Faithful Stewardship

Lasting Legacy.

Aion Retirement strategies built on values, trust, and clarity.

You’ve worked hard, saved wisely, and now you're looking ahead—not just for your retirement, but for the family and legacy you’ll leave behind. You want to convert your traditional IRA to a Roth IRA without the concern of draining your savings, lowering your account balance, or raising your tax bracket! That’s where we come in.

Empower Your

Financial Future

Navigate the complexities of retirement planning with confidence. We take the time to share the risks and possibilities you face in your retirement and give you the information to make empowered and educated decisions.

Vetted Fiduciaries

at Your Fingertips

We understand the importance of trust when it comes to your finances. Rest easy knowing that all Aion Retirement advisors are vetted fiduciaries, legally bound to act in your best interest. Local or nationwide, we've got you covered.

Your Journey,

Your Terms

Take control of your financial journey by reviewing your choices at your leisure. Speak with advisors at no cost to you, ensuring you find the perfect fit for your retirement plans.

Build Your Dream

Build Your

Dream

Start Your Financial

Journey Today

Mark Connell grew up in a Marine Corps fighter pilot home, living in five states and moving seven times by the age of 13 when his family settled in Plano, Texas. In addition to a disciplined upbringing, his childhood taught him how to make friends quickly and easily! Mark is a son, husband, dad, and grandfather, and truly loves serving people.

Mark began his financial services career in 2001 with a national broker-dealer earning his securities license Series 7, 6, 63 and 65, as well as his insurance license. He quickly moved into comprehensive financial planning and earned the CERTIFIED FINANCIAL PLANNER (CFP™) designation.

Mark started and owned his own Registered Investment Advisory (RIA) firm, then moved into Wealth Management with Capital Advisory Group where Mark served clients, managed portfolios and oversaw operations. After a hiatus from the financial sector, Mark returned to financial services seeing a significant need for preservation and distribution solutions for retirees and those approaching retirement.

52%

of US households might not be able to afford essential expenses in retirement. A reminder to plan ahead, folks!

☀️☔

19.2

Retiring at 65? Hold on to your passport! The average life expectancy of 65-year-olds is 19.2 years, giving you plenty of time to chase sunsets and tick travel goals off your bucket list.✈️

61?

The real retirement age: Don’t let 65 fool you. Surveys show the actual average retirement age is 61, so plan your financial freedom accordingly.

31%

Buckle up, workforce! The number of pre-retirees (45-64) grew a whopping 31% in the past decade, meaning more folks are approaching the finish line.

Who We

Typically Serve

You’re nearing or in retirement

You want to leave your Roth IRA to

your children tax-free

You’re cautious with money and

don’t want a big tax hit

You value integrity, clarity, and

relationships over hype and complexity

What We

Help You Do

We specialize in helping people just like you—faith- and family-oriented individuals age 55 and up—navigate Roth IRA conversions, retirement income, and tax planning with a simple, honest approach. We can show you how to convert your IRA to a Roth:

Without coming out of pocket

Without lowering your account balance

Without raising your income tax bracket

Without causing the surviving spouse to face the widow’s or widower’s penalty

Without causing your heirs to pay tax on an inherited IRA

Let’s talk about your Insurance goals.

YOUR ONE-STOP-SHOP FOR

RETIREMENT Confidence

Retirement

Our tools and guides demystify retirement planning, providing simple and approachable answers to your

most pressing questions.

Taxes

Understanding your taxes is crucial. Our top-notch tools and articles provide the tax information you need, making it easier for you to stay financially savvy.

Let’s talk about your Retirement goals.

Clients

Build Your Dream

Testimonials

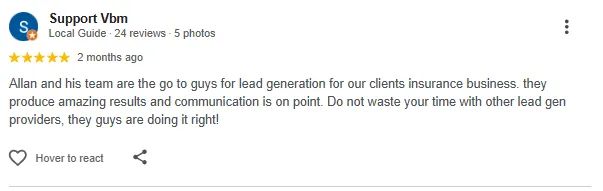

WHAT OUR Clients ARE SAYING...

Whether you’re seeking a financial

advisor or exploring our free and personalized financial calculators, Aion Retirement is your go-to destination

for a secure and confident retirement. Let’s shape your financial future together.

Quick Links

© Aion Retirement All Rights Reserved 2025