WHAT DO OUR CLIENTS SAY?

A Client's Journey to Success with DB Credit Repair

As a millennial educator, with very little formal knowledge about financial and credit literacy, Darren quickly helped me and my family in one of the most pressing situations of our lives. By providing me top quality credit education and repair, it is evident that Darren clearly cares about his community and will help bridge the Financial Wealth Gap one customer at a time. He is worth every penny! Whether you want a car, an apartment, a house, or just planning for the future. Do it! DB Credit Repair is for the people! No gimmicks, No scams. True top quality services.

Working with DB credit repair has been an amazing experience! Darren acts as a supportive coach throughout the process, demonstrating a professional attitude that guides you through every step. He truly understands your situation and prepares you for the financial freedom that everyone deserves. The service provided is top-notch and efficient.

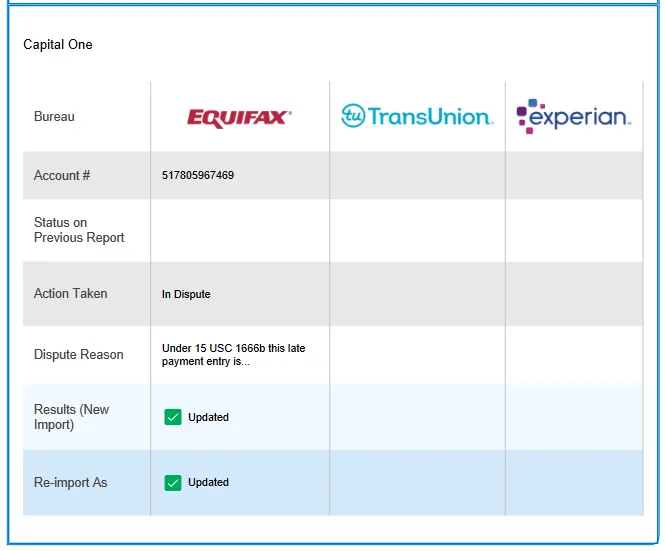

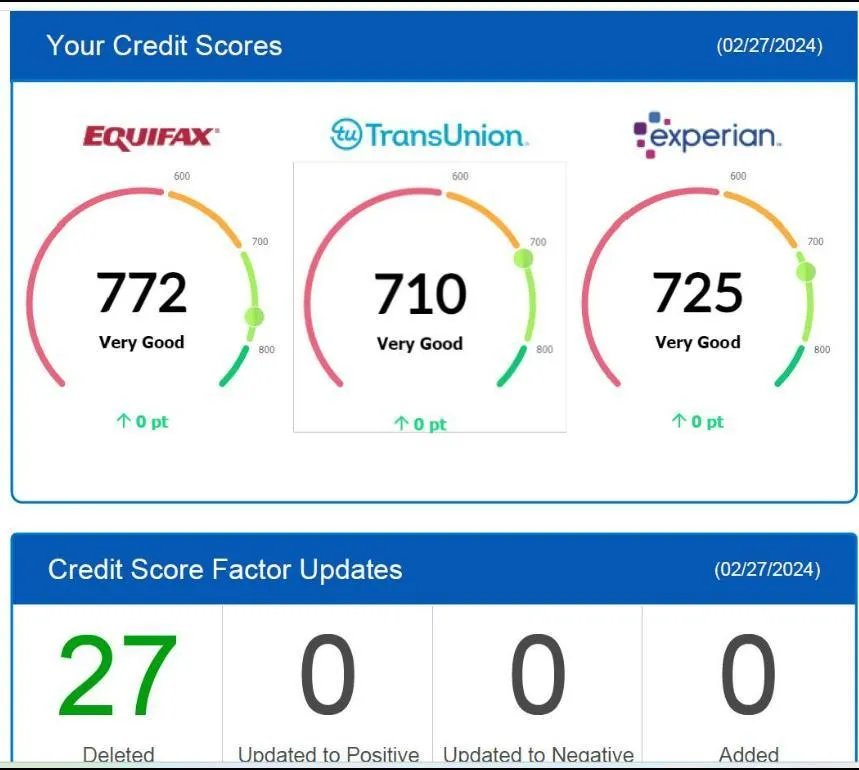

DB Credit Repair deserves my utmost appreciation for their outstanding service. The team displayed remarkable professionalism and efficiency while assisting me in the intricate process of credit repair. Their guidance was comprehensive, and they delivered prompt and tangible results. Thanks to their expertise and dedication, my credit score has improved significantly, granting me access to opportunities I never thought possible. I wholeheartedly recommend DB Credit Repair to anyone seeking to take charge of their financial future and achieve their credit goals.

I appreciated the personalized approach I received from DB Credit Repair. They took the time to understand my specific situation and goals. They developed a customized plan and worked diligently to achieve results. Their hard work and dedication paid off, and my credit score is now in much better shape.

DB Credit Repair Turned My Credit Score Around!

