FAQ

FAQ

Questions Answered By R&D Advisers

At R&D Advisers we are inundated with questions around the Research & Development (R&D) government scheme for SME companies in the UK and seek to be

leaders in providing the right information to help you through your claim process. This short FAQ guide breaks down some of the most common questions to give you some clarity as to if your business is eligible. R&D claims work on a case by case basis and in many cases, companies are unaware they could be eligible.

For a free assessment and claim estimate email our team of R&D Advisers at [email protected]

Does your company carry out R&D?

Creating or improving a new product, process or service requires carrying out efficient research and development which could involve finding solutions for certain problems that may or may not have been done before. Other than your own business, Research and Development projects can be done for clients as well.

The definition of R&D is broad by nature. Whether you are taking a big leap of faith or resolving scientific and technological difficulties, you are executing qualifying activities. This may include creating new products, processes or services, and/or improving them to better accommodate the needs of your customers.

Carrying out this project is not always a sure-win. Sometimes, you are not sure if it is feasible. If you do not know how to achieve the goal, you may be in a position where you are trying to resolve uncertainties, consequently qualifying for R&D tax relief.

Questions Answered By R&D Advisers

At R&D Advisers we are inundated with questions around the Research & Development (R&D) government scheme for SME companies in the UK and seek to be

leaders in providing the right information to help you through your claim process. This short FAQ guide breaks down some of the most common questions to give you some clarity as to if your business is eligible. R&D claims work on a case by case basis and in many cases, companies are unaware they could be eligible.

For a free assessment and claim estimate email our team of R&D Advisers at [email protected]

Does your company carry out R&D?

Creating or improving a new product, process or service requires carrying out efficient research and development which could involve finding solutions for certain problems that may or may not have been done before. Other than your own business, Research and Development projects can be done for clients as well.

The definition of R&D is broad by nature. Whether you are taking a big leap of faith or resolving scientific and technological difficulties, you are executing qualifying activities. This may include creating new products, processes or services, and/or improving them to better accommodate the needs of your customers.

Carrying out this project is not always a sure-win. Sometimes, you are not sure if it is feasible. If you do not know how to achieve the goal, you may be in a position where you are trying to resolve uncertainties, consequently qualifying for R&D tax relief.

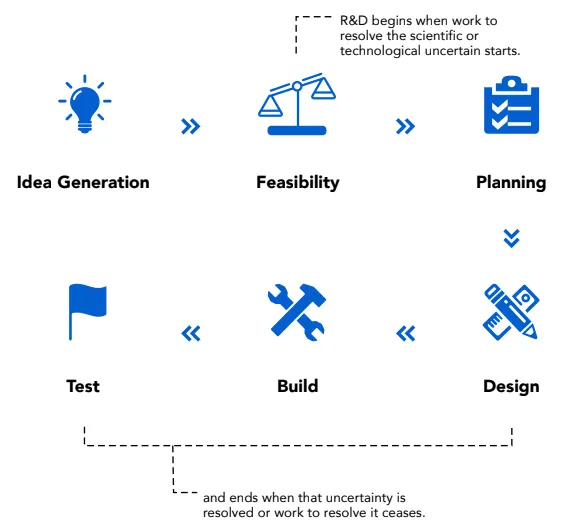

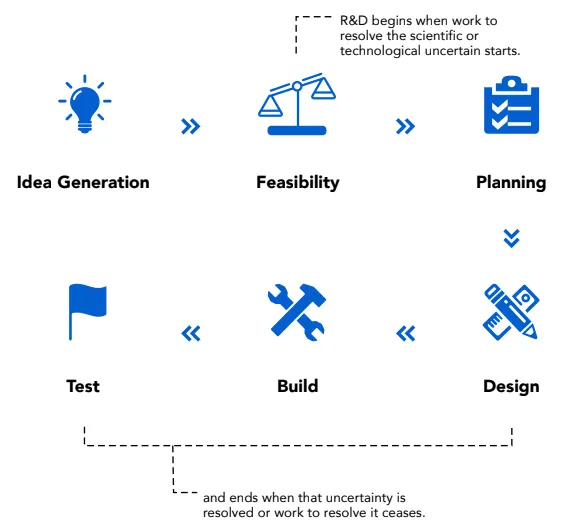

When Does R&D Start and When Does it Finish?

In simple words, Research and Development work begins when your objective is to scientifically and technologically improve your project. It ends when the uncertainties have been answered or resolved. Anything beyond these parameters will not be

classified under R&D.

Is My Project Qualified for R&D Tax Credits?

For your project to qualify for R&D tax credits, you will need to achieve development in your respective industry or market first - preferably in the field of science or technology. If your project has already achieved development but the details are not for the public to acquire (e.g. confidential information), it can still qualify for R&D.

Keep in mind that R&D does not always guarantee success. However, some projects that are conclusively unsuccessful can still be qualified for R&D - if and only if they sought a solution that was not evident at the outset.

