YOUR AMERICAN DREAM STARTS WITH A SIMPLE AND ENJOYABLE MORTGAGE EXPERIENCE

When obtaining a mortgage, most people experience poor communication, confusing costs and fees, along with delayed closing dates. Waymaker Mortgage is revolutionizing the lending industry with clear mortgage strategy plans, world class communication, and quick closing timelines so that 25,000 families will achieve their American dream by 2026.

You’ve heard the horror stories…how hard it is to qualify, the mounds of paperwork you have to provide, the difficulties and delays. Not to mention the fighting, shopping, and haggling to get the right loan terms. We’re here to solve that for you through our no hassle, simple mortgage experience. The first step is to review your unique situation and make sure that you achieve the perfect mortgage loan strategy, minus the stress. Whether you need a mortgage to buy a home, are looking to refinance to a better rate, or want to cash-out from your equity, our team of loan strategy experts at Waymaker Mortgage are here to make your American Dream a reality!

Expert Loan Strategies

Waymaker Mortgage works with many investors on your behalf. We’ll help you find the perfect loan strategy and loan program that aligns with your goals and unique situation. With our proprietary technology, we will secure the most competitive loan terms available to make sure that you are paying the lowest payment possible each month.

High Tech Meets Human Touch

At Waymaker Mortgage, our clients always come first. It is our mission to make sure that each customer feels taken care of and listened to. We know that home loans can be confusing – that’s why our first class lending experience provides answers at your fingertips 24/7 through simple to use technology along with human guidance anytime you need it during the journey to funding your home loan!

We're Here

To Serve

Your time is valuable. We know you may not be able to meet during “banker’s hours” and life happens along the way! That’s why we have intentionally created the most efficient lending experience available. At Waymaker, we combine cutting edge tech, the most up to date loan products and seamless communication when processing each loan. This leads to quicker close times, service on your terms, and less stress.

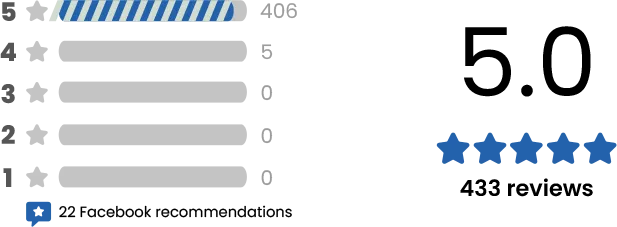

WHAT PEOPLE ARE SAYING ABOUT

WAYMAKER MORTGAGE

We’ve committed to providing each and every client we serve with raving fan service! We hope we’ve earned your 5-star review!

on Google, 23 June, 2021

The Waymaker team were very helpful and easy to work with. The online document submission made providing our information painless, and they were very helpful in answering the questions we had. They provided detailed comparisons of many different options for us so we could understand which choices were right for our situation. The team prioritized our loan and worked hard to ensure we were able to close on time! – Jocelyn West

on Google, 23 June, 2021

Scottie did an amazing job helping with our loan, answering our questions, and walking us through the whole process. Waymaker made the whole process seem less to. They provided nifty price breakdowns, notified us of when new documents needed to be signed, and provided a convenient and easy to use document submission system.

I’d also like to give a shout out to Trey Grubb who covered for Scottie during his days off. There was a bit of delay with the underwriter, and he did a great job of bugging them and getting the info back to us.

Thanks to both Scottie and Trey for all their help! – Austin Fisher

on Google, 23 March, 2021

Scottie did an absolutely fantastic job helping me secure financing for my new home. As a first time homeowner buyer this process was extremely overwhelming. Scottie and his team provided me with quick service, easy to understand resources, and a teachers heart that helped me understand exactly what I was signing up for. I would 10/10 recommend Scottie to anyone looking to purchase a home or refinance their current mortgage. – Jacob Smiley

on Google, 23 Jan, 2021

They are stellar! Lowest rates, best service, efficient, friendly, no hassle and PATIENT. Out of the 5 mortgage groups I was speaking to, they offered the best service and the lowest rates.

I worked with Scottie and Dominique and they were very professional, kept things simple, and were clearly out for whatever was best for my family. To be honest, due to my own ignorance of loans and the vernacular, I needed a lot more of their time/explanations to be comfortable. They were the only ones who took the time to talk to me and were amazing about it. Even with the market being volatile at the time, they slowed things down for me, answered questions, and broke it down so that I could understand enough to be comfortable. They did all this with ZERO PRESSURE which made it that much more of a pleasant experience.