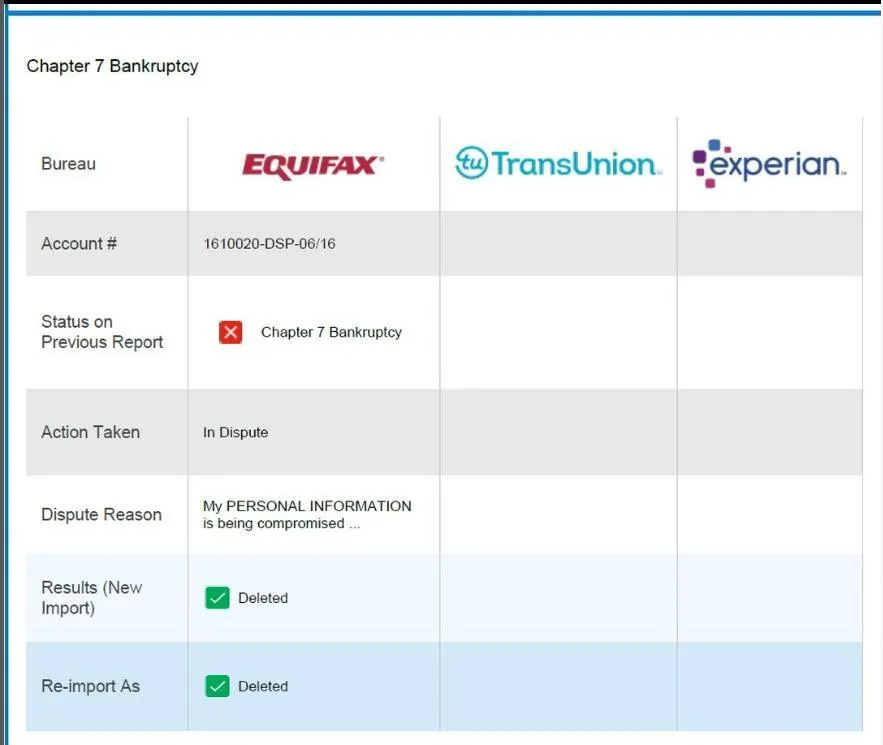

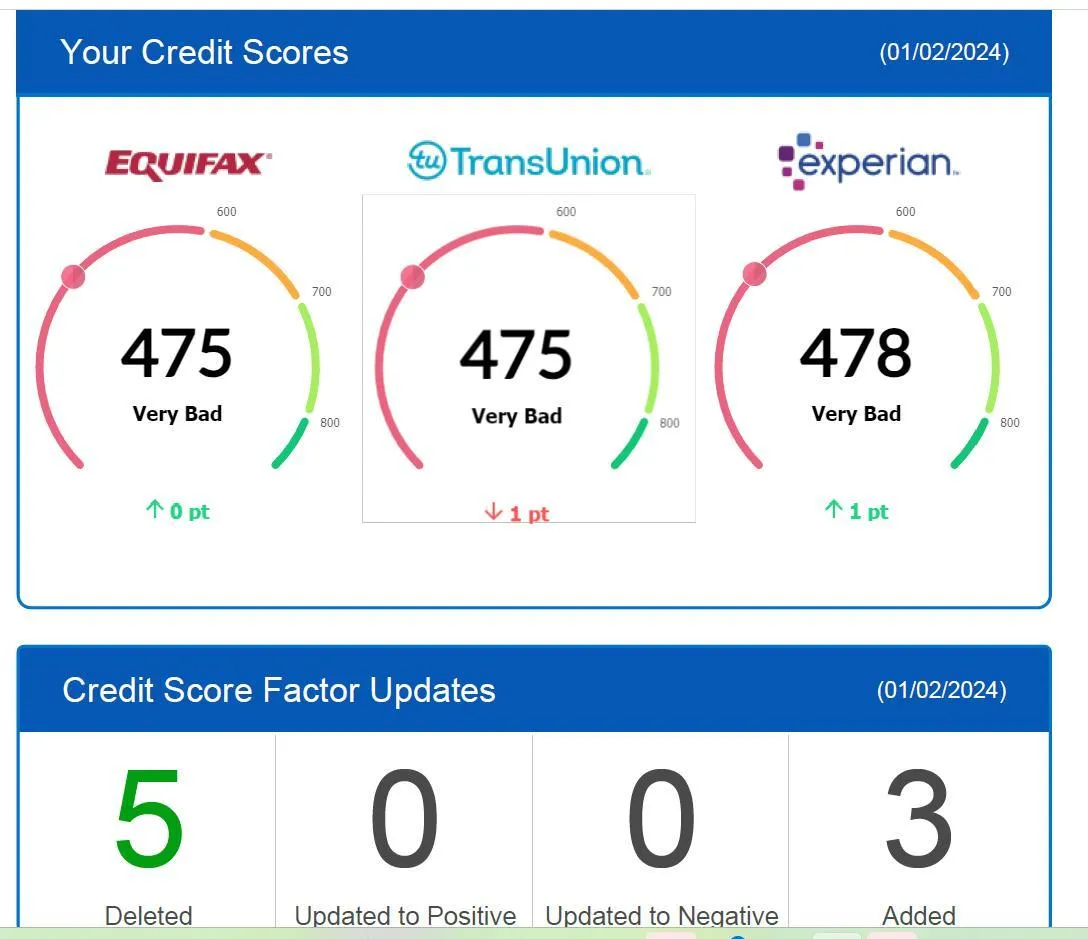

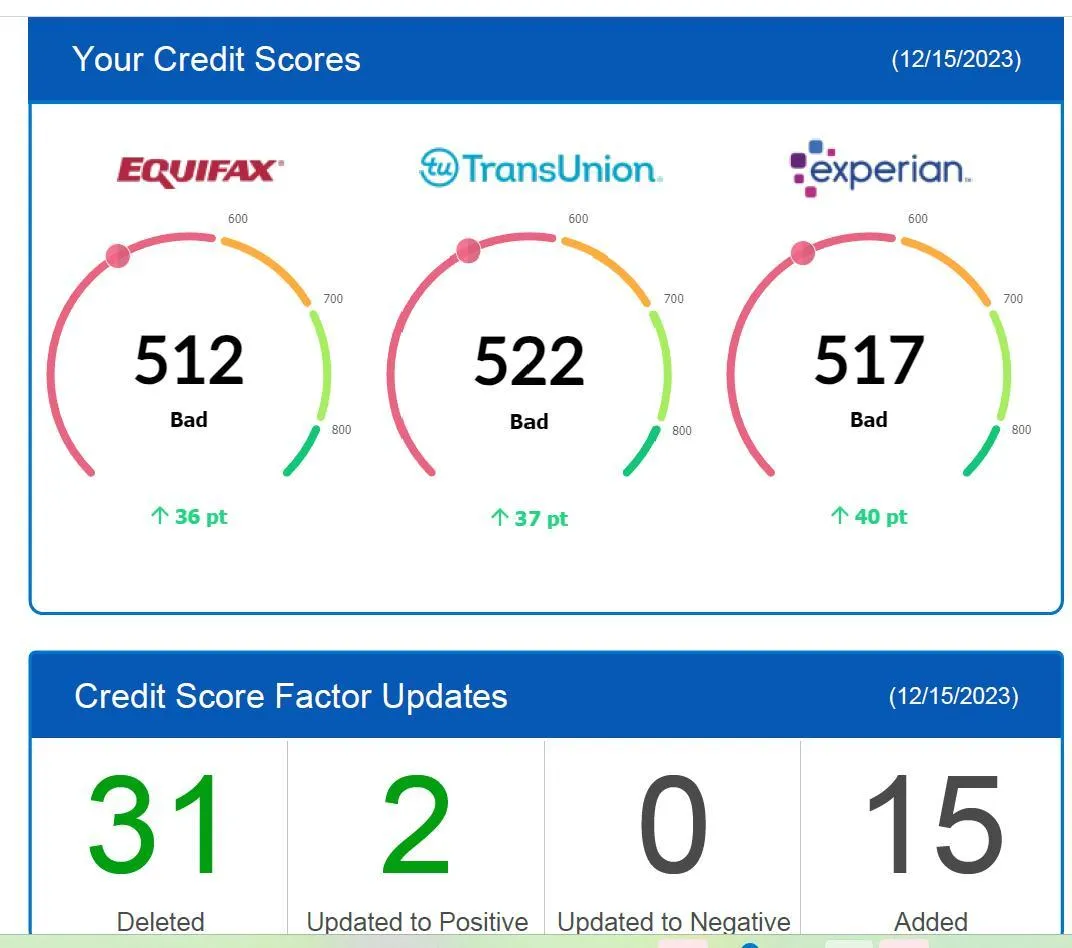

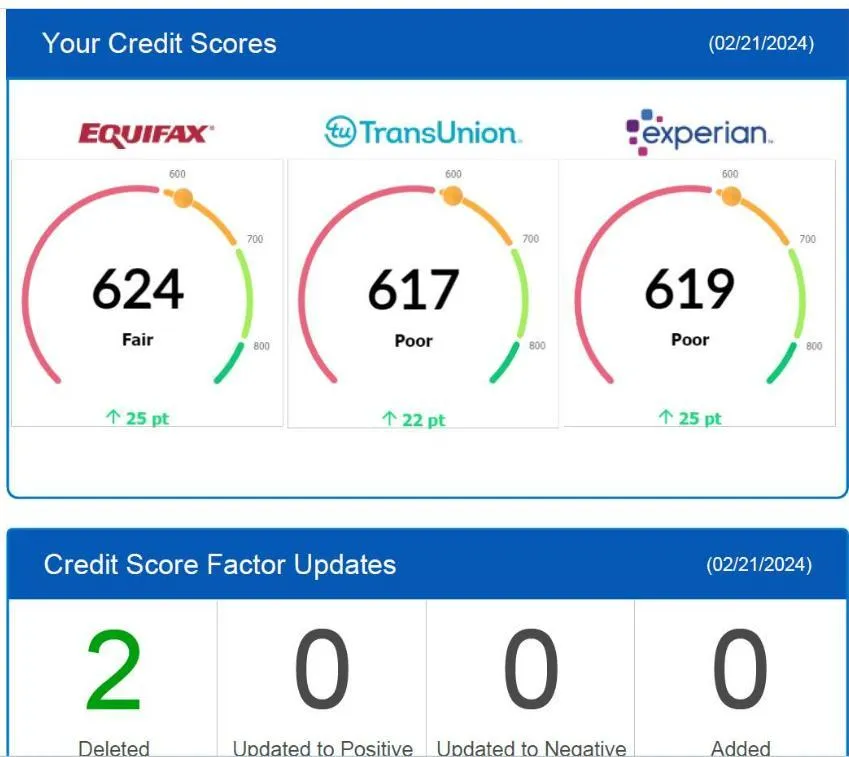

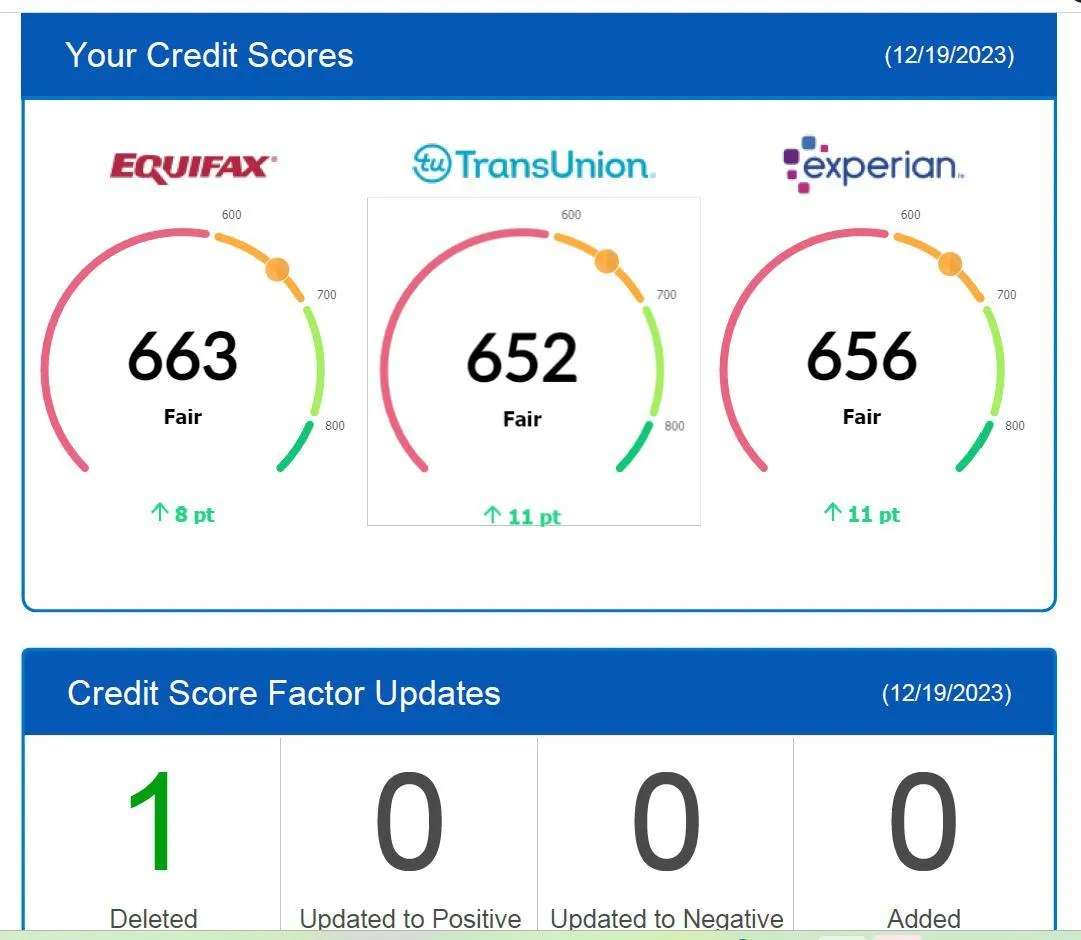

