The Hive Brokerage LLC.

Real estate for operators who build

Services

How we help you win

Residential

Buyers, sellers, developers, house hackers, fix & flip, rental placement with data-driven guidance.

Commercial

Development sites, multifamily, retail & office, leasing with institutional-grade analysis.

Advising

Deal review, portfolio analysis, strategy sessions for investors and developers.

Recent Success

Featured Deals & Case Studies

Hartford County, CT

12-Unit Multifamily Portfolio

Helped investor acquire a 12-unit building with 8.2% cap rate, including $150K in seller concessions for immediate value-add improvements.

$2.4M • 8.2% Cap

Fairfield County, CT

Fix & Flip Single Family

Sourced off-market property, negotiated $85K below asking, coordinated complete renovation resulting in $120K profit after 6 months.

$425K • $120K Profit

Providence, RI

Commercial Retail Space

Represented buyer in acquiring 4,200 SF retail property with long-term tenant in place, achieving 7.5% cap rate with expansion potential.

$1.8M • 7.5% Cap

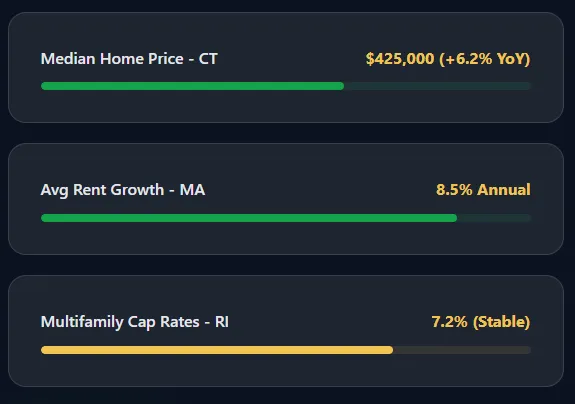

Market Intelligence

Local Market Insights & Trends

Q4 2024 Market Highlights

Investment HotSpots

Hartford County, CT

Strong rental demand with 3.2% vacancy rates and 6%+ annual appreciation. Multifamily buildings 2-12 units seeing highest demand.

Low Vacancy High Yield Growth Area

Providence Metro, RI

Urban revitalization driving commercial opportunities. Mixed-use developments with favorable zoning changes underway.

Development Mixed-Use Urban Growth

Worcester County, MA

Luxury market stabilizing with opportunities in luxury rentals and fix & flip single-family properties.

Luxury Fix & Flip Premium

Meet Our Team

Built by operators, for operators

Founder & Principal Broker

Since 2018 • CT • MA • RI

Marco Epifani is the Founder and Principal Broker of The Hive, a modern real estate brokerage built for investors, developers, and high-performing agents.

Licensed since 2018, Marco entered real estate after immigrating to the U.S. at 16, building his career from the ground up with no financial backing. Since then, he has been directly involved in nearly $50 million in real estate transactions, with experience spanning residential, multifamily, mixed-use, land, and development deals across Massachusetts, Rhode Island, and Connecticut.

Marco specializes in sourcing off-market opportunities, structuring creative transactions, and negotiating complex deals for serious operators. He has flipped over 100 units between multifamily, single families and commercial assets. He owns rental properties, and has helped numerous clients scale their portfolios and achieve seven-figure net worths.

The Hive was founded to help people reconnect with the American Dream through real estate—combining discipline, execution, and long-term thinking into every deal and every relationship.

Client Success

What Our Clients Say

"The Hive helped me acquire my first multifamily property. Their underwriting was thorough and they found issues I would have missed. Deal went smooth and I'm already cash flow positive."

John D.

First-time Investor • Hartford, CT

"As a developer, I need brokers who understand construction timelines and zoning. The Hive delivered. They helped us secure entitlements and pre-lease 60% before breaking ground."

Maria R.

Developer • Providence, RI

"Sold my rental portfolio of 5 units through The Hive. Their market analysis was spot-on and they handled the 1031 exchange paperwork. Saved me thousands in taxes."

Tom C.

Portfolio Owner • Fairfield, CT

Ready to Get Started?

Let's talk about your next move

Coverage Areas

Where We Operate

Connecticut

Primary Markets

Hartford County - Multifamily focus

Fairfield County - Luxury & commercial

Windham County - Mixed-use opportunities

Litchfield County - Development sites

Property Types

2-12 Units Single Family Commercial Development

Massachusetts

Primary Markets

Worcester County - Emerging market

Springfield Area - Value-add opportunities

Boston Metro Suburbs - Multifamily

Bristol County - Commercial properties

Property Types

Apartments Retail Office Mixed-Use

Rhode Island

Primary Markets

Providence County - Urban revitalization

Kent County - Stable rental market

Washington County - Vacation rentals

Newport County - Luxury properties

Property Types

Commercial Multifamily Historic Waterfront

Connecticut

Primary Markets

Hartford County - Multifamily focus

Fairfield County - Luxury & commercial

New Haven County - Mixed-use opportunities

Litchfield County - Development sites

Property Types

2-12 Units Single Family Commercial Development

Massachusetts

Primary Markets

Worcester County - Emerging market

Springfield Area - Value-add opportunities

Boston Metro Suburbs - Multifamily

Bristol County - Commercial properties

Property Types

Apartments Retail Office Mixed-Use

Rhode Island

Primary Markets

Providence County - Urban revitalization

Kent County - Stable rental market

Washington County - Vacation rentals

Newport County - Luxury properties

Property Types

Commercial Multifamily Historic Waterfront

Local Market Expertise

We don't just work in these markets—we live here, invest here, and understand the local dynamics that drive value. From zoning regulations to neighborhood trends, we provide insights you won't find in online reports.

Current Opportunities

Investment Opportunities

Hartford County, CT

6-Unit Multifamily Value-Add

Mixed-use building with 4 residential units and 2 commercial spaces. Below-market rents provide immediate upside potential.

$2.4M • 8.2% Cap

Providence, RI

Retail Development Site

15,000 SF development opportunity in revitalizing commercial corridor. Zoning allows for mixed-use development with residential component.

$425K • $120K Profit

Exclusive Access for Clients

We source both on-market and off-market opportunities for our clients. Many deals never hit the open market. Join our investor network to get first access.

Our Process

How We Work With Clients

1. Discovery & Strategy

We start by understanding your goals, risk tolerance, and timeline. Whether you're a first-time buyer or experienced investor, we align on strategy before we look at properties.

Goal alignment and timeline planning

Financial qualification and budget analysis

Market area selection based on criteria

Investment strategy development

2. Market Analysis & Property Search

Deep dive into market data, property analysis, and deal screening. We underwrite every opportunity before presenting it to you.

Comp analysis and property valuation

Market trends and demographic research

Property screening and due diligence

ROI and cash flow projections

3. Deal Structuring & Negotiation

Strategic negotiation focused on protecting your interests while winning competitive deals. We structure offers that align with your goals.

Offer strategy and negotiation planning

Contingency protection and risk mitigation

Contract review and term optimization

Vendor coordination and timeline management

4. Due Diligence & Closing

Comprehensive due diligence quarterbacking to protect your investment. We coordinate all parties to ensure smooth closing.

Inspection coordination and issue resolution

Appraisal review and value validation

Financing coordination and document preparation

Closing timeline management and post-closing support