\

Ready To Move Your

Business Forward?

Equipment Financing & Leasing

Keep your business running with important equipment upgrades

Equipment Financing & Leasing

Ready To Move Your

Business Forward?

New Equipment Today. Full Write-off This Year.

Finance new or used equipment before December 31st to use Section 179 for a 100% tax deduction. Learn More

How Equipment Financing Loans Can Work for You

Having the right equipment for your business can make or break your business. Sometimes you may not have the cash on

hand when you need to upgrade crucial equipment and that’s where we come in. Our equipment financing loans help

businesses secure the equipment they need to keep their business up and running.

Equipment Financing Options

- Get up to $150,000 for equipment that’s critical for running your business

- Lease new or pre-owned equipment

Improve Efficiency

- Help operations run smoother with new equipment

- Keep your working capital to fund other important parts of your business

No Limitations

- Lease about any type of new or pre-owned equipment

- You decide what equipment your business really needs

Quick, Painless Process

- Get funding fast so you can make important purchases quickly

- Flexible payment options are available

Equipment Financing & Leasing Details

Unexpected equipment repairs or upgrades can have a significant

impact on your business. From heavy equipment like forklifts to large

medical equipment, having the equipment you need is an important

part of your business’s success. The cost of equipment purchases don’t

have to be prohibitive – with equipment financing and leasing, you

can get up to $150,000 in funding for new or pre-owned equipment.

At Advance Funding, you’ll be able to take advantage of our

Lowest Payment Guarantee and no down payment requirements. Our

dedicated Funding Specialists are committed to securing fast

approvals and the best possible terms for your business.

Qualifications for Equipment Financing

6 months

in business

|

Fair to

Excellent Credit

|

Equipment quote

from a vendor

How to Apply

Applying for equipment financing from Advance Funding is easy. Simply fill out our quick and

easy online application and one of our friendly Funding Specialists will contact you to learn

more about your business. Your Funding Specialist can help you decide which financing option

is a good fit for your business regardless of whether you need equipment financing or a small

business loan. Once you apply for equipment financing, you’ll receive an answer in as

little as 24 hours1

or call

Types of Equipment Financing

Small Business Loans for Trucking

Companies

Fuel your trucking business with loans

tailored for truck companies

Agriculture Business Loans

Grow your farming business to its

fullest potential with small business

loans

Construction Business Loans

Build your business to reach great

heights with loans from Advance

Funding

Restaurant Loans

Serve your customers better with loans

that serve your business

Gym and Fitness Center Business Loans

Get loans that work out the best for

your business with Advance Funding

Beauty & Wellness Business Loans

Give your business the best makeover

with small business loans

Why Advance Funding?

No matter what industry you're in, we understand that you need equipment for your business. With a friendly,

custom-tailored approach for your unique business, we deliver the equipment financing you need.

We Know Your Industry

We have experience helping a wide variety

of business owners secure the right

financing solution

Fast & Easy Application Process

No-cost, no-obligation application with

funding in as few as 24 hours1

Trusted by Businesses Like Yours

Over $4.5 billion in funding to more than

75,000 businesses nationwide

Funding Specialists Who Care

Experienced Funding Specialists help you

make the right decision

High Approval Rates

Even if you’ve been turned down

elsewhere, there’s still a great chance we

can get you the business capital.

Hassle-Free Payments

We provide fixed terms and set up simple,

automatic payments3

Types of Equipment Financing

Small Business Loans for Trucking

Companies

Fuel your trucking business with loans

tailored for truck companies

Agriculture Business Loans

Grow your farming business to its

fullest potential with small business

loans

Construction Business Loans

Build your business to reach great

heights with loans from National

Funding

Restaurant Loans

Serve your customers better with loans

that serve your business

Gym and Fitness Center Business Loans

Get loans that work out the best for

your business with National Funding

Beauty & Wellness Business Loans

Give your business the best makeover

with small business loans

FAQ: Equipment Financing

What is equipment financing?

Similar to an auto loan for purchasing a car, equipment financing allows a business owner to purchase a piece of equipment with payments made over time. Whereas with an equipment lease, a business owner can rent equipment with regular payments and without the intention of owning it. When the lease ends, there is typically an option to renew the lease again or return the equipment.

How does equipment financing work?

Equipment financing provides you with equipment for your business. You make regular payments for the equipment price plus interest. Once the repayment term for your loan is over, you’ll either own the equipment outright or will need to make a decision on renewing your lease or not. Almost any type of equipment can be financed for your business so your operations run smoothly and stay competitive.

How do you get equipment financing?

Alternative lenders make it simple to secure financing for necessary equipment upgrades. While traditional banks don’t often offer equipment financing loans due to equipment depreciation, Advance Funding has a team of Funding Specialists who specialize in securing customized financing solutions for your equipment needs. Simply fill out our quick application to get started.

How long can you finance equipment?

The length of your loan term is dependent on several factors and varies by loan. However, you can generally finance equipment anywhere from one year all the way up to a decade.

Can I use Section 179 tax deduction for equipment financing?

Section 179 is applicable toward equipment-financed purchases and often has added value for business owners by allowing them to deduct up to 100% of the purchase cost. This gives you a tax savings benefit while also keeping working capital for other expenses in your business. Depending on the equipment, combining financing with the Section 179 deduction could greatly help your bottom line. View our guide to small business tax deductions for info on Section 179 and other deductions.

How do I learn how to finance heavy equipment?

Heavy equipment purchases can place a financial burden on your business, but financing equipment is a great way to make it more affordable for your business. An equipment financing loan or lease allows you to make periodic payments toward a heavy equipment purchase. Advance Funding offers a quick and easy application process where upon approval, you could receive the funds in as little as 24 hours.

How do I learn how to finance farm equipment?

Running a farm relies on having the right equipment. It’s easy to secure funding for critical equipment such as tractors, combines, or sprayers. With our simple application process, you can receive funding in as little as 24 hours upon approval. Advance Funding has a team of experts who specialize in securing customized loan terms for farms of all sizes.

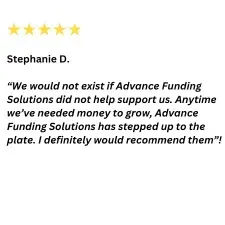

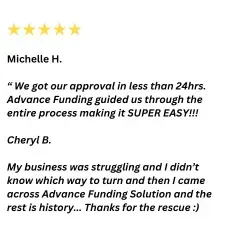

Ratings & Reviews

Find Out How Much Funding You Qualify For

From equipment financing to working capital loans, we’ve helped business owners from many industries receive the

business funding they need. You’ll receive expert support and answers to your business lending questions while

working with a friendly Funding Specialist. Advance Funding is a trusted lending partner. You can rely on us to help

finance your working capital and growth.

© 2024 Advance Funding Solutions

Products offered by Advance Funding Inc. and affiliates are business products only. The products may be provided by third parties and subject to lender approval. In California, products made or arranged pursuant to a California Financing Law License.