What Makes A Project Not Qualified for R&D Tax Credits?

Most of the time, projects that copy existing products, processes, materials, devices, or services will not be qualified for R&D Tax Credits. Even if it seeks to improve the cosmetic or aesthetic qualities of certain products, materials, devices, processes, and services, it will not make them qualify for R&D. Instead, creating a new and unique output through science and technology renders it the best chance to qualify.

We, at R&D Advisers, are made up of highly qualified chartered tax advisers and sector specialists who all have excelled in our respective fields. As we seek to maintain such distinction, we utilize a constantly evolving process to prepare R&D tax credit claims that meet the standards - the HMRC's high standards. We aim to deliver maximum value to your business. And if you are not certain about your work - whether it qualifies or not; our team of R&D expert advisers will be happy to give you a free audit and claim estimate that you could be eligible for.

Feel free to contact us at [email protected] for a free audit and claim estimate today.

When Does R&D Start and When Does it Finish?

In simple words, Research and Development work begins when your objective is to scientifically and technologically improve your project. It ends when the uncertainties have been answered or resolved. Anything beyond these parameters will not be

classified under R&D.

Is My Project Qualified for R&D Tax Credits?

For your project to qualify for R&D tax credits, you will need to achieve development in your respective industry or market first - preferably in the field of science or technology. If your project has already achieved development but the details are not for the public to acquire (e.g. confidential information), it can still qualify for R&D.

Keep in mind that R&D does not always guarantee success. However, some projects that are conclusively unsuccessful can still be qualified for R&D - if and only if they sought a solution that was not evident at the outset.

What Makes A Project Not Qualified for R&D Tax Credits?

Most of the time, projects that copy existing products, processes, materials, devices, or services will not be qualified for R&D Tax Credits. Even if it seeks to improve the cosmetic or aesthetic qualities of certain products, materials, devices, processes, and services, it will not make them qualify for R&D. Instead, creating a new and unique output through science and technology renders it the best chance to qualify.

We, at R&D Advisers, are made up of highly qualified chartered tax advisers and sector specialists who all have excelled in our respective fields. As we seek to maintain such distinction, we utilise a constantly evolving process to prepare R&D tax credit claims that meet the standards - the HMRC's high standards. We aim to deliver maximum value to your business. And if you are not certain about your work - whether it qualifies or not; our team of R&D expert advisers will be happy to give you a free audit and claim estimate that you could be eligible for.

Feel free to contact us at [email protected] for a free audit and claim estimate today.

What Qualifies As A R&D Tax Relief?

The 11 Critical Questions To Ask Yourself

Could you be making savings from your business outgoings? Are you eligible for any tax breaks that you could potentially reclaim or benefit from?

A number of projects in your business could potentially qualify as research and development (R&D). Many companies are confused around what is classified as “R&D” and miss out on huge tax savings and cash back into their business via an R&D tax credit.

Here are 11 thought-provoking questions to help you understand your business activities and whether or not you could qualify for the R&D tax relief.

R&D covers a wide range of activities and you’ll be surprised by what could potentially qualify. Many are still of the thinking that it’s only scientific work that is seen as R&D but this is far from the truth. Improving business processes (or at least attempting to), developing services and products require technical expertise and therefore uncertainty around the project. Therefore there could be a strong case for making a claim.

What Qualifies As A R&D Tax Relief?

The 11 Critical Questions To Ask Yourself

Could you be making savings from your business outgoings? Are you eligible for any tax breaks that you could potentially reclaim or benefit from?

A number of projects in your business could potentially qualify as research and development (R&D). Many companies are confused around what is classified as “R&D” and miss out on huge tax savings and cash back into their business via an R&D tax credit.

Here are 11 thought-provoking questions to help you understand your business activities and whether or not you could qualify for the R&D tax relief.

R&D covers a wide range of activities and you’ll be surprised by what could potentially qualify. Many are still of the thinking that it’s only scientific work that is seen as R&D but this is far from the truth. Improving business processes (or at least attempting to), developing services and products require technical expertise and therefore uncertainty around the project. Therefore there could be a strong case for making a claim.

11 questions you should ask about your business to see if you could qualify for R&D tax benefits.

If the answer is “yes” to one or any of the below then it's worth exploring with an R&D tax adviser if it's worth making a claim to apply for this government backed tax scheme.

1. Have you created any design work that enhances technology?

2. Have you done any software development in software for your industry?

3. Has your company developed any internal process to reduce costs and speed up production time?

4. Does your business manufacture its own products?

5. Has your company made particular advances in science and/or technology over the past 2 years?

6. Have you combined 2 or more existing technologies that have created an enhancement in your industry?

7. Does your company function in any sectors below that could benefit from R&D related claims?

8. Do you use existing technologies in a new way that’s never been done before?

9. Have you created new products or planned services that could qualify based on the above?

10. Are you waiting on any patent products or services that could qualify for R&D?

11. Are you able to track R&D related income through your finance activities?

Common sectors that qualify for a R&D claim:

Aerospace

Biotechnology

Defence

Food

Pharmaceutical

University spin-offs

Automotive

Construction

Engineering

Manufacturing

Software development

Costs that qualify for claiming R&D tax credits?

Spend attributed to the following areas can in general make up your R&D claim:

- Equipment and materials used in the R&D process or results created

- Direct staff costs

- Freelancers, sub-contractors and agency workers used for specific R&D project related work

- Software licence/ licenses

- Independent research contributions

- Prototypes created within your business

What to do next?

These questions are a guiding point to help you start thinking about your potential R&D. If you’ve answered “yes” or a positive response to any of the questions then we might possibly be able to help you through the process and support you with making a claim. Our on-hand team of R&D experts and Tax advisers will work with you to discover if you’re eligible and support you further. R&D legislation is a forever changing landscape so get in touch with us today to see if you qualify.

The complexity of R&D means specific knowledge of the law and how it’s applied to HMRC is required to see if a project will qualify and the potential sum involved. This is why question 11 is critical to answer. Once a claim has potential, the next step is to figure out all costs in association with the project to support your R&D claim. Having strong records, systems and processes in place are required to do this effectively.

11 questions you should ask about your business to see if you could qualify for R&D tax benefits.

If the answer is “yes” to one or any of the below then it's worth exploring with an R&D tax adviser if it's worth making a claim to apply for this government backed tax scheme.

1. Have you created any design work that enhances technology?

2. Have you done any software development in software for your industry?

3. Has your company developed any internal process to reduce costs and speed up production time?

4. Does your business manufacture its own products?

5. Has your company made particular advances in science and/or technology over the past 2 years?

6. Have you combined 2 or more existing technologies that have created an enhancement in your industry?

7. Does your company function in any sectors below that could benefit from R&D related claims?

8. Do you use existing technologies in a new way that’s never been done before?

9. Have you created new products or planned services that could qualify based on the above?

10. Are you waiting on any patent products or services that could qualify for R&D?

11. Are you able to track R&D related income through your finance activities?

Common sectors that qualify for a R&D claim:

Aerospace

Biotechnology

Defence

Food

Pharmaceutical

Automotive

Engineering

Construction

Manufacturing

Software development

University spin-offs

Costs that qualify for claiming R&D tax credits?

Spend attributed to the following areas can in general make up your R&D claim:

- Equipment and materials used in the R&D process or results created

- Direct staff costs

- Freelancers, sub-contractors and agency workers used for specific R&D project related work

- Software licence/ licenses

- Independent research contributions

- Prototypes created within your business

What to do next?

These questions are a guiding point to help you start thinking about your potential R&D. If you’ve answered “yes” or a positive response to any of the questions then we might possibly be able to help you through the process and support you with making a claim. Our on-hand team of R&D experts and Tax advisers will work with you to discover if you’re eligible and support you further. R&D legislation is a forever changing landscape so get in touch with us today to see if you qualify.

The complexity of R&D means specific knowledge of the law and how it’s applied to HMRC is required to see if a project will qualify and the potential sum involved. This is why question 11 is critical to answer. Once a claim has potential, the next step is to figure out all costs in association with the project to support your R&D claim. Having strong records, systems and processes in place are required to do this effectively.

Does your business qualify for a R&D tax credit?

Take our free claim assessment quiz to find out if your business qualifies for a R&D claim today

Copyright © R&D Advisers. All Rights Reserved.

DISCLAIMER

By completing any form on our website, you will be contacted by our in-house team of R&D tax rebate specialists. We use the information you have provided to contact you regarding a potential rebate you are enquiring. Any claims made on our website are based on existing clients or industry knowledge. Please understand that results vary and are not typical, nor are we implying your business will be entitled to any amounts referenced. Your claim (if eligible) will be based on your business circumstances.

© R&D Advisers. R&D Advisers is a trading name of RD Advisers Ltd. are registered in England, company registration number 13592699, Information Commissioner's Office registration number A9081829.

Does your business qualify for a R&D tax rebate?

Take our free claim assessment quiz to find out if your business qualifies for a R&D claim today

Copyright © R&D Advisers. All Rights Reserved.

DISCLAIMER

By completing any form on our website, you will be contacted by our in-house team of R&D tax rebate specialists. We use the information you have provided to contact you regarding a potential rebate you are enquiring. Any claims made on our website are based on existing clients or industry knowledge. Please understand that results vary and are not typical, nor are we implying your business will be entitled to any amounts referenced. Your claim (if eligible) will be based on your business circumstances.

© R&D Advisers. R&D Advisers is a trading name of RD Consultancy Ltd. are registered in England, company registration number 14601229.