WHAT DO OUR CLIENTS SAY?

A Client's Journey to Success with DB Credit Repair

As a millennial educator, with very little formal knowledge about financial and credit literacy, Darren quickly helped me and my family in one of the most pressing situations of our lives. By providing me top quality credit education and repair, it is evident that Darren clearly cares about his community and will help bridge the Financial Wealth Gap one customer at a time. He is worth every penny! Whether you want a car, an apartment, a house, or just planning for the future. Do it! DB Credit Repair is for the people! No gimmicks, No scams. True top quality services.

Working with DB credit repair has been an amazing experience! Darren acts as a supportive coach throughout the process, demonstrating a professional attitude that guides you through every step. He truly understands your situation and prepares you for the financial freedom that everyone deserves. The service provided is top-notch and efficient.

DB Credit Repair deserves my utmost appreciation for their outstanding service. The team displayed remarkable professionalism and efficiency while assisting me in the intricate process of credit repair. Their guidance was comprehensive, and they delivered prompt and tangible results. Thanks to their expertise and dedication, my credit score has improved significantly, granting me access to opportunities I never thought possible. I wholeheartedly recommend DB Credit Repair to anyone seeking to take charge of their financial future and achieve their credit goals.

I appreciated the personalized approach I received from DB Credit Repair. They took the time to understand my specific situation and goals. They developed a customized plan and worked diligently to achieve results. Their hard work and dedication paid off, and my credit score is now in much better shape.

DB Credit Repair Turned My Credit Score Around!

