Our approach

Your journey through mortgages should be as smooth as carving down the side of a mountain on some fresh powder. We totally get that, so we combined our 20+ years of experience and passion to bring you Mortgage Ride.

We realized we had an opportunity to empower people with knowledge and assist them in avoiding pitfalls along the way. No one wants their bike or board stumbling off balance along the path, right!?

That’s why we simply say, RIDE WITH US! Allow us to make your experience fun and enjoyable as you expand your portfolio. Mortgage Ride is committed to providing our clients a more relaxed approach through their mortgage needs by providing the very best rates, fees, and personalized service.

Curious about your home’s worth? We have a quick, easy solution to getting more info right back at cha!

Punch in your email with our buddies at MYHOME!

COME RIDE WITH US!

Mortgage Ride is committed to delivering the best ride through your mortgage experience by providing the very best fees, service and knowledge to assist in reaching your goals. Whether its slopes, ramps, surf, or mortgages, we just really like to ride. Come Ride with us!

In-person and

remote options

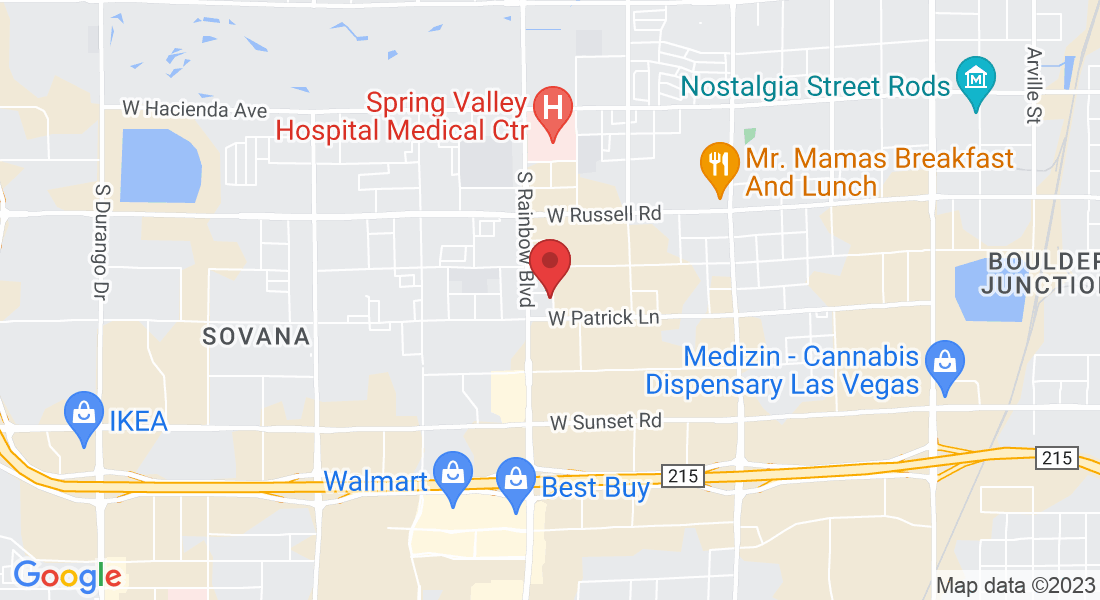

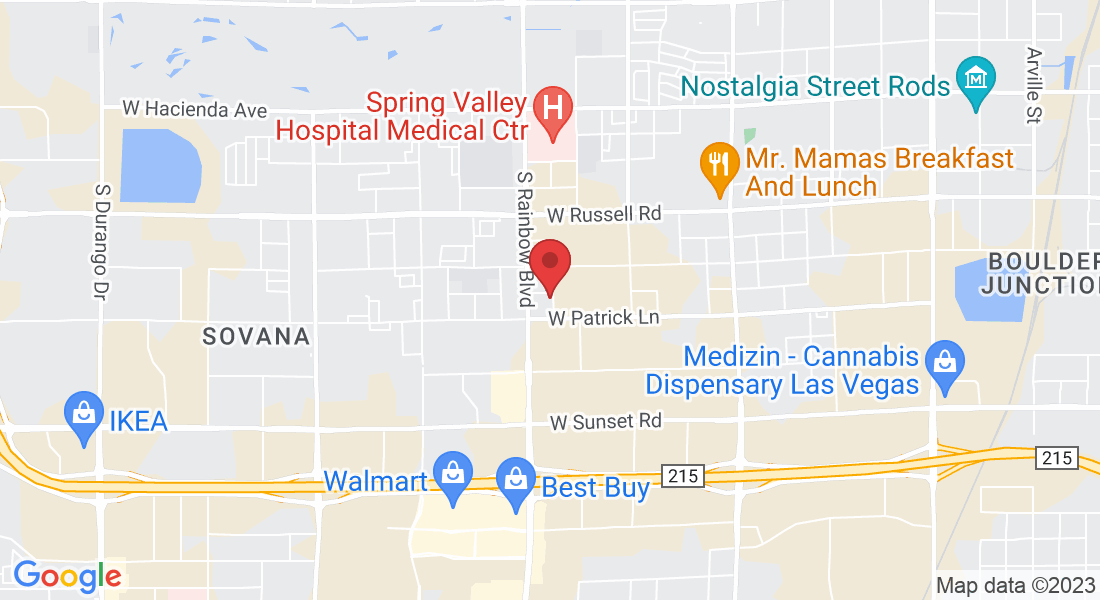

Our office is conveniently located in Las Vegas. Can’t

make it into the office? No worries – we’ve got you

covered with teletherapy.

Curious about your home’s worth? We have a quick, easy solution to getting more info right back at cha!

Punch in your email with our buddies at MYHOME!

COME RIDE WITH US!

Mortgage Ride is committed to delivering the best ride through your mortgage experience by providing the very best fees, service and knowledge to assist in reaching your goals. Whether its slopes, ramps, surf, or mortgages, we just really like to ride. Come Ride with us!

In-person and

remote options

Our office is conveniently located in Las Vegas. Can’t

make it into the office? No worries – we’ve got you

covered with teletherapy.

FROM THE RIDE SHOP

GAS IT

TEE

FROM THE RIDE SHOP

GAS IT

TEE

Our products

We offer more products and opportunities beyond what you see here on our digital home base. You know how it is, when you start rolling downhill, you have to be ready to ride! As a mortgage banker/broker, we are able to offer wholesale pricing and rates. With all the options out there, let us guide you to great results. That mountain bike trail is a lot more fun when someone knows the way down to the river.

FHA

Qualify with a lower credit score, as low as a 3.5% down payment, qualify even with past bankruptcies, or refiannce your existing FHA loan with FHA Streamline to have a lower interest payment.

VA

Finance up to 100% of the loan and have less closing costs as a qualified veteran, service member, or spouse.

USDA

No down payment required, 30-year fixed rate, and no cash reserves for closing cost. Elite pricing starting at 640+ FICO.

Jumbo

Jumbo loans range from $548,251 and above with a low interest rate.

Our products

We offer more products and opportunities beyond what you see here on our digital home base. You know how it is, when you start rolling downhill, you have to be ready to ride! As a mortgage banker/broker, we are able to offer wholesale pricing and rates. With all the options out there, let us guide you to great results. That mountain bike trail is a lot more fun when someone knows the way down to the river.

FHA

Qualify with a lower credit score, as low as a 3.5% down payment, qualify even with past bankruptcies, or refiannce your existing FHA loan with FHA Streamline to have a lower interest payment.

FHA

Finance up to 100% of the loanand have less closing costs as a qualified veteran, service member, or spouse.

USDA

No down payment required, 30-year fixed rate, and no cash reserves for closing cost. Elite pricing starting at 640+ FICO.

Jumbo

Jumbo loans range from $548,251 and above

with a low interest rate.

As Chief Riding Officer for Mortgage Ride, I am dedicated to providing financial solutions for professionals, their clients, individuals, and families to help them make informed mortgage decisions that integrate with their personal financial plans.”

