\

Ready To Move Your

Business Forward?

Agriculture Business Loans

Grow your farming business to its fullest potential with

small business loans

Agriculture Business Loans

Ready To Move Your

Business Forward?

How an Agriculture Business Loan Can Help You

Farming doesn't always work like other industries. Many farms and ranches are still a family affair. That makes it all the

more important that you have cash on hand to pay for unexpected expenses or growth opportunities. Small business

loans for agriculture businesses can help you get the cash you need. Securing small business funding can sometimes be

difficult in the agricultural industry since revenue isn’t always steady as seasons and plans change. That is why we offer

agriculture funding options specifically for those who have a small farm or ranch in need of financing.

What are the Benefits of a Farm Loan?

A farm loan is beneficial because it offers access to funds to meet farming or ranching needs. An agricultural loan can

either help sustain your current business needs or grow your business when you are ready to expand. It can also provide

you with peace of mind by letting you focus on the important aspects of your farm rather than worrying about how you

are going to fund farm expenses. Obtaining an agricultural loan can help you fund the essential aspects of your farm to

continue to have a successful business, like new equipment, expansion, expenses and hiring employees. Advance Funding

is dedicated to providing loan opportunities for farmers and ranchers, and we are here to help you along the way.

Finance New Equipment

- Replace worn out combines, tractors or trucks

- Agribusiness funding allows you tofinance or lease new or used farm equipment

Hire Workers With an Agriculture Loan

- Improve production by hiring the workforce you need to harvest crops

- Help prevent livestock loss by having staff available round the clock

Expand Your Operation

- Purchase more farmland to increase the yields of your farm

- Invest in the future of your farm or ranch by adding new crops or upgrading livestock housing

Cash For Things Your Farm Needs

- Pay everyday expenses like utilities or fuel bills

- Cover the cost of new tools or hardware to keep your farm in top shape

How to Apply

Qualifying for a trucking business loan is straightforward. Typically, Advance Funding requires at least $250,000 in

annual sales and at least six months in operation. Our application process is simple and requires as few documents as

possible – you’ll provide your business bank statements and we'll do a soft credit pull.

or call

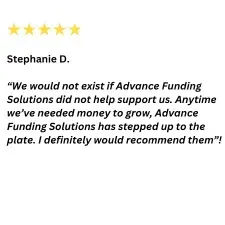

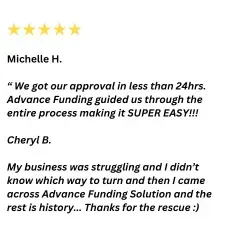

What Customers Are Saying

Ron Beatty, Owner

Beatty Lawn & Tree Service

Knowing how hard it had been trying to secure small

business loans in the past, this family-owned business

sought out Advance Funding thanks to its reputation for

accessible, hassle-free loans. Being able to purchase new,

reliable equipment was a critical component for this growth

business, and Advance Funding helped them make it

happen.

Types of Agriculture Loans

Small Business Loans

Get the capital you need to pay

workers, invest in technology and

cover expenses.

$5,000 to $500,000

Equipment Financing

and Leasing

Purchase or lease new and used

farm equipment for your business.

Up to $150,000

Why Advance Funding?

It can be difficult to find small business loans for agriculture due to the unique nature of the industry. It's important to

work with a lender who understands the financial challenges faced by farmers and ranchers. We take the time to learn

about you and your farm before we make recommendations on small business agriculture loans.

We Know Agriculture Businesses

Experience supporting agriculture business

owners

Trusted by Businesses Like Yours

Over $4.5 billion in funding to more than

75,000 businesses nationwide

Personalized Experience

Lending solutions and payment options

tailored to your specific needs

Fast & Easy Application Process

No-cost, no-obligation application with

funding in as few as 24 hours

Funding Specialists Who Care

Experienced Funding Specialists help you

make the right decision

Worry-Free Lending

No collateral requirements, plus simple,

automatic payments3

Agriculture Business Resources

Farming is an industry that doesn't run on time or money alone. To succeed, you need to have love and passion for

your work. Many agriculture business owners just like you have faced similar challenges to secure agribusiness

financing. Check out some of our resources below to help you learn more about types of loans in agriculture as well as

tips for running a financially successful agriculture business.

Securing a Loan on Agriculture Land: The What, Why and How

Learn how farm business loans can help your agricultural

business reach its goals. In addition to funding the purchase

of new farmland, agribusiness loans can be used for a

variety of operating costs like equipment maintenance. This

blog details how to get a loan for farmland and helps you

understand things to consider when looking for a farm loan.

When It's Worth It to Opt for Farm Equipment

Financing

Wondering when it’s time to replace old farm equipment?

You’ll need to consider factors such as how long you’ve

been using your current equipment and if you’ve already

had to repair it. You also need to determine if the

equipment is essential to running your farm and if you can

upgrade it to be more efficient. This article takes a look at

why it might be a good idea to finance new or used

equipment instead of using up cash reserves to replace

equipment.

What is a Section 179 Tax Reduction

Did you know you may be able to receive an immediate tax

break when you purchase, lease or finance new farm

equipment? In a bumper crop year, you can purchase the

new harvester, tractor or sprayer your farm needs and

potentially save on your tax bill. Read this blog to learn

more about the deduction and how it can change your

agriculture loan needs.

Frequently Asked Questions

Making the decision to apply for a farm loan can sometimes be difficult. That is why we are here to help and answer

some of the most important questions. If you have additional questions, our Funding Specialists are available to

answer any questions you may have.

What is an agriculture farm loan?

An agriculture farm loan from Advance Funding is a loan specifically designed to fund small farms and ranches. An agriculture business loan can be used towards purchasing farming equipment, land, supplies, and more. If you are ready to expand your farm, upgrade your ranch or simply need funds for everyday agricultural expenses, a farm loan can help you meet your goals.

How do I qualify for a agriculture farm loan?

At Advance Funding, we make it simple to qualify for an agriculture farm loan by offering our application process online, plus it only takes a few minutes to fill out. We won’t ask for extensive paperwork or a huge backlog on bank statements, just the basics. One of our Funding Specialists will get back to you shortly after to ask you a few questions to get a better idea of your agricultural business.

What is the interest rate on an agriculture farm loan?

Since loan type, amount, and length varies by agricultural business, the loan interest will also vary. We have dedicated Funding Specialists here to help you determine what loan is best for you and your business needs.

Ratings & Reviews

Find Out How Much Funding You Qualify For

From equipment financing to working capital loans, we’ve helped business owners from many industries receive the

business funding they need. You’ll receive expert support and answers to your business lending questions while

working with a friendly Funding Specialist. Advance Funding is a trusted lending partner. You can rely on us to help

finance your working capital and growth.

© 2024 Advance Funding Solutions

Products offered by Advance Funding Inc. and affiliates are business products only. The products may be provided by third parties and subject to lender approval. In California, products made or arranged pursuant to a California Financing Law License.