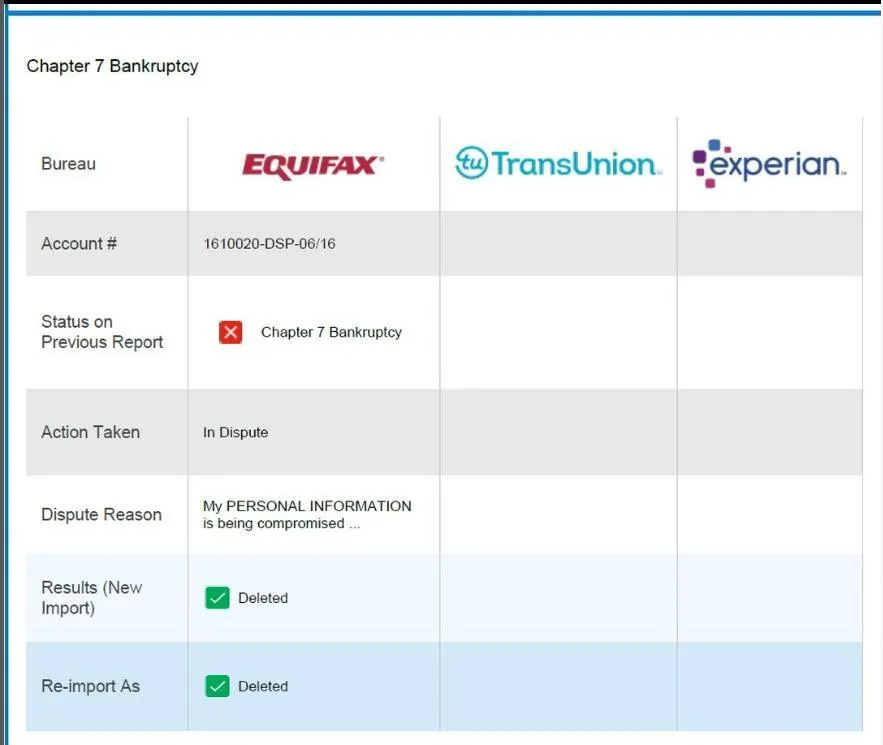

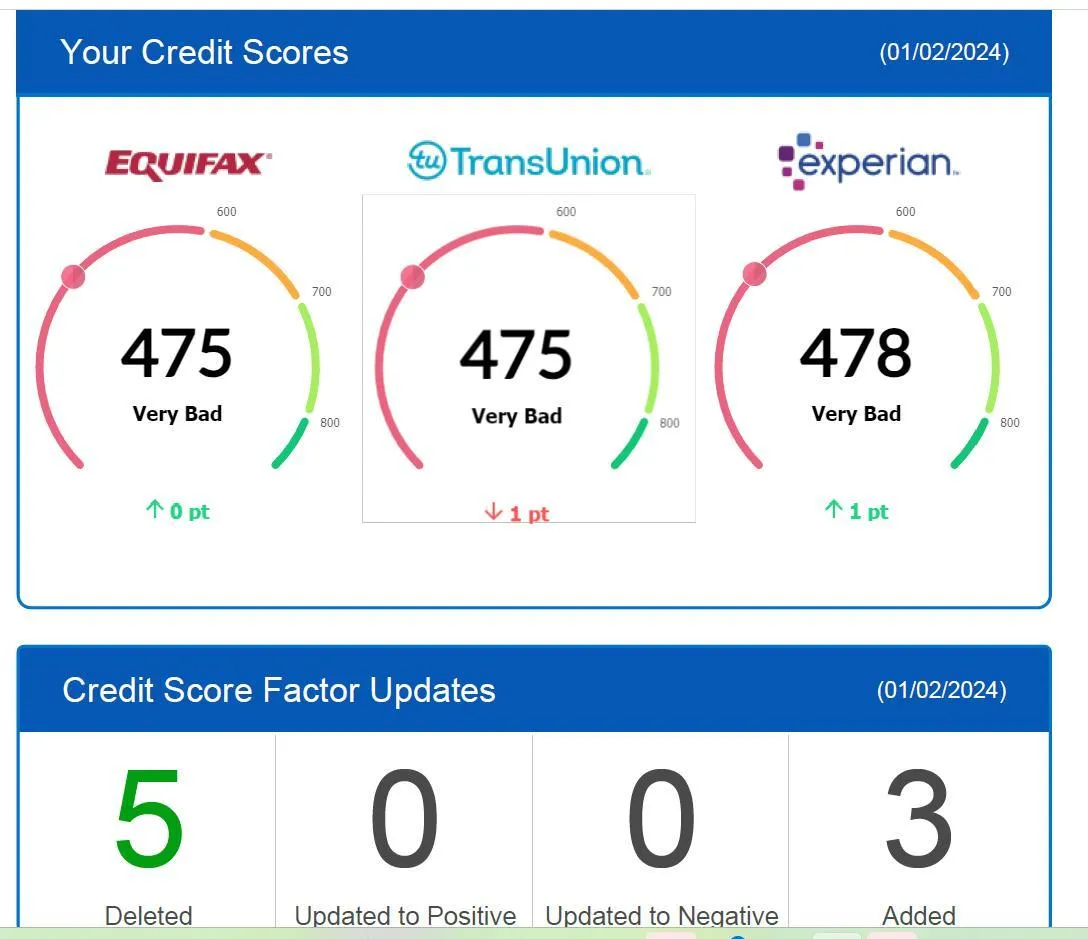

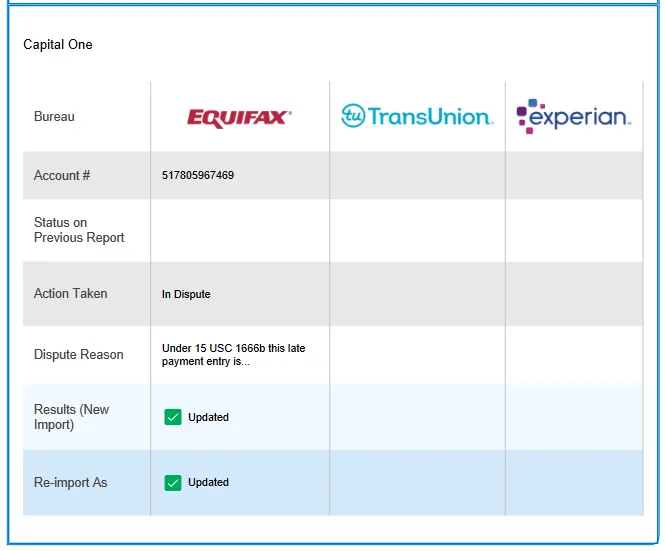

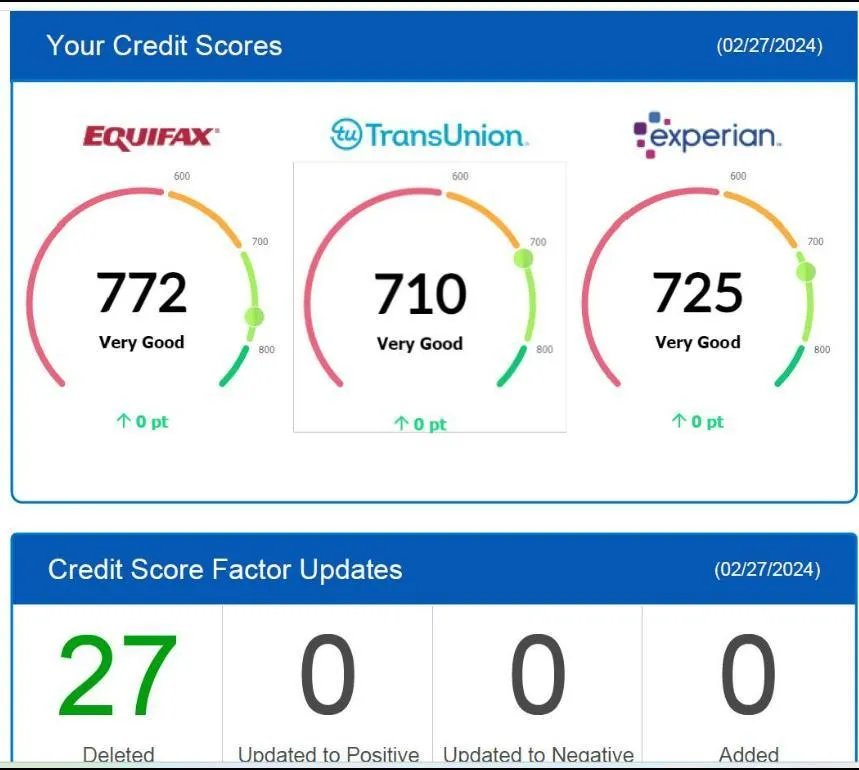

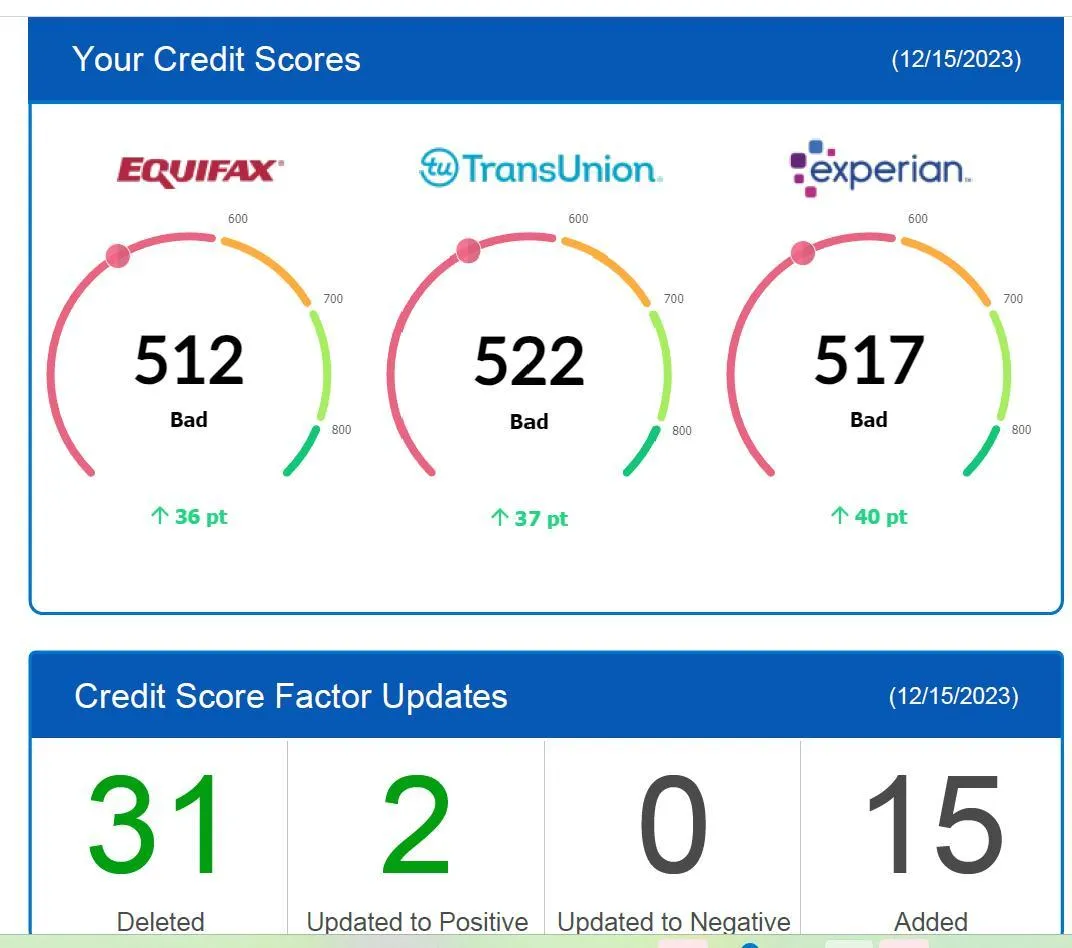

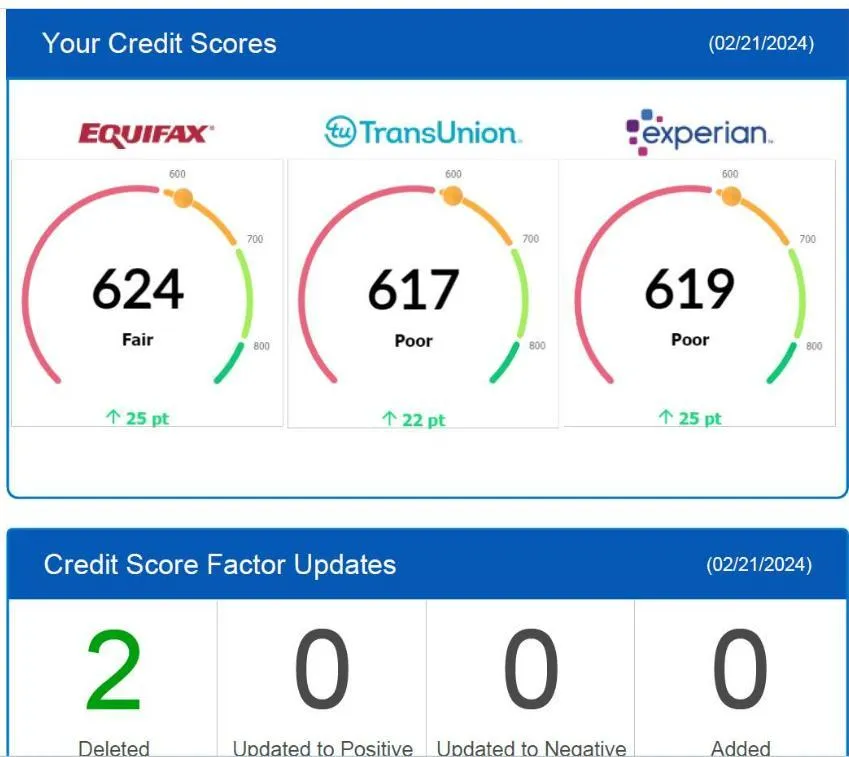

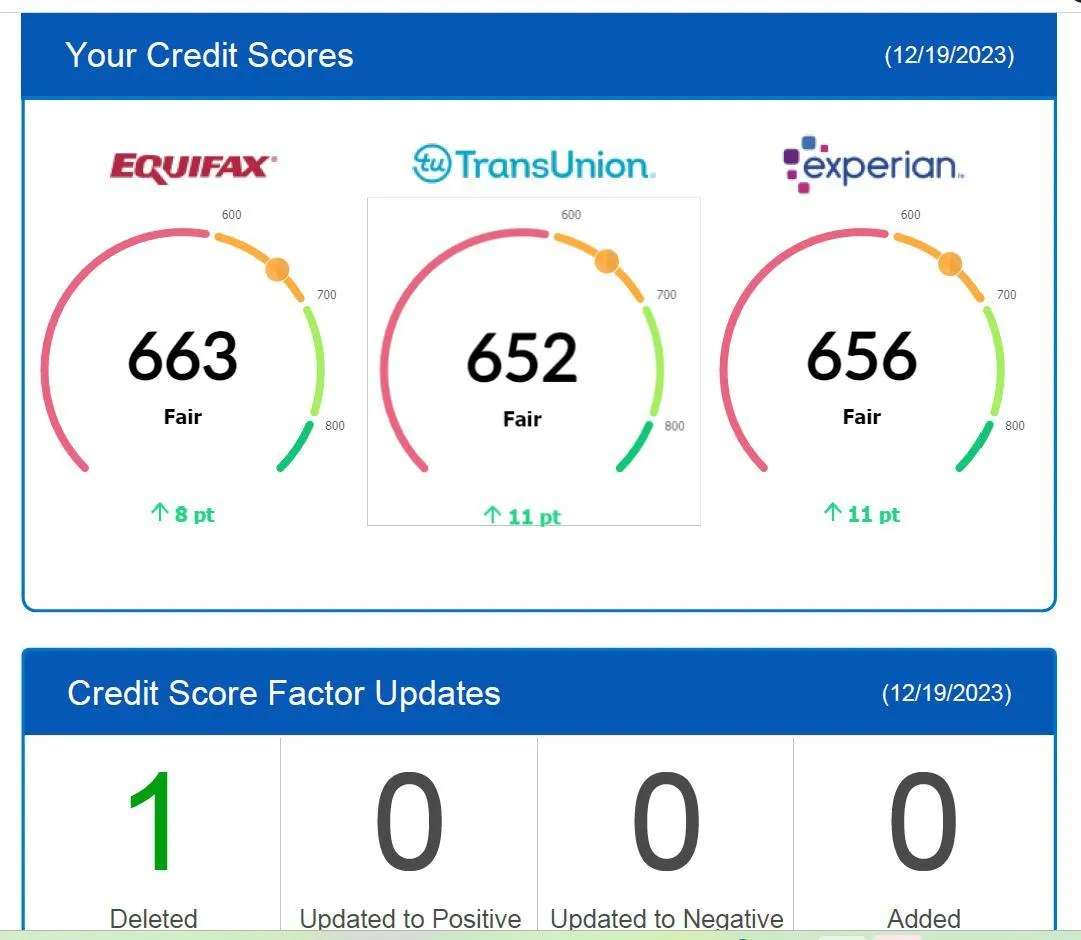

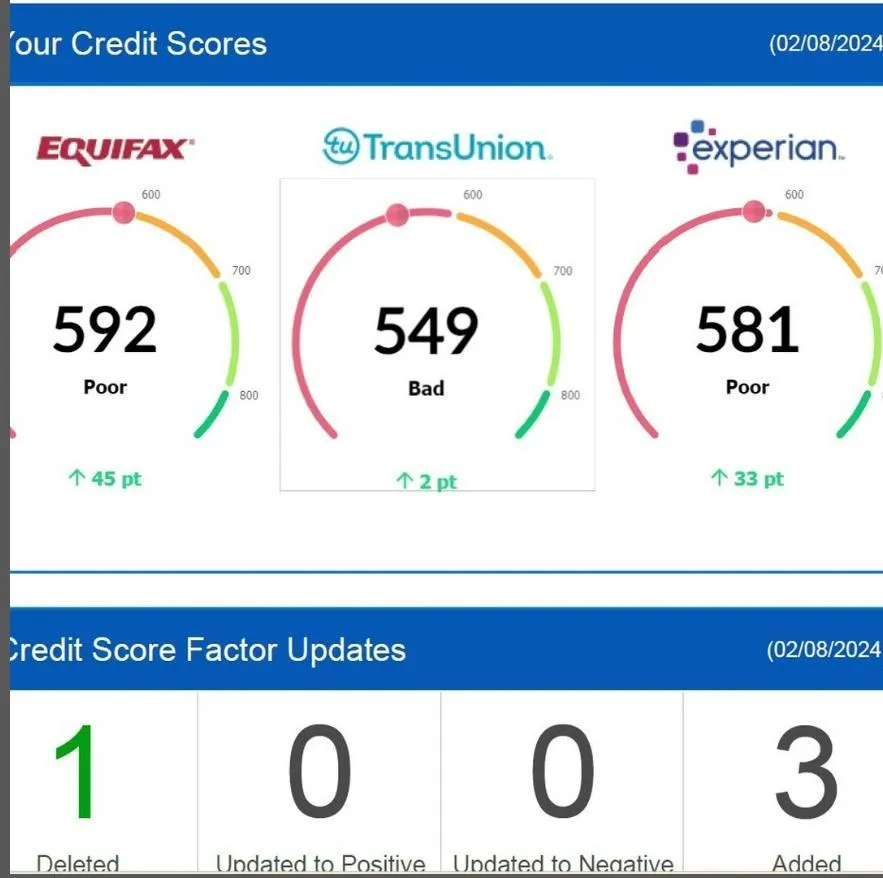

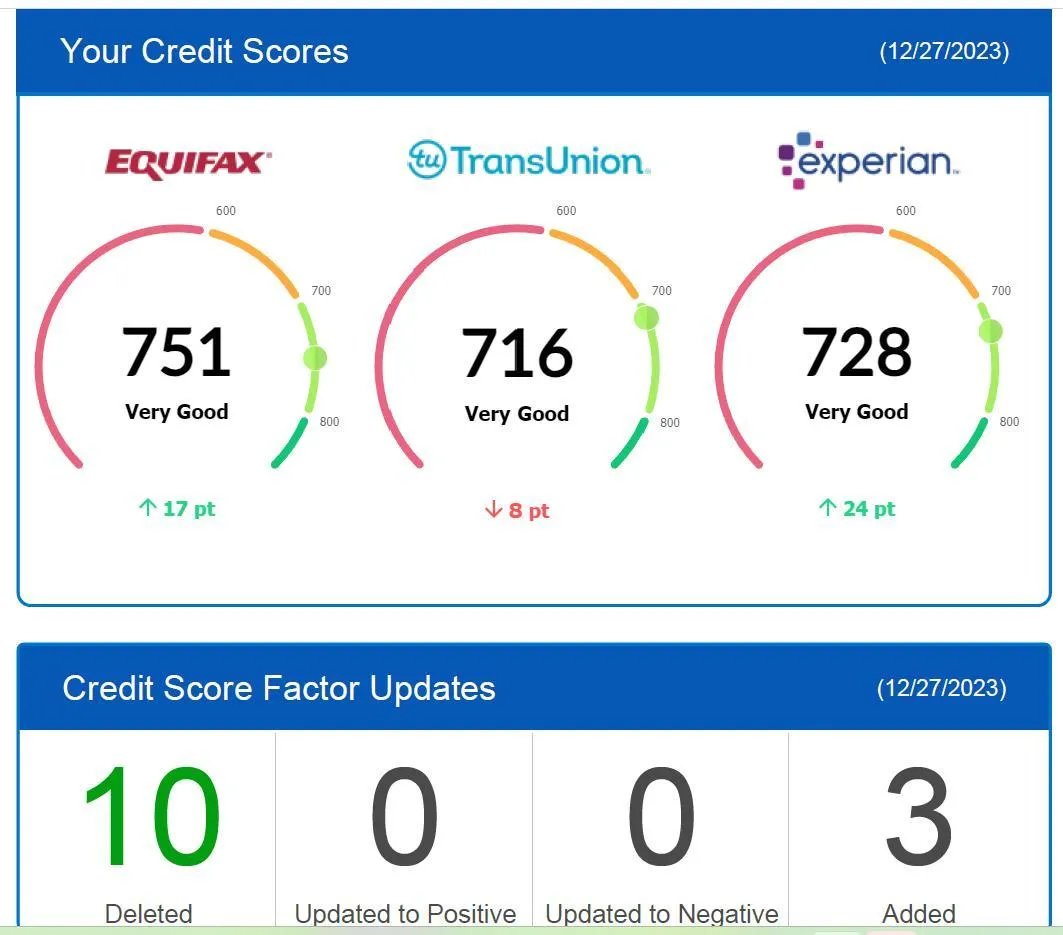

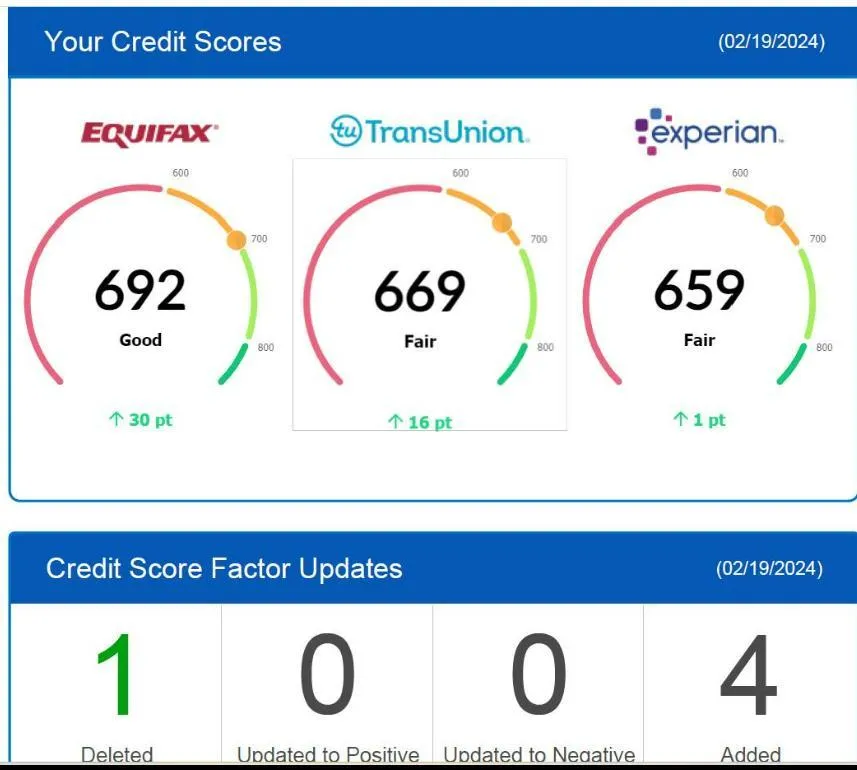

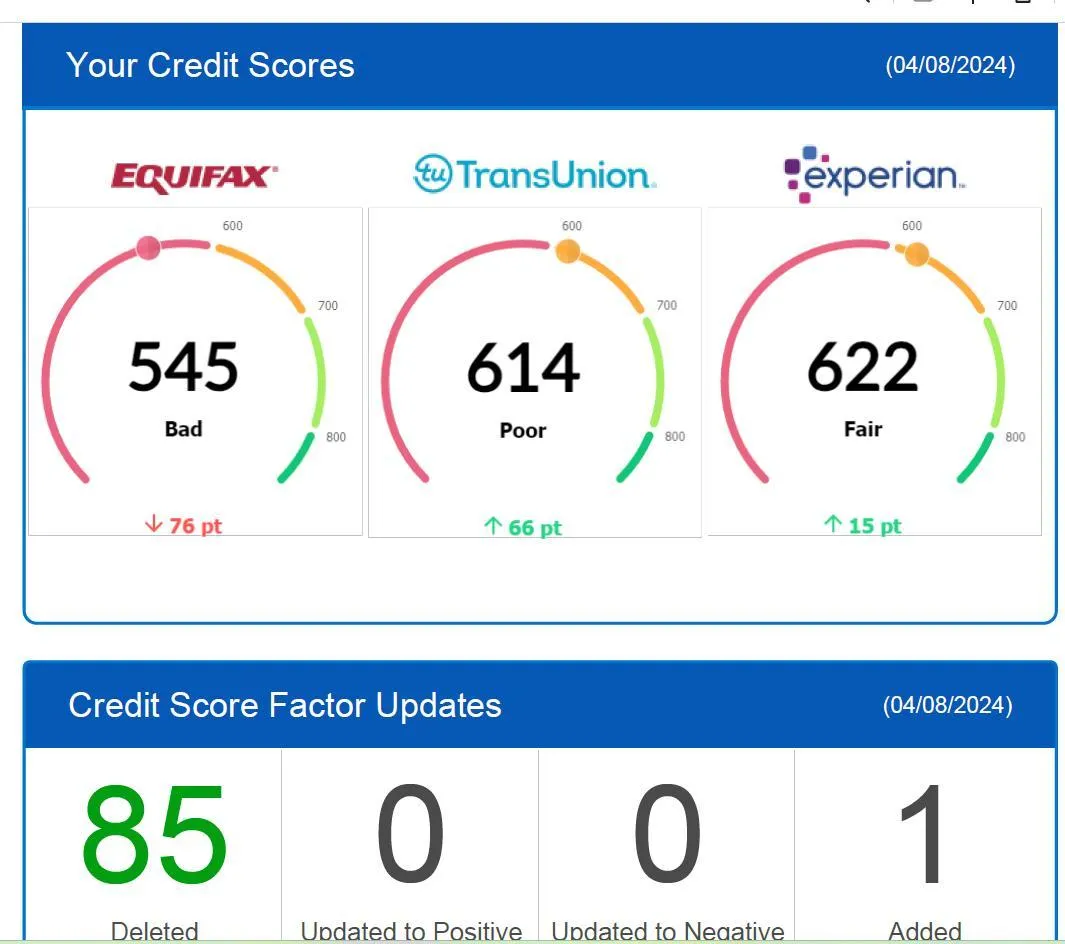

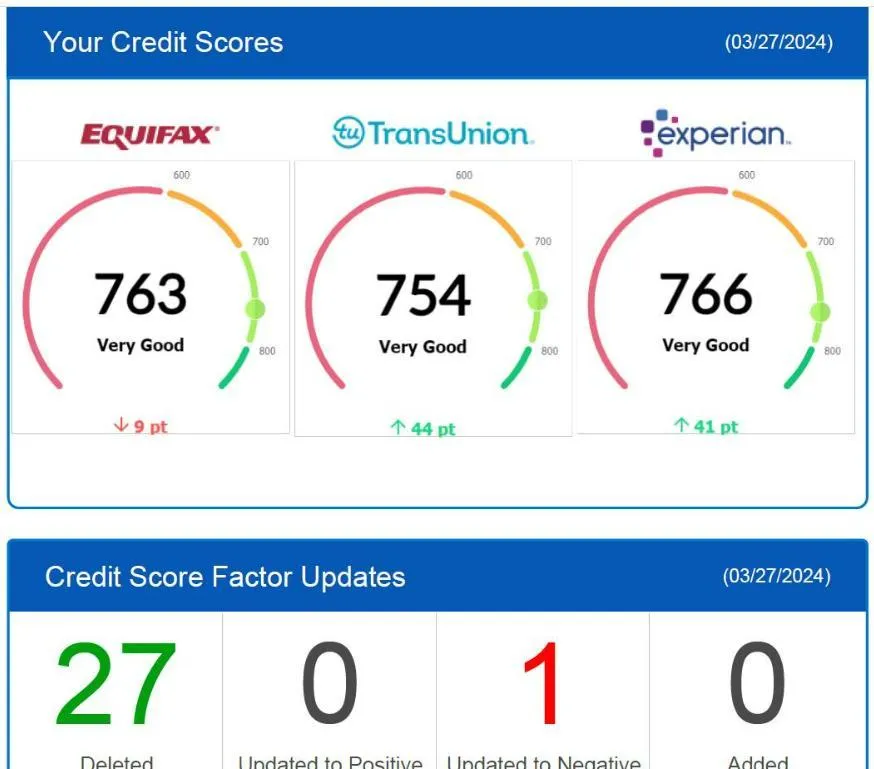

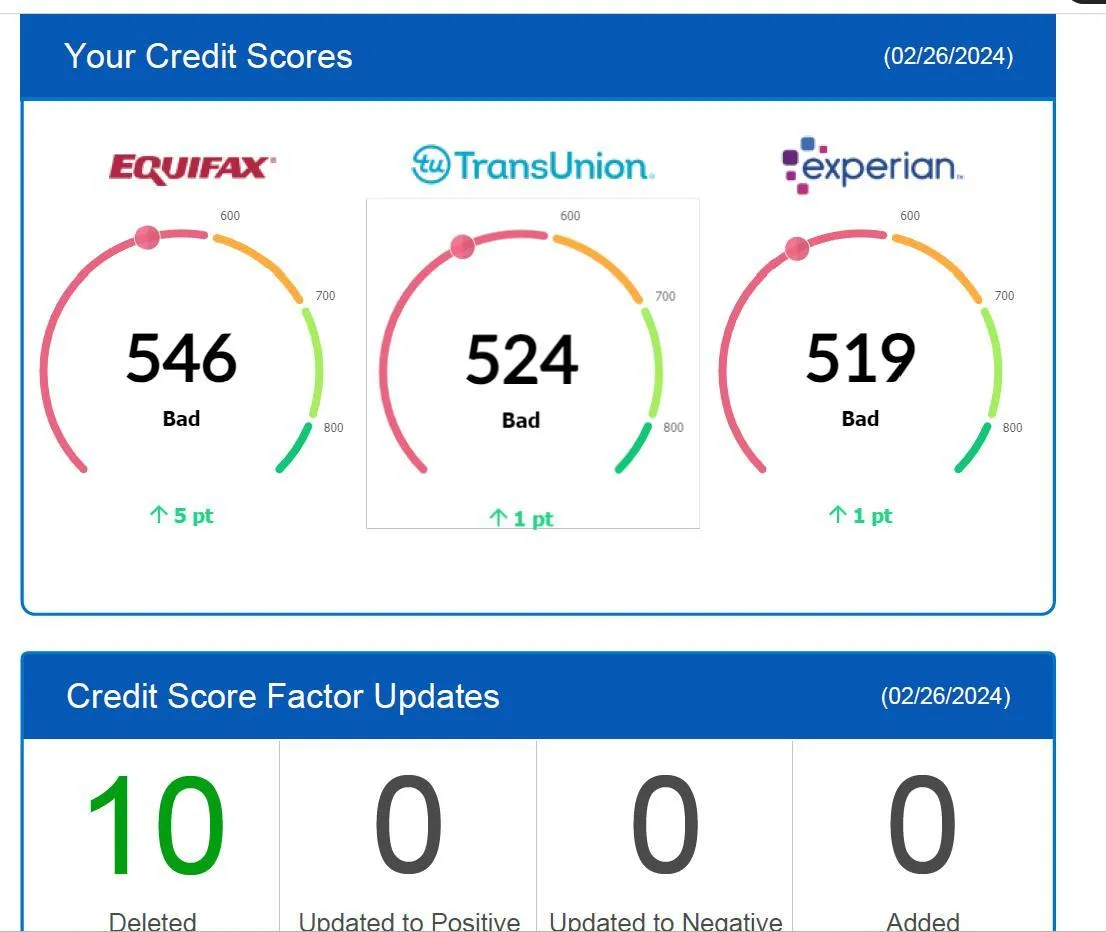

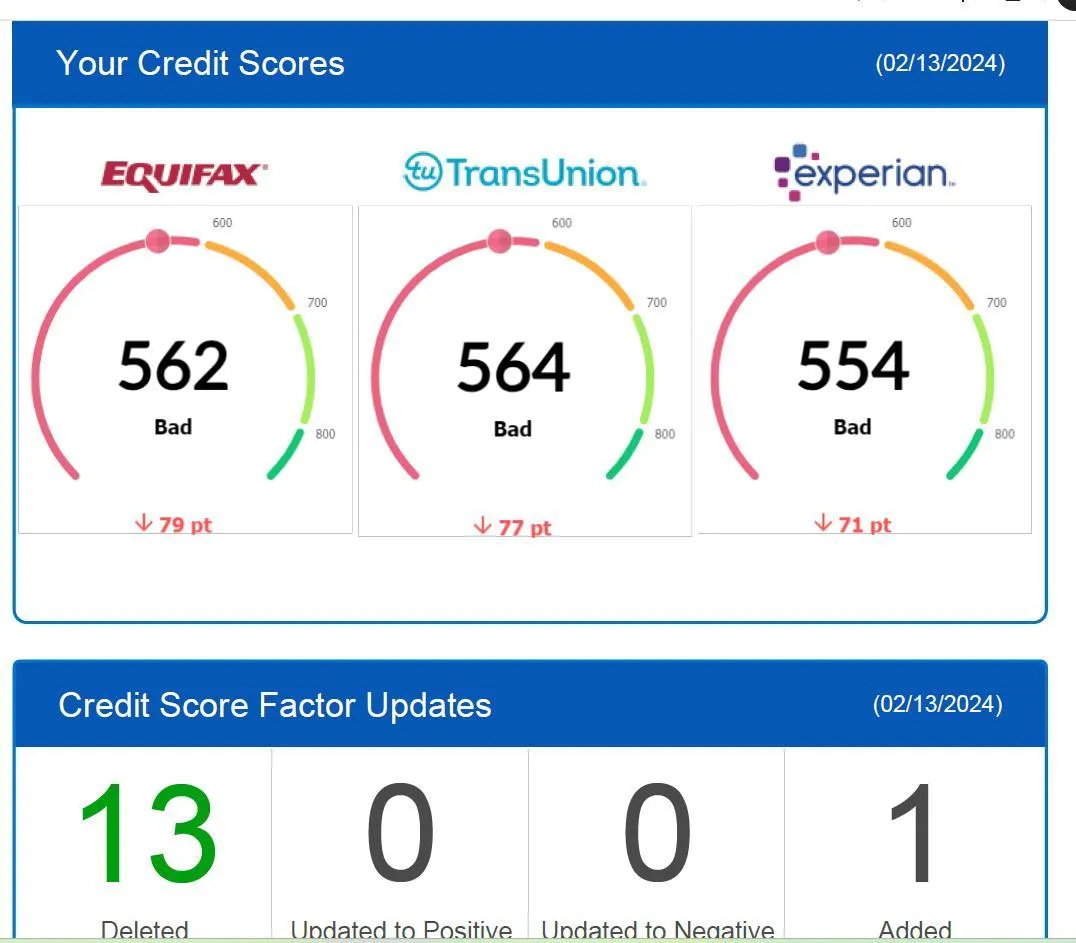

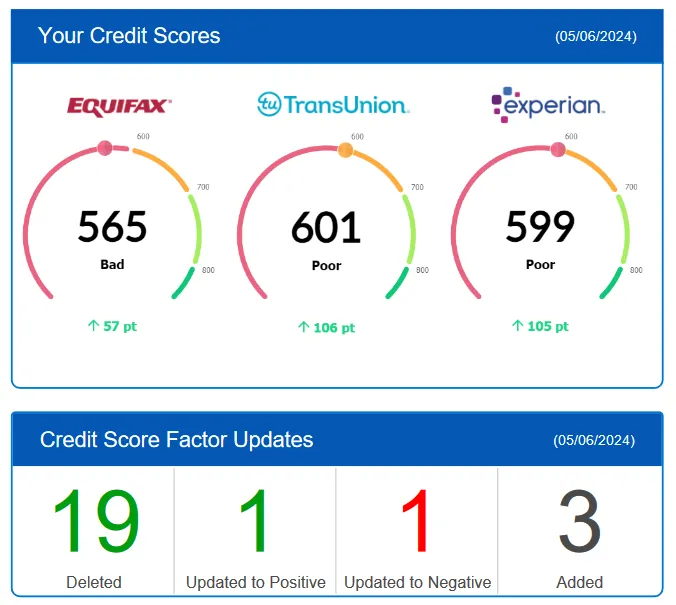

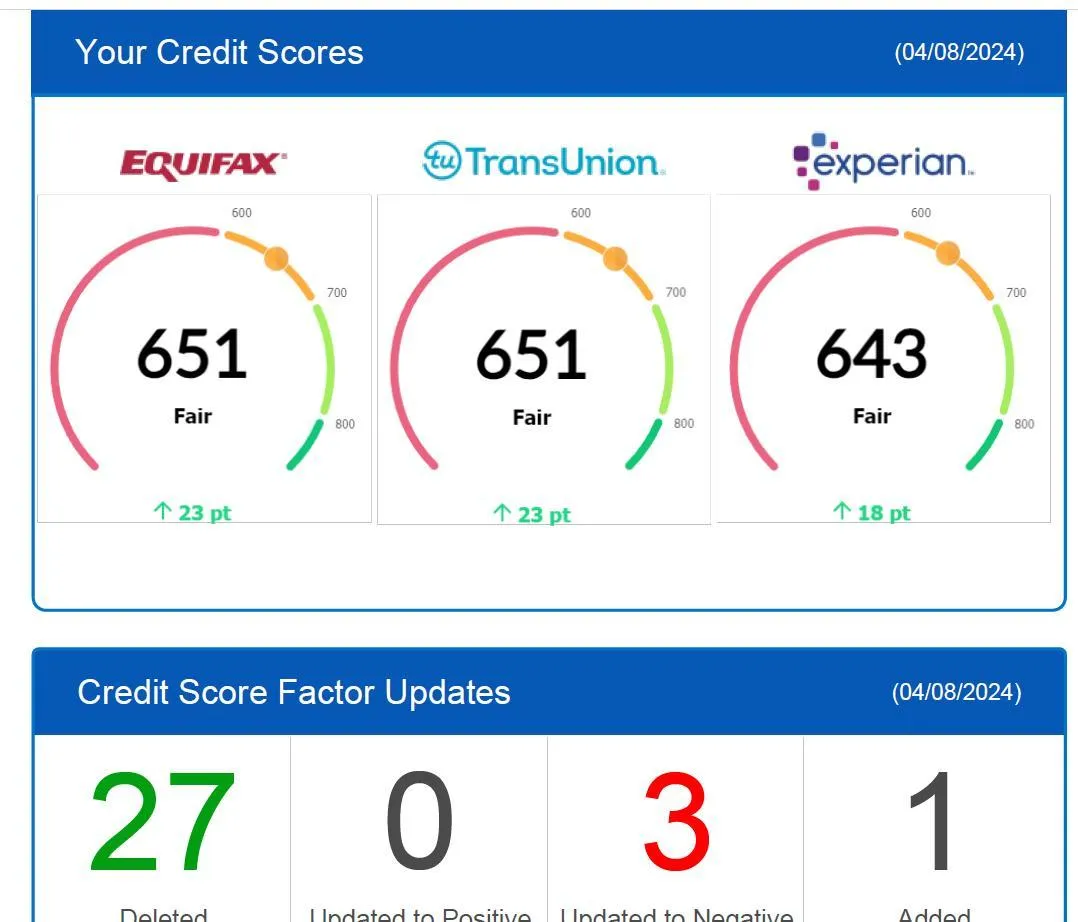

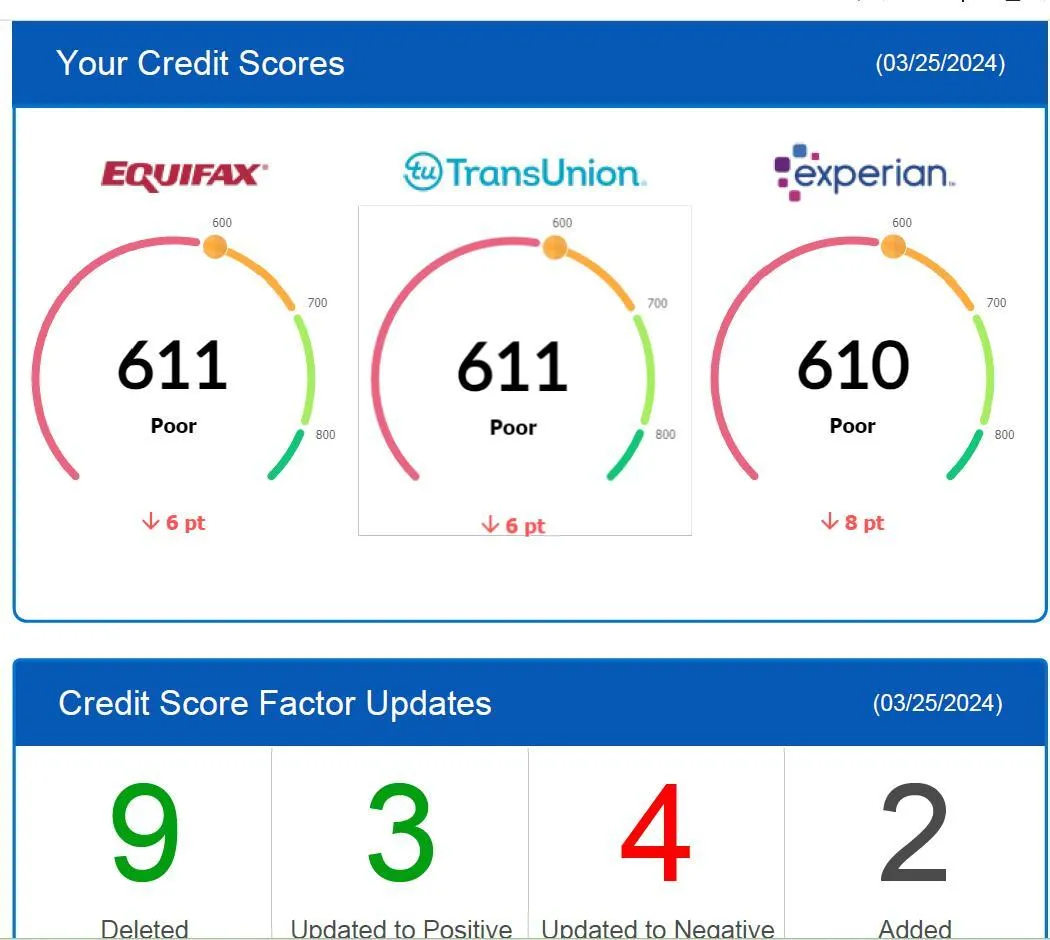

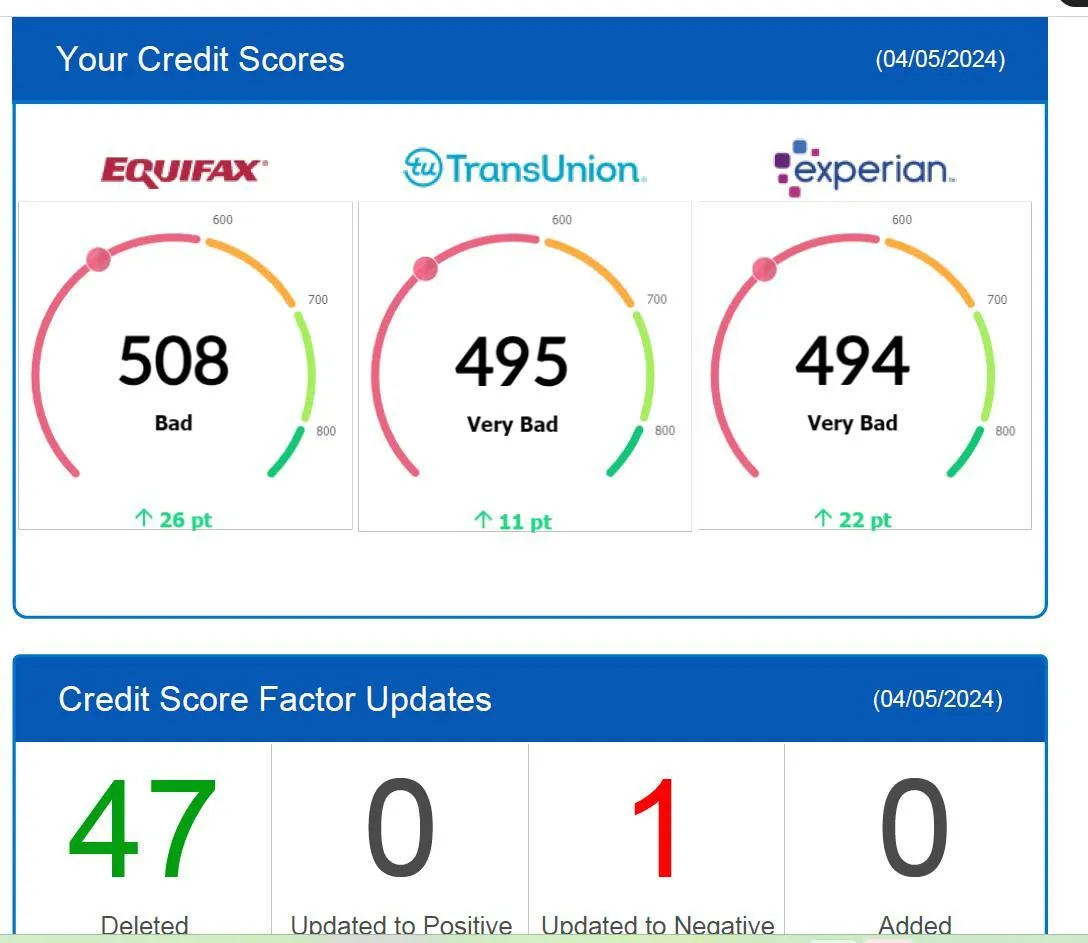

I'm here to describe my amazing experience with DB Credit Repair! My credit score was stuck in the low 500s (or even high 400s) – not a good place to be. I knew I needed help, and DB Credit Repair came through in a BIG way. DB Credit Repair team clearly knows their stuff. They guided me through the process and made everything easy to understand. They were always available to answer my questions and address any concerns I had.

Within just two months of working with their program, I saw a fantastic jump! My credit score is now soaring in the 600s. This is a huge improvement, and I'm so grateful to DB Credit Repair for making it happen. Seeing my score climb in just two months was incredible. It motivated me to stay on track.

If you're struggling with bad credit, don't hesitate to reach out to DB Credit Repair. They can help you achieve the financial freedom you deserve, just like they are helping me!

TESTIMONIALS

Maximizing Your Credit Score

Maximizing Your Credit Score: Insights from a Professional Credit Consultant in NY

In today's financial landscape, your credit score holds the key to countless opportunities, from securing loans to obtaining favorable interest rates. Yet, many individuals find themselves grappling with less-than-optimal credit scores, unaware of the strategies that could elevate their financial standing. DB Credit Repair, a trusted name in the realm of credit consultation in NY, offering invaluable insights into maximizing your credit score and unlocking a world of financial freedom.

Understanding the Importance of Your Credit Score

Your credit score serves as a numerical representation of your creditworthiness, influencing lenders' decisions regarding loan approvals and interest rates. From mortgage lenders to credit card companies, many financial institutions rely on credit scores to assess the risk associated with extending credit to individuals.

The Role of DB Credit Repair: Navigating the Complexities of Credit Restoration

In the bustling metropolis of New York, where financial opportunities abound, we emerge as a beacon of hope for individuals seeking to improve their credit scores. With years of experience in the industry, our team of professional credit consultants possesses the expertise and insights necessary to navigate the complexities of credit restoration effectively.

Strategies for Maximizing Your Credit Score

1.Credit Report Analysis:

Begin your journey to a higher credit score with a comprehensive analysis of your credit report. Identifying inaccuracies, discrepancies, or negative items is the first step toward rectifying any potential issues.

2.Timely Payment History:

Consistently paying your bills on time is one of the most impactful factors in determining your credit score. Late payments can significantly lower your score, so prioritize timely payments to demonstrate your creditworthiness.

3.Credit Utilization Ratio:

Maintain a low credit utilization ratio by keeping your credit card balances well below their limits. Aim to use no more than 30% of your available credit to avoid signaling financial strain to lenders.

4.Diversified Credit Mix:

A healthy credit mix, including a combination of credit cards, loans, and other lines of credit, can bolster your credit score. However, avoid opening multiple new accounts within a short period, as this can negatively impact your score.

5.Regular Monitoring and Maintenance:

Stay vigilant about monitoring your credit report for any changes or discrepancies. Address any issues promptly and continue to implement positive credit habits to maintain a healthy score.

The DB Credit Repair Advantage: Personalized Solutions for Financial Success

We understand that every individual's financial situation is unique. That's why we take a personalized approach to credit consultation, crafting tailored solutions that address your specific needs and goals. Whether you're aiming to boost your credit score for a major purchase or simply striving for financial stability, our team is dedicated to guiding you every step of the way.

Harnessing the Power of Credit Building Strategies

1. Secured Credit Cards:

