Call Experts: 888 278 8815

Drop a Line [email protected]

Visit Office1207 Delaware Ave #2744 Wilmington, DE 19806

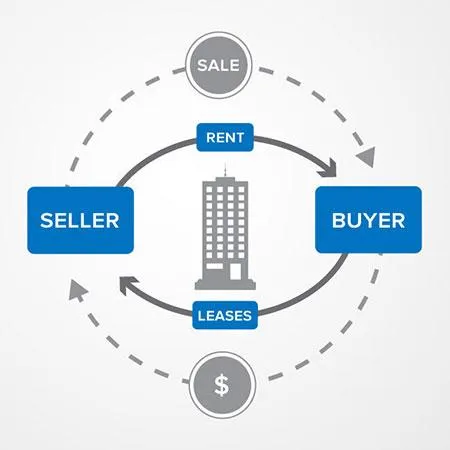

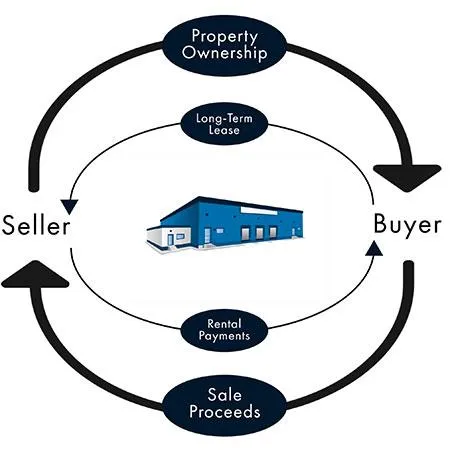

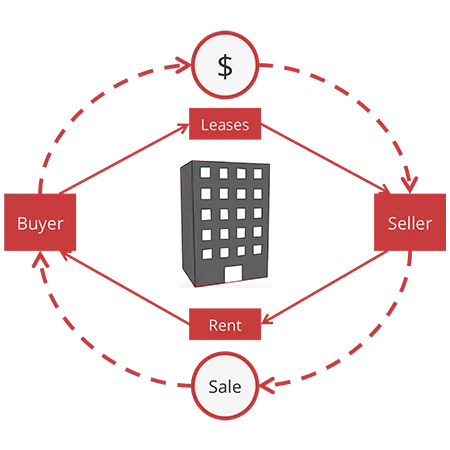

SALE LEASE BACK

Providing the best LDMB CONSULTING & ADVISORY to customers.

HELPING THOSE PEOPLE WHO IN NEEDS

UNDERSTANDING SALE LEASBACK

A sale leaseback involves selling your property to a buyer who then leases it back to you. This arrangement allows you to access immediate cash while continuing to use the property as a tenant. It's an effective solution for both commercial and residential property owners facing financial challenges.

HELPING THOSE PEOPLE WHO IN NEEDS

HOW DOES A SALE LEASEBACK WORK

A sale leaseback transaction provides immediate liquidity by selling your property and then leasing it back from the new owner. This allows you to stay in your property, using the proceeds from the sale to manage your financial needs.

HELPING THOSE PEOPLE WHO IN NEEDS

HOW DOES IT BENEFIT YOU

1. Immediate Cash Flow: Gain access to funds from the sale of your property.

2. Continued Occupancy: Stay in your property as a tenant, maintaining your business or residence

3. Potential to Buy Back: Some agreements allow you to repurchase your property in the future.

4. Address Distressed Properties: If you have a distressed property or can’t keep up with payments, a sale leaseback can provide relief.

5. Alternative to Reverse Mortgages: For those not old enough to qualify for a reverse mortgage but wanting to remain in their home, a sale leaseback is a viable option.

HELPING THOSE PEOPLE WHO IN NEEDS

WHY CONSIDER A SALE LEASEBACK

1. Insufficient Reserves:

Lenders require you to have enough reserves to cover payments. A liquidity partner can provide the necessary cash reserves to meet these requirements.

2. Down Payment and Closing Costs:

If you don’t have enough for the down payment or closing costs, a liquidity partner can bridge the gap, ensuring you have the funds needed to close the deal.

3. Asset-Rich but Cash-Poor:

You might have many assets but lack liquidity. A joint venture allows you to team up with someone who has the cash flow to complement your asset base.

4. Protect Your Savings:

You may not want to spend your life savings on a single deal. Partnering with someone who has liquidity can help you invest without depleting your savings.

HELPING THOSE PEOPLE WHO IN NEEDS

THE PROS AND CONS

Helping people those who in need

PROS:

Helping people those who in need

CONS

1. Immediate liquidity.

2. Continued use of the property.

3. Potential future buyback options.

1. Higher lease payments compared to previous mortgage payments.

2. One-sided lease agreements that may favor the new owner.

3. Risk of not being able to repurchase the property.

HELPING THOSE PEOPLE WHO IN NEEDS

COMMERCIAL SALE LEASEBACK

Many business or property owners sell their property to access cash but want to remain as tenants. This arrangement allows them to continue operating their business while gaining immediate funds. It’s an excellent option for owners who prefer to retain occupancy of their property post-sale.

HELPING THOSE PEOPLE WHO IN NEEDS

RESIDENTIAL SALE LEASEBACK

For homeowners, a sale leaseback can be a lifeline if you’re on the brink of losing your property. If you can’t secure financing, some companies may offer to buy your home and lease it back to you. While this can provide immediate relief, it’s important to be aware that some companies might not intend for you to repurchase the property. Their goal could be to gain a valuable property with a tenant in place.

HELPING THOSE PEOPLE WHO IN NEEDS

OUR APPROACH

We aim to come up with plans that enable you to buy back your property quickly. Our goal is to ensure you transition from a tenant back to a homeowner, avoiding the pitfalls of losing your home permanently.

HELPING THOSE PEOPLE WHO IN NEEDS

GET STARTED TODAY

We have a few investors who will buy your home and lease it back to you at an affordable rate, with the option to buy it back within a determined period. Contact LDMB CONSULTING & ADVISORY today to schedule a consultation. We will help you navigate this option and work towards regaining your property ownership.

LOAN CONSULTING:

While we cannot guarantee approval, we will work tirelessly on your behalf until all options are exhausted!!

LOAN CONSULTING:

We do charge a loan consulting fee, similar to a broker or origination fee, but only when the loan is approved and will close. This fee is added to the closing costs and will be paid at closing.

KEY POINTS

1.Conditional Fee: The fee is only charged upon loan approval and closing.

2.Varied Fee Structure: The fee may be a percentage of the loan amount or a flat fee, depending on the specifics of your file.

3.Fee Cap: We guarantee that our consulting fee will not exceed 1.5% of the loan amount.

4.Negotiation on Your Behalf: While we cannot determine the exact fee until we secure financing, rest assured that we will negotiate on your behalf to ensure the best possible terms.

5. Transparency: We commit to full transparency about any additional charges from lenders or brokers once we begin advisory working on your file.

GET STARTED WITH OUR CONSULTATION & ADVISORY SERVICES

To get started with our consultation, there’s an initial administration fee of just $9.99, which covers a full week of access to our services!

Please note that there are other consulting and advisory fees associated with different products and services. Some fees may be flat rates, percentages, or included within the administrative fee. This initial $9.99 fee allows us to work with you and dedicate our time to your needs.

OUR OFFER

Initial Administration Fee: $9.99 for the first week.

Continued Access:

If you wish to continue working with us after the first week, it’s only $9.99 per week. You can cancel at any time.

Non-Refundable Fee:

Unfortunately, the $9.99 fee is non-refundable. However, you will still have full access to consult with us until the week is over!!

BENEFITS

Comprehensive Consultation: During your access period, you can consult with us on any topic our site

provides. Risk-Free Start: If you're unsatisfied, you only lose $9.99.

Sign up now to begin your consultation and take the first step toward securing your financing solutions!

© Copyright 2025. Operation Save Your Home America. All Rights Reserved.