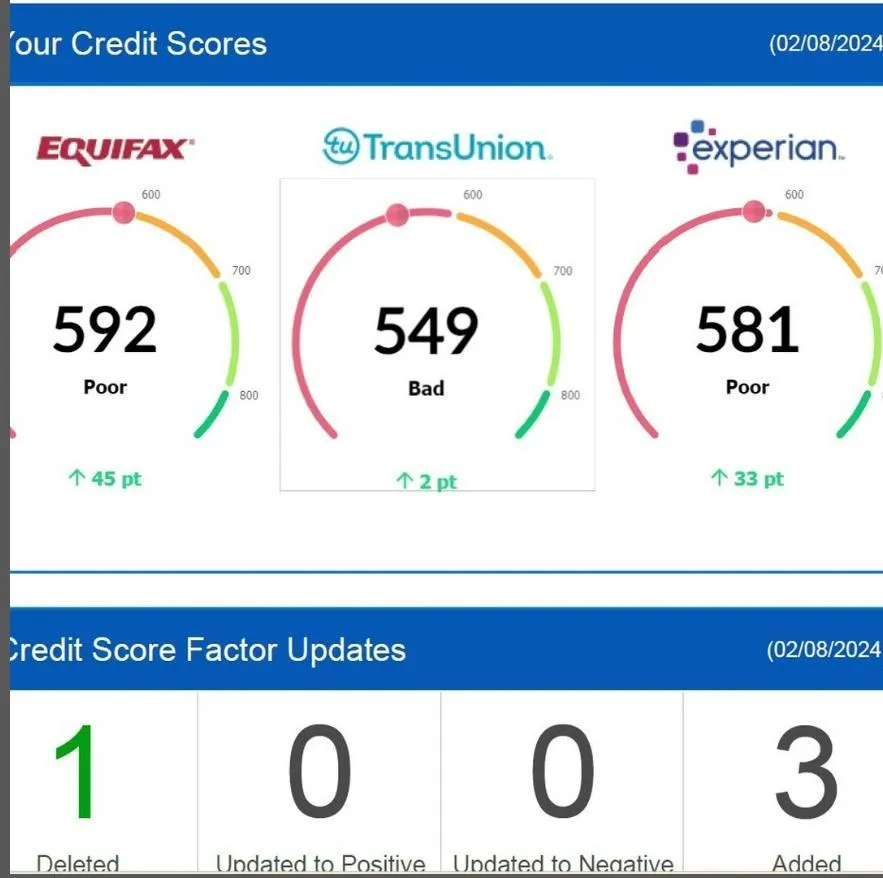

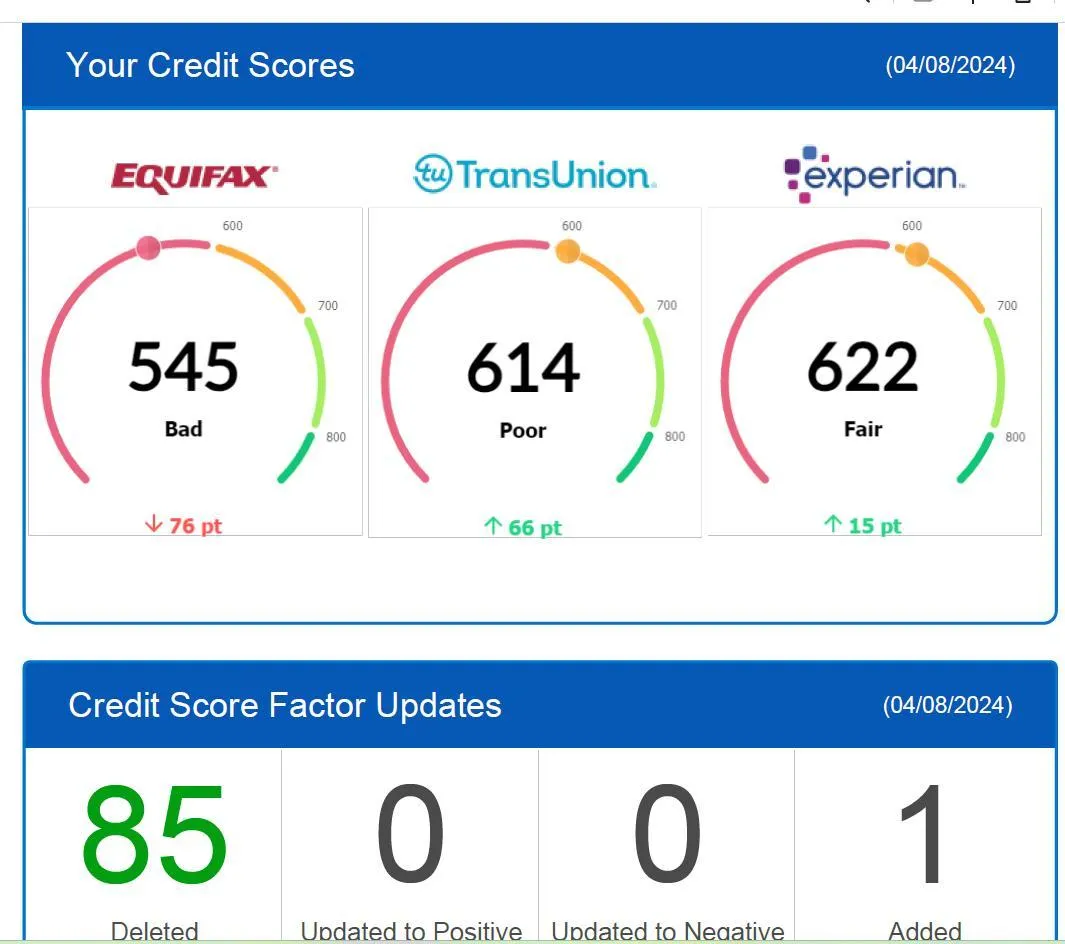

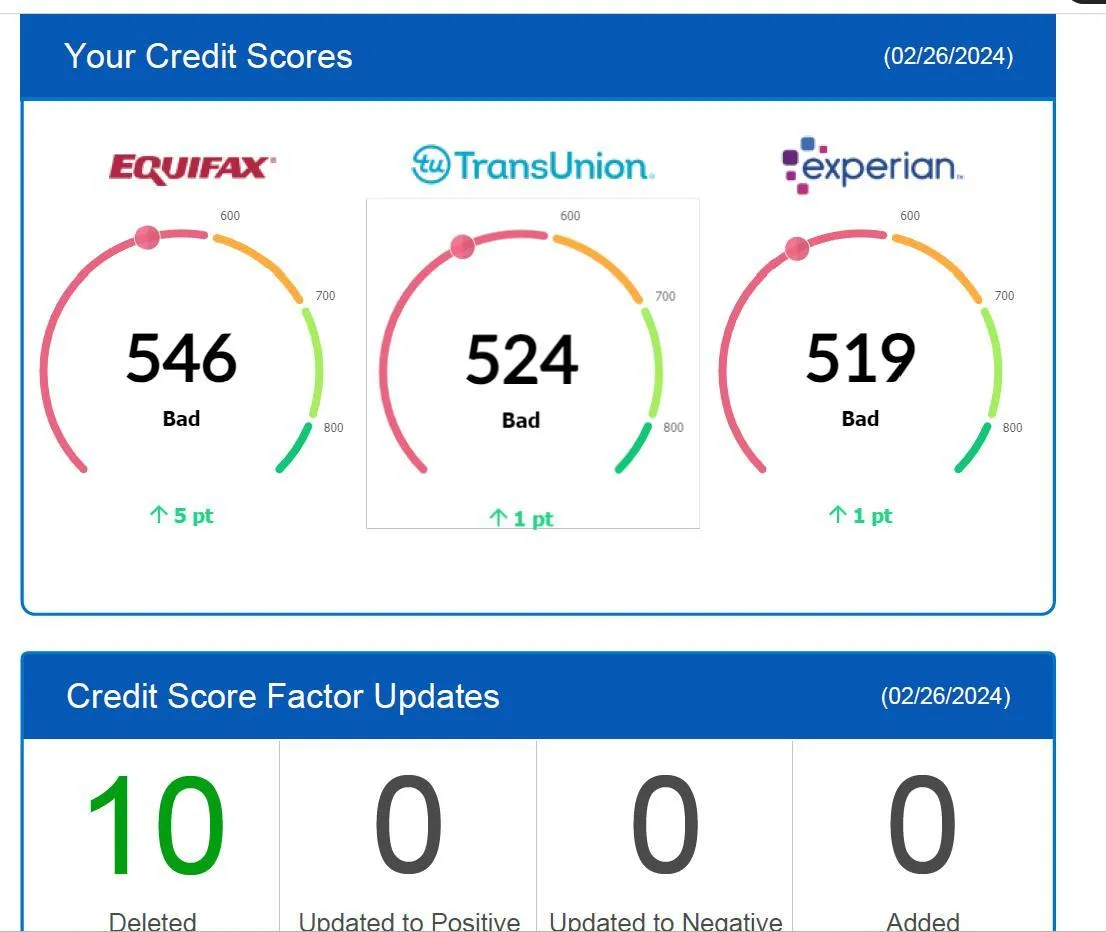

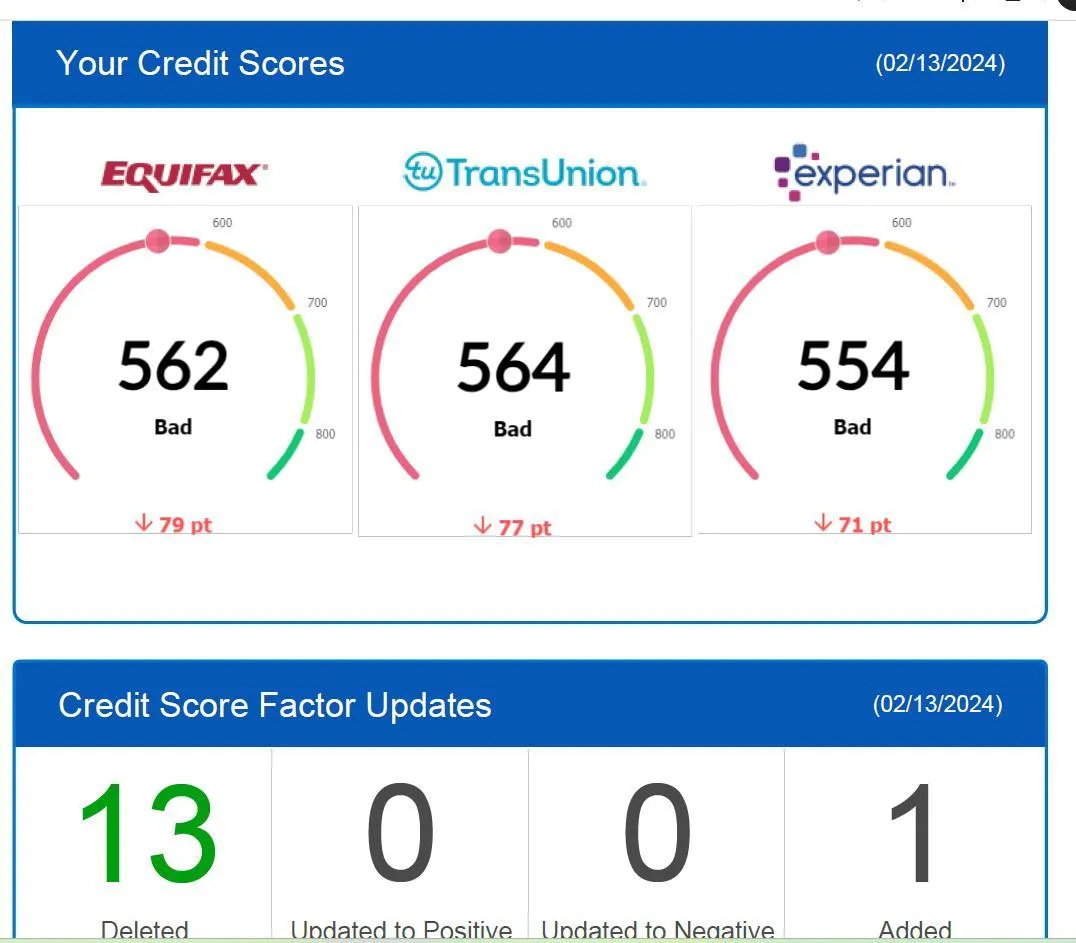

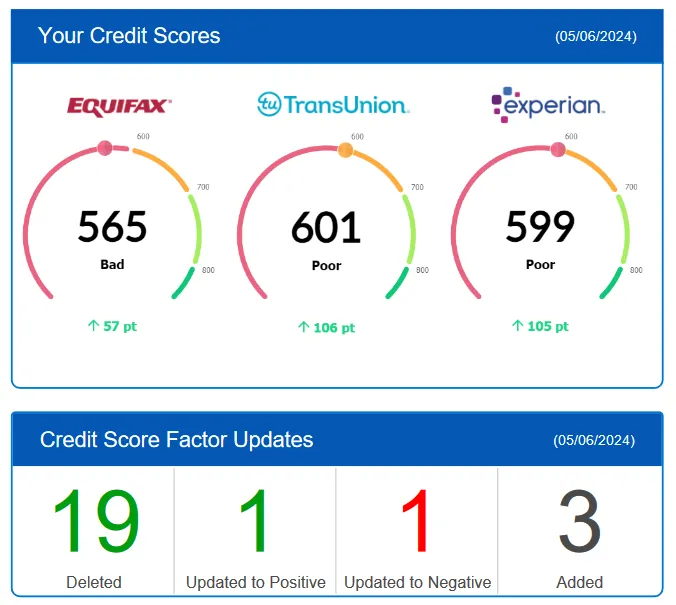

