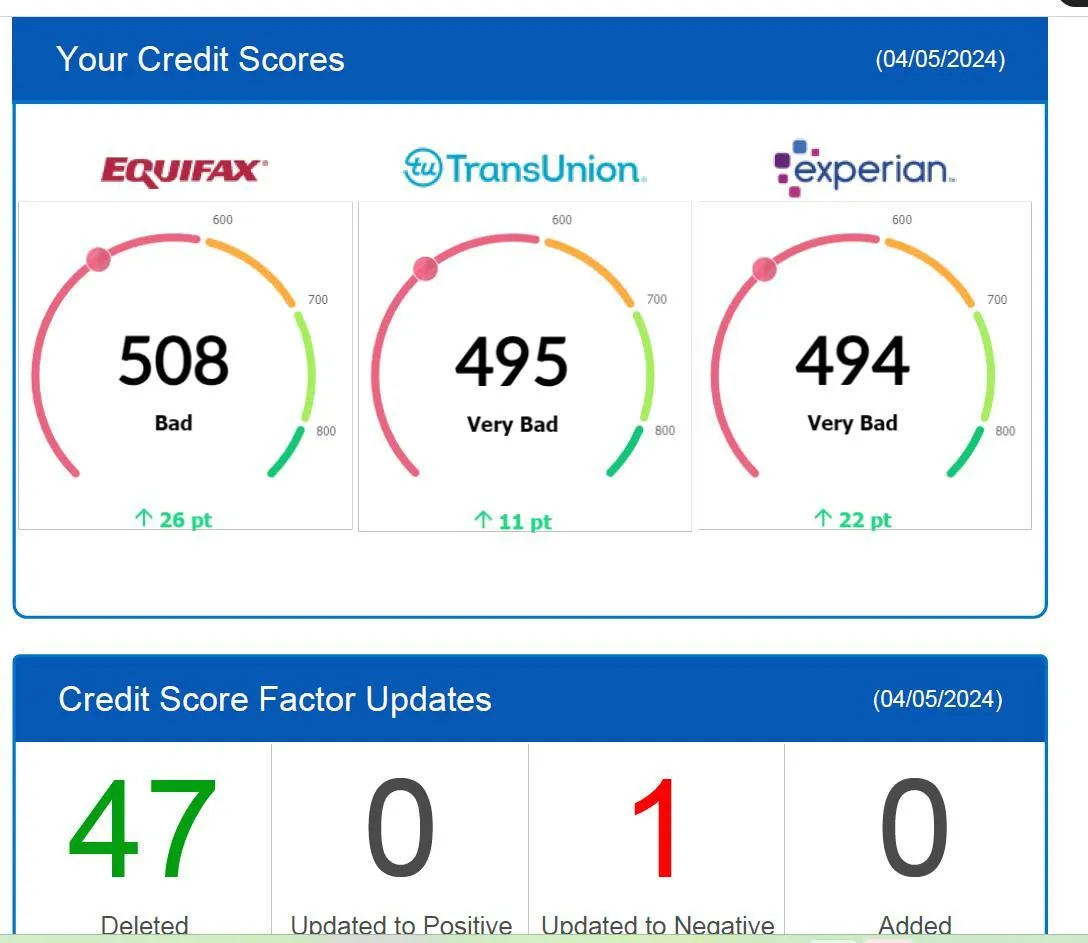

I'm here to describe my amazing experience with DB Credit Repair! My credit score was stuck in the low 500s (or even high 400s) – not a good place to be. I knew I needed help, and DB Credit Repair came through in a BIG way. DB Credit Repair team clearly knows their stuff. They guided me through the process and made everything easy to understand. They were always available to answer my questions and address any concerns I had.

Within just two months of working with their program, I saw a fantastic jump! My credit score is now soaring in the 600s. This is a huge improvement, and I'm so grateful to DB Credit Repair for making it happen. Seeing my score climb in just two months was incredible. It motivated me to stay on track.

If you're struggling with bad credit, don't hesitate to reach out to DB Credit Repair. They can help you achieve the financial freedom you deserve, just like they are helping me!

TESTIMONIALS

From Repo to Redemption: Repairing Credit After Repossessions

From Repo to Redemption: Repairing Credit After Repossessions

Experiencing repossession can be a challenging and stressful ordeal, but it's not the end of the road for your financial well-being. With the right strategies and assistance, you can repair your credit and work towards a brighter financial future. In this guide, we'll explore how to bounce back from repossession, repair your credit, and regain control of your financial health. From understanding the impact of repossessions on your credit to enlisting the help of DB Credit Repair, we've got you covered.

Understanding the Impact of Repossessions on Your Credit:

When a repossession occurs, it can have a significant negative impact on your credit score. The repossession will be noted on your credit report, indicating that you failed to make timely payments on a loan or lease agreement. This can result in a significant drop in your credit score and make it challenging to obtain new credit or loans in the future. However, with time and effort, it's possible to repair the damage and improve your credit standing.

Steps to Repair Your Credit After Repossessions:

Assess Your Credit Report:

The first step in repairing your credit after a repossession is to obtain a copy of your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion. Review your report carefully to understand the extent of the damage and identify any inaccuracies or errors that may be affecting your credit score.