They are kind, and always out for what is in your best interest. If you need to get a home loan, refinance, or a partner in financial planning go to them! – YouCanBeStrong

on Google, 17 March, 2021

Great experience! very competitive with terms, and came through with everything that was promised up front. Would definitely use them again. – Calvin Coles

on Google, 22 Dec, 2020

As a first time home buyer I was very nervous about the lending process as I heard it can be a nightmare. Luckily for me, my agent recommended Team Scottie at Waymaker Mortgage Group. From day 1 Scottie’s team made me feel like our relationship was more than just transactional by educating me on the buying process and trying to understand my long term goals. What I appreciated most about working with Scottie’s team is their prompt communication and transparency which is not very easy to come by. If you are looking to buy, sell, or refinance your home then give Team Scottie at Waymaker Mortgage Group a call! – Tyus Carter

on Google, 23 June, 2021

Have used them about 5-6 times. They are diligent about getting the information to underwriting. – Kevin Borchers

on Google, 29 May, 2021

Scottie’s team at Waymaker helped us every step of the way. We got notices of the different milestones as we progressed through the loan. They always explained the how, what and why for each step along the way. In the beginning they coached us on how to get our credit score high enough to qualify for a better rate. We truly appreciate the time and patience they took with us to see it through. Thank you again to the team at Waymaker Mortgage Group! – Daniel Haines

on Google, 23 June, 2021

Best House Buying Experience I’ve ever Had. Give them a Call if you want to know every detail that is going on. Smoooth Transition…. – T K

on Google, 12 March, 2021

Being in the real estate business myself, it was great to work with a team like Waymaker Mortgage Group. They are on the ball! Hope to work with them in the future. – Selina Wilson

on Google, 15 Jan, 2021

Have helped us with several loans. Easy to work with! Didn’t give up on us when we were giving up on ourselves! Always positive and helpful! Go the Extra mile! Thanks for your help! – Cathy Borchers

on Google, 26 Oct, 2020

Scottie and his team were wonderful to work with. They provided timely and professional assistance that allowed us to have a stress free move from out of state and make the best decisions throughout the process. We are very appreciative! – Courtney Plaszenski

on Google, 28 Aug, 2020

When buying a home you have a lot of different options of people to work with but we’re very grateful we chose Scottie. This was our first mortgage and we 10/10 recommend him! Scottie and his team were friendly, and incredibly helpful while walking us through the process. They also were great with answering any questions we had! – Jenna Dukes

Find out what your home is worth

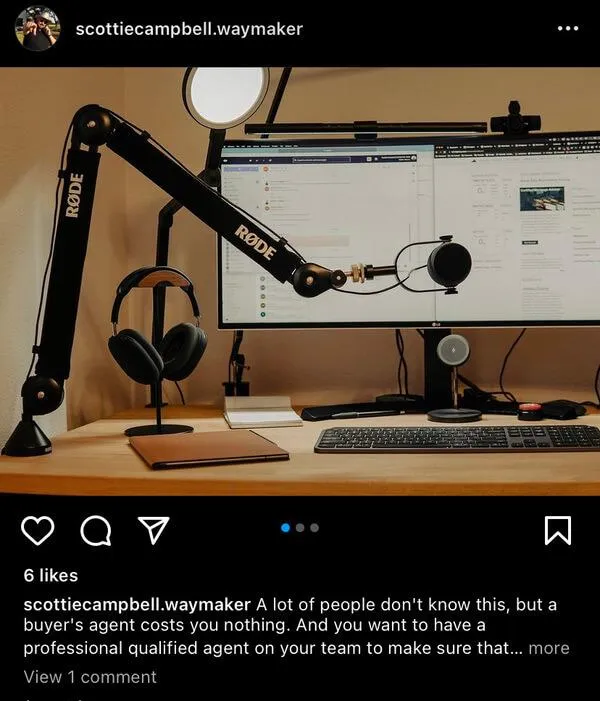

The American Dream Shows a Slice of Georgetown, Texas

Watch this clip from an episode of The American Dream, hosted by Scottie Campbell, Founder of Waymaker Mortgage. Shot in Georgetown Texas, Scottie interviews Kenny Hay, the Regional Manager of 600 Degrees and Slapbox Pizza.

The American Dream Flips the Script on House Flippers

In this episode clip of The American Dream, Scottie Campbell, Founder of Waymaker Mortgage, visits his hometown in Warren, Ohio to explore house flipping and the local real estate market. He interviews Neal Neuberger, a “jack of all trades” with Maverick & Walker Homes, and Sami Yacoub, a realtor with William Zamarelli Realtors.

Closing Costs Uncovered

Scottie Campbell, Waymaker Mortgage’s Founder, discloses all you need to know about closing costs. He covers the three categories that all closing costs fall under, including loan fees, settlement fees, and escrow fees and what specific charges fall under each category.

GREENLIGHT APPROVAL

At Waymaker Mortgage, we work on the front end to make sure your purchase mortgage loan is 100% Greenlight Approved which goes a big step beyond “pre-approved” – we provide a true loan approval from the mortgage loan underwriter! This means that instead of going to a seller with a shaky loan pre-approval issued by only a loan officer’s review, you have an ironclad guarantee that your Greenlight Approval has gone through a stringent underwriting process making your offer stand out and much more likely to be accepted by a seller! Once the seller accepts, your loan is already conditionally approved and ready to go! As a Greenlight Approved buyer, you will know what your final loan approval conditions are even before they are under contract which ultimately creates peace through the process for all parties involved – a big WIN for our clients and partners.

Here are some of the advantages of our Greenlight Approval Process:

- Clear plan of action and mortgage loan strategy determined upfront!

- No need to submit more of your own information to validate your loan after making an offer!

- Edge out the competition in bids by promising a guaranteed, underwritten loan!

- Know with 100% confidence what you are comfortable spending on a home, even in a competitive buyer’s market!

REAL ESTATE AGENTS

Agent Mastermind

This free, weekly interactive mastermind is designed to help real estate agents and brokers improve their marketing and sales results. You’ll learn how to attract more clients, build a more valuable network, enhance your credibility and build your brand. Access to Agent Mastermind also comes with a database of Powerpoints, PDFs, spreadsheets and handouts especially designed for Agent Mastermind. Agent Mastermind includes the latest marketing strategies on how to increase your visibility, credibility and brand on the Internet and new strategies, techniques & tips by some of the top agents around the country that will dramatically impact your business!

In short… it is everything you need to get real results!

Every Tuesday at 11 AM Central / 12 PM Eastern, Agent Mastermind offers a free class in how to take your real estate game to the next level. Sign up now!

Homebot

Homebot drives repeat and referral business for real estate agents and loan officers by helping your clients build wealth through real estate ownership.

Homebot will send your clients a personalized digest report every month providing them the vital information they want to know- such as their home’s value, their home equity position, and strategic real estate tips on how to build their wealth. With over 4 million users nationwide and a 80% monthly engagement rate, Homebot is one of the best tools for a realtor to establish rapport and provide long term value to your clients.

Sign up for Homebot today and get an edge in the market- give your clients value and they will reward you in return.

Xsellerate

Ever wondered how you could convert more leads into actionable opportunities in less time? Welcome to Xsellerate – our custom-designed marketing CRM that automates lead conversion and creates real conversations with prospects who are ready to do business. Xsellerate is packed full of easy-to-use, proven marketing and conversion campaigns specifically designed for realtors. Best of all, it’s available to our top agent partners at a fraction of market cost!

We believe there are 4 vital parts to every successful closing in real estate: Traffic, Conversion, Follow Up and Call To Action. What we’ve found is that every organization is good at 1 or 2 of these but all teams can benefit from stronger systems and automation in these areas.

There are over a dozen different ways to reach out to prospective new clients and keep past clients engaged with XSellerate. All of the features available are designed to get you booked conversations with real people who need your help. Xsellerate also offers a robust campaign for growing online presence and local market domination through automating the process of collecting reviews on Google.

Book a call today to learn more and start to accelerate your traffic, follow up, conversions and call to action!

Education and Training

Waymaker Mortgage offers training sessions to real estate agents looking to improve their skills in a competitive market. We will either come to your office or set up a virtual seminar and can train up to dozens of agents at the same time!

Some of our agent favorites include:

Using Video To Grow Your Business

22 Ways to Create Listing Opportunities

How To Leverage HomeBot

The 4 Parts Of A Sale

How To Increase Conversion With Less Friction

Using the DISC Test To Grow Your Team

Becoming the Go-To Modern Real Estate Professional in Your Market

Local Market Domination in 90 Days

Building A World-Class Team

Daily Success Plan For Realtors

Real Estate Agent’s Guide to Government Loans (VA, FHA, USDA)

Real Estate Agent’s Guide to Conventional Loans

How To Leverage Renovation & Construction Lending To Grow Your Business

Real Estate Agent’s Guide To Creative Lending (Doctor Loans, Bank Statement, Asset Depletion, DSCR – Investor Cash Flow; Fix and Flip; Wealth Building Loans)

Don’t settle for just okay- hone your skills and become the best! Call us and set up your free training today!