— Erik Feldman (Chief Riding Officer)

What People Are Saying

“Erik & Team were very helpful every step of the way. They were knowledgeable and always happy to explain any questions I had. They made this stressful process very manageable. Thanks for all your help! Would definitely recommend!!.”

— James V.

“Mortgage Ride has helped me with buyers as a Realtor and as a buyer myself. We just closed on my personal property and it was completely stress free from start to finish. If you don’t want a headache and want to be able to sleep at night, go on a Mortgage Ride!”

— Connor P.

“The team is very organized and on top of communications. Really appreciate all their help and would definitely use them again! Closed on time with no issues.”

— Lori H.

“Erik and his team are awesome!! They are like family and make the process so smooth. They have lots of patience and are very helpful in making sure you are able to get the best rate for you loan. I would definitely recommend them and will use them again and again!!”

— Keith B.

We strive to make the home mortgage journey an exceptional experience for all clients. We hope you found our service and knowledge to have been key in helping you on this Ride. If you did, would you kindly do us a favor, and share your experience to the public review site listed below? The gesture would mean the world to us. 🙏

What People Are Saying

“Erik & Team were very helpful every step of the way. They were knowledgeable and always happy to explain any questions I had. They made this stressful process very manageable. Thanks for all your help! Would definitely recommend!!.”

-June2022

— James V.

“Mortgage Ride has helped me with buyers as a Realtor and as a buyer myself. We just closed on my personal property and it was completely stress free from start to finish. If you don’t want a headache and want to be able to sleep at night, go on a Mortgage Ride!”

— Connor P.

“The team is very organized and on top of communications. Really appreciate all their help and would definitely use them again! Closed on time with no issues.”

— Lori H.

“Erik and his team are awesome!! They are like family and make the process so smooth. They have lots of patience and are very helpful in making sure you are able to get the best rate for you loan. I would definitely recommend them and will use them again and again!!”

— Keith B.

We strive to make the home mortgage journey an exceptional experience for all clients. We hope you found our service and knowledge to have been key in helping you on this Ride. If you did, would you kindly do us a favor, and share your experience to the public review site listed below? The gesture would mean the world to us. 🙏

THe RIDE blog

Refinancing My Home

Should I Refinance My Home?

Refinancing your home can be a money-saving move although this is not applicable in all situation. This may provide you with the opportunity to lower your interest rate or you can take a cash out you can use to remodel your home. Looking for effective home refinancing program is the best solution you can have at the moment to get into a lower rate mortgage and get an extra cash which you can on anything you want to finance.

Why You Need To Refinance

There are many reasons why people especially individuals with current mortgages should be concerned primarily with the threat of rising inflation, downsizing income source, and other related financial matters. In the current state of the economy today, whether it will improve or not is always tied to the rise in inflation. For this particular reason, most banks today have increased their prevailing interest rates, particularly in housing loans. If the rate of increase for this particular market will reach more than two percent of the prevailing interest rates currently being followed in the market today, home owners with existing home loans from the banking sector or other related financial institution will certainly face a dilemma especially in meeting their monthly repayment schedule.

One of the primary reasons why you need to refinance is to lower the interest rate on your current home loan. Generally, the rule of thumb is that refinancing is often a good idea if the refinancing program can lower your interest rate by at least two percent. But on the other hand, majority of lenders suggest that 1% savings is enough of an incentive to refinance. This will be a great financial relief especially for those struggling to meet their monthly bank payments.

Long term repayment extension is one of the major benefits you can enjoy by simply refinancing your home. Your local mortgage broker will be able to accommodate you and show you various refinancing options you may qualify for. There are actually several attractive mortgage refinance programs being offered by local lending agencies which provide long term extension plans in order to extend the period for repayment of the loan. If you cannot qualify for this type of financial relief, you can always check out for other mortgage refinancing companies that offer mortgage refinance services and find out if they can offer you much friendlier terms than other third party providers.

Get started today