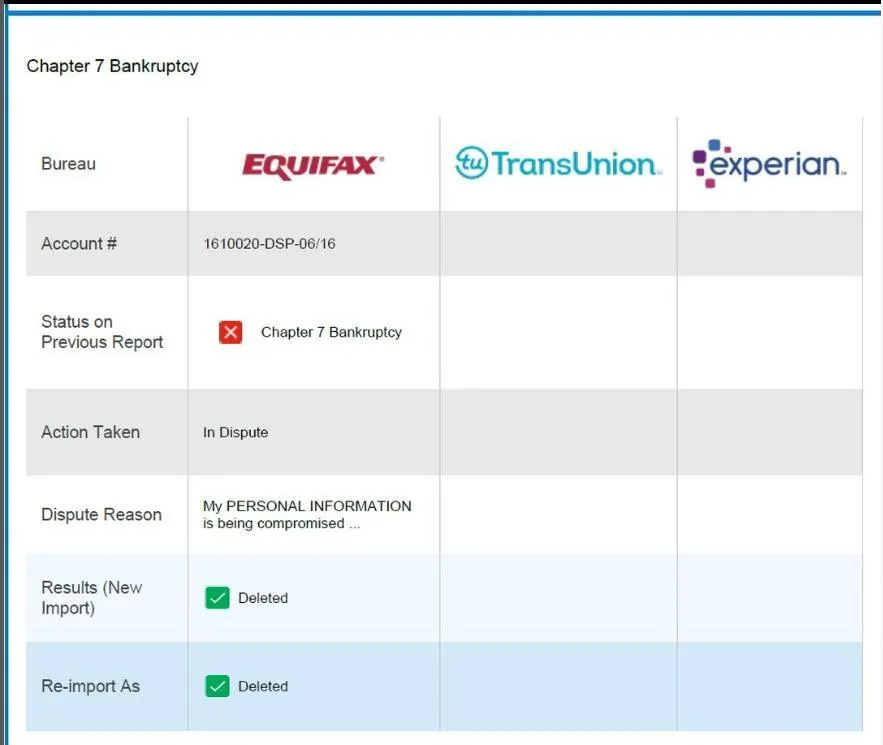

Dispute Inaccurate Information:

If you find any inaccuracies or errors on your credit report related to the repossession, it's essential to dispute them with the credit bureaus. Provide documentation and evidence to support your dispute and request that the incorrect information be removed from your credit report.

Make Timely Payments:

One of the most effective ways to rebuild your credit after a repossession is to make timely payments on your remaining debts. Pay all of your bills on time, including credit card bills, utility bills, and loan payments. Consistently making on-time payments demonstrates to creditors that you are responsible with your finances and can help improve your credit score over time.

Reduce Your Debt:

Another crucial step in repairing your credit is to work towards reducing your overall debt load. Pay down existing debts, such as credit card balances and personal loans, as much as possible. Lowering your debt-to-income ratio can improve your credit utilization ratio, which is a significant factor in determining your credit score.

Establish Positive Credit History:

In addition to making timely payments and reducing your debt, it's essential to establish positive credit history. Consider applying for a secured credit card or becoming an authorized user on someone else's account to start building positive credit history. Make small purchases and pay off the balance in full each month to demonstrate responsible credit management.

How DB Credit Repair Can Help:

At DB Credit Repair, we specialize in assisting individuals in repairing their credit after repossessions. Our team of experts understands the complexities of credit repair and will work tirelessly to help you achieve your financial goals. Here's how we can help:

Credit Analysis:

We'll conduct a thorough analysis of your credit report and identify areas for improvement. Our experts will develop a personalized credit repair plan tailored to your unique circumstances and financial goals.

Dispute Resolution:

We'll work with credit bureaus and creditors to dispute inaccurate or negative information on your credit report, including repossession-related items. Our goal is to ensure that your credit report accurately reflects your creditworthiness and financial history.

Credit Education:

We'll provide you with valuable insights and resources to help you understand how credit works and how to maintain healthy credit habits. Our goal is not only to repair your credit but also to empower you to take control of your financial future.

To conclude:

Recovering from a repossession and repairing your credit may feel overwhelming, but with the right strategies and expert assistance, it’s completely achievable. By following the steps in this guide and working with DB Credit Repair, you can take proactive measures to rebuild your credit and regain control of your financial health.

Don’t let a repossession define your future. Schedule a Free Credit Consultation now and let DB Credit Repair help you take the first step toward financial redemption and a brighter tomorrow! Click to Schedule a free Credit Consultation Now!👉👉 : www.dbcreditrepairs.com/db-calendar-booking-appointment

Visit our Website: www.dbcreditrepairs.com for more insights and strategies for a secure financial future.

Credit Score Summary

Get In Touch

Email: [email protected]

Phone: 646-832-4959 or 914-841-5577

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours :

Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED

© Copyright2024 A - DB CREDIT Repair - | 120 Day Money Back Guarantee from the date of the sale | All Rights Reserved.

Get In Touch

Email: [email protected]

Customer Support: 646-832-4959

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours :

Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED