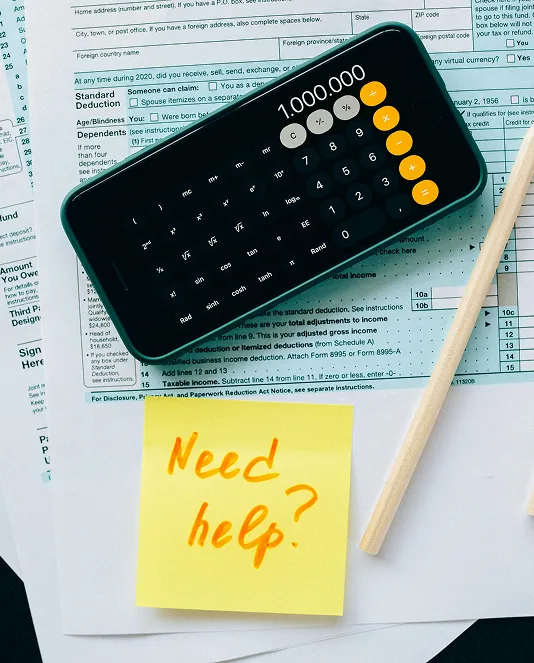

It's Not how Much Make - It's how Much you Keep.

Home / Services Details

Clear, practical support for your financial journey

Financial management doesn't have to be overwhelming. We offer straightforward, personalized advice and tools to keep you on track and confident.

How We Help

Tax Planning Services

Tax planning is about making strategic financial decisions today to minimize taxes tomorrow. Whether you’re a business owner or an individual, our experts analyze deductions, credits, and legal tax-saving opportunities to keep more money in your pocket.

Year-Round Tax Strategy – Not just a year-end scramble

We take a proactive, educational approach by providing continuous tax planning and compliance monitoring—helping clients navigate changing tax regulations, reduce potential exposure, and make confident financial decisions throughout the year.

Business Tax Optimization – Entity structuring, deductions, and credits

Our team analyzes entity classification, income allocation, and available tax incentives to strategically minimize liabilities while ensuring full regulatory compliance.

Retirement & Investment Tax Planning – Reduce taxable income

We integrate tax-efficient retirement vehicles and investment strategies to defer income, manage capital gains exposure, and enhance long-term after-tax returns.

Estimated Tax Planning – Avoid underpayment penalties

We provide detailed income projections and estimated quarterly payment calculations to help clients plan cash flow proactively and reduce the risk of underpayment penalties and interest.

Tax Preparation Services

Tax filing doesn’t have to be stressful. Our licensed preparers handle everything—from complex business returns to personal filings—ensuring compliance and maximizing deductions.

Personal Tax Returns – Optimized for maximum refunds

We prepare individual tax returns using advanced income analysis and deduction optimization to ensure accuracy, compliance, and the most favorable tax outcome allowed by law.

Business Tax Returns – Corporate, LLC, Partnership, and S-Corp filings

Our team handles complex business tax filings with precise reporting, strategic classification, and adherence to federal and state regulations across all entity types.

Self-Employed & Freelancer Taxes – Deduction tracking for Self Employed Businesses

We specialize in tax preparation for self-employed professionals by identifying allowable deductions, managing expense documentation, and minimizing self-employment tax exposure.

Prior-Year Amended Returns – Fix past filing mistakes

We review and amend previously filed returns to correct errors, claim missed deductions or credits, and resolve compliance issues with the IRS or state authorities.

Reliable Bookkeeping Services

Outsource your bookkeeping to LEAS! We handle financial tracking, transaction management, and clean records for tax time. Get started today. Bookkeeping is the backbone of financial health. We manage day-to-day transactions, reconcile accounts, and prepare financial statements so you can focus on growth.

Transaction Recording – Sales, Expenses, and Payroll tracking

We accurately record and categorize financial transactions to maintain clean, organized books and real-time visibility into business performance.

Bank & Credit Card Reconciliation – Catch errors early

Our reconciliation process ensures all bank and credit card activity matches your records, allowing us to identify discrepancies, prevent errors, and reduce fraud risk.

Financial Reporting – Profit & loss, balance sheets, cash flow

We generate timely, GAAP-compliant financial statements to support informed decision-making, performance analysis, and strategic planning.

Sales Tax Compliance: Precision, Peace of Mind, and Protection

We handle registration, calculation, and filing so you can focus on what you do best.

Tax-Ready Financials – No year-end scramble

Our bookkeeping systems are designed to keep your finances audit-ready and fully aligned with tax reporting requirements, eliminating last-minute cleanups.

Payroll Processing

Payroll mistakes are costly. We ensure timely, accurate paychecks, tax withholdings, and compliance with ever-changing labor laws.

Employee Payroll Processing – Salaries, hourly, bonuses, and commissions

We handle accurate payroll calculations across all pay types, ensuring timely processing while complying with wage and labor regulations.

Payroll Tax Filing & Deposits – No more penalty fears

Our team manages payroll tax filings and scheduled deposits at the federal, state, and local levels to prevent late filings, penalties, and interest.

Direct Deposit & Pay Stubs – Modern, paperless options

We provide secure direct deposit services and electronic pay stubs, delivering a streamlined and compliant payroll experience for employers and employees.

Year-End W-2s & 1099s – Done correctly, on time

We prepare and file year-end payroll forms with precise reconciliation to ensure accurate reporting and on-time submission to employees and tax authorities.

Business Formation Services

Payroll mistakes are costly. We ensure timely, accurate paychecks, tax withholdings, and compliance with ever-changing labor laws.

Entity Selection (LLC, S-Corp, C-Corp, etc.) – Tax-optimized advice

We evaluate your business goals and structure options to recommend the most tax-efficient entity while aligning with regulatory requirements.

State Registration & EIN Filing – Legal foundation set up fast

We handle all state registration steps and obtain your Employer Identification Number (EIN) to ensure your business is legally recognized and ready to operate.

From Formation to Dissolution: Your Partner in the Full Business Lifecycle

When the time comes for a new chapter, we guide you through an orderly and compliant entity dissolution process, filing final returns and handling state requirements to prevent future liability.

Tax & Compliance Guidance – Avoid first-year pitfalls

We provide proactive guidance on tax obligations, filing requirements, and compliance considerations to help your new business avoid costly mistakes in its critical first year.

Managing finances doesn't have to be complex. With expert guidance, you can achieve clarity and control over your financial future. Our tailored services meet you where you are, providing the tools and strategies for confident decision-making. Every plan is personalized to align with your long-term goals. At the heart of our service is ongoing support, ensuring a future you feel proud of and secure in.

Empowering Your Business with Financial Clarity.

About Us

Services

Tax Resolution

Bookkeeping Services

Payroll Services

Tax Planning

Tax Preparation

Business Formations

Get In Touch

PO Box:

609, South Goliad Unit, 1082, Rockwell 75087

Office/Text:

(682) 800-4758

VP:

(972) 675-7052

Email:

[email protected]