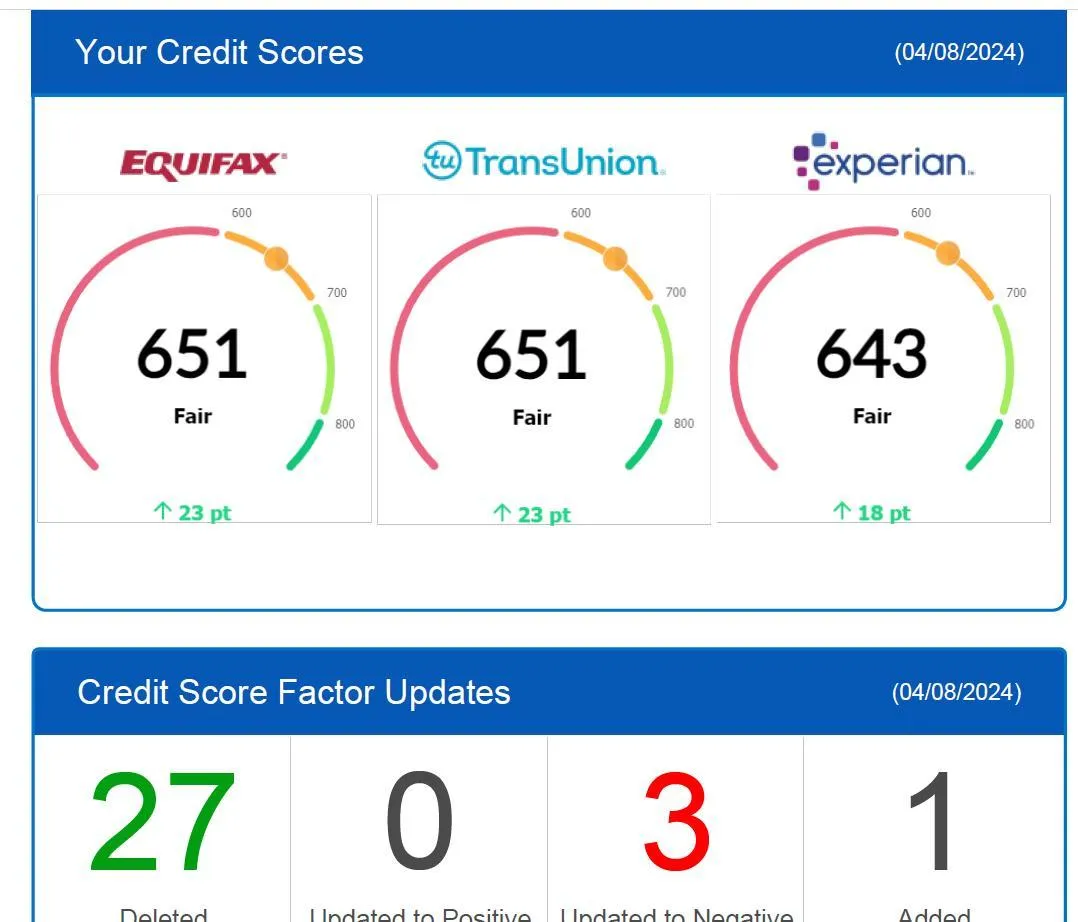

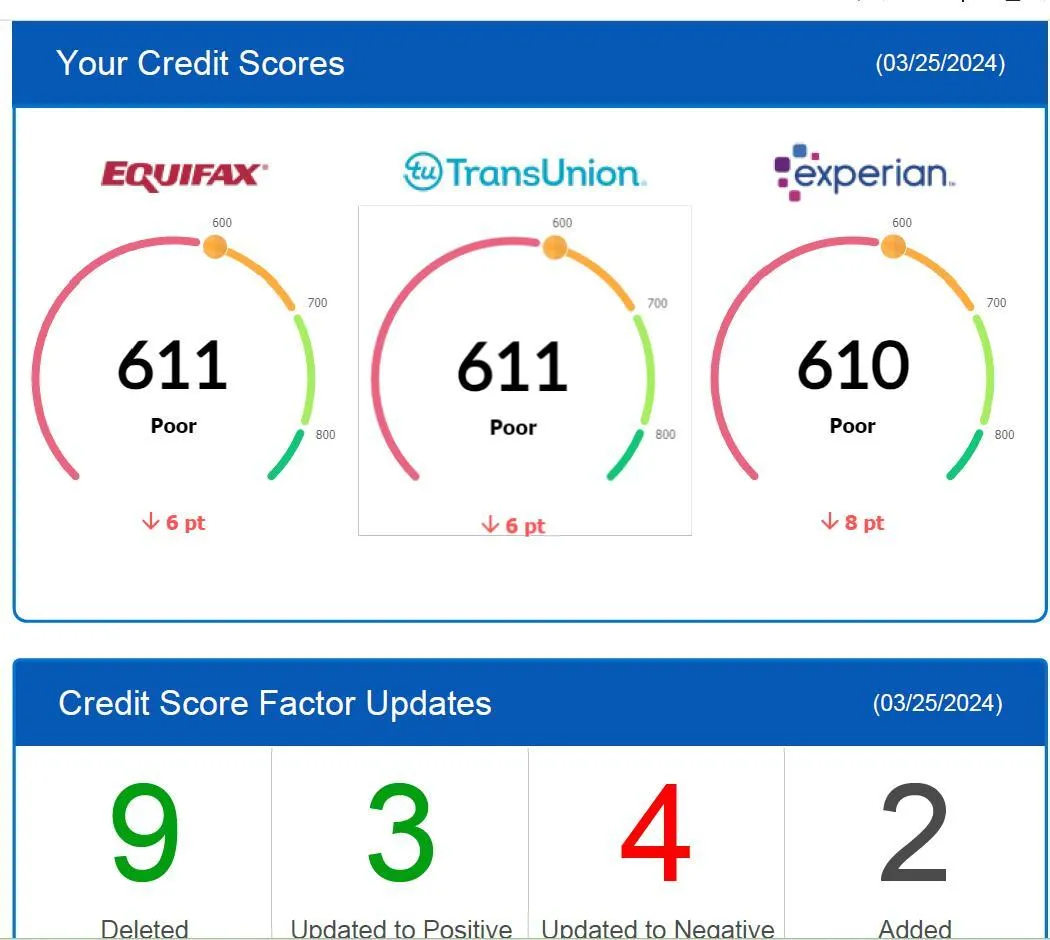

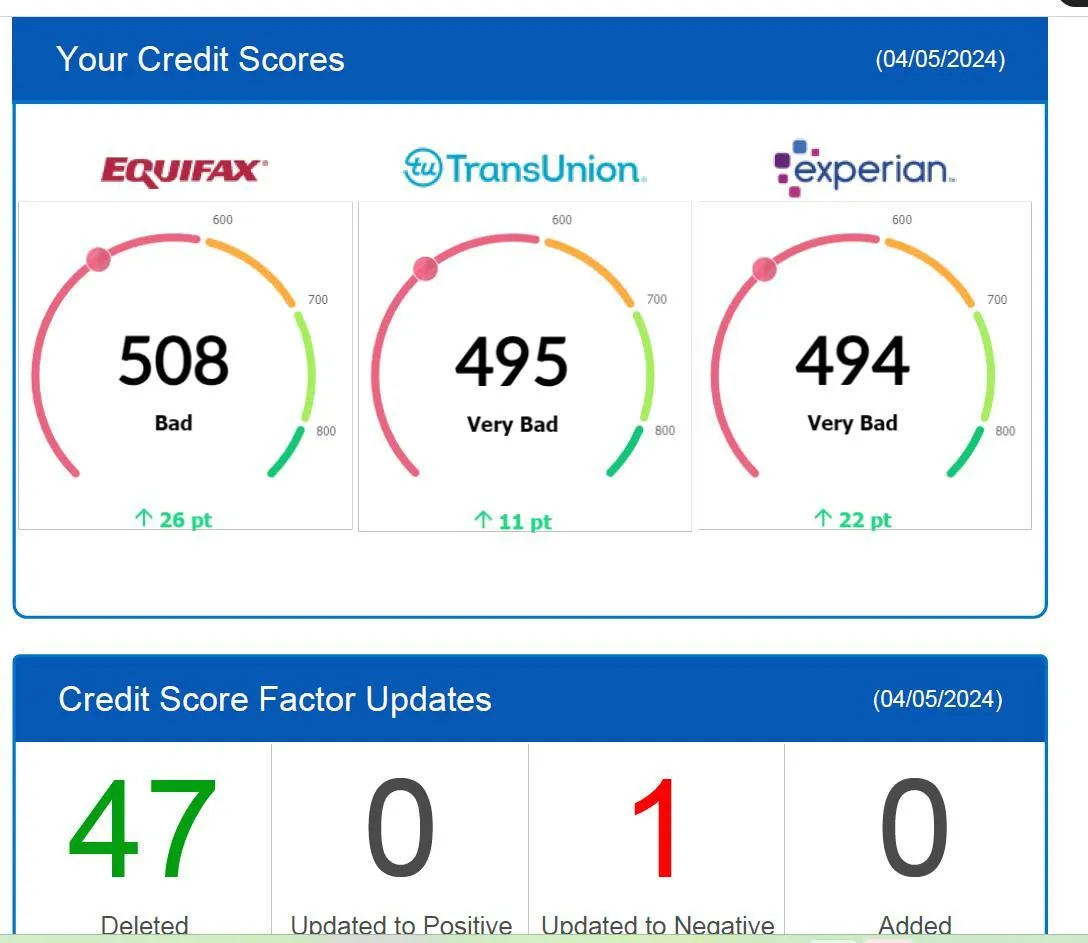

I'm here to describe my amazing experience with DB Credit Repair! My credit score was stuck in the low 500s (or even