\

Ready To Move Your

Business Forward?

Short Term Business Loans

Handle immediate business needs without long-term

obligations.

Short Term Business Loans

Ready To Move Your

Business Forward?

How Short Term Business Loans Can Work for You

When it comes to business loans, the length of your personal business loan term is almost as important as securing funds.

Almost all businesses require additional capital at some point, but there’s a big difference between long-term loans and

temporary financing solutions, otherwise known as short-term loans. Most short-term small business loans are repaid

within a year or less, but some long-term loans can last over a decade.

What are the Benefits of Short Term Business Loans?

Speed! Short term business loans offer quick financing to support immediate business expenses. Unlike long term loans,

short term loans don’t come with the risk of accumulating large debts or interest and don’t have the long-term

commitment to loan payments. A short term loan can provide the right amount of money for your business while

allowing you to pay off the loan quickly.

When would a business need a short term loan? Short term loans can benefit you when cash flow is slow during a short

time period of time or when funding is needed to help your business grow. A short term loan can help your business now

to set you up for long term success. Apply online to see what short-term financial solutions can help your business thrive.

Fast Funding

- Most short term loan programs are funded quickly, some within 24 hours1

- Not waiting for loan funds to hit your account means you can utilize the money when you need it most

Increased Approval Rates

- Short term business loan lenders often don’t require collateral or perfect credit for credit approvals

- Alternative lenders like National Funding typically have higher approval rates for short term loans

Flexible Repayment Options

- Customized, short term loans can offer a variety of payment options

- Flexibility lets you set up a loan program that works best for your unique business needs

Take Care of Immediate Needs

- Cover costs related to equipment repairs or an unexpected tax bill by using a short term business loan

- Use short term loans to set your business up for future success by investing in long-term growth plans

How to Apply

Short term business loans from Advance Funding make the online application and approval process easier than ever.

Applying for short term business lending is simple. After you fill out a simple online application, we’ll reach out to you

to learn more about your business, your resources, and your needs. Together, we can create a loan program and

business loan terms designed to fit your company needs in terms of coverage and payment timelines. Apply today to

get your process started.

or call

How Do Short Term Business Loans Work?

Fast & Easy Application Process

No-cost, no-obligation application with

funding in as few as 24 hours1

Helpful Loan Guidance

A Funding Specialist will contact you to

help you choose the right business

financing option.

Quick Decision, Fast Funding

You could be approved, and funds

deposited into your account, in as

little as 24 hours.1

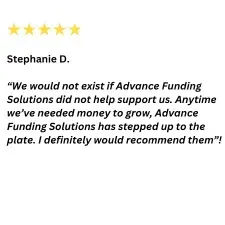

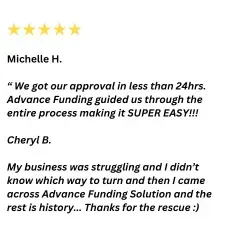

What Customers Are Saying

Ron Beatty, Owner

Beatty Lawn & Tree Service

Knowing how hard it had been trying to secure small

business loans in the past, this family-owned business

sought out Advance Funding thanks to its reputation for

accessible, hassle-free loans. Being able to purchase new,

reliable equipment was a critical component for this growth

business, and Advance Funding helped them make it

happen.

How Short Term Small Business Loans Support Your Industry

Virtually every type of business has short-term needs for cash to cover business expenditures and keep their

operations on track. Advance Funding has experience providing funding solutions for businesses in almost every type

of industry. Check out the many small business loans we provide:

Small Business Loans for Trucking

Companies

Fuel your trucking business with loans

tailored for truck companies

Agriculture Business Loans

Grow your farming business to its

fullest potential with small business

loans

Construction Business Loans

Build your business to reach great

heights with loans from Advance

Funding

Restaurant Loans

Serve your customers better with loans

that serve your business

Gym and Fitness Center Business Loans

Get loans that work out the best for

your business with Advance Funding

Beauty & Wellness Business Loans

Give your business the best makeover

with small business loans

Why Advance Funding?

