Summit Real Estate Fund LLC

How Investing With Us Works

Investing in our customizable fund is simple and flexible. Instead of committing to a blind pool, you review and select individual deals that align with your goals, risk tolerance, and preferred timeline. Once you choose, your capital is invested directly into those specific opportunities, and you receive regular updates and performance reports for each one. As deals reach their planned exit — whether through a sale or refinance — your principal and returns are distributed back to you, giving you the freedom to reinvest and grow your portfolio on your terms.

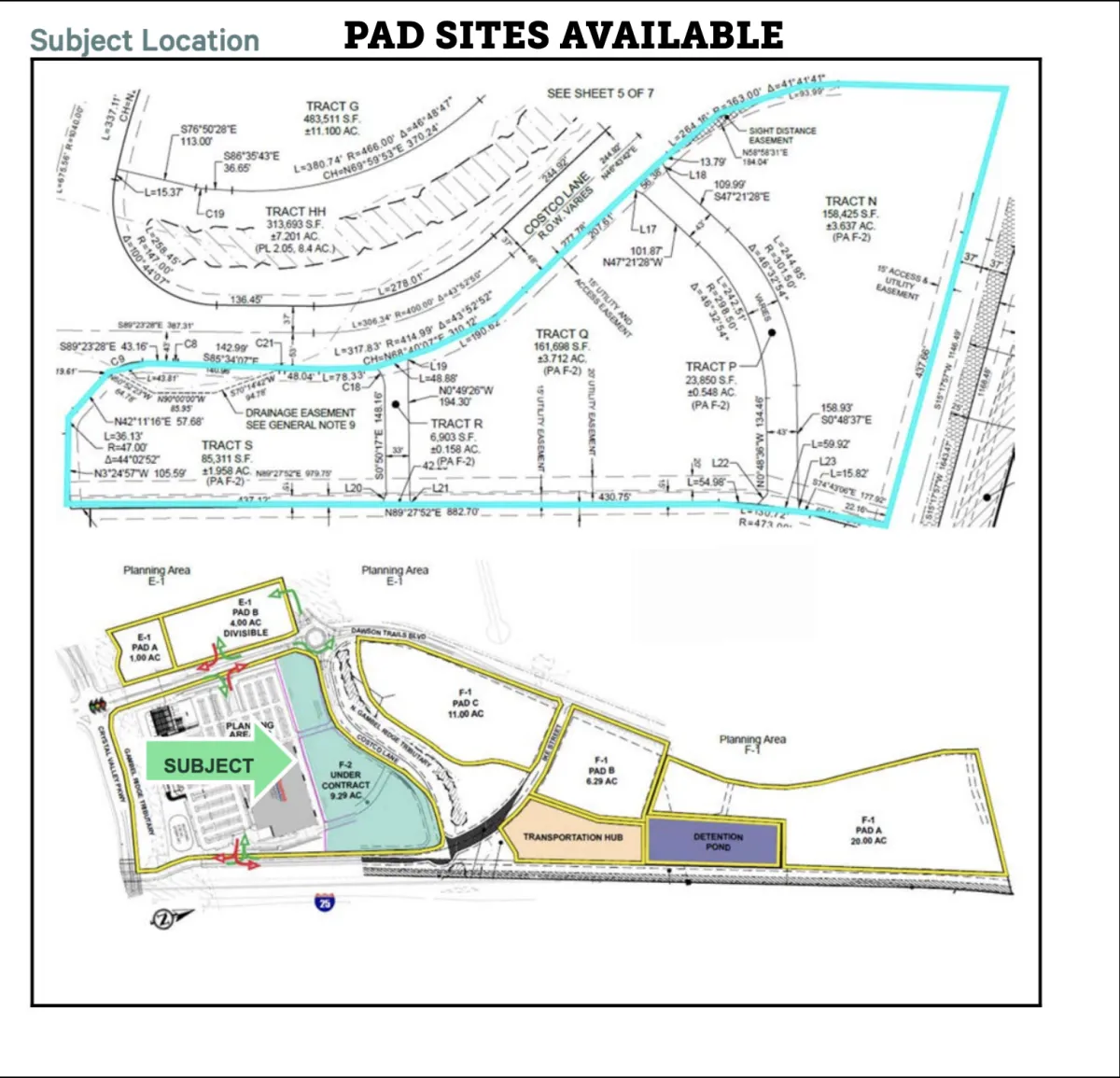

Dawson Trails Project

Development Contiguous to Costco in Castle Rock, CO

Total Land: 9.31 Acres zoned commercial

Deal Type: Class A Retail

Coming soon...

How We Evaluate Deals

Rigorous Underwriting: Every deal undergoes detailed financial and operational analysis to ensure realistic projections and strong risk-adjusted returns.

Market Research: We focus on markets with healthy job growth, population trends, and long-term economic drivers.

Operator Vetting: We partner only with experienced, reputable operators who have a proven track record of execution.

Alignment with Strategy: Each opportunity must align with our fund’s income, growth, and diversification objectives.

Downside Protection: We stress-test deals under conservative scenarios to safeguard investor capital through changing market conditions.

Frequently Asked Questions

Who can invest in this fund?

Our fund is open to accredited investors who want access to curated private real estate opportunities and value the ability to build a diversified portfolio on their terms.

Can I choose which deals I invest in?

Yes — unlike a traditional blind pool fund, our customizable structure lets you select only the deals that best match your goals and risk tolerance.

How often will I receive updates on my investments?

Investors receive regular performance reports and detailed updates for each active deal, so you always know how your capital is working for you.

What are the expected returns?

Returns vary by deal, market conditions, and investment horizon. We focus on delivering attractive risk-adjusted returns by targeting well-vetted opportunities with strong fundamentals.

How many deals can I invest in at once?

There’s no set limit — you can choose to invest in a single deal or build a diversified portfolio across multiple opportunities, depending on your goals and available capital.

How do I exit the fund?

Each deal has its own projected hold period and exit strategy, which may include a refinance or sale. When a deal exits, your capital and returns are distributed back to you. Because you choose your deals, you’re not locked into a single fund timeline — your exits match the specific deals you select.