The Ultimate Guide to Prospecting for Mortgage Professionals

The Ultimate Guide to Prospecting for Mortgage Professionals

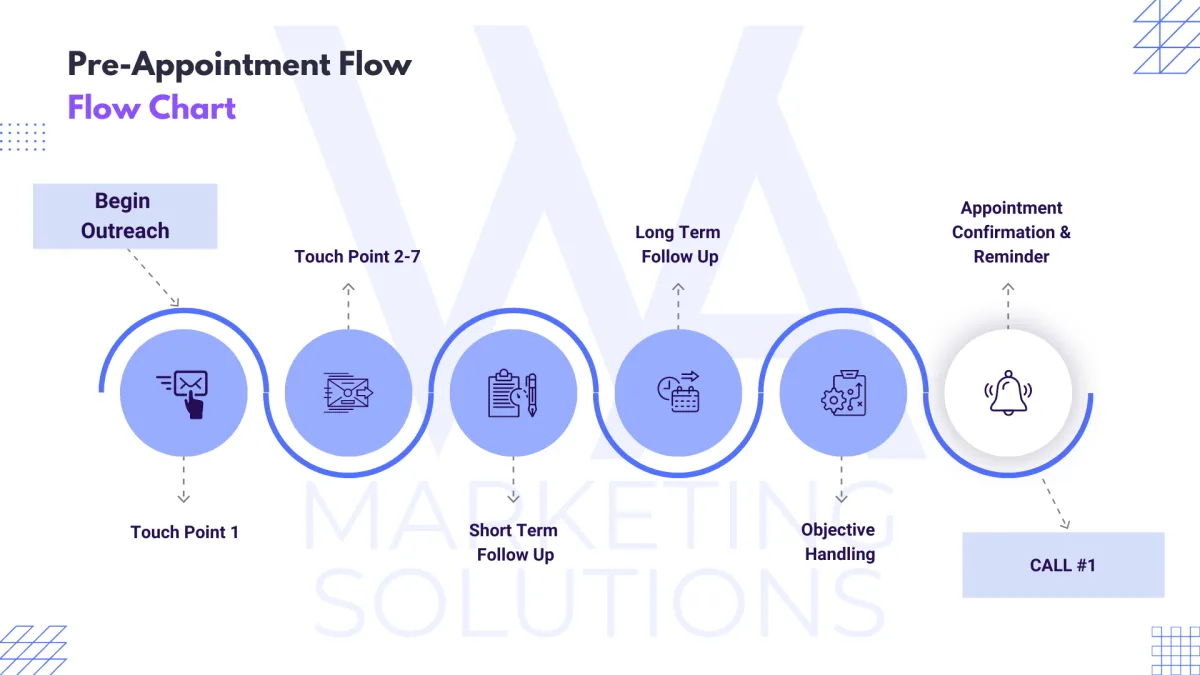

In the competitive world of mortgage lending, prospecting is the lifeblood of success. Effective prospecting involves a systematic approach to reaching out to potential clients, nurturing relationships, and converting leads into loyal customers. This guide breaks down the process into manageable steps, ensuring you have a robust strategy to follow. Let’s dive in!

Introduction

Prospecting is the cornerstone of building a successful mortgage business. It involves identifying potential clients, reaching out to them, and guiding them through the mortgage process. A structured prospecting plan ensures consistent lead generation, which is crucial for long-term success. This guide will help you understand the nuances of effective prospecting, from the first touch point to closing the deal.

Daily Outreach

Consistency is key in prospecting. Daily outreach ensures that you are constantly in touch with potential leads, keeping your pipeline full. Here’s how to structure your daily outreach:

Set Daily Goals: Aim to contact a specific number of prospects each day. This could be through phone calls, emails, or social media.

Use a CRM: A Customer Relationship Management (CRM) system helps you track your interactions and schedule follow-ups.

Segment Your Leads: Prioritize your leads based on their likelihood to convert. This helps you focus on the most promising prospects.

Touch Point 1: Initial Contact

The first touch point is crucial as it sets the tone for future interactions. Here’s how to make a strong first impression:

Personalized Outreach: Use the prospect’s name and reference any mutual connections or relevant information you have about them.

Value Proposition: Clearly state how you can help them with their mortgage needs.

Call to Action: Encourage them to take the next step, whether it’s scheduling a call or providing more information.

Follow Up Touch Points 2-7

Follow-up is where many prospects convert. Consistent and strategic follow-up shows that you are committed and reliable.

Touch Point 2-3

Reiterate Value: Remind them of the benefits you can offer and address any initial questions or concerns.

Provide Additional Information: Share relevant content such as market reports, client testimonials, or case studies.

Touch Point 4-5

Engage on Multiple Channels: If you’ve been emailing, try calling or connecting on LinkedIn.

Offer a Meeting: Suggest a more in-depth conversation or a meeting to discuss their needs in detail.

Touch Point 6-7

Urgency and Incentives: Highlight any time-sensitive opportunities or special offers.

Personal Touch: Send a handwritten note or a small token of appreciation to stand out.

Short Term Following Up

For prospects who show interest but are not ready to commit, short-term follow-up is essential. This includes:

Weekly Check-ins: Brief, value-driven messages to keep the conversation going.

Educational Content: Share articles, videos, or infographics that address their concerns or interests.

Long Term Following Up

Some prospects need more time to make a decision. Long-term follow-up ensures you remain top-of-mind when they are ready.

Monthly Updates: Send newsletters or market updates to stay relevant.

Personal Touches: Remember important dates like birthdays or anniversaries and send a note to show you care.

Objection Handling

Handling objections effectively is critical in converting prospects. Common objections include interest rates, fees, and the complexity of the mortgage process. Here’s how to address them:

Listen Actively: Understand their concerns fully before responding.

Empathize and Educate: Show empathy and provide clear, concise information to address their worries.

Offer Solutions: Present alternatives or solutions that align with their needs and preferences.

Appointment Confirmations and Reminders

Securing appointments is a major step forward, but ensuring they happen is equally important.

Confirmation Emails: Send a detailed email confirming the appointment time, date, and agenda.

Reminder Messages: Send reminders 24 hours and 1 hour before the appointment to reduce no-shows.

Preparation Tips: Provide any necessary information or documents they should prepare for the meeting.

Importance of Tested Templates

Having tested templates ready can save time and ensure consistency in your communication. These templates should be:

Personalizable: Allow for customization to make each message feel unique.

Proven: Use templates that have shown success in previous interactions.

Versatile: Have templates for different stages of the prospecting process, from initial outreach to follow-up.

Conclusion

Prospecting for mortgage professionals is a systematic process that, when done correctly, can significantly boost your business. By following the steps outlined in this guide, you can ensure consistent and effective prospecting, leading to more closed deals and satisfied clients. Remember, the key to success lies in persistence, personalization, and providing value at every touch point. Happy prospecting!

If you want all of the above taken care for you, visit wamarketingsolutions.com to learn how!

© 2025 WA Marketing Solutions. All Rights Reserved