high 400s) – not a good place to be. I knew I needed help, and DB Credit Repair came through in a BIG way. DB Credit Repair team clearly knows their stuff. They guided me through the process and made everything easy to understand. They were always available to answer my questions and address any concerns I had.

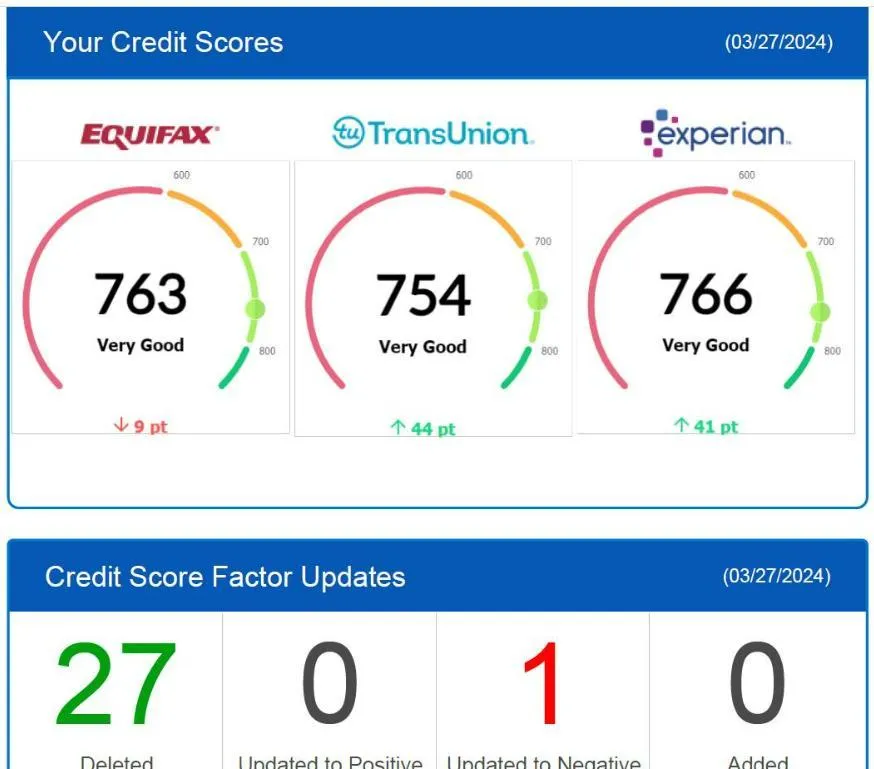

Within just two months of working with their program, I saw a fantastic jump! My credit score is now soaring in the 600s. This is a huge improvement, and I'm so grateful to DB Credit Repair for making it happen. Seeing my score climb in just two months was incredible. It motivated me to stay on track.

If you're struggling with bad credit, don't hesitate to reach out to DB Credit Repair. They can help you achieve the financial freedom you deserve, just like they are helping me!

TESTIMONIALS

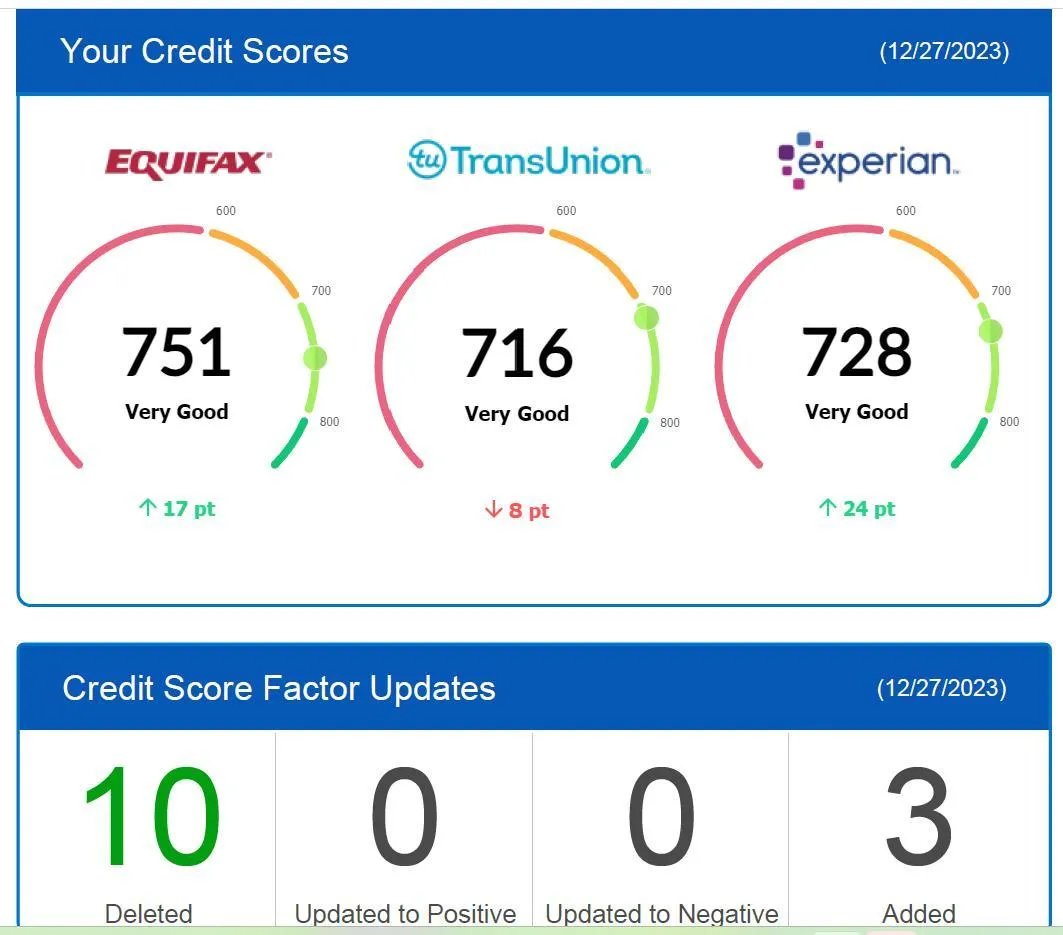

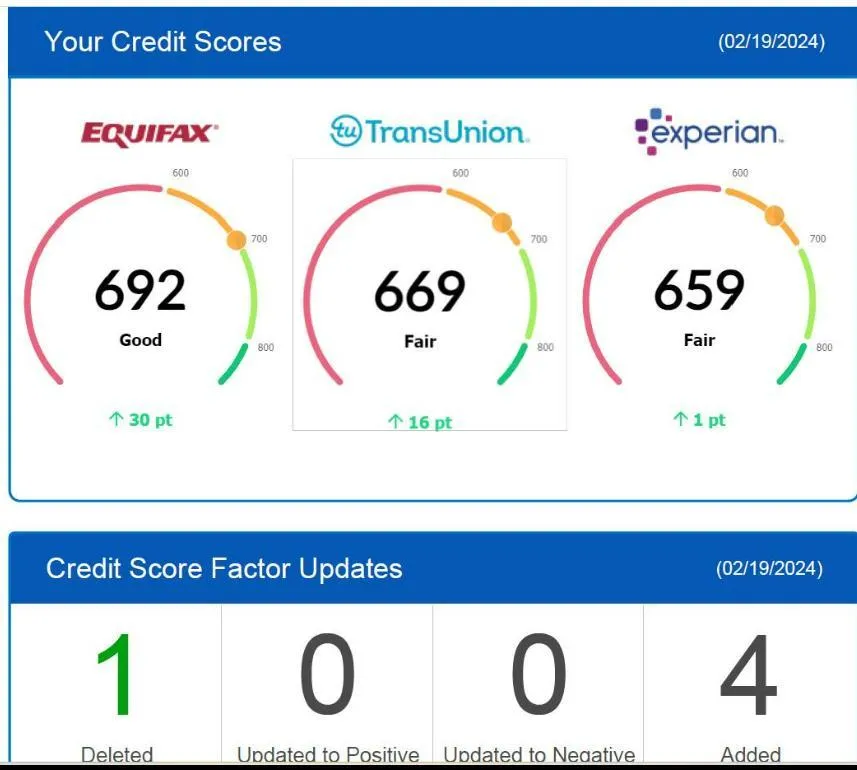

Credit Score Summary

Get In Touch

Email: [email protected]

Phone: 646-832-4959 or 914-841-5577

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours :

Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED

© Copyright2024 A - DB CREDIT Repair - | 120 Day Money Back Guarantee from the date of the sale | All Rights Reserved.

Get In Touch

Email: [email protected]

Customer Support: 646-832-4959

Address: 70 Virginia Rd. White Plains, NY 10603

Assistance Hours :

Mon – Sat 9:00am - 7:00pm

Sunday – CLOSED