Nobody provides a more personalized approach when it comes to short term loans. Experienced Funding Specialists

will guide you every step of the way and answer your funding questions. And, our process makes getting the money

you need to cover business expenses easy and simple.

We Know Your Industry

We have experience helping a wide variety

of business owners secure the right

financing solution

Fast & Easy Application Process

No-cost, no-obligation application with

funding in as few as 24 hours1

Trusted by Businesses Like Yours

Over $4.5 billion in funding to more than

75,000 businesses nationwide

Funding Specialists Who Care

Experienced Funding Specialists help you

make the right decision

High Approval Rates

Even if you’ve been turned down

elsewhere, there’s still a great chance we

can get you the business capital.

Hassle-Free Payments

We provide fixed terms and set up simple,

automatic payments3

Short Term Business Loans Resources

Financing the immediate needs of your business might seem complicated. We want to make sure you’re comfortable

applying for a small business short term loan. Below, we’ve compiled some of the most important things you need to

know when considering a short term loan.

How Do Daily Loan Repayments Work?

While most long-term business financing is set up for

monthly payments, some short term loans require a daily

loan payment. Learn more about how a short term loan with

daily repayments works.

4 Myths About Short-Term Loans for Small Business Owners

You may have heard some things about short-term loans for

businesses. This post will help dispel some common myths

that surround short-term financing. Take a look to learn

more about how short-term loans can actually help your

business.

5 Internal Business Metrics Every Owner Should Measure Weekly

When considering a short term loan, it’s important to know

where your business stands financially. You can monitor the

health of your business by frequently checking on these 5

key metrics. Read this post to learn more about checking

your business health weekly.

Industries We Serve

Every business is unique. That’s why we strive to tailor financing options to the needs and the nature of your business. Over the years, we have provided loans to many businesses across multiple industries.

Small Business Loans for Trucking

Companies

Fuel your trucking business with loans

tailored for truck companies

Agriculture Business Loans

Grow your farming business to its

fullest potential with small business

loans

Construction Business Loans

Build your business to reach great

heights with loans from National

Funding

Restaurant Loans

Serve your customers better with loans

that serve your business

Gym and Fitness Center Business Loans

Get loans that work out the best for

your business with National Funding

Beauty & Wellness Business Loans

Give your business the best makeover

with small business loans

FAQ: Short Term Business Loans

Wondering how short term loans work or how they can help your business? Most business owners are a little unsure

about receiving a short term loan. To help you better understand how the money from short term loans can help your

business, we’ve put together some common questions people often ask.

How do I get a short term business loan?

Applying for a short term loan is almost always easier than getting a long-term business loan. At Advance Funding, we’ll help you find the right short term loans for your business with a customized loan solution. Simply fill out our easy online application to get started.

Can I get short term business loans with bad credit?

Contrary to what many business owners believe, there are short term loans available for businesses with poor credit. In fact, a short term loan could actually help you raise your credit score while avoiding excess interest payments.

Do short term loans affect your credit rating?

Yes! In a good way. A short term loan can help improve your credit score over time. As long as you make your payments on time and pay off your loan according to schedule, you’ll likely see your credit score rise.

How long are the terms of short term business loans?

Short term loans typically range from 6 to 18 months. This short term and fast financing solution is a great fit for those who don’t want a long-term commitment to loan payments. This is also great for those who need financial assistance for a short period of time due to unexpected expenses or a slow season. Whatever your financial needs are, we are here to help you find the right loan for your business. Simply apply online to start the loan approval process and we’ll contact you shortly to discuss your business needs, whether that be short term, or longer.

Ratings & Reviews

Find Out How Much Funding You Qualify For

From equipment financing to working capital loans, we’ve helped business owners from many industries receive the

business funding they need. You’ll receive expert support and answers to your business lending questions while

working with a friendly Funding Specialist. Advance Funding is a trusted lending partner. You can rely on us to help

finance your working capital and growth.

© 2024 Advance Funding Solutions

Products offered by Advance Funding Inc. and affiliates are business products only. The products may be provided by third parties and subject to lender approval. In California, products made or arranged pursuant to a California Financing Law License.