For individuals with limited credit history or past credit challenges, secured credit cards offer a valuable opportunity to rebuild credit. By making a security deposit that serves as collateral, cardholders can demonstrate responsible credit usage and gradually improve their credit score over time.

2. Credit Builder Loans:

Credit builder loans are another effective tool for establishing or rebuilding credit. These loans are designed to help individuals with thin or damaged credit files by allowing them to make small monthly payments that are reported to credit bureaus. Over time, consistent repayment of these loans can lead to significant improvements in credit scores.

Empowering Individuals for Financial Success

Our mission extends beyond merely improving credit scores; we strive to empower individuals with the knowledge and resources needed to achieve lasting financial success. Through educational resources, personalized guidance, and ongoing support, DB Credit Repair equips clients with the tools necessary to take control of their financial futures.

Conclusion

Ready to take control of your financial future? With our expertise, you can start your journey to maximizing your credit score and unlocking endless financial opportunities.

Don’t wait—Book free credit Consultation Now by clicking the link:👉👉www.dbcreditrepairs.com/db-calendar-booking-appointment and let DB Credit Repair help you take the first step toward financial success!

Visit our Website: www.dbcreditrepairs.com for more insights and strategies for a secure financial future.

Credit Score Summary

Get In Touch

Email: [email protected]

Phone: 646-832-4959 or 914-841-5577

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours :

Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED

© Copyright2024 A - DB CREDIT Repair - | 120 Day Money Back Guarantee from the date of the sale | All Rights Reserved.

Get In Touch

Email: [email protected]

Customer Support: 646-832-4959

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours :

Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED