Charitable Bargain Sale

Part Donation, Part Sale

In a charitable bargain sale, you sell your real estate or securities to Every Kid Swims at a price below their fair market value. The difference between the market value and the sale price is considered a donation, which qualifies for an income tax deduction and is exempt from capital gains tax.

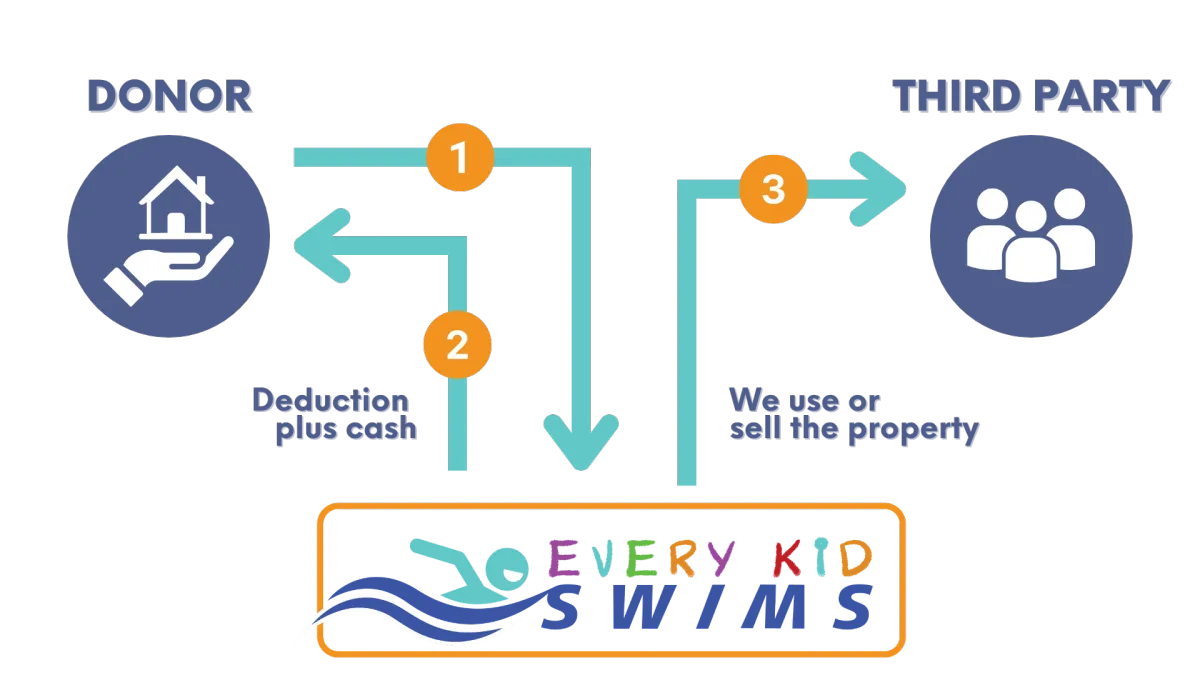

How it Works:

Donate Your Assets, Receive Tax Benefits

You can contribute real estate or securities to Every Kid Swims (EKS) for less than their appraised market value. This transaction is a combination of a charitable donation and a sale.

EKS can either pay you the full purchase price upfront or provide you with a payment plan (installment note) with terms agreed upon by both parties.

For real estate donations, EKS may use the property directly or sell it to support our mission. Your gift will guide how the proceeds are used.

Benefits

Tax Advantages

Enjoy an income tax deduction for the portion of your property donated to EKS, based on its appraised market value. Additionally, avoid paying capital gains tax on the donated portion.

Financial Flexibility

Use the proceeds from the sale of your property to pay off existing debts, such as a mortgage, or invest in new properties.

Fulfill Your

Philanthropic Goals

Experience the satisfaction of making a substantial charitable contribution to EKS while you are still living.

More Information

To ensure compliance and proper valuation, EKS requires approval of all real estate donations prior to completion.

To determine the fair market value for tax purposes, an independent appraisal is required for non-publicly traded real estate or securities.

Transferring property with outstanding debt could have potential income tax consequences.

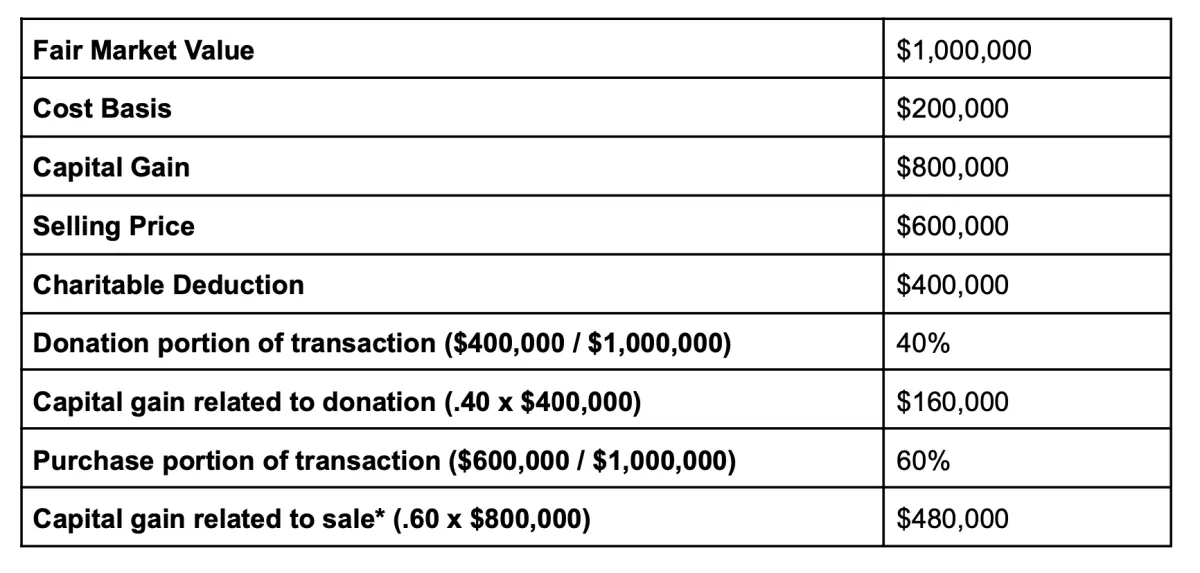

Example: You might plan to use your home's equity to cover retirement community fees. However, your home's value has increased significantly, and you'd like to donate a portion of this extra value to EKS through a bargain sale. To determine your home's worth, you’ll need a professional appraisal. If the appraisal shows your home is valued at $1 million, and you sell it to EKS for $600,000, you can claim a charitable deduction for the difference.

Note: Typically, homeowners can exclude up to $250,000 (individuals) or $500,000 (married couples) of capital gains from the sale of their primary residence. Because the property in this example was a primary residence, none of the gain was subject to tax. However, if a different property had been donated, the $480,000 profit would have been taxable as capital gains.

Frequently Asked Questions

What is a Bargain Sale?

A bargain sale is a transaction where you sell property to a charitable organization for less than its fair market value.

Is a Bargain Sale right for me?

A charitable bargain sale is for you if…

You want to donate property to Every Kid Swims, while retaining some of its value for your personal needs.

You want to give us real estate, securities or other assets that we can sell for our benefit.

You are willing to sell your property to us for an amount below its fair market value.

You are looking for a gift plan that can reduce your capital gains liability, generate a charitable deduction, and give you cash for your property.

What if the property has a mortgage or other lien on it?

The mortgage or lien can and should be paid off prior to the bargain sale or with the sale proceeds received by the previous owner. This produces the best tax benefit to the donor/seller. If the charity assumes the lien or mortgage, then this is considered taxable income to the donor/seller.

Can I arrange for a gift annuity with the sale proceeds of the deal?

Assuming there are net sale proceeds to the donor/seller, these proceeds can be used to establish a charitable gift annuity. Or the gift portion of the bargain sale can be used for a gift annuity contract. For example, a donor arranges a bargain sale of real estate with EKS for the sale price of $100,000. The property has an appraised market value of $200,000 thus making this arrangement a bargain sale of $100,000 and a charitable gift of $100,000. The donor can turn around and donate the sale proceeds ($100,000) received in this deal for a charitable gift annuity. This produces the maximum tax benefits for the donor. On the other hand, the charity can agree to a charitable gift annuity contract based on the donated portion ($100,000) of the bargain sale.

Why not sell my property and make a gift from the proceeds of the sale instead?

When you enter into a bargain sale you receive an immediate infusion of cash from us. This may help bridge the gap between residence sale and purchase of a new residence, or other immediate needs for cash while a sale of your appreciated property is pending.

Can I choose the appraiser who determines market value of my property in the bargain sale?

Yes, in fact, we may also choose to conduct an appraisal for our due diligence purposes, but part of a bargain sale is asking you to choose a qualified appraiser to evaluate the market value of your property. A qualified appraiser not only helps both of us determine your fair market value, but is required by the IRS when you file for a deduction from the bargain sale transaction.