Loans from $10,000 - $2,000,000

Legal/

Advertising Disclosure

Last Updated: January 8, 2025

Funding Financiers is a marketing lead generator with its main office located at 1 E Erie St, Chicago, IL 60611, telephone number (773) 432-7117

Funding Financiers

Advertised Terms and Information

- The information on this page relates to advertised terms made by or through Funding Financiers.

- Funding Financiers is not a lender, does not broker loans to lenders, and does not make loans or credit decisions. Funding Financiers is not an agent, representative, or broker of any lender and does not endorse or charge you for any service or product. All credit decisions, including loan approval and any conditional rates and terms you may be offered, are the responsibility of the lenders and will vary based upon your loan request, your particular financial situation, and criteria determined by the lenders making the offer.

- Not all consumers will qualify for the advertised rates and terms, and providing your information on this site does not guarantee that you will be approved for a loan.

- The rates and offers shown on this site are from entities in the Funding Financiers network. In some cases, Funding Financiers will not have a direct relationship with the entity, but will be able to access the rates via a third party partner.

- A consumer that accesses a website owned by Funding Financiers may not be connected with a provider of the product the consumer initially sought. While Funding Financiers strives to connect a consumer with that product, there may be a better suited product for a consumer, or the consumer may not connect, based on the information he or she provided, with a provider of the initially sought product.

Additional Disclosures

General Advertising Disclosure

Funding Financiers owns and operates this website. We are an Illinois-based company that works to provide you, our customer, with a range of personal finance options.

We earn revenue primarily in two ways, either when we match you to a company providing products that could be of interest to you or when you successfully close such a product. Our most important asset is the trust of our customers, and our services need to reflect reality to maintain that trust.

Funding Financiers services are free for consumers to use.

Personal Loans

A Personal Loan can offer funds relatively quickly once you qualify you could have your funds within a few days to a week. A loan can be fixed for a term and rate or variable with fluctuating amount due and rate assessed, be sure to speak with your loan officer about the actual term and rate you may qualify for based on your credit history and ability to repay the loan. A personal loan can assist in paying off high-interest rate balances with one fixed term payment, so it is important that you try to obtain a fixed term and rate if your goal is to reduce your debt. Some lenders may require that you have an account with them already and for a prescribed period of time in order to qualify for better rates on their personal loan products. Lenders may charge an origination fee generally around 1% of the amount sought. Be sure to ask about all fees, costs and terms associated with each loan product. Loan amounts of $1,000 up to $50,000 are available through participating lenders; however, your state, credit history, credit score, personal financial situation, and lender underwriting criteria can impact the amount, fees, terms and rates offered. Ask your loan officer for details.

As of 13 May 2021, Funding Financiers consumers were seeing match rates as low as 2.49% (on a $20,000 loan amount for a term of three (3) years. Rates and APRs were based on a self-identified credit score of 700 or higher, zero down payment, and origination fees of $0 to $100 (depending on loan amount and term selected).

Personal Loans Examples

Example 1: A $10,000 loan with a 5-year term at 13% Annual Percentage Rate (APR) would be repayable in 60 monthly installments of $228 each. The actual payment amount and year-end balance will vary based on the APR, loan amount, and term selected.

Example 2: A $25,000.00 secured personal loan financed for 60 months at an interest rate of 8.500% would yield an APR* (Annual Percentage Rate) of 8.496% and 59 monthly payments of $512.87 and 1 final payment of $513.24.

Examples are shown for illustrative purposes only. Nothing contained in the examples should be considered a guarantee, agreement, or commitment to loan funds or extend credit. Interest rates and terms are subject to change at any time without notice. Loans are not available in all states at all requested amounts. All loan applications are subject to credit approval by the lender(s) with whom you are matched. Funding Financiers does not offer, extend, or alter credit terms. Funding Financiers may connect you with lenders who can perform such activities after reviewing your credit history (a hard pull of credit will be performed by lenders with whom you are matched if you decide to proceed to apply for credit) under the Fair Credit Reporting Act such permissible purpose exists in order to evaluate your request promptly and adequately. Rate, terms, and fees will be based on individual credit history and underwritten by the lender. Funding Financiers does not set rates, terms, or fees, nor does it undertake any underwriting activities, including decision making. All Equal Credit Opportunity Act requirements are adhered to and each lender will provide you with all required disclosures. Request all fees, terms, and rate information from the participating lender.

The Personal Loan offers that you are matched to are from companies from which Funding Financiers receive compensation. This compensation may impact which offer you are matched to or how and where products appear on this site (including for example, the order in which they appear or whether a lender or offer is "featured" on the site). Funding Financiers does not analyze all personal loan companies or all personal loan offers available in the marketplace.

Personal Loan Providers determine the underwriting criteria necessary for approval, you should review each Provider's terms and conditions to determine which loan works for you and your personal financial situation. All reasonable efforts are made to provide and maintain accurate information. All rates, fees, and terms are presented without guarantee and are subject to change pursuant to each Provider's discretion. There is no guarantee you will be approved for credit or that upon approval you will qualify for the advertised rates, fees, or terms shown.

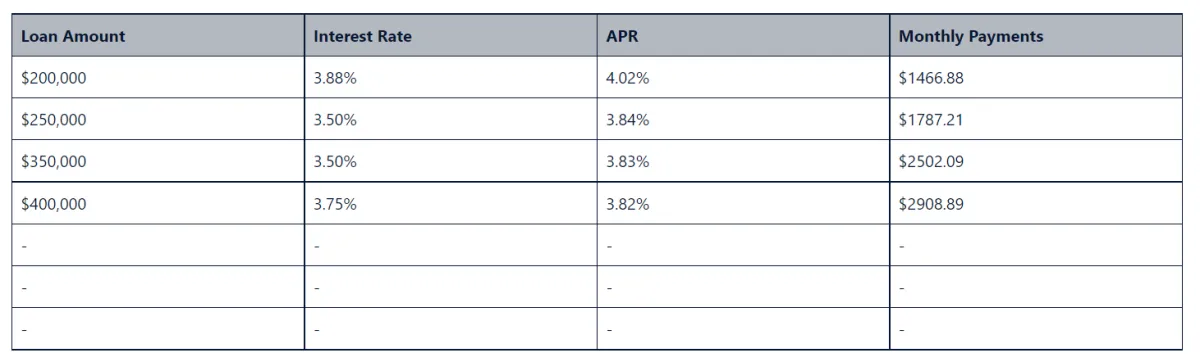

15-year Fixed Mortgage Rates

15-year Fixed Rate as low as 3.75% (3.82% APR) – Disclosure current as of 18-Apr-22.

- The advertised loan is a 15-year fixed rate full amortizing loan, assuming a $400,000 loan amount and a 3.75% interest rate.

- This loan has 180 monthly principal and interest payments of $2908.89. The disclosed APR is based on 1.238 discount points, 0% origination fee and $1,605 in additional prepaid finance charges due at closing.

- The Annual Percentage Rate (APR) is 3.82%.

Payment Examples

Disclosure Assumptions

- Interest rate quoted assumes a FICO score of 720 with a maximum loan-to-value ratio of 80% on a primary residence.

- The actual interest rate, APR and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property and other factors as determined by Lenders.

- Not available in all states.

- Rates are subject to change daily without notice.

- Payment amounts shown do not include taxes or insurance.

Life Insurance Products and Services

Funding Financiers offers consumers access to various different life insurance products and services. Funding Financiers may receive compensation from the companies displayed to the consumer on its sites. Funding Financiers does not include all insurance companies or products, and Funding Financiers advises consumers to shop for the best insurance product for their own particular situation.

Funding Financiers is not a life insurance provider, and does not make underwriting decisions. Providing your information on this website does not guarantee that you will be approved for a life insurance product. The operator of this website is a life insurance agent, representative, & broker of life insurance and does not endorse or charge you for any service or product.

