Unlock the Power of Multifamily Investment

Multifamily vs. Stocks & Bonds

Investing in apartment communities through Northern Lights Multifamily Partners offers a stable alternative to high-volatility assets like stocks and bonds. Our value-add strategies unlock consistent monthly income and long-term equity growth—delivering returns that outperform many traditional investments with lower overall risk.

Multifamily vs. Other Real Estate Classes

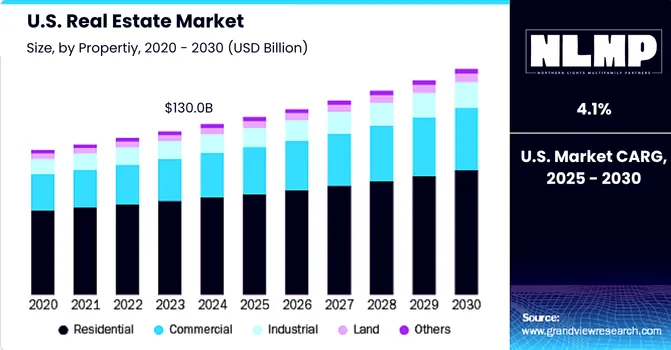

Multifamily properties remain the top-performing asset class in real estate. At NLMP, we leverage operational efficiencies, capital improvements, and strategic market selection to generate superior cash flow and appreciation. Compared to office, retail, or industrial sectors, our focused approach yields stronger, more reliable returns for investors seeking both growth and stability.

Source: www.grandviewsearch.com

Unlock Powerful Real Estate Tax Advantages

At Northern Lights Multifamily Partners, we invest in stabilized multifamily properties with strong occupancy rates (typically above 80%) and positive cash flow. This strategy allows our investors to earn consistent income—while still benefiting from strategic tax losses at the end of each year.

Our investors benefit from three key depreciation methods

1

Straight-Line Depreciation

A predictable, year-over-year deduction spread across the property’s useful life.

2

Accelerated Depreciation

Faster deductions by separating out building components with shorter recovery periods—delivering greater tax savings early on.

3

Bonus Depreciation

A large upfront deduction that allows investors to write off a significant portion of the asset’s cost in the first year.

At Northern Lights Multifamily Partners, we invest in stabilized multifamily properties with strong occupancy rates (typically above 80%) and positive cash flow. This strategy allows our investors to earn consistent income—while still benefiting from strategic tax losses at the end of each year.

Multifamily vs Single Family

Inflation Resilience

As living costs rise, multifamily real estate tends to appreciate in value, helping investors maintain steady income and build long-term equity. Compared to more volatile assets like stocks or bonds, these properties offer a greater sense of financial stability during inflationary periods.

Recession-Ready Performance

Multifamily assets are known for their durability during economic downturns. High demand and lower vacancy rates make them a dependable source of revenue, adding security and balance to investment portfolios even in challenging times.

Favorable Tax Treatment

Real estate investment offers powerful tax efficiencies. Through deductions, depreciation, and incentive programs, investors can ease their tax burdens and maximize their net returns.