Agent Concierge Team

Our Agent Concierge Team is a dedicated group with the sole mission of helping our partners succeed with anything you may need! Every real estate agent is paired with a “Relationship

Accelerator” and “Loan Strategist” team who work together to ensure that every buyer is well taken care of and every question is answered in a timely manner. This is our secret formula to ensure that your transactions CLOSE ON TIME with CLEAR COMMUNICATION and your leads get FOLLOWED UP ON (like green on a pickle) which in turn saves you time so that you can serve even more families.

They are professionals with decades of experience in loan processing and real estate. Whether it is finding the perfect marketing or advice on winning new clients, our team is here for you.

Our Agent Concierge Team provides to our partners:

– A dedicated Relationship Accelerator to help you succeed at reaching your goals! Our Relationship Accelerators are passionate about helping provide marketing, processes / systems and resources to help you implement a daily success plan in your business that will help you succeed long term.

– A dedicated Loan Strategist and lending team that provides Pre-Qualifications and Greenlight Approvals (fully underwritten upfront) in real-time when you need us! Our Loan Strategists are passionate about helping your clients to achieve their American Dream through education and expert advice.

– Easy accessibility to get your questions answered and needs met in real-time

The loan process can be hard- it has over 150 steps- but we’re committed to be right with you and your clients through all of them. Interested? Schedule a quick conversation with our Partnership Development team to see how we can help you serve even more families in real estate!

American Dream TV Show

We are an exclusive partner of “The American Dream”, a show featured on CNBC, The Travel Channel, Fox Business and other major networks dedicated to featuring the top real estate players from around the country and local businesses that are the heart of thriving communities. Our show highlights the real estate, lifestyle and culture of cities around the United States while giving real value to homebuyers and sellers focused on what is happening within the real estate market.

Waymaker Mortgage’s Founder Scottie Campbell is the exclusive correspondent host for the Austin and Central Texas region. If you are a top-producing real estate agent, builder, house flipper, or local business success story, we invite you to audition for our casting call to be featured on our show! This is an excellent opportunity to generate exposure and increase name recognition for you and your business.

Mortgage Coach

Here at Waymaker Mortgage, we embrace clarity through total transparency and home buyer education. Mortgage Coach is a unique tool that provides customized loan strategies for your clients and will keep you looped in on the advice our team is providing throughout the entire lending experience. Starting at initial pre-qualification every single borrower we work with receives a Total Cost Analysis personalized mortgage website link that is also shared with their buyer’s agent for total clarity.

Mortgage Coach is the only platform that allows mortgage lenders to create digital and accurate home loan comparisons for consumers and it is exclusively available to the nation’s top tier loan officer teams. The transparency and education of our Total Cost Analysis tool has revolutionized the rate quoting and pricing process allowing borrowers to make faster, more informed mortgage decisions.

As a real estate agent, your advantages are twofold: first, you are going to be in the loop the

entire time while our Waymaker Loan Strategy team is helping your client. Second, you are going to be able to work hand-in-hand with your Waymaker Loan Strategist to guide the client to the best loan process available for their needs. Buyers can be headstrong, but Mortgage Coach will help you nudge them in the right direction. Get ready to stay informed by downloading the Mortgage Coach mobile app today!

Schedule a demo with one of our Loan Strategists to see the Mortgage Coach Advice Engine in action!

TIRED OF LOOKING AT SCREENS AND WANT TO TALK TO A REAL PERSON?

CONTACT US

© Copyright 2021 Waymaker Mortgage | (www.nmlsconsumeraccess.org) | Terms, conditions, and restrictions may apply. Loan products are subject to availability and credit approval. Not a commitment to extending credit. Hometown Lenders USA AZ BK-0949142. Licensed by the Department of Corporations under the California Department of Financial Protections & Innovation. Company License # 41DBO60614. | Mortgage Company Complaint

Hometown Lenders is licensed under the laws of the State of Texas and by state law is subject to regulatory oversight by the Texas Department of Banking

Texas Mortgage Banker Disclosure – Figure: 7 TAC 81.200(c) “CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”

205 ILCS 635/2-9 Posting of license

The license of a licensee whose home office is within the State of Illinois or of an out-of-state licensee shall be conspicuously posted in every office of the licensee located in Illinois. Out-of-state licensees without an Illinois office shall produce the license upon request. Licensees originating loans on the Internet shall post on their Internet website their license number and the address and telephone number of the Commissioner. The license shall state the full name and address of the licensee. The license shall not be transferable or assignable. A separate certificate shall be issued for posting in each full-service Illinois office.

Licensee shall post on their internet web site the address and telephone number of the IDFPR. James R. Thompson Center

IDFPR-Residential Mortgage Banking

100 W. Randolph, 9th Floor

Chicago, Illinois, 60601

Tel: (844) 768-1713