Business Loans

Business Loans are those loans that are for commercial use and any property and/or proceeds from the proposed request will be used by the requestor for commercial purpose only and not for any personal, family or household purposes, and that the proposed request would constitute a business loan which is exempted from the disclosure requirements of the Truth in Lending Act.

Most of our Business Funding Partners do not require collateral for business loans; however, please note that it is possible to be offered another product by the lender depending on your needs and if the underwriting requirements dictate the same. Traditional bank and SBA loans generally are known for collateral requirements.

There is no one-size fits all business loan. Rather there are several types that will likely be offered and or discussed with you upon completing your request. Business Funding Partners determine the underwriting criteria necessary for approval, you should review each Partner's terms and conditions to determine which business funding option works for your business’s financial situation. All reasonable efforts are made to provide and maintain accurate information. All rates, fees, and terms are presented without guarantee and are subject to change pursuant to each Partner's discretion. There is no guarantee your business will be approved for credit or that upon approval your business will qualify for the advertised rates, fees, or terms shown. Lender terms and conditions will apply and all products may not be available in all states. Ask your lender for details.

How we display offers

On products where we show offers, we determine an order to display the offers we were able to find. Our sort order is based on a number of factors, including, but not limited to, your stated preferences, compensation we receive from the partner, and the order of products returned by our partner. The sort order is not meant to be a recommendation of a product or an endorsement of a product. We do not show all available offers that may be available in the marketplace.

On certain products we may display a Featured Offer. Similar to how we sort offers, we select which offer to feature based on a number of factors, including, but not limited to, your stated preferences, compensation we receive from the partner, and the order of products returned by our partner. By displaying this Featured Offer, we are neither making a recommendation of the product nor endorsing the product.

On products where we match you to a partner (and don't display any offers), the partner to which we match you is determined by a number of factors, including, but not limited to, your stated preferences, our partners' requirements, and compensation we receive from the partner

Where we operate

This site is directed at, and made available to, persons in the continental U.S., Alaska, and Hawaii only.

Credit inquiries

If applicable, checking loan rates generates a soft inquiry on your credit report, which is visible only to you. Our lending partners may perform a hard inquiry that could affect your credit score when you submit an application for credit.

Information Sharing

Funding Financiers collects information from consumers in order to try to match the consumer to financial products in which the consumer is interested. Funding Financiers shares the information that it collects from consumers with partners in its network to to attempt to find offers for the consumer. The partners that Funding Financiers shares information with may include lenders, brokers, insurance companies, insurance agents, debt relief companies, credit card companies, or other partners and third parties, both financial and non-financial.

Funding Financiers may append consumer-provided information with other information about the consumer from third parties, including social security numbers. Subject to applicable laws and regulations as well as contractual restrictions, Funding Financiers may share this information with its network of partners.

Funding Financiers strives to connect you with a top lender that matches your stated interest. In some cases, however, Funding Financiers will connect you with a partner in its network that may in turn connect you with such a lender. In other cases, Funding Financiers may suggest a different product that may fit your unique financial situation.

Credit Card Disclosure

The card offers that appear on this site are from companies from which Funding Financiers receives compensation. This compensation may impact how and where products appear on this site (including for example, the order in which they appear). Funding Financiers does not include all card companies or all card offers available in the marketplace.

Credit Card Providers determine the underwriting criteria necessary for approval; you should review each Provider’s terms and conditions to determine which card works for you and your personal financial situation. All reasonable efforts are made to provide and maintain accurate information. All credit card rates, fees, and terms are presented without guarantee and are subject to change pursuant to each Provider’s discretion. There is no guarantee you will be approved for credit or that upon approval you will qualify for the advertised rates, fees, or terms shown. The “Credit Needed” information is provided by the Credit Card Providers and is not a guarantee of approval.

Any opinions, analyses, reviews or recommendations expressed in articles, marketing materials or otherwise are those of the author’s alone and/or Funding Financiers, and have not been reviewed, approved or otherwise endorsed by any Credit Card Provider.

See the online Provider’s credit card application for details about terms and conditions. Reasonable efforts are made to maintain accurate information. However all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the provider’s website.

Advertised Terms and Information

The information and disclosures above relate to advertised terms made by or through Funding Financiers.

FICO score means the FICO credit score report that a lender receives from a consumer reporting agency.

Government Programs

Funding Financiers advertising copy occasionally refers to government programs designed to help homeowners. The referenced programs are described in more detail in this advertising disclosure. Funding Financiers does not participate in these programs nor do we make any decisions in relation to these programs.

The below information is provided as guidance only; please speak with a licensed loan officer or a lender in order to determine your actual eligibility. Programs may not be available from all Network Lenders and/or you may be better served by another loan product or program.

Homeowner Assistance Fund

On March 11, 2021 President Biden signed the American Rescue Plan into law, the most recent COVID-19 relief bill. The bill includes provisions designed to help with payment assistance for homeowners who have fallen behind on their mortgage payments.

The bill allocates $9.9 billion toward the Homeowner Assistance Fund (HAF). This fund helps homeowners struggling with financial hardship due to the ongoing coronavirus pandemic. It includes provisions such as allowing financial assistance to homeowners who are struggling to make their monthly payments.

Alongside the assistance programs, these homeowners can also look into options such as reducing their monthly payments by refinancing their mortgage under today's near-historically low interest rates.

What is the HAF?

It provides money to the states to instill payment assistance programs to help homeowners who were negatively affected by COVID-19. These funds will allow the states to set up programs to provide financial assistance to help homeowners with foreclosure prevention.

How can homeowners access money from HAF?

Anyone who began experiencing financial hardship after Jan. 21, 2020 is eligible to apply for HAF, according to the National Consumer Law Center. Homeowners can use these funds to pay for the following qualified expenses:

1 Mortgage payments

2 Housing costs due to forbearance

3 Principal reduction

4 Expenses like utilities, internet, HOA dues or insurance

States will request the funds and the Treasury Department must begin making payments within 45 days of when the law was enacted. From there, the states will decide when homeowners can begin applying for financial assistance.

For more information, please visit

https://home.treasury.gov/poli...

RefiNow and Refi Possible

Fannie Mae's RefiNow and Freddie Mac's Refi Possible are programs to help lower income homeowners take advantage of low interest rates by refinancing. There are similar requirements for both programs, but broadly

- Your mortgage must be owned by Fannie Mae or Freddie Mac;

- Income must be at or below 80% of the median income in your area;

- Good track record of mortgage payments;

- Credit score of 620 or higher; and

- The refinance must lower your monthly payment and/or your interest rate.

RefiNow was launched in June of 2021; Refi Possible will launch in August 2021. To learn more, including more detailed descriptions of the program requirements and how to determine your eligibility, please visit

RefiNow: https://www.knowyouroptions.co...

Refi Possible: https://guide.freddiemac.com/a...

Debt Relief/Debt Settlement

Funding Financiers may offer consumers the option of working with our credit repair and debt relief partners. These partner offers that appear on this site are from companies from which Funding Financiers receives compensation. This compensation may impact how and where the partners appear on this site (including for example, the order in which they appear or whether a partner is “featured” on the site). Funding Financiers does not recommend or endorse any of these partners.

These partners may contact consumers via phone or email to enroll in the services. Any fees for the services will be paid by the consumers to the partner and not to Funding Financiers

© 2025 Funding Financiers

Legal . Advertising Disclosure . Terms . Privacy . Do Not Sell My Personal Information . Contact Us

This site is directed at, and made available to, persons in the continental U.S., Alaska and Hawaii only.

Funding Financiers is not a lender or broker itself, or a life insurance company, insurance agent, or insurance broker itself. It does not broker loans to lenders; it does not make

loans or credit decisions; it does not make insurance decisions. This website does not constitute an offer or solicitation to lend. Providing your information on this website does not guarantee that you will be approved for a loan or an insurance product. The operator of this website is a life insurance agent, representative, and broker of any lender or insurance company and does not endorse or but does charge you a